PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906135

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906135

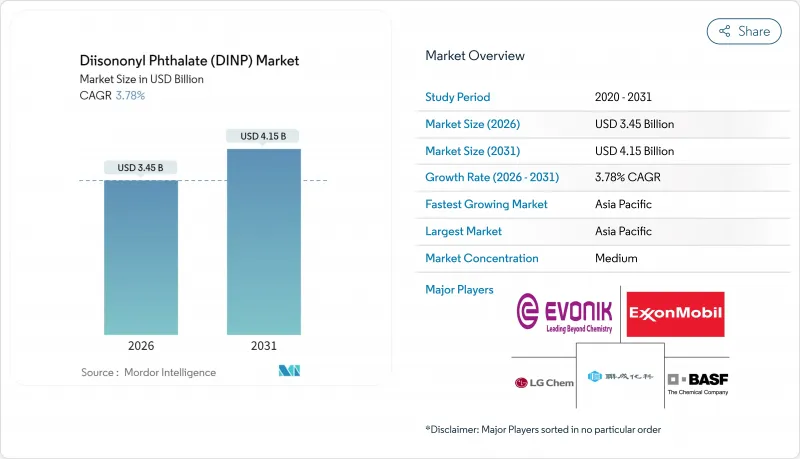

Diisononyl Phthalate (DINP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Diisononyl Phthalate Market was valued at USD 3.32 billion in 2025 and estimated to grow from USD 3.45 billion in 2026 to reach USD 4.15 billion by 2031, at a CAGR of 3.78% during the forecast period (2026-2031).

Steady infrastructure spending, entrenched demand for flexible PVC, and the resilience of established supply chains offset rising regulatory scrutiny in key consuming regions. Manufacturers are pivoting toward safer application routes and traceable feedstocks to safeguard volume, while cost-focused buyers in construction and electrical sectors continue to value DINP's proven price-performance balance. Asia-Pacific maintains demand leadership and posts faster growth than the global average, helped by large-scale petrochemical investments that secure long-term resin availability. In North America and Europe, the January 2025 EPA risk evaluation forces companies to speed up sustainable product rollouts and invest in compliance-centric process upgrades.

Global Diisononyl Phthalate (DINP) Market Trends and Insights

Growing Demand for Flexible PVC

DINP remains indispensable because about 95% of global output plasticizes flexible PVC products that serve construction, automotive, and wire markets. Global PVC consumption is advancing at a 5.96% CAGR to 2025, ensuring a steady pull for DINP over the medium term. Long service lives of between 5 and 30 years in flooring and cable applications add predictable replacement demand. Parallel progress in circular PVC, where pyrolysis-sourced feedstocks cut CO2 emissions by 50%, pushes producers to demonstrate end-of-life solutions without sacrificing scale. Such developments allow the Diisononyl Phthalate market to preserve volume while improving sustainability credentials.

Expanding Building and Construction Industry

Construction rebound drives elevated use of vinyl flooring, wall cladding, and roofing membranes that require DINP for flexibility and weather resistance. Residential renovation levels in North America and ongoing urbanization in Asia sustain demand, even as recent capacity additions by Formosa and Shintech temper PVC pricing power. The shift from flexible LVT to rigid SPC formats increases processing complexity and encourages producers to refine DINP grades for higher heat stability. The Diisononyl Phthalate market benefits from this specialization, yet margins hinge on keeping cost-per-square-foot competitive with low-cost imports.

Regulatory Scrutiny and Health-Risk Assessments

The January 2025 EPA risk evaluation concluded that DINP presents unreasonable risks for certain spray-applied products and consumer floor coverings, triggering mandatory risk management that may limit specific uses. California's Proposition 65 listing and the CPSC ban in toys add further constraints. These rules fragment demand, force manufacturer reformulation, and increase compliance costs. Persistent oversight in the EU and forthcoming reach-style legislation in other jurisdictions keep regulatory risk at the forefront for participants in the Diisononyl Phthalate market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand in Electrical Wire and Cable Insulation

- Recovery in Automotive Production and Lightweight Interiors

- Accelerating Switch to Bio-/Non-Phthalate Plasticizers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PVC commanded 86.62% of revenue in 2025 and is forecast to grow at a 3.96% CAGR through 2031. This scale secures continuous feedstock offtake for DINP while integrated producers leverage existing assets for cost leadership. Emerging circular PVC resins help maintain volume and future-proof compliance, keeping the Diisononyl Phthalate market anchored in this substrate.

Acrylic and polyurethane niches together occupy the balance of revenue. Acrylic coatings exploit DINP's solvency to enhance film flexibility in demanding climatic conditions, whereas select polyurethane foam producers choose DINP to improve rebound life in seating. Non-isocyanate polyurethane R&D introduces future substitution risk, although commercial adoption remains limited through the forecast horizon.

The Diisononyl Phthalate (DINP) Market Report is Segmented by Polymer Type (PVC, Acrylic, and Polyurethane), Application (Floor and Wall Coverings, Coated Fabrics, and More), End-User Industry (Building and Construction, Electrical and Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 58.83% of 2025 revenue and is forecast to expand at a 4.07% CAGR to 2031. China's 50% global share in PVC output, supported by BASF's EUR 10 billion Verbund investment, anchors supply while India's construction boom pulls incremental tonnage. Trade actions, such as China's 43.5% anti-dumping duties on select U.S. imports, create episodic price distortions that local DINP producers exploit to defend home markets.

North America experiences policy-driven transitions following the EPA risk verdict, prompting formulators to shift toward safer coatings and to fast-track ISCC-certified grades. The domestic chemical sector ekes out a 1.5% gain in 2024 after a subdued 2023, aided by shale-advantaged feedstocks. Europe pushes circularity through REACH and mandatory recycling targets; anti-dumping duties on Korean DOTP also shape the competitive field, indirectly sustaining demand for locally made DINP grades that remain compliant with evolving standards.

South America, the Middle East, and Africa together provide a small but rising customer base driven by industrial diversification projects and limited regulatory friction. Weak collection systems and low recycling rates, however, risk future intervention, echoing the OECD finding that 22 million t of plastics leaked into the environment in 2019. Producers eyeing these regions emphasize affordable DINP formulations while preparing for eventual policy convergence with OECD norms.

- Azelis Group NV

- BASF SE

- Evonik Industries AG

- Exxon Mobil Corporation

- GM Chemie Pvt Ltd

- Hanwha Solutions Chemical Division Corporation

- KLJ Group

- LG Chem Ltd

- Mitsubishi Chemical Group Corporation

- NAN YA PLASTICS CORPORATION

- Polynt SpA

- Shandong Qilu Plasticizers Co Ltd

- UPC Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Flexible PVC

- 4.2.2 Expanding Building and Construction Industry

- 4.2.3 Rising Demand in Electrical Wire and Cable Insulation

- 4.2.4 Recovery in Automotive Production and Lightweight Interiors

- 4.2.5 Adoption in 5G Telecom Cable Insulation

- 4.3 Market Restraints

- 4.3.1 Regulatory Scrutiny and Health-Risk Assessments

- 4.3.2 Accelerating Switch to Bio-/Non-Phthalate Plasticizers

- 4.3.3 Emerging Solvent-Based PVC Recycling Cuts Virgin DINP Use

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Polymer Type

- 5.1.1 PVC

- 5.1.2 Acrylic

- 5.1.3 Polyurethane

- 5.2 By Application

- 5.2.1 Floor and Wall Coverings

- 5.2.2 Coated Fabrics

- 5.2.3 Consumer Goods

- 5.2.4 Films and Sheets

- 5.2.5 Wires and Cables

- 5.2.6 Other Applications

- 5.3 By End-User Industry

- 5.3.1 Building and Construction

- 5.3.2 Electrical and Electronics

- 5.3.3 Automotive and Transportation

- 5.3.4 Packaging and Food Contact Materials

- 5.3.5 Healthcare and Medical Devices

- 5.3.6 Other End-Use Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Azelis Group NV

- 6.4.2 BASF SE

- 6.4.3 Evonik Industries AG

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 GM Chemie Pvt Ltd

- 6.4.6 Hanwha Solutions Chemical Division Corporation

- 6.4.7 KLJ Group

- 6.4.8 LG Chem Ltd

- 6.4.9 Mitsubishi Chemical Group Corporation

- 6.4.10 NAN YA PLASTICS CORPORATION

- 6.4.11 Polynt SpA

- 6.4.12 Shandong Qilu Plasticizers Co Ltd

- 6.4.13 UPC Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment