PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906138

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906138

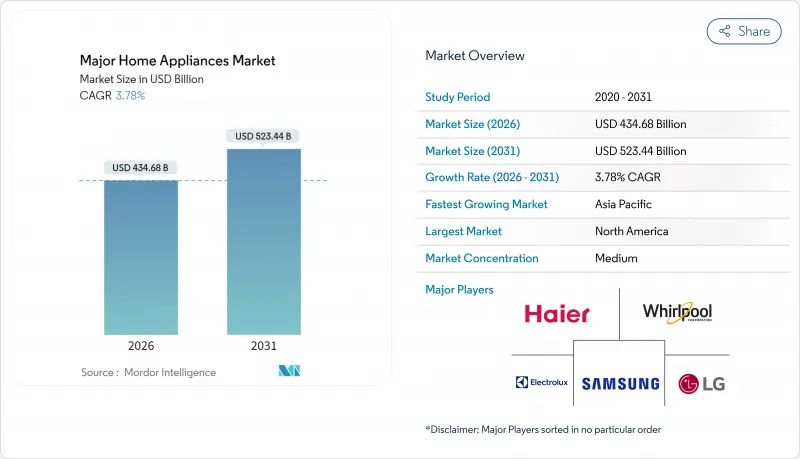

Major Home Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Major Home Appliances Market was valued at USD 418.85 billion in 2025 and estimated to grow from USD 434.68 billion in 2026 to reach USD 523.44 billion by 2031, at a CAGR of 3.78% during the forecast period (2026-2031).

Accelerated urban housing completions, stricter energy-efficiency rules, and fast-rising demand for digitally connected products underpin this steady expansion of the major home appliances market. Regulatory tailwinds in North America and the European Union are shortening replacement cycles, while Asia-Pacific manufacturing scale secures cost leadership and export momentum. In parallel, emerging economies in the Middle East & Africa are posting the quickest gains as rising disposable incomes unlock first-time purchases of refrigerators, washing machines, and air conditioners. Competitive intensity is rising because Chinese brands leverage aggressive pricing, rapid innovation, and expanding logistics footprints to challenge established Western incumbents.

Global Major Home Appliances Market Trends and Insights

Rapid Urbanization-Fuelled Housing Completions

Large-scale urban construction keeps the major home appliances market on a firm growth path. Government incentives lifted China's refrigerator retail volumes 5.4% through November 2024, confirming the tight link between new apartments and multi-appliance purchases . Newly built dwellings typically require an entire kitchen and laundry suite, multiplying demand well beyond the headline housing unit numbers. Sharp's joint venture with Elaraby Group to assemble 500,000 refrigerators annually in Egypt by 2027 underlines how manufacturers localize output close to fast-growing cities to curb freight costs and serve regional buyers. Similar patterns are visible in the United States, where softness in existing-home sales contrasts with a 4% rise in new-home transactions, pivoting appliance demand toward full-fit-out packages that favor high-efficiency models. As utilities in emerging megacities raise tariffs, consumers increasingly select energy-rated refrigerators and air conditioners, strengthening the replacement and first-purchase cycle of the major home appliances market.

Digitally Connected "Smart-Home Ready" Demand Spike

The appetite for networked white goods is moving from early adopters to mainstream buyers in the major home appliances market. LG's January 2025 pact with Microsoft to embed Copilot AI across appliances signals a pivot from hardware to software-centric value creation. Samsung's Bespoke AI Laundry Combo, launched in India at INR 319,000 (USD 3,843) offers automated cycle selection and remote diagnostics, proving that advanced features are graduating from luxury to baseline expectations. GE Appliances extends this logic by folding recipe planning and grocery ordering into its SmartHQ app ecosystem. Bundled energy-management suites such as GE's EcoBalance, co-developed with ABB, further blur boundaries between appliances and household infrastructure. Strong Q1 2025 sales of Haier's connected water-purification line-up 264% year on year-confirm consumer willingness to pay for integrated digital convenience.

Persistent Logistics Cost Inflation on Bulky Goods

Freight rates for containers leaving China more than doubled between October 2023 and June 2024, pushing landed costs up throughout the major home appliances market . Large appliances suffer extra charges because dimensional weight pricing limits container fill optimization. Manufacturers juggle whether to absorb higher ocean freight or pass it through to consumers already wrestling with inflation. Online channels feel the pinch when specialized last-mile crews with two-person delivery teams become scarce and pricey. Small island states, heavily reliant on maritime trade, face disproportionate shelf-price jumps that can blunt first-time appliance uptake. The resulting demand elasticity risks a vicious cycle of lower shipment volumes and even higher per-unit freight.

Other drivers and restraints analyzed in the detailed report include:

- Energy-Efficiency Standards Driving Upgrade Cycles

- Rental-First Living Models in Tier-1 Asian Cities

- Semiconductor Supply Volatility Post-2025

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerators dominated 2025 value with a 28.45% slice of the major home appliances market share, driven by their status as household essentials and continued innovation in inverter compressors, multi-door formats, and embedded IoT diagnostics. The major home appliances market size for cooling appliances is projected to expand steadily as manufacturers roll out variable-capacity devices that comply with emerging energy labels. Chinese exporters shipped 4.48 billion units in 2024, highlighting the scale advantage underpinning global price competitiveness. In contrast, dishwashers are slated for the fastest 5.22% CAGR as urban residents in Europe, North America, and increasingly Asia seek time savings and hygiene assurance. Rising water scarcity regulations also position modern dishwashers as resource-efficient alternatives to manual cleaning.

Premium refrigerator sub-segments featuring adaptive temperature zones, air-purification systems, and voice control command higher margins. Smart notification technologies flag door-left-open events, reducing food waste and enhancing user convenience. Luxury dishwashers add steam sanitation and app-based cycle customization, appealing to health-conscious households. Washing machines and air conditioners form a stable middle tier; both benefit from inverter motors and low-GWP refrigerants aligned with global climate policy. Ovens, including microwave-convection hybrids, show balanced yet slower growth, though impending U.S. standards will nudge the category toward high-efficiency replacements. The "other" cluster-water heaters, waste disposers, and integrated home hubs-offers niche opportunities tied to regional building codes and lifestyle shifts.

The Global Major Home Appliances Market Report is Segmented by Product (Refrigerators, Freezers, Washing Machines, Dishwashers, Ovens, Air Conditioners, Other Major Home Appliances), Distribution Channel (Multi-Brand Stores, Exclusive Brand Outlets, Online, Other Distribution Channels), and Geography (North America, South America, Europe, Asia-Pacific, and Other). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific heads the major home appliances market with 46.88% value share in 2025 thanks to enormous domestic demand and unrivaled manufacturing hubs. China remains the central production engine, yet India and Vietnam attract incremental factories as brands diversify risk. Urbanization and growing middle-class incomes sustain refrigerator and washing-machine upgrades, while government energy-label programs encourage premiumization. South Korea and Japan drive smart-home innovation, seeding software platforms subsequently rolled out across Southeast Asia.

North America retains a sizeable high-value base characterized by frequent replacement cycles and early adoption of connectivity. Energy-efficiency mandates catalyze upgrades, and consumers show a willingness to pay for bespoke designs and bundled energy-management services. However, lingering inflation and higher interest rates moderate volume growth. The United States also houses research centers for AI integration, influencing global product roadmaps within the major home appliances market.

Europe shows divergent patterns: mature Western economies rely on steady replacement demand, whereas Central and Eastern Europe post above-average unit gains from first-time purchases. The region sits at the forefront of circular-economy regulation, pushing manufacturers to develop repair-friendly and recyclable models. Middle East & Africa shines as the fastest-growing region at a 5.38% CAGR through 2031, underpinned by infrastructure investment in the Gulf and accelerating electrification in Sub-Saharan Africa. Rapid housing projects in the UAE and Saudi Arabia translate into bundled appliance sales for new apartments. South America offers mixed prospects: Brazil exhibits sizable scale yet faces consumer credit constraints, while Colombia and Peru attract greenfield production aimed at tariff reduction. Collectively, geography continues to shape product mix, price positioning, and go-to-market choices within the major home appliances market.

- Arcelik A.S.

- Bosch-Siemens Hausgerate GmbH (BSH)

- Electrolux AB

- Fisher & Paykel Appliances Ltd.

- Glen Dimplex Group

- Godrej & Boyce Mfg. Co. Ltd.

- Gree Electric Appliances Inc.

- Haier Smart Home Co., Ltd.

- Hisense Group

- Hitachi Global Life Solutions, Inc.

- LG Electronics Inc.

- Midea Group

- Panasonic Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- SMEG S.p.A.

- Sub-Zero Group, Inc.

- TCL Technology

- Whirlpool Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid urbanization-fuelled housing completions

- 4.2.2 Digitally connected "smart-home ready" appliance demand spike

- 4.2.3 Energy-efficiency standards driving upgrade cycles

- 4.2.4 Rental-first living models in Tier-1 Asian cities

- 4.2.5 Recycling-credits for appliance trade-ins emerging in EU

- 4.2.6 Health-focused hygiene features gaining traction

- 4.3 Market Restraints

- 4.3.1 Persistent logistics cost inflation on bulky goods

- 4.3.2 Semiconductor supply volatility post-2025

- 4.3.3 Slower mortgage formation in Europe's top markets

- 4.3.4 Low switching propensity in price-sensitive LATAM segments

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Suppliers

- 4.5.3 Bargaining Power Of Buyers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights Into The Latest Trends And Innovations In The Market

- 4.7 Insights On Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, Etc.) In The Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Refrigerators

- 5.1.2 Freezers

- 5.1.3 Washing Machines

- 5.1.4 Dishwashers

- 5.1.5 Ovens (Incl. Combi & Microwave)

- 5.1.6 Air Conditioners

- 5.1.7 Other Major Home Appliances

- 5.2 By Distribution Channel

- 5.2.1 Multi-Brand Stores

- 5.2.2 Exclusive Brand Outlets

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 Canada

- 5.3.1.2 United States

- 5.3.1.3 Mexico

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Peru

- 5.3.2.3 Chile

- 5.3.2.4 Argentina

- 5.3.2.5 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 United Kingdom

- 5.3.3.2 Germany

- 5.3.3.3 France

- 5.3.3.4 Spain

- 5.3.3.5 Italy

- 5.3.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.3.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.3.3.8 Rest of Europe

- 5.3.4 Asia-Pacific

- 5.3.4.1 India

- 5.3.4.2 China

- 5.3.4.3 Japan

- 5.3.4.4 Australia

- 5.3.4.5 South Korea

- 5.3.4.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.3.4.7 Rest of Asia-Pacific

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Arcelik A.S.

- 6.4.2 Bosch-Siemens Hausgerate GmbH (BSH)

- 6.4.3 Electrolux AB

- 6.4.4 Fisher & Paykel Appliances Ltd.

- 6.4.5 Glen Dimplex Group

- 6.4.6 Godrej & Boyce Mfg. Co. Ltd.

- 6.4.7 Gree Electric Appliances Inc.

- 6.4.8 Haier Smart Home Co., Ltd.

- 6.4.9 Hisense Group

- 6.4.10 Hitachi Global Life Solutions, Inc.

- 6.4.11 LG Electronics Inc.

- 6.4.12 Midea Group

- 6.4.13 Panasonic Corporation

- 6.4.14 Robert Bosch GmbH

- 6.4.15 Samsung Electronics Co., Ltd.

- 6.4.16 Sharp Corporation

- 6.4.17 SMEG S.p.A.

- 6.4.18 Sub-Zero Group, Inc.

- 6.4.19 TCL Technology

- 6.4.20 Whirlpool Corporation

7 Market Opportunities & Future Outlook

- 7.1 Smart and connected appliances reshaping homes

- 7.2 Eco-friendly and energy-efficient technologies rise