PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910837

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910837

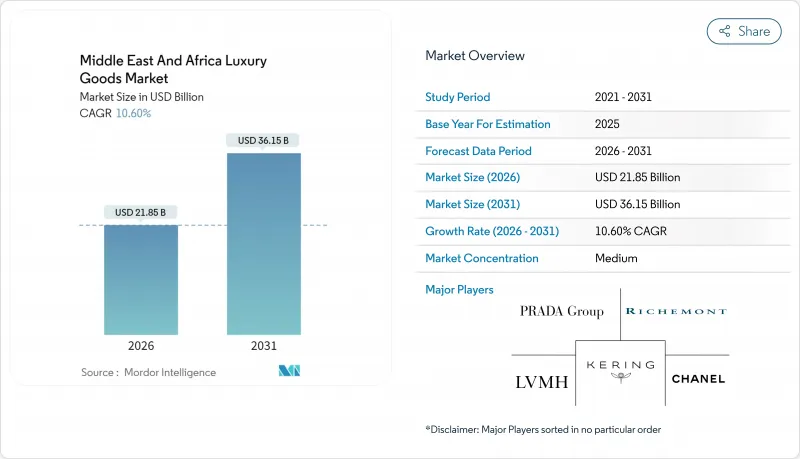

Middle East And Africa Luxury Goods - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Middle East and Africa luxury goods market was valued at USD 19.76 billion in 2025 and estimated to grow from USD 21.85 billion in 2026 to reach USD 36.15 billion by 2031, at a CAGR of 10.60% during the forecast period (2026-2031).

This growth is driven by an increasing number of high-net-worth individuals, retail ecosystems supported by tourism, and government efforts to diversify economies. Additionally, the rise of e-commerce and the influence of social media have made luxury goods more accessible to consumers. While European conglomerates continue to dominate the market, regional brands and online-first labels are gaining traction by focusing on cultural authenticity and sustainability. Governments in the Gulf are simplifying customs processes and introducing VAT-refund programs, making the region more appealing for luxury shopping. Meanwhile, countries like South Africa and Nigeria are experiencing higher aspirational spending, contributing to a diverse growth pattern that strengthens the long-term prospects of the luxury goods market.

Middle East And Africa Luxury Goods Market Trends and Insights

Product innovation in terms of raw material and design

Luxury brands are increasingly leveraging material innovation by combining advanced technologies with traditional craftsmanship to create distinctive value propositions. For instance, Goldgenie Dubai plans to launch the 24k Gold iPhone 16 Pro range in July 2025, showcasing a blend of cutting-edge technology and gold craftsmanship aimed at ultra-high-net-worth individuals in the Gulf region. Regional artisans are also collaborating with global luxury brands to incorporate local materials and techniques, crafting authentic products that appeal to culturally-aware consumers. Additionally, companies like Paragon ID are addressing both innovation and anti-counterfeiting concerns by integrating blockchain authentication and RFID solutions into their offerings. This focus on superior materials and technological advancements enables brands to command higher prices while fostering long-term consumer trust. As competition intensifies, brands are accelerating innovation cycles to introduce exclusive materials and limited-production techniques, ensuring their offerings remain unique and difficult for competitors to replicate.

Consumer shift toward sustainable and eco-certified luxury products

Environmentally conscious consumers are driving significant changes in luxury consumption patterns by closely examining brand practices and demanding greater supply chain transparency. Hermes International has responded to these shifting expectations by committing to 100% recycled gold and silver in its workshops and achieving validation from the Science-Based Targets initiative for its emissions reduction goals. African luxury brands are also leveraging this trend by focusing on sustainably sourcing indigenous materials such as shea, frankincense, and myrrh, which helps them build authentic sustainability stories and gain a competitive advantage. Beyond material sourcing, luxury brands are adopting circular economy practices, including repair services, upcycling programs, and policies to avoid destroying unsold inventory. Governments in regions like the United Arab Emirates and Saudi Arabia are supporting this transition by enforcing sustainability disclosure requirements and ESG reporting mandates. Additionally, consumers are willing to pay higher prices for luxury products that are certified as sustainable, creating opportunities for brands that can effectively demonstrate environmental responsibility throughout their value chains.

Proliferation of counterfeit products

Counterfeit products damage brand reputation and weaken consumer trust, creating unfair competition that reduces legitimate market share and pricing power. Dubai's Commercial Compliance and Consumer Protection agency recently seized 3.5 million counterfeit goods, highlighting the widespread impact of illicit trade on luxury brand revenues and market positioning. Counterfeit activities are often concentrated in major trade hubs and tourist destinations, making it challenging for luxury brands to protect their intellectual property and maintain their exclusive image. To address these issues, brands are increasingly using advanced authentication technologies, such as blockchain solutions for tracking diamonds and verifying luxury goods. While the United Arab Emirates has implemented several anti-counterfeiting laws, enforcement effectiveness varies across regions. Many markets face challenges like limited resources and complex jurisdictional issues. Additionally, the rapid growth of online marketplaces and social media platforms has created new channels for counterfeit distribution, requiring constant monitoring and enforcement. To tackle this, brands are investing in consumer education campaigns to help customers identify authentic products and understand the risks of purchasing counterfeit items.

Other drivers and restraints analyzed in the detailed report include:

- Tourism-led retail ecosystems

- Influence of social media and celebrity endorsement

- Stringent regulatory environment and compliance costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, clothing and apparel hold a 37.15% share of the market, highlighting their strong appeal across various consumer groups. This segment acts as the main entry point for luxury consumption in the growing markets of the Middle East and Africa. The popularity of modest luxury fashion in Gulf countries drives demand, with brands customizing their collections to meet local dress codes while maintaining global design standards. For example, Thebe Magugu's collaboration with Cape Town's Mount Nelson Belmond Hotel showcases how African fashion designers work with luxury hospitality brands to create culturally relevant apparel that appeals to both local and international audiences. The segment's strength is supported by regular seasonal updates, celebrity endorsements, and the influence of social media, which continuously drive interest in new collections and exclusive releases. Additionally, fashion weeks in Dubai and Saudi Arabia provide key opportunities for luxury apparel brands to present their collections, build cultural connections, and engage with consumers in the Middle East.

Watches are the fastest-growing product category, with an 10.98% CAGR projected through 2031. This growth is fueled by the region's cultural appreciation for watches as both investment assets and symbols of status, which remain valued regardless of economic conditions. Brands like Out of Order watches are responding to this demand by creating region-specific collections, such as the Arjwan Edition, designed to reflect Middle Eastern tastes and cultural significance. The category also benefits from active collector communities and secondary markets, particularly in the Gulf, where luxury watches are seen as portable wealth and valuable family heirlooms. To meet rising demand, Swiss and German watchmakers are opening regional service centers and boutiques. Limited editions and intricate watch complications generate excitement and support premium pricing strategies. Furthermore, combining traditional mechanical craftsmanship with modern materials and technologies allows brands to stand out, attracting sophisticated consumers who value authentic luxury experiences.

The Middle East and Africa Luxury Goods Market Report is Segmented by Product Type (Clothing and Apparel, Footwear, Leather Goods, Watches, Jewellery, Eyewear, Others), End User (Men, Women, Unisex), Distribution Channel (Single-Brand Stores, Multi-Brand Stores, and More), and Geography (South Africa, Saudi Arabia, United Arab Emirates, Nigeria, Egypt, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- LVMH Moet Hennessy Louis Vuitton SE

- Kering SA

- Prada SpA

- Compagnie Financiere Richemont SA

- Giorgio Armani SpA

- OTB Group

- Dolce & Gabbana S.r.l.

- Coty Inc.

- Rolex SA

- Hermes International SA

- Roberto Cavalli SpA

- The Swatch Group Ltd

- Chopard & Cie S.A

- Tod's S.p.A.

- Bulgari S.p.A.

- The Estee Lauder Companies Inc.

- L'Oreal Group

- Capri Holdings Limited

- Salvatore Ferragamo S.p.A.

- Tapestry, Inc.

- Chanel S.A

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Product innovation in terms of raw material and design

- 4.2.2 Consumer shift toward sustainable and eco-certified luxury products

- 4.2.3 Tourism-led retail ecosystems

- 4.2.4 Influence of social media and celebrity endorsement

- 4.2.5 Expansion of mono-brand boutiques and mall developments

- 4.2.6 Consumers' inclination towards limited edition products

- 4.3 Market Restraints

- 4.3.1 Proliferation of counterfeit products

- 4.3.2 Stringent regulatory environment and compliance costs

- 4.3.3 Supply chain fragility and lead-time variability

- 4.3.4 Labor shortages in specialized craftsmanship

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Clothing and Apparel

- 5.1.2 Footwear

- 5.1.3 Leather Goods

- 5.1.4 Watches

- 5.1.5 Jewellery

- 5.1.6 Eyewear

- 5.1.7 Other Product Types

- 5.2 By End User

- 5.2.1 Men

- 5.2.2 Women

- 5.2.3 Unisex

- 5.3 By Distribution Channel

- 5.3.1 Single-Brand Stores

- 5.3.2 Multi-Brand Stores

- 5.3.3 Online Luxury Stores

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 South Africa

- 5.4.2 Saudi Arabia

- 5.4.3 United Arab Emirates

- 5.4.4 Nigeria

- 5.4.5 Egypt

- 5.4.6 Morocco

- 5.4.7 Turkey

- 5.4.8 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 LVMH Moet Hennessy Louis Vuitton SE

- 6.4.2 Kering SA

- 6.4.3 Prada SpA

- 6.4.4 Compagnie Financiere Richemont SA

- 6.4.5 Giorgio Armani SpA

- 6.4.6 OTB Group

- 6.4.7 Dolce & Gabbana S.r.l.

- 6.4.8 Coty Inc.

- 6.4.9 Rolex SA

- 6.4.10 Hermes International SA

- 6.4.11 Roberto Cavalli SpA

- 6.4.12 The Swatch Group Ltd

- 6.4.13 Chopard & Cie S.A

- 6.4.14 Tod's S.p.A.

- 6.4.15 Bulgari S.p.A.

- 6.4.16 The Estee Lauder Companies Inc.

- 6.4.17 L'Oreal Group

- 6.4.18 Capri Holdings Limited

- 6.4.19 Salvatore Ferragamo S.p.A.

- 6.4.20 Tapestry, Inc.

- 6.4.21 Chanel S.A

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK