PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906094

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906094

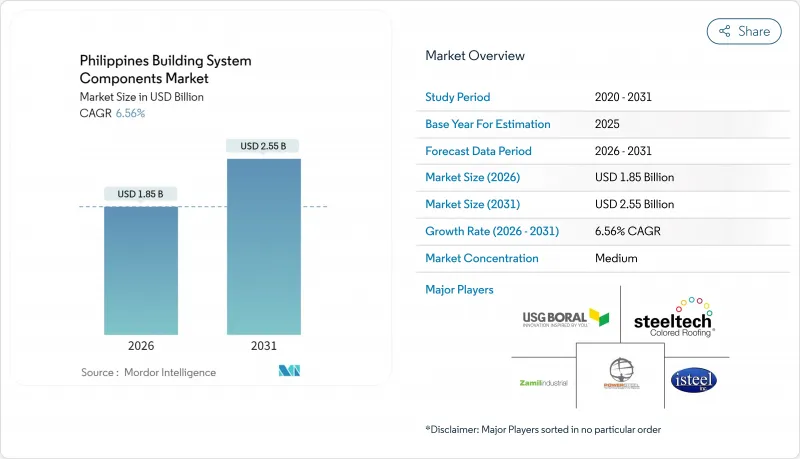

Philippines Building System Components - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Philippines Building System Components Market size in 2026 is estimated at USD 1.85 billion, growing from 2025 value of USD 1.74 billion with 2031 projections showing USD 2.55 billion, growing at 6.56% CAGR over 2026-2031.

Growth rests on the government's pledge to keep infrastructure outlays near 6% of GDP, a strategy formalized through the Build Better More program's 185 flagship projects worth about USD 165 billion. Public-sector spending generates steady demand across residential, commercial, and industrial sites, while digital procurement and BIM mandates speed approvals and shrink project lead times. Market participants also capitalize on the rising adoption of prefab steel systems that counter skilled-labor shortages in Metro Manila and Central Luzon. SteelAsia's capacity-doubling investments and green-steel finance channels further underpin long-term material availability and sustainability compliance.

Philippines Building System Components Market Trends and Insights

Build Better More Program Sustains Infrastructure Momentum

The flagship Build Better More portfolio earmarks USD 165 billion for 185 road, rail, and flood-control projects, effectively locking in multiyear order visibility for component suppliers. Roughly 83% of projects target road connectivity, guaranteeing large call-offs for beams, rebar, and precast decks. Sovereign lending lines of up to USD 24 billion from the Asian Development Bank amplify funding headroom and reassure private contractors of payment security. Mandatory e-procurement via PhilGEPS lowers bid paperwork and accelerates notice-to-proceed issuance, shortening the revenue-conversion cycle for manufacturers. Together, these moves translate public commitments into bankable demand throughout the forecast horizon.

Prefabricated Solutions Mitigate Labor Bottlenecks

Acute shortages in skilled trades push builders toward factory-made light-gauge steel panels and volumetric modules that cut on-site man-hours by up to 40%. The National Building Code already recognizes prefabricated assemblies, granting regulatory clarity provided flame-spread and smoke-density tests are met. Megawide's Taytay precast complex illustrates capacity advantages, recently winning a double-tee girder supply for the Candaba Viaduct retrofit. Similar facilities near Clark and Batangas shorten delivery radii and reduce logistics risks. With 6.5 million workers engaged in infrastructure over the last five years, yet still insufficient, off-site production will keep expanding until vocational training output matches demand.

Cost Swings Undermine Project Margins

The Philippines imports 86% of its steel, exposing contractors to freight surcharges and currency swings that can inflate column prices mid-build. Cemex Philippines reported lower peso cement prices yet saw volumes retreat 13% in 2023 as project owners deferred pours amid gypsum volatility. Average construction cost hit PHP 14,276 (USD 255) per m2 in January 2025, the highest since records began. Megawide combats shocks with 90-day inventory buffers, but geopolitical flashpoints still ripple through spot offers, forcing value-engineering or change orders that strain schedules.

