PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906128

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906128

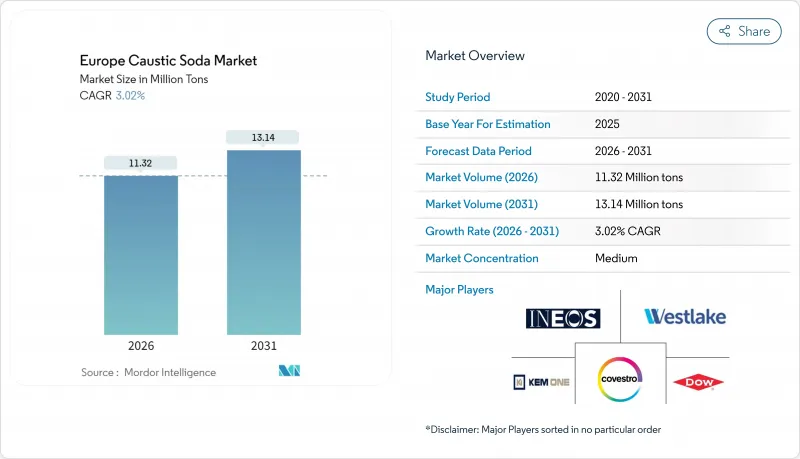

Europe Caustic Soda - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe Caustic Soda Market was valued at 10.99 Million tons in 2025 and estimated to grow from 11.32 Million tons in 2026 to reach 13.14 Million tons by 2031, at a CAGR of 3.02% during the forecast period (2026-2031).

This steady expansion signals a mature phase in which energy-efficient technologies and regulatory tailwinds outweigh growth constraints such as elevated power prices. Caustic soda's classification as a critical chemical under the proposed EU Critical Chemicals Act underscores its strategic role in safeguarding regional industrial autonomy. Membrane cell technology dominates the competitive arena because it cuts electricity consumption at a time when spot prices have spiked to stress-test levels of EUR 275/MWh. Downstream integration continues to favor the liquid form, while sustained investments in wastewater treatment, battery-grade alumina refining and fiber-based packaging keep demand resilient across cyclical downturns. At the same time, import arbitrage from low-cost Asian exporters and volatile energy costs create margin pressure that accelerates portfolio rationalization among incumbent producers.

Europe Caustic Soda Market Trends and Insights

Increasing Demand from Water Treatment Application

New urban-wastewater rules require tertiary and quaternary treatment across the bloc, triggering a surge in caustic-soda dosing for pH control and phosphorus removal. Spain and Germany are scaling plant upgrades, and municipalities must comply with an energy-neutral target by 2045, guaranteeing baseline consumption even as facilities pivot to renewable power. Micropollutant removal standards further broaden caustic-soda usage in advanced oxidation and precipitation. Because municipal upgrades are multi-billion-euro projects, the European caustic soda market enjoys stable long-cycle demand insulated from broader industrial slowdowns. Industry data show chlor-alkali processes consume roughly 2,600 kWh per ton of chlorine, linking caustic-soda supply directly to energy-efficiency investments.

Rising Alumina Demand from EV-Battery Supply Chain

Battery-grade alumina refineries that cluster near European gigafactories require higher caustic-soda purity and volumes per output ton than legacy grades. German automotive hubs anchor this pull, while French and Belgian sites race to secure regional feedstock. Although Northvolt's 2024 bankruptcy dented sentiment, vehicle electrification remains a structural growth engine. The sector historically consumes 21% of global caustic soda and now benefits from premium pricing that offsets energy costs, strengthening the long-run demand case.

High Energy Costs in Europe

Electricity accounts for over half of chlor-alkali cash costs, so volatility tied to the Russia-Ukraine conflict slashed regional operating rates when prices neared EUR 275/MWh. BASF lost 25% domestic chemical output, prompting a 54 MW green-hydrogen electrolyzer that should yield 8,000 t of H2 annually and curb 72,000 t of emissions. Producers must absorb higher power tariffs until renewable additions stabilize the grid, translating into margin compression and selective shutdowns.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Fiber-Based Packaging

- Expansion of Soap and Detergent Manufacturing Hubs

- Import Arbitrage Squeezing EU Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The membrane cell route commands 77.48% of the European caustic soda market share in 2025, reflecting its superior energy profile and regulatory compliance advantages. Producers accelerated diaphragm-to-membrane conversions as electricity costs soared, a shift that lifted membrane capacity additions to 3.14% CAGR through 2031. Emerging electro-electrodialysis technologies promise further cuts in specific power consumption, reinforcing the long-term dominance of membranes. The European caustic soda market size for membrane-based output is forecast to widen steadily because legacy mercury cells face mandatory phase-outs under environmental statutes. In parallel, Saudi projects supplied by European engineering firms signal global export opportunities for the region's technology providers, sustaining a virtuous cycle of innovation and deployment.

Traditional diaphragm assets are shrinking as operators such as Olin shutter older lines that cannot meet energy-intensity benchmarks. Retrofit activity is capital-heavy, yet financing remains accessible because lenders increasingly link credit costs to emissions performance, giving membrane upgrades a quantifiable payback. Mercury cells, once common, linger only in isolated integrated complexes and will exit entirely before 2027 under EU directives. Overall, the production-process landscape positions the European caustic soda market for incremental efficiency gains that partly offset power-price headwinds.

The Caustic Soda Europe Market Report Segments the Industry by Production Process (Membrane Cell, Diaphragm Cell, Other Production Processes), Form (Solid, Liquid), Application (Pulp and Paper, Organic Chemical, Inorganic Chemical, Soap and Detergent, Alumina, Water Treatment, Other Applications), and Geography (Germany, United Kingdom, Italy, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (tons).

List of Companies Covered in this Report:

- BASF

- Covestro

- Dow

- Ercros

- INEOS

- Kem One

- Nouryon

- Olin Corporation

- PCC SE

- Spolchemie

- Vynova Group

- Westlake Corporation

- WeylChem International GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand from Water Treatment Application

- 4.2.2 Rising Alumina Demand from EV-Battery Supply Chain

- 4.2.3 Growth of Fiber-Based Packaging

- 4.2.4 Expansion of Soap and Detergent Manufacturing Hubs

- 4.2.5 Growing Requirement for Chemical Synthesis

- 4.3 Market Restraints

- 4.3.1 High Energy Costs in Europe

- 4.3.2 Occupational-Safety and REACH Compliance Costs

- 4.3.3 Import Arbitrage squeezing European Union's margins

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Trade Analysis

- 4.9 Price Trends

- 4.10 Production Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Production Process

- 5.1.1 Membrane Cell

- 5.1.2 Diaphragm Cell

- 5.1.3 Other Production Processes (Mercury Cell (legacy), Emerging Electro-electrodialysis and Direct Electro-synthesis)

- 5.2 By Form

- 5.2.1 Solid

- 5.2.2 Liquid

- 5.3 By Application

- 5.3.1 Pulp and Paper

- 5.3.2 Organic Chemicals

- 5.3.3 Inorganic Chemicals

- 5.3.4 Soap and Detergents

- 5.3.5 Alumina

- 5.3.6 Water Treatment

- 5.3.7 Other Applications (Food and Feed Processing, etc.)

- 5.4 By Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Russia

- 5.4.7 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Covestro

- 6.4.3 Dow

- 6.4.4 Ercros

- 6.4.5 INEOS

- 6.4.6 Kem One

- 6.4.7 Nouryon

- 6.4.8 Olin Corporation

- 6.4.9 PCC SE

- 6.4.10 Spolchemie

- 6.4.11 Vynova Group

- 6.4.12 Westlake Corporation

- 6.4.13 WeylChem International GmbH

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment