PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910857

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910857

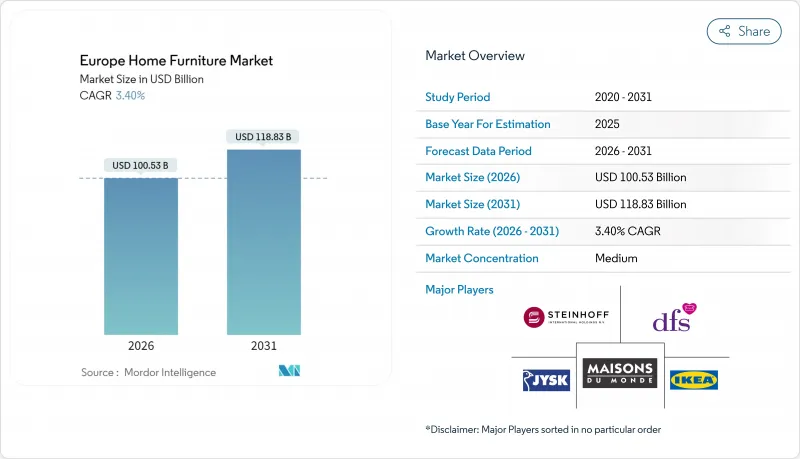

Europe Home Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe Home Furniture Market is expected to grow from USD 97.22 billion in 2025 to USD 100.53 billion in 2026 and is forecast to reach USD 118.83 billion by 2031 at 3.4% CAGR over 2026-2031.

In Europe, home furniture dominates the furniture market, commanding over 60% of the total market demand. This stronghold is bolstered by a surge in residential renovations, a boom in urban housing, and a trend of replacing old with new. Such a commanding presence underscores the pivotal role home furniture plays in Europe's broader furniture landscape. Measured growth reflects a maturing environment in which hybrid work patterns spur home-office investments, sustainability regulations reshape product design, and e-commerce expands purchasing convenience. Imports from China rose 35% in 2024, raising competitive pressure on regional producers even as early-2025 output ticked up 1.5% amid easing supply chain frictions. The Ecodesign for Sustainable Products Regulation (ESPR) and the European Union Deforestation Regulation (EUDR) now oblige manufacturers to prioritize durability, recyclability, and traceable sourcing, prompting accelerated adoption of circular manufacturing models. Competitive intensity has escalated, with leaders such as IKEA committing EUR 2.1 billion to price reductions while digital-first challengers leverage data analytics to target value-conscious shoppers.

Europe Home Furniture Market Trends and Insights

Growing Home-Renovation Activities Post-COVID-19

European homeowners continue redirecting discretionary budgets toward interior upgrades as remote work cements multipurpose living requirements. Modular sofas, adjustable desks, and space-saving storage now outrank purely aesthetic pieces in purchase decisions. Spanish outdoor specialists KETTAL, EXPORMIM, and GANDIABLASCO report elevated orders for patio collections that blur indoor-outdoor boundaries. Sustainability weighs heavily: 86% of consumers incorporate environmental criteria when choosing furniture. The renovation wave thus sustains baseline demand even as housing transactions slow.

Rising Popularity of E-Commerce Furniture Platforms

Online penetration reached 10% of German furniture sales and 9% in the UK during 2024 as shoppers embraced digital showrooms, AR visualization, and rapid-delivery promises. Songmics Home's 3,873% UK sales surge illustrates how niche players scale quickly through marketplace algorithms. Mobile now drives 75% of oakfurnitureland.co.uk orders, underscoring the importance of app performance and one-click checkout. Legacy retailers respond with omnichannel rollouts; IKEA booked USD 1.9 billion online revenue in 2024 while opening urban planning studios that double as click-and-collect hubs. Price transparency increases margin pressure yet broadens addressable audiences across rural and small-city locations.

Volatile Raw-Material Prices

German structural timber climbed to EUR 280/m3 in early 2025 and is forecast to exceed EUR 300/m3, while roof batten prices jumped 25% year-on-year to EUR 335/m3. North American softwood tariffs lifted E-SPF delivered costs by EUR 50/m3, inflating European inputs. Producer indices show OSB panel inflation at 1.84% even as pellet prices fell 6.6%, underscoring mixed category dynamics. The EUDR further narrows sourcing options, compelling long-term contracts with certified forests. Manufacturers hedge through material diversification and dynamic pricing, yet margin compression persists.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Rental / Subscription Furniture Services

- Sustainability Regulations Driving Eco-Friendly Designs

- Inflation-Led Squeeze on Discretionary Spending

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Living Room and Dining Room pieces represented 34.62% of the Europe home furniture market share in 2025, underscoring consumers' prioritization of sociable, multifunctional spaces. Subsequent demand supports stable volumes for seating, storage, and dining ensembles even as overall household budgets tighten. The Europe home furniture market size for Home Office furniture is projected to grow fastest at a 3.87% CAGR, thanks to entrenched hybrid work policies that require ergonomic desks and task chairs. Bedroom and kitchen categories gain from wellness and home-cooking trends, respectively, while outdoor lines capture summer renovation budgets as patios become year-round leisure zones. Retailers tailor merchandising by showcasing room-set vignettes that integrate acoustics, lighting, and tech accessories for seamless lifestyle solutions.

