PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906083

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906083

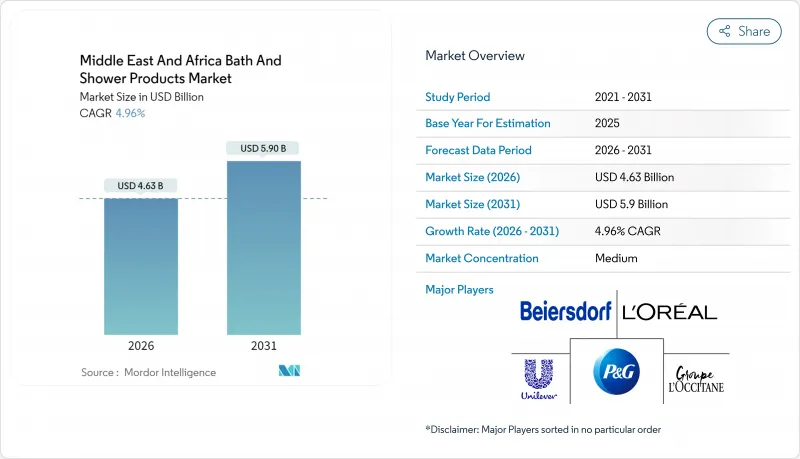

Middle East And Africa Bath And Shower Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Middle East and Africa bath and shower products market is expected to grow from USD 4.41 billion in 2025 to USD 4.63 billion in 2026 and is forecast to reach USD 5.9 billion by 2031 at 4.96% CAGR over 2026-2031.

The market growth stems from demographic shifts, evolving consumer preferences, and increased health awareness. The growing middle-class population, with heightened hygiene consciousness, is increasing the demand for premium, natural, and specialized bath and shower products. Rising urbanization and higher disposable incomes enable consumers to spend more on personal care products as part of their wellness routines. The enhanced focus on personal hygiene, following recent health events, has increased consumer interest in products offering additional benefits like moisturizing, anti-bacterial properties, and skin nourishment. Regional consumers seek products adapted to the varied climate conditions and skin types across the Middle East and Africa. The increasing preference for natural and organic ingredients, pH-balanced and sulfate-free formulations, indicates a shift toward safer and environmentally conscious personal care options.

Middle East And Africa Bath And Shower Products Market Trends and Insights

Surging hygiene-conscious middle-class population

The Middle East and Africa bath and shower products market is primarily driven by the growing hygiene-conscious middle-class population. Increased awareness of personal hygiene and wellness has led consumers to incorporate quality bath and shower products into their daily routines. With higher disposable incomes, the expanding middle class is investing more in premium, natural, and specialized personal care products. According to the United Nations Office of the Special Adviser on Africa (May 2023), Africa's middle-class population is projected to exceed 40% of the total population by 2060 . This demographic transformation represents a growing consumer base prioritizing hygiene and personal grooming, increasing the demand for bath and shower products. The continued urbanization and economic development in the region are expected to sustain this middle-class expansion, presenting opportunities for brands to develop innovative products aligned with local cultural preferences in the Middle East and Africa.

Growing demand for pH-balanced, sulfate-free products

The Middle East and Africa bath and shower products market is experiencing significant growth driven by increasing demand for pH-balanced and sulfate-free products. Consumers in the region demonstrate heightened awareness about the harmful effects of conventional bath products containing sulfates and synthetic chemicals, which can strip natural skin oils and disrupt the skin's pH balance. The region's hot and arid climate makes consumers particularly conscious about selecting products that enhance skin hydration and minimize potential irritation. This has resulted in a substantial shift toward gentler formulations specifically designed for sensitive skin. The growing perception of pH-balanced and sulfate-free products as safer and more natural alternatives has prompted manufacturers to develop innovative formulations incorporating skin-friendly ingredients that align with these evolving consumer preferences.

Proliferation of counterfeit products

The Middle East and Africa bath and shower products market faces significant constraints due to counterfeit products. These fake goods are prevalent in emerging markets with weak regulatory enforcement, attracting price-sensitive consumers with lower costs. The presence of counterfeit products reduces market share for legitimate brands and erodes consumer confidence in personal care products. Counterfeit bath and shower items often contain substandard or harmful ingredients that can cause skin irritations, allergies, and other health issues. The sophistication of these counterfeit operations has increased, with fake products accurately replicating the packaging, branding, and marketing claims of authentic items. The impact of counterfeiting extends beyond consumer safety concerns. Established companies face substantial financial losses after investing in research, development, marketing, and distribution of legitimate products.

Other drivers and restraints analyzed in the detailed report include:

- Influence of social media and celebrity endorsement

- Natural and organic ingredient demand

- Regulatory complexity and delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Body wash and shower gel commands a significant 35.02% market share in the Middle East and Africa bath and shower products market in 2025. This dominance reflects strong consumer preferences for liquid formats that deliver superior convenience and enhanced hygiene benefits. The segment's robust performance is driven by innovative products incorporating diverse fragrances, premium natural ingredients, and specialized formulations targeting specific skin concerns. The heightened emphasis on personal hygiene protocols following the pandemic, combined with consumer desire for premium bathing experiences, has substantially strengthened demand in this category.

Bar soap demonstrates exceptional growth potential with a projected CAGR of 5.38% through 2031, establishing itself as the market's fastest-growing segment. This remarkable growth trajectory is primarily attributed to increasing environmental consciousness, particularly regarding plastic waste reduction compared to liquid formats. The segment's expansion is supported by its compelling combination of eco-friendly attributes, competitive pricing structure, and biodegradable properties. Significant advancements in bar soap formulations, including the integration of premium natural ingredients and enhanced moisturizing compounds, have substantially increased their market appeal, particularly in rural and price-sensitive markets. The strategic combination of environmental sustainability, cost-effectiveness, and advanced formulation technologies has positioned bar soap as a pivotal growth driver in the bath and shower products market.

Conventional bath and shower products hold a 67.12% market share in 2025, driven by established distribution networks and competitive pricing. These products maintain widespread consumer acceptance through affordability, accessibility, and brand familiarity. In the Middle East and Africa regions, conventional soaps remain integral to daily hygiene practices and cultural traditions, supported by their long-standing market presence. Manufacturers utilize efficient mass production capabilities and extensive retail networks to ensure widespread product availability. Consumer confidence in established formulations, along with incremental improvements in moisturizing and antibacterial properties, sustains demand despite market diversification.

The organic bath and shower products segment is expected to grow at a CAGR of 5.28% through 2031. This growth stems from consumers' increasing preference for natural and chemical-free formulations, which they view as beneficial for skin health and environmental sustainability. Urban and affluent consumers show particular interest in products with transparent ingredient lists and ethical sourcing practices. The segment's expansion is particularly strong among millennials and Gen Z consumers seeking environmentally responsible beauty products. Organic soaps incorporating regional ingredients like argan oil and olive extracts resonate with local consumer preferences, contributing to market growth.

The Middle-East and Africa Bath and Shower Products Market is Segmented by Product Type (Bar Soap, Body Wash/Shower Gel, and Other Product Type), Category (Conventional and Organic), End-User (Adult, and Kids), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail Stores, and Others Distribution Channel), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- The Procter & Gamble Company

- Unilever PLC

- L'Oreal S.A.

- Beiersdorf AG

- Johnson & Johnson Consumer Health

- L'Occitane International SA

- Reckitt Benckiser Group

- Henkel AG & Co. KGaA

- Colgate-Palmolive Company

- Estee Lauder Companies Inc.

- Coty Inc.

- Bath & Body Works, Inc.

- Natura & Co. (The Body Shop)

- Godrej Consumer Products Ltd.

- Dabur International Ltd.

- Edgewell Personal Care Co.

- Church & Dwight Co., Inc.

- Lion Corporation

- Nunu (National Detergent Co.)

- Savanna Laboratories (Egypt)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging hygiene-conscious middle-class population

- 4.2.2 Growing demand for pH-balanced, sulfate-free products

- 4.2.3 Influence of social media and celebrity endorsement

- 4.2.4 Natural and organic ingredient demand

- 4.2.5 Shift towards premium and luxury bath products

- 4.2.6 Product innovation and multifunctionality

- 4.3 Market Restraints

- 4.3.1 Proliferation of counterfeit products

- 4.3.2 Regulatory complexity and delays

- 4.3.3 Supply chain disruptions from poor transportation infrastructure

- 4.3.4 High cold chain storage operational costs

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Bar Soap

- 5.1.2 Body Wash/Shower Gel

- 5.1.3 Other Product Type

- 5.2 By Category

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By End-User

- 5.3.1 Adult

- 5.3.2 Kids

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Specialty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Others Distribution Channel

- 5.5 By Geography

- 5.5.1 South Africa

- 5.5.2 Saudi Arabia

- 5.5.3 United Arab Emirates

- 5.5.4 Nigeria

- 5.5.5 Egypt

- 5.5.6 Morocco

- 5.5.7 Turkey

- 5.5.8 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 The Procter & Gamble Company

- 6.4.2 Unilever PLC

- 6.4.3 L'Oreal S.A.

- 6.4.4 Beiersdorf AG

- 6.4.5 Johnson & Johnson Consumer Health

- 6.4.6 L'Occitane International SA

- 6.4.7 Reckitt Benckiser Group

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Colgate-Palmolive Company

- 6.4.10 Estee Lauder Companies Inc.

- 6.4.11 Coty Inc.

- 6.4.12 Bath & Body Works, Inc.

- 6.4.13 Natura & Co. (The Body Shop)

- 6.4.14 Godrej Consumer Products Ltd.

- 6.4.15 Dabur International Ltd.

- 6.4.16 Edgewell Personal Care Co.

- 6.4.17 Church & Dwight Co., Inc.

- 6.4.18 Lion Corporation

- 6.4.19 Nunu (National Detergent Co.)

- 6.4.20 Savanna Laboratories (Egypt)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK