PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910824

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910824

Europe Major Home Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

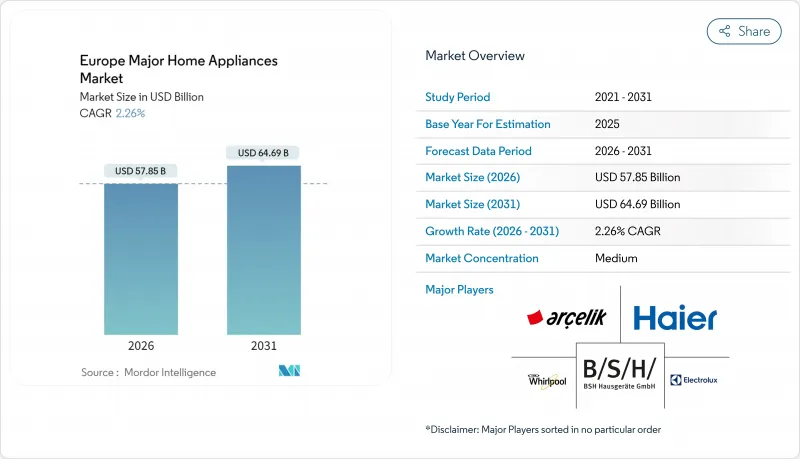

The Europe Major Home Appliances Market was valued at USD 56.57 billion in 2025 and estimated to grow from USD 57.85 billion in 2026 to reach USD 64.69 billion by 2031, at a CAGR of 2.26% during the forecast period (2026-2031).

Housing-stock decarbonization rules, mandatory digital product passports, and accelerated retirement of non-A-class models are shortening replacement cycles even as the installed base in Western Europe approaches saturation. Scale manufacturers are converting regulatory complexity into a competitive advantage because they can amortize compliance costs and roll out software updates that keep products aligned with evolving energy labels. Connectivity based on the Matter standard is redefining customer expectations, with buyers now viewing smart integration, AI-enabled diagnostics, and over-the-air feature updates as standard rather than luxury. Re-shoring incentives in Germany, Poland, and France partially shield supply chains from nickel- and steel-price swings while supporting EU carbon-border-adjustment objectives.

Europe Major Home Appliances Market Trends and Insights

Energy-label tightening drives accelerated replacement cycles

The July 2025 regulation bans sales of vented and condenser dryers below A-class efficiency, channelling demand toward heat-pump models that save electricity compared with legacy units. Retailers launched clearance campaigns for non-compliant inventory, encouraging bargain hunters while nudging mid-income households to finance higher-priced efficient models. QR-code labels offer real-time spec sheets, letting shoppers rank products by lifetime energy cost instead of ticket price, which favours premium brands. Manufacturers are redesigning chassis to meet the reparability index arriving in 2027, substituting snap-fit modules for welded assemblies. The compressed upgrade window lifts short-term shipments yet forces OEMs to embed margin into service plans because longer lifecycles will depress future unit sales.

Surge in heat-pump dryer adoption amid EU electrification push

Heat-pump technology experienced significant growth, driven by climate-related incentives, with unit sales reaching 2.18 million in 2021. However, market momentum slowed in 2024 as demand stagnated due to uncertainties surrounding policy frameworks. France revived momentum by pledging to assemble 1 million heat pumps annually, trimming dependence on Asian imports and smoothing supply shocks. Heat-pump dryers contribute to lowering annual household electricity expenses while complying with the Energy Performance of Buildings Directive. The BENELUX region demonstrates the highest penetration of premium models, driven by substantial utility rebate programs that incentivize adoption. Broader market diffusion is projected to occur as component costs decline, with significant growth expected by 2028. Original Equipment Manufacturers (OEMs) are strategically emphasizing advanced features such as auto-clean condensers and Wi-Fi-enabled diagnostics. These innovations not only support higher price points but also enable OEMs to collect critical after-sales data, enhancing their ability to refine product offerings and strengthen customer engagement.

Escalating nickel & steel costs pressure OEM margins

OEMs typically mitigate risks associated with coil purchases through hedging strategies. However, smaller assemblers often face challenges due to limited access to credit lines required for long-term financial instruments such as swaps. To manage costs, some manufacturers are adopting material substitution strategies, such as replacing traditional materials with aluminium liners or polymer exteriors. While these alternatives reduce expenses, they often compromise reparability scores, potentially impacting product longevity and customer satisfaction. Additionally, currency volatility exacerbates financial pressures, as raw materials are predominantly priced in US dollars, whereas most sales transactions are conducted in euros or sterling. In response to sustainability trends, certain manufacturers have introduced quarterly indexed surcharges for "green steel." While this initiative aligns with environmental goals, it poses a risk of consumer resistance, particularly in regions where price sensitivity is a critical factor.

Other drivers and restraints analyzed in the detailed report include:

- Smart-home interoperability (Matter standard) unlocks cross-brand ecosystems

- Re-shoring incentives boost local production resilience

- EU Right-to-Repair rules lengthen replacement cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Conventional refrigerators held 30.96% of 2025 sales, underscoring their anchor status in the Europe major home appliances market despite consumer buzz around connectivity. LG's MoodUP model with color-changing panels and internal cameras attracts style-conscious urban buyers willing to pay a premium. The Europe major home appliances market size for refrigerators is forecast to expand modestly as energy labels move toward stricter A-only tiers over the next five years. In response to right-to-repair constraints, manufacturers are increasingly implementing modular compressors and snap-fit door gaskets. These innovations are strategically designed to streamline service processes, minimize downtime, and effectively reduce warranty-related expenses. This approach reflects a proactive effort to enhance operational efficiency while addressing regulatory and consumer demands for repairability. Side-by-side and French-door styles gain traction in Southern Europe, where kitchen renovations embrace open-plan designs.

Smart refrigerators, growing at a 10.13% CAGR, integrate AI freshness algorithms that scan expiry dates and suggest recipes, locking consumers into proprietary food apps. Samsung's Family Hub ecosystem and Bosch's Home Connect leverage voice assistants to upsell consumables. Energy-efficient defrost cycle optimization has significantly reduced annual energy consumption, enabling compliance with the European Union's 2030 eco-targets ahead of schedule by four years. This achievement underscores the effectiveness of advanced energy management strategies in meeting stringent regulatory benchmarks. OEMs monetize post-sale data by partnering with grocery chains for automated re-ordering, opening new revenue streams beyond hardware margins. As the Europe major home appliances market matures, premium smart units serve as beachheads for cross-selling other connected appliances.

Europe Major Home Appliances Market is Segmented by Product (Refrigerators, Freezers, Dishwashers, Clothes Dryers, Washing Machines, and More), and Distribution Channel (multi-Brand Stores, Online, and More), Technology (smart Connected Major Appliances), and Country (Europe, United Kingdom, Germany, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- BSH Hausgerate GmbH

- Electrolux AB

- Whirlpool Corp.

- Haier Europe (Candy/Hoover)

- Arcelik A.S. (Beko, Grundig)

- LG Electronics

- Samsung Electronics

- Miele & Cie. KG

- Gorenje Hisense

- Vestel

- SMEG

- Liebherr Hausgerate

- De'Longhi Group

- Indesit (Whirlpool)

- Glen Dimplex

- Groupe SEB

- Midea Group

- Panasonic Corp.

- Sharp Corp.

- Philipps Domestic Appliances

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Energy-label tightening drives accelerated replacement cycles

- 4.2.2 Surge in heat-pump dryer adoption amid EU electrification push

- 4.2.3 Smart-home interoperability (Matter standard) unlocks cross-brand ecosystems

- 4.2.4 Re-shoring incentives boost local production resilience

- 4.2.5 Growing uptake of subscription-based "appliance-as-a-service" models

- 4.2.6 Post-Brexit UK rebate scheme for high-efficiency white goods

- 4.3 Market Restraints

- 4.3.1 Escalating nickel & steel costs pressure OEM margins

- 4.3.2 EU Right-to-Repair rules lengthen replacement cycles

- 4.3.3 Tightened EPC obligations dampen landlord demand

- 4.3.4 Fragmented e-waste compliance across member states

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Refrigerators

- 5.1.2 Freezers

- 5.1.3 Dishwashing Machines

- 5.1.4 Washing Machines

- 5.1.5 Ovens

- 5.1.6 Air Conditioners

- 5.1.7 Other Major Home Appliances

- 5.2 By Distribution Channel

- 5.2.1 Multi-Brand Stores

- 5.2.2 Exclusive Brand Outlets

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

- 5.3 By Technology

- 5.3.1 Smart Connected Major Appliances

- 5.3.2 Conventional Major Appliances

- 5.4 By Country

- 5.4.1 Europe

- 5.4.2 United Kingdom

- 5.4.3 Germany

- 5.4.4 France

- 5.4.5 Spain

- 5.4.6 Italy

- 5.4.7 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.4.8 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.4.9 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 BSH Hausgerate GmbH

- 6.4.2 Electrolux AB

- 6.4.3 Whirlpool Corp.

- 6.4.4 Haier Europe (Candy/Hoover)

- 6.4.5 Arcelik A.S. (Beko, Grundig)

- 6.4.6 LG Electronics

- 6.4.7 Samsung Electronics

- 6.4.8 Miele & Cie. KG

- 6.4.9 Gorenje Hisense

- 6.4.10 Vestel

- 6.4.11 SMEG

- 6.4.12 Liebherr Hausgerate

- 6.4.13 De'Longhi Group

- 6.4.14 Indesit (Whirlpool)

- 6.4.15 Glen Dimplex

- 6.4.16 Groupe SEB

- 6.4.17 Midea Group

- 6.4.18 Panasonic Corp.

- 6.4.19 Sharp Corp.

- 6.4.20 Philipps Domestic Appliances

7 Market Opportunities & Future Outlook

- 7.1 Retrofit IoT modules for legacy large appliances across rental housing stock

- 7.2 Heat-pump-based washer-dryer combos targeting low-carbon building codes