The segment hierarchy influences inventory strategy: living room SKUs remain high-turn staples, whereas office lines demand modularity and rapid replenishment cycles. IKEA's small-format planning studios now center on living-room layouts augmented by configurable desk add-ons. Suppliers leverage virtual reality to help shoppers visualize open-plan conversions, driving basket sizes without expanding store footprints. Product designers emphasize modularity and easy assembly to lower reverse-logistics costs tied to booming e-commerce sales. Environmental compliance also sways product engineering, as ESPR durability criteria favor solid-wood frames and replaceable upholstery panels.

Wood maintained a 53.71% share of the Europe home furniture market in 2025, anchored by consumer affinity for natural finishes and perceived longevity. Yet EUDR traceability demands raise sourcing complexities, propelling some buyers toward certified bamboo, fast-growing eucalyptus, and recycled composites. Plastic & polymer furniture is poised for a 4.6% CAGR by 2031 as manufacturers incorporate post-consumer resin and 3D-printing efficiencies that appeal to cost-conscious segments. Metal frames enjoy popularity in loft-style interiors, while bio-based materials such as mycelium foams gain experimental traction in seating. Herman Miller's bamboo-based Eames Lounge Chair highlights how premium brands de-risk compliance while preserving iconic aesthetics.

Material choice intertwines with logistics and price exposure: polymers shield against timber price swings but face petroleum volatility, whereas engineered wood panels benefit from standardized inputs yet must meet formaldehyde emission caps. ESPR recyclability rules incentivize mono-material construction and disassembly-friendly joinery. Retail messaging increasingly flags Life-Cycle Assessment scores to satisfy environmentally conscious buyers. Over time, wood's lead may narrow as alternative inputs align better with circular targets and volatile cost structures.

The Europe Home Furniture Market Report is Segmented by Product (Living Room and Dining Room Furniture, Bedroom Furniture, and More), Material (Wood, Metal, Plastic and Polymer, Others), Price Range (Economy, Mid-Range, Premium), Distribution Channel (Home Centers, Specialty Furniture Stores, and More), and Geography (United Kingdom, Germany, France, Spain, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IKEA Group

- Steinhoff International (Conforama, POCO)

- JYSK Group

- DFS Furniture

- Groupe ADEO (Leroy Merlin, Alinea)

- Maisons du Monde

- Natuzzi S.p.A.

- Poltrona Frau

- HNI Corporation

- Herman Miller (now MillerKnoll)

- Vestre

- Calligaris

- BoConcept

- Ligne Roset

- ALF Group

- Kinnarps

- Gautier

- Rohr-Bush

- BM Mobel

- Actona Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing home-renovation activities post-COVID-19

- 4.2.2 Rising popularity of e-commerce furniture platforms

- 4.2.3 Expansion of rental/subscription furniture services

- 4.2.4 Sustainability regulations driving eco-friendly designs

- 4.2.5 Circular economy push for refurbished furniture

- 4.2.6 Workplace hybridization boosting home-office demand

- 4.3 Market Restraints

- 4.3.1 Volatile raw-material prices

- 4.3.2 Inflation-led squeeze on discretionary spending

- 4.3.3 Cross-border logistics bottlenecks

- 4.3.4 Consumer fatigue toward fast-furniture

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Living Room and Dining Room Furniture

- 5.1.2 Bedroom Furniture

- 5.1.3 Kitchen Furniture

- 5.1.4 Home Office Furniture

- 5.1.5 Bathroom Furniture

- 5.1.6 Outdoor Furniture

- 5.1.7 Other Furniture

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic and Polymer

- 5.2.4 Others

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-Range

- 5.3.3 Premium

- 5.4 By Distribution Channel

- 5.4.1 Home Centers

- 5.4.2 Specialty Furniture Stores (including exclusive brand outlets and local stores from the unorganized sector)

- 5.4.3 Online

- 5.4.4 Other Distribution Channels (includes hypermarkets, supermarkets, teleshopping, departmental stores, etc.)

- 5.5 By Geography

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 IKEA Group

- 6.4.2 Steinhoff International (Conforama, POCO)

- 6.4.3 JYSK Group

- 6.4.4 DFS Furniture

- 6.4.5 Groupe ADEO (Leroy Merlin, Alinea)

- 6.4.6 Maisons du Monde

- 6.4.7 Natuzzi S.p.A.

- 6.4.8 Poltrona Frau

- 6.4.9 HNI Corporation

- 6.4.10 Herman Miller (now MillerKnoll)

- 6.4.11 Vestre

- 6.4.12 Calligaris

- 6.4.13 BoConcept

- 6.4.14 Ligne Roset

- 6.4.15 ALF Group

- 6.4.16 Kinnarps

- 6.4.17 Gautier

- 6.4.18 Rohr-Bush

- 6.4.19 BM Mobel

- 6.4.20 Actona Company

7 Market Opportunities and Future Outlook

- 7.1 Circular Rental Furniture Subscriptions Driven by EU Policies

- 7.2 Digitally Enabled Mass-Customized Furniture with EUDR Compliance