Other drivers and restraints analyzed in the detailed report include:

- Digital Mandates Reshape Procurement

- Green-steel Finance Accelerates Capacity Upgrades

- Labor Scarcity Persists Despite Automation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Structural components held 39.22% of 2025 revenue, anchoring the Philippines' building system components market through their indispensability in bridges, expressways, and mid-rise buildings. Demand stays elevated as the Daang Maharlika upgrade (USD 4.49 billion) and the USD 414 million NLEX-SLEX connector require decks, girders, and crash-tested guardrails. The segment's 9.18% CAGR, the highest among system types, reflects surging call-offs for precast piles and long-span beams produced in controlled yards near Metro Manila. Contractors deploy composite shear walls and high-strength bolts to satisfy updated seismic codes, thereby boosting per-project material value.

Mechanical and electrical systems trail but still benefit from the Philippines Digital Infrastructure Project's tower roll-outs and data-center pipeline. Plumbing assemblies grow steadily with potable-water grid expansions such as the USD 2.04 million Baybay City scheme featuring multimedia filtration and 28.5 km of HDPE mains. Collectively, these complementary systems reinforce structural demand, as bundled procurement gains favor from suppliers offering full-line packages under single warranty terms.

The Philippines Building System Components Market Report is Segmented by System Type (Structural, Mechanical, Electrical, Plumbing), by End-User (Residential Buildings, Commercial Buildings, Industrial and Logistics, Others), by Material Type (Steel-Based Components, Gypsum/Drywall Boards, Aluminum Extrusions, Other Materials), and by Geography (Luzon, Visayas, Mindanao). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Power Steel Corp.

- USG Boral Building Products

- Zamil Industrial Investment Co.

- United Steel Technology Int'l Corp.

- iSteel Inc.

- Cornerstone Building Brands

- JEA Steel Industries Inc.

- Kirby Building Systems

- Sekisui Chemical

- Lindab International AB

- James Hardie Philippines Inc.

- Tata BlueScope Steel

- ClarkDietrich

- FrameCad

- Knauf Gypsum Philippines

- Saint-Gobain Philippines

- Cemex Philippines

- LafargeHolcim Philippines

- Pacific Paint (Boysen)

- Metek Modular Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Resilient public-sector infrastructure pipeline (Build Better More)

- 4.2.2 Rapid adoption of light-gauge steel & prefab systems

- 4.2.3 Digital BIM mandates for government projects (2026)

- 4.2.4 Green-steel project finance availability

- 4.2.5 Climate-resilient building code upgrade (typhoon & seismic)

- 4.2.6 Overseas-worker remittance-funded home expansions

- 4.3 Market Restraints

- 4.3.1 Volatile imported steel & gypsum prices

- 4.3.2 Acute skilled-labor shortages in construction trades

- 4.3.3 Informal "other-costs" inflating project budgets

- 4.3.4 Typhoon-driven logistics disruptions

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Policies & Government Initiatives

- 4.9 Impact of "Build Better More" Program

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By System Type

- 5.1.1 Structural

- 5.1.2 Mechanical

- 5.1.3 Electrical

- 5.1.4 Plumbing

- 5.2 By End-User

- 5.2.1 Residential Buildings

- 5.2.2 Commercial Buildings

- 5.2.3 Industrial and Logistics

- 5.2.4 Others

- 5.3 By Material Type

- 5.3.1 Steel-Based Components

- 5.3.2 Gypsum / Drywall Boards

- 5.3.3 Aluminum Extrusions

- 5.3.4 Other Materials(Composite, Wood, etc.)

- 5.4 By Geography

- 5.4.1 Luzon (incl. NCR)

- 5.4.2 Visayas

- 5.4.3 Mindanao

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 Power Steel Corp.

- 6.4.2 USG Boral Building Products

- 6.4.3 Zamil Industrial Investment Co.

- 6.4.4 United Steel Technology Int'l Corp.

- 6.4.5 iSteel Inc.

- 6.4.6 Cornerstone Building Brands

- 6.4.7 JEA Steel Industries Inc.

- 6.4.8 Kirby Building Systems

- 6.4.9 Sekisui Chemical

- 6.4.10 Lindab International AB

- 6.4.11 James Hardie Philippines Inc.

- 6.4.12 Tata BlueScope Steel

- 6.4.13 ClarkDietrich

- 6.4.14 FrameCad

- 6.4.15 Knauf Gypsum Philippines

- 6.4.16 Saint-Gobain Philippines

- 6.4.17 Cemex Philippines

- 6.4.18 LafargeHolcim Philippines

- 6.4.19 Pacific Paint (Boysen)

- 6.4.20 Metek Modular Systems

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment