PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906088

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906088

Indonesia Home Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

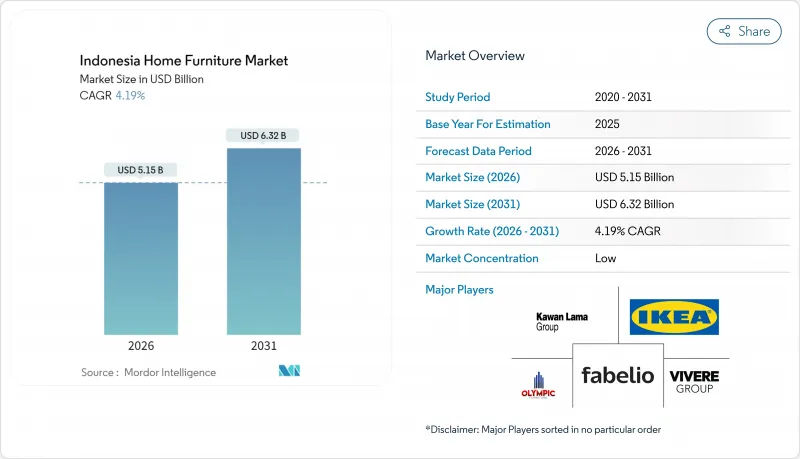

The Indonesia home furniture market was valued at USD 4.94 billion in 2025 and estimated to grow from USD 5.15 billion in 2026 to reach USD 6.32 billion by 2031, at a CAGR of 4.19% during the forecast period (2026-2031).

Robust urban population growth, government incentives for downstream timber processing, and recovering tourism demand are combining to sustain this momentum despite global economic headwinds. International brands expanding their footprints, especially IKEA and JYSK, are introducing global retail standards that lift local consumer expectations while enriching product diversity. Digitally enabled sales channels continue to reduce information gaps and logistical barriers, making online furniture shopping viable across the archipelago. Ongoing certification programs such as SVLK Plus strengthen Indonesia's credibility in sustainable wood sourcing, helping the country secure premium orders from regulated export markets.

Indonesia Home Furniture Market Trends and Insights

Rising Urbanization & Middle-Class Expansion

Indonesia's urbanization rate of 57.93% is lifting household furniture budgets, with city dwellers outspending rural counterparts on home upgrades. Rapid growth of tier-2 and tier-3 cities spreads consumption beyond Java and unlocks new retail nodes for domestic manufacturers. Smaller urban living spaces are driving demand for space-saving, multifunctional furniture that maximizes utility. A youthful demographic profile-67% of Indonesians are under 40-creates an early-adopter customer base keen on modern design and digital engagement. Infrastructure projects, notably new urban rail lines and highway links, further raise disposable incomes by improving labor mobility and job access.

E-Commerce Furniture Boom

Indonesia's digital economy is forecast to reach USD 68.12 billion in 2025, and furniture is benefiting directly from faster online adoption. Pandemic-era restrictions converted millions of first-time digital shoppers, pushing retailers to invest heavily in virtual showrooms and augmented-reality placement tools. National shipping costs have fallen 40% in five years, making bulkier items like sofas economically deliverable to remote islands. Social commerce channels and influencer partnerships help brands reach younger consumers who rely on peer recommendations when selecting household items. Omnichannel models such as IKEA's click-and-collect are blurring online and in-store experiences, increasing conversion rates and average order values.

Volatile Legal Timber Supply & Pricing

Quarterly raw-material costs fluctuate up to 30%, squeezing manufacturer margins and destabilizing production schedules. Enhanced SVLK enforcement temporarily reduced the pool of certified suppliers, leaving mills scrambling for compliant logs. Anti-illegal-logging sweeps disrupt informal sources, compelling businesses to fund pricier plantation timber or experiment with engineered substitutes. Climate-related droughts and floods undermine plantation yields in Kalimantan and Sumatra, extending harvest cycles and intensifying price spikes. Export bans on raw logs aim to promote local processing but create domestic imbalances as saw-mill capacity lags raw supply.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Downstream Timber Processing

- International Brand Expansion

- Influx of Low-Cost Imported Flat-Pack Units

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Living Room & Dining Room items captured 31.00% of the Indonesia home furniture market share in 2025, benefiting from cultural emphasis on communal meals and social entertainment. Average selling prices in this category remain above overall market norms, lifting revenue despite modest unit growth. Frequent remodeling among urban households sustains replacement demand for sofas, buffets, and dining sets. Bedroom Furniture is projected to outpace all other categories at a 4.95% CAGR as work-from-home practices convert bedrooms into multi-functional zones. International players continuously launch compact wardrobes and modular beds that maximize Jakarta apartment footprints.

The Indonesia home furniture market size for Bedroom Furniture is set to reach USD 0.48 billion by 2031 underpinned by ergonomic storage and desk solutions. Kitchen Furniture growth rides a shift toward open-plan layouts that require integrated cabinetry and island counters. Home Office sub-categories accelerate as corporates extend hybrid models, driving demand for adjustable desks and privacy partitions. Niche demand for Bathroom and Outdoor pieces broadens as developers add balconies and courtyard spaces to mid-range housing. Manufacturers introducing IoT charging ports and spill-resistant fabrics add value across all product lines.

Wood retained a 61.70% share of the Indonesia home furniture market size in 2025, supported by FSC-certified plantations that span 3.2 million acres across Java and Kalimantan. SVLK Plus certification, introduced in 2025, enhances traceability, opening higher-margin export channels in Europe and North America. Plastic & Polymer alternatives are forecast to grow fastest at 6.23% CAGR as resin prices stay below volatile timber costs and lightweight units lower shipping fees. Metal frames gain acceptance in modern apartments seeking minimalist aesthetics and durability in humid climates. Rattan, bamboo, and composite hybrids supply eco-friendly options that tie local craftsmanship to global sustainability trends.

Competitive advantages arise from value-added finishing, kiln-drying precision, and CNC routing that match international tolerance levels. Manufacturers diversify supply chains to cushion price swings, blending plantation teak with engineered wood cores that meet performance specifications. Climatic stresses prompt R&D into heat-treated bamboo and recycled polymer blends to ensure dimensional stability in coastal regions. Downstream incentives unlock funding for panel-lamination lines and UV-curing systems that cut waste while boosting throughput. Exporters highlighting carbon-footprint reporting win contracts from European retailers under tightening ESG frameworks.

The Indonesia Home Furniture Market Report is Segmented by Product (Living Room & Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, and More), Material (Wood, Metal, Plastic & Polymer, Others), Price Range (Economy, Mid-Range, Premium), Distribution Channel (Home Centers, Specialty Furniture Stores, Online, Other Distribution Channels), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Kawan Lama Group (Informa)

- IKEA Indonesia

- Vivere Group

- Olympic Furniture

- Fabelio

- Cellini Indonesia

- Domicil Indonesia

- Indachi Furniture

- King Koil Indonesia

- Pabrik Meubel Kayu Guhdo

- Big Land (Ligna)

- The Original Kayu

- Ivaro Furniture

- Selma Furniture

- JYSK Indonesia

- Malindo Furniture

- Prudential Indonesia Furniture

- Ace Hardware Indonesia

- Metrox Group (Home & Living)

- Rumah123 Custom Studios

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Urbanisation & Middle-Class Expansion

- 4.2.2 E-Commerce Furniture Boom

- 4.2.3 Government Incentives For Downstream Timber Processing

- 4.2.4 International Brand Expansion

- 4.2.5 Work-From-Home Demand For Modular Office Units

- 4.2.6 Preference For Certified Sustainable Teak & Rattan

- 4.3 Market Restraints

- 4.3.1 Volatile Legal Timber Supply & Pricing

- 4.3.2 Influx Of Low-Cost Imported Flat-Pack Units

- 4.3.3 Fragmented Unorganised Retail's Limited Digitisation

- 4.3.4 High Inter-Island Logistics Costs

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Living Room & Dining Room Furniture

- 5.1.2 Bedroom Furniture

- 5.1.3 Kitchen Furniture

- 5.1.4 Home Office Furniture

- 5.1.5 Bathroom Furniture

- 5.1.6 Outdoor Furniture

- 5.1.7 Other Furniture

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Others

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-Range

- 5.3.3 Premium

- 5.4 By Distribution Channel

- 5.4.1 Home Centers

- 5.4.2 Specialty Furniture Stores (including exclusive brand outlets and local stores from the unorganized sector)

- 5.4.3 Online

- 5.4.4 Other Distribution Channels (includes hypermarkets, supermarkets, teleshopping, departmental stores, etc.)

- 5.5 By Geography

- 5.5.1 Java

- 5.5.2 Sumatra

- 5.5.3 Kalimantan

- 5.5.4 Sulawesi

- 5.5.5 Bali & Nusa Tenggara

- 5.5.6 Papua & Maluku

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Kawan Lama Group (Informa)

- 6.4.2 IKEA Indonesia

- 6.4.3 Vivere Group

- 6.4.4 Olympic Furniture

- 6.4.5 Fabelio

- 6.4.6 Cellini Indonesia

- 6.4.7 Domicil Indonesia

- 6.4.8 Indachi Furniture

- 6.4.9 King Koil Indonesia

- 6.4.10 Pabrik Meubel Kayu Guhdo

- 6.4.11 Big Land (Ligna)

- 6.4.12 The Original Kayu

- 6.4.13 Ivaro Furniture

- 6.4.14 Selma Furniture

- 6.4.15 JYSK Indonesia

- 6.4.16 Malindo Furniture

- 6.4.17 Prudential Indonesia Furniture

- 6.4.18 Ace Hardware Indonesia

- 6.4.19 Metrox Group (Home & Living)

- 6.4.20 Rumah123 Custom Studios

7 Market Opportunities & Future Outlook

- 7.1 Accelerated Entry of Global Furniture Brands and Retail Formats

- 7.2 Growing Adoption of Modular and Space-Saving Urban Home Designs