PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906093

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906093

GCC Luxury Goods - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

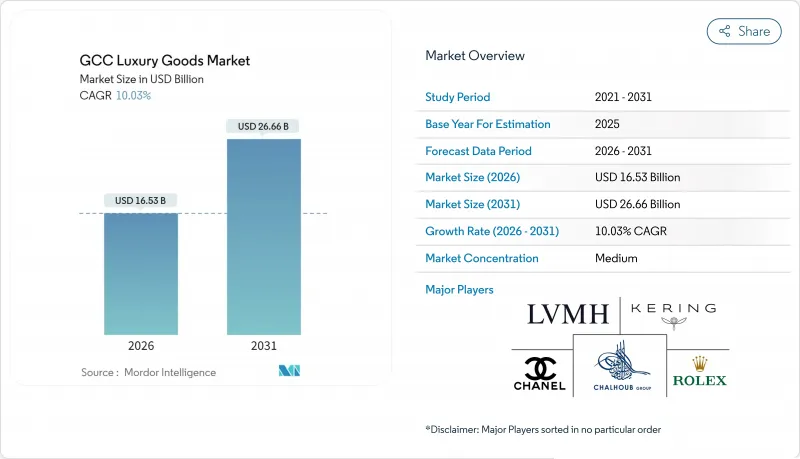

The GCC (Gulf Cooperation Council) luxury goods market was valued at USD 15.02 billion in 2025 and estimated to grow from USD 16.53 billion in 2026 to reach USD 26.66 billion by 2031, at a CAGR of 10.03% during the forecast period (2026-2031).

This growth is driven by substantial investments in retail infrastructure and government-led initiatives to diversify the economy. Cities like Riyadh and Dubai are witnessing the construction of large flagship malls, while e-commerce is expanding rapidly, making luxury products more accessible to consumers. Brands are launching products that align with local cultural preferences, further boosting demand. Tourism programs are also playing a significant role in driving sales, as visitors contribute to the growing appetite for high-end fashion, jewelry, and accessories. Investments in European luxury brands are strengthening the market further. Watches are becoming a key product category driving premium growth, while the men's segment is showing increasing momentum in terms of demand. The digital transformation of distribution channels is reshaping how luxury goods are sold, with online platforms gaining prominence. Despite moderate market fragmentation, regional distributors and niche brands have opportunities to grow by utilizing localized marketing strategies and adopting omnichannel approaches to engage consumers effectively.

GCC Luxury Goods Market Trends and Insights

Consumers' inclination toward limited-edition products

In the Gulf Cooperation Council luxury goods market, wealthy consumers are increasingly drawn to exclusive, limited-edition products. This has led brands to create regionally inspired collections that boost demand and profits. The growing number of wealthy individuals supports this trend, with the United Arab Emirates seeing a net increase of 6,700 high-net-worth individuals in 2024, the highest globally, according to the World Economic Forum. For example, Dubai Watch Week 2023 attracted over 23,000 visitors, a 42% rise from the previous event, and showcased more than 20 exclusive watch launches designed for local preferences. Similarly, in August 2025, the Apparel Group launched the ALDO Artist Series, a 16-piece collection available in Gulf Cooperation Council stores, created in collaboration with four global artists, blending cultural storytelling with footwear and accessories. These strategies, including limited-edition watches, Ramadan-themed couture, collaborative footwear, and custom fragrances, enhance the appeal of luxury products while increasing prices and profit margins through exclusivity.

Government-supported heritage festivals driving increased spending

Government-supported heritage festivals are driving luxury spending in the Gulf Cooperation Council by combining culture, tourism, and premium retail in major events. In Saudi Arabia, Riyadh Season 2024 showcased the "Christian Dior: Designer of Dreams" exhibition, which opened on November 21, 2024, and the "1001 Seasons of Elie Saab" fashion show on November 13, 2024. These events featured global celebrities like Celine Dion and Jennifer Lopez and promoted luxury shopping in restored heritage areas. Layali Diriyah 2025, starting on February 12, 2025, drew over 110,000 visitors to its unique setting near the Diriyah United Nations Educational, Scientific, and Cultural Organization (UNESCO) site, offering designer pop-ups, retail activities, and cultural experiences. In the United Arab Emirates, Abu Dhabi's "Timeless Eid, Timeless Luxury" campaign continues to link luxury retail promotions with public holidays, increasing visits and time spent in high-end malls. These festivals create regular boosts in spending on apparel, accessories, and gifts while strengthening the cultural connection to luxury shopping.

Rising availability of counterfeit products

The issue of counterfeit luxury goods continues to be a major challenge in the GCC luxury goods market. The growing use of online platforms has further complicated the problem, as counterfeit sellers take advantage of loopholes in cross-border shipping regulations to distribute fake products more easily. In Kuwait, authorities made significant efforts to address the issue, confiscating over 623,000 counterfeit items from a warehouse in Farwaniya in June 2024 and seizing more than 720 fake goods at the Friday Market in Al-Rai in August 2024. Brands are working to tackle this problem by implementing advanced technologies such as blockchain-based certificates, unique QR codes, and exclusive service warranties to verify the authenticity of their products. They are running consumer awareness campaigns to educate buyers on how to identify genuine products. The persistence of this issue highlights the need for ongoing collaboration between governments, brands, and consumers to effectively combat counterfeit activities.

Other drivers and restraints analyzed in the detailed report include:

- Growing preference for sustainable and eco-certified luxury products

- Expansion of luxury shopping malls and retail real-estate

- Strict regulatory frameworks and associated compliance expenses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, clothing and apparel remained the largest segment in the GCC luxury goods market, accounting for 35.31% of the market share. This segment benefits from the region's strong cultural preference for premium traditional clothing, such as abayas and kanduras, as well as luxury occasion wear. Both wealthy locals and tourists are drawn to these garments, which combine cultural significance with modern fashion trends. The availability of custom tailoring, high-quality materials, and exclusive collections further supports the demand. To cater to changing consumer expectations, retailers are increasingly offering personalized in-store services and curated online shopping experiences, making this segment a cornerstone of the market.

Watches are the fastest-growing segment, with a projected CAGR of 10.52% through 2031. The demand for exclusivity and fine craftsmanship has encouraged leading watch brands, including Swiss manufacturers, to launch Gulf-exclusive designs and limited-edition collections. Events like Dubai Watch Week have further boosted interest by providing immersive experiences and opportunities for customers to engage directly with luxury timepieces. High-net-worth individuals and collectors are driving sales through both physical stores and online platforms. The focus on heritage, rarity, and storytelling has positioned watches as a rapidly expanding category, complementing the established dominance of luxury apparel in the Gulf Cooperation Council market.

The GCC Luxury Goods Market Report is Segmented by Product Type (Clothing and Apparel, Footwear, and More), End User (Men, Women, and More), Distribution Channel (Single-Brand Stores, Mult-Brand Stores, and More), and Geography (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, and Oman). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- LVMH Moet Hennessy Louis Vuitton

- Kering SA

- Compagnie Financiere Richemont SA

- Chanel SA

- Capri Holdings Ltd

- Breitling SA

- The Swatch Group Ltd.

- Burberry Group Plc

- Dolce & Gabbana Srl

- Audemars Piguet Holding SA

- Tapestry Inc.

- Giorgio Armani SpA

- Hermes International SA

- Rolex SA

- Estee Lauder Companies Inc.

- Chopard & Cie S.A

- Hugo Boss AG

- Chalhoub Group

- Tod's S.p.A.

- Prada SpA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Consumers' inclination toward limited edition products

- 4.2.2 Impact of social media and celebrity endorsements

- 4.2.3 Government-supported heritage festivals driving increased spending

- 4.2.4 Gulf Cooperation Council's strategic investments in European luxury brands

- 4.2.5 Growing consumer preference for sustainable and eco-certified luxury products

- 4.2.6 Expansion of luxury shopping malls and retail real-estate

- 4.3 Market Restraints

- 4.3.1 Rising availability of counterfeit products

- 4.3.2 Cultural sensitivities and norms

- 4.3.3 Strict regulatory frameworks and associated compliance expenses

- 4.3.4 Tougher personal luxury import duties in Saudi 2024

- 4.4 Regulatory Outlook

- 4.5 Consumer Behaviour Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Clothing and Apparel

- 5.1.2 Footwear

- 5.1.3 Leather Goods

- 5.1.4 Watches

- 5.1.5 Jewellery

- 5.1.6 Eyewear

- 5.1.7 Other Product Types

- 5.2 By End User

- 5.2.1 Men

- 5.2.2 Women

- 5.2.3 Unisex

- 5.3 By Distribution Channel

- 5.3.1 Single-Brand Stores

- 5.3.2 Multi-Brand Stores

- 5.3.3 Online Luxury Stores

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 Saudi Arabia

- 5.4.2 United Arab Emirates

- 5.4.3 Qatar

- 5.4.4 Kuwait

- 5.4.5 Oman

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 LVMH Moet Hennessy Louis Vuitton

- 6.4.2 Kering SA

- 6.4.3 Compagnie Financiere Richemont SA

- 6.4.4 Chanel SA

- 6.4.5 Capri Holdings Ltd

- 6.4.6 Breitling SA

- 6.4.7 The Swatch Group Ltd.

- 6.4.8 Burberry Group Plc

- 6.4.9 Dolce & Gabbana Srl

- 6.4.10 Audemars Piguet Holding SA

- 6.4.11 Tapestry Inc.

- 6.4.12 Giorgio Armani SpA

- 6.4.13 Hermes International SA

- 6.4.14 Rolex SA

- 6.4.15 Estee Lauder Companies Inc.

- 6.4.16 Chopard & Cie S.A

- 6.4.17 Hugo Boss AG

- 6.4.18 Chalhoub Group

- 6.4.19 Tod's S.p.A.

- 6.4.20 Prada SpA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK