PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906091

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906091

Indonesia Bottled Water - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

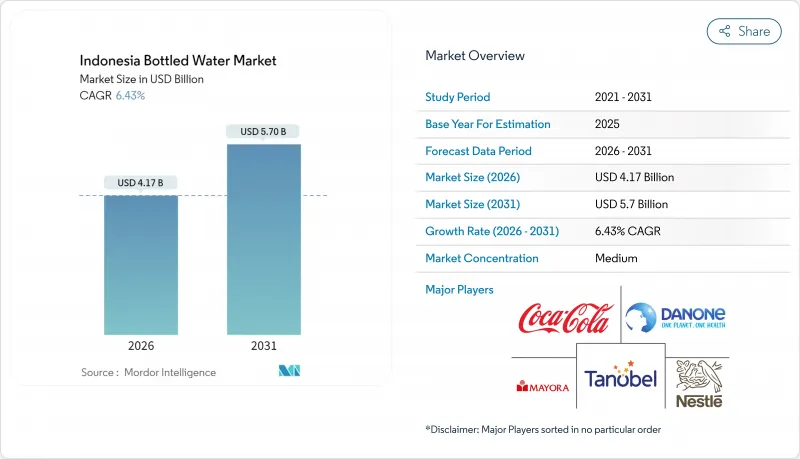

The Indonesian bottled water market was valued at USD 3.92 billion in 2025 and estimated to grow from USD 4.17 billion in 2026 to reach USD 5.7 billion by 2031, at a CAGR of 6.43% during the forecast period (2026-2031).

Today's demand showcases a significant pivot: most households now predominantly turn to branded or refillable drinking water, moving away from conventional sources. This shift is bolstered by rapid urbanization, heightened health consciousness, and enhanced distribution networks spanning the nation's 17,000 islands. While still water retains its dominance, there's a swift ascent in demand for functional and flavored variants, especially among health-conscious millennials. PET packaging leads the pack, but alternatives like recycled resin, label-free bottles, and glass formats are emerging, driven by growing sustainability concerns. To navigate the archipelago's diverse landscape, competitors are honing in on eco-design, establishing regional production hubs, and leveraging digital commerce to tap into both mass and premium market segments.

Indonesia Bottled Water Market Trends and Insights

Growth of premium and functional bottled water products

In Indonesia, the rise of premium and functional water segments is transforming traditional mass-market dynamics. Health-conscious consumers are increasingly gravitating towards alkaline and vitamin-enhanced products. A case in point is PT Sariguna Primatirta's foray into the high-pH market with its SuperO2 and Vio8+ offerings. Meanwhile, brands like Pristine 8.6+ are honing in on specific health benefits. This segment's expansion is fueled by growing disposable incomes and marketing campaigns that tout functional water as a form of preventive healthcare. Niche brands, such as Kangen Water, are leveraging digital marketing, especially on platforms like Instagram and Facebook, to make inroads into urban markets. As a result of this premiumization trend, established players are discovering new revenue streams, while specialized brands find fertile ground among value-conscious consumers seeking more than just basic hydration.

Innovative packaging solutions for convenience and environmental impact

As environmental regulations tighten and consumers increasingly favor sustainability, packaging innovation has emerged as a key differentiator. MOUNTOYA has pioneered Indonesia's first label-free bottled water packaging, marking a significant step in curbing plastic waste without compromising product integrity or brand visibility. In a notable move, Coca-Cola, in collaboration with PT Amandina Bumi Nusantara, has rolled out bottles made entirely from recycled PET. This initiative underscores Coca-Cola's robust commitment to circular economy principles, with an ambitious target of achieving 50% rPET content across its entire portfolio by 2025. Responding to the Indonesian government's new warning requirements on BPA leaching, innovators are pivoting towards BPA-free packaging materials, granting them a competitive edge. While premium brands champion sustainability messaging, driving an 8.16% CAGR growth in glass bottle segments, cost considerations pose challenges for broader market adoption.

Microplastic and nanoplastic health concerns

Research by Buletin Keslingmas highlights a concerning trend: sun-exposed PET bottles contain 175 microplastic particles per liter, outpacing the 132.25 particles found in their unexposed counterparts. In Makassar, assessments by the Global Journal of Environmental Science and Management identified risk quotients exceeding 1 for PET microplastic exposure, indicating potential organ inflammation and shifts in the immune system. These alarming findings are prompting consumers to opt for pricier glass packaging and more sophisticated filtration systems. Responding to this heightened awareness, the Indonesian government has mandated warnings for BPA leaching, underscoring the mounting regulatory focus on packaging safety. This move could hasten the shift to alternative materials. In tandem, companies are investing significant resources in research and development for safer packaging solutions, although the associated transition costs pose challenges, particularly for smaller entities, which may compromise their short-term profitability.

Other drivers and restraints analyzed in the detailed report include:

- Rapid urbanisation boosting on-the-go hydration needs

- Adoption of advanced purification and bottling technologies

- Water scarcity and sustainability issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, still water commands a dominant 88.15% market share, underscoring Indonesian consumers' preference for pure hydration. Yet, the functional and flavored water segments are surging, boasting an 8.32% CAGR through 2031. This growth is largely fueled by health-conscious millennials and Gen Z, who are on the lookout for added nutritional benefits. While sparkling water has traditionally occupied a niche, it's now gaining momentum, especially in urban locales and upscale dining, with expatriates leading the charge. The functional water realm, which includes alkaline, vitamin-enhanced, and oxygenated variants, sees brands like SuperO2 and Pristine 8.6+ making waves with targeted health claims.

Companies are redefining the functional water arena with premium positioning strategies, using scientific research as a tool to command higher prices and stand apart from standard still water. PT Sariguna Primatirta's foray into diverse functional variants is a testament to how industry stalwarts are capitalizing on the premiumization trend. Digital marketing, especially on social media, plays a pivotal role in this segment's growth, enlightening consumers about health benefits and resonating particularly with younger audiences. Meanwhile, BPOM's stringent food safety regulations bolster quality assurance across all water types, instilling consumer confidence and bolstering premium pricing for functional variants.

In 2025, PET bottles dominate the market with an 88.68% share, thanks to their cost efficiency, lightweight nature, and well-established supply chains spread across Indonesia's diverse geography. Meanwhile, glass bottles are rapidly gaining traction, boasting the fastest growth rate at an 8.05% CAGR. Their rise is fueled by a premium market positioning, heightened sustainability concerns, and their ability to preserve taste, making them a favorite among discerning consumers. Although aluminum cans and bottles hold a smaller market share, they're witnessing growth, especially in the functional and sparkling water segments. Here, the metallic packaging not only boosts perceived quality but also enhances shelf appeal.

As environmental regulations tighten and awareness of plastic pollution rises, the packaging industry is witnessing a significant transformation. In a notable move towards circular economy principles, Coca-Cola, via PT Amandina Bumi Nusantara, has rolled out 100% recycled PET bottles. This initiative sees the company processing a substantial 3,000 tonnes of used PET bottles monthly, as highlighted by Starlinger. Further underscoring the industry's shift, AQUA has pledged to incorporate 50% recycled content by 2025, while MOUNTOYA is making waves with its label-free packaging innovation. These moves highlight how sustainability is evolving into a key competitive edge. Additionally, with the Indonesian government mandating warnings on BPA leaching, there's a swift pivot towards BPA-free materials. This shift not only underscores a commitment to health and safety but also opens doors for innovative packaging solutions that harmonize cost, convenience, and environmental stewardship.

The Indonesia Bottled Water Market Report is Segmented by Product Type (Still Water, Sparkling Water, Functional Water, Flavoured Water), Packaging Material (PET Bottles, Glass Bottles, Aluminum Cans and Bottles, Others), Pricing (Mass, Premium/Luxury), Distribution Channel (On-Trade, Off-Trade), and Geography (Java, Sumatra, Kalimantan, Sulawesi, Rest of Indonesia). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Danone (PT Tirta Investama - AQUA)

- PT Mayora Indah Tbk

- PT Sariguna Primatirta Tbk

- Nestle Indonesia

- The Coca-Cola Company

- PT Indofood CBP Sukses Makmur Tbk

- Fraser & Neave Ltd

- PT Pristine Prima Indonesia

- PT Tirta Fresindo Jaya

- Asahi Group - Vittoria Sparkling

- PT Super Wahana Tehno

- PT ABC President Indonesia

- PT Nojorono Pratama

- PT Wings Food

- PT Tempo Scan Pacific

- PT Ades Waters Indonesia

- PT Aetra Air Jakarta (Private-label)

- PT Langgeng Sukmasejati

- PT Namasindo Plas

- PT Sutindo Chemical Indonesia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of premium and functional bottled Water Products

- 4.2.2 Innovative packaging solutions for convenience and environmental impact

- 4.2.3 Rapid urbanisation is boosting on-the-go hydration needs

- 4.2.4 Adoption of advanced purification and bottling technologies

- 4.2.5 Increasing health consciousness with a shift from sugary drinks

- 4.2.6 Expansion of the tourism and hospitality sector

- 4.3 Market Restraints

- 4.3.1 Microplastic and nanoplastic health concerns

- 4.3.2 Water scarcity and sustainability issues

- 4.3.3 Price sensitivity and intense competition

- 4.3.4 Strict regulatory compliance and costs

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Still Water

- 5.1.2 Sparkling Water

- 5.1.3 Functional Water

- 5.1.4 Flavoured Water

- 5.2 By Packaging Material

- 5.2.1 PET Bottles

- 5.2.2 Glass Bottles

- 5.2.3 Aluminum Cans and Bottles

- 5.2.4 Others

- 5.3 By Pricing

- 5.3.1 Mass

- 5.3.2 Premium/Luxury

- 5.4 By Distribution Channel

- 5.4.1 On-trade

- 5.4.2 Off-trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience/Grocery Stores

- 5.4.2.3 Home and Office Space

- 5.4.2.4 Online Retail

- 5.4.2.5 Other Off-trade channels

- 5.5 By Region

- 5.5.1 Java

- 5.5.2 Sumatra

- 5.5.3 Kalimantan

- 5.5.4 Sulawesi

- 5.5.5 Rest of Indonesia

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Danone (PT Tirta Investama - AQUA)

- 6.4.2 PT Mayora Indah Tbk

- 6.4.3 PT Sariguna Primatirta Tbk

- 6.4.4 Nestle Indonesia

- 6.4.5 The Coca-Cola Company

- 6.4.6 PT Indofood CBP Sukses Makmur Tbk

- 6.4.7 Fraser & Neave Ltd

- 6.4.8 PT Pristine Prima Indonesia

- 6.4.9 PT Tirta Fresindo Jaya

- 6.4.10 Asahi Group - Vittoria Sparkling

- 6.4.11 PT Super Wahana Tehno

- 6.4.12 PT ABC President Indonesia

- 6.4.13 PT Nojorono Pratama

- 6.4.14 PT Wings Food

- 6.4.15 PT Tempo Scan Pacific

- 6.4.16 PT Ades Waters Indonesia

- 6.4.17 PT Aetra Air Jakarta (Private-label)

- 6.4.18 PT Langgeng Sukmasejati

- 6.4.19 PT Namasindo Plas

- 6.4.20 PT Sutindo Chemical Indonesia

7 MARKET OPPORTUNITIES AND FUTURE TRENDS