PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906150

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906150

France Office Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

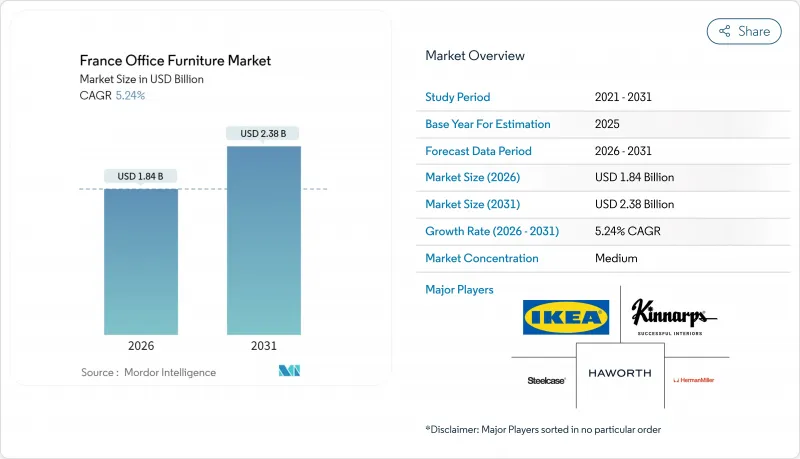

The France Office Furniture Market was valued at USD 1.75 billion in 2025 and estimated to grow from USD 1.84 billion in 2026 to reach USD 2.38 billion by 2031, at a CAGR of 5.24% during the forecast period (2026-2031).

Momentum rests on hybrid-working normalization, a wave of ESG-driven retrofits, and persistent corporate emphasis on talent retention through well-designed workspaces. Height-adjustable desks, ergonomic task seating, and multi-purpose lounge systems dominate order books as employers redesign offices for collaboration and wellness. At the same time, EU sustainability directives and timber supply disruptions channel demand toward recycled plastics and modular metal frames that facilitate circular use. Rapid SME digitization funnels purchase onto online platforms, compressing quotation cycles and putting pricing pressure on legacy dealers while simultaneously broadening supplier reach. Competition remains balanced: global giants exploit scale advantages, yet agile domestic firms prosper by pairing localized manufacturing with consultative design services.

France Office Furniture Market Trends and Insights

Hybrid-Working Policy Refresh Drives Ergonomic Seating Demand

The increasing prevalence of regular telework among private-sector employees and managers has necessitated businesses to allocate resources for ergonomic investments across multiple locations, including corporate headquarters, regional hubs, and employees' home offices. This shift underscores the growing need for organizations to adapt their operational strategies to support a distributed workforce effectively. Organizations such as Societe Generale report measurable productivity gains and a decline in musculoskeletal claims after deploying sit-stand desks, adaptive lumbar supports, and head-adjustable monitors across branches. Procurement teams increasingly evaluate furniture against ISO 45001 compliance, turning ergonomic spend from discretionary to mandatory. As a result, manufacturers differentiate through medical-grade certifications, sensor-based posture feedback, and modular assemblies that adjust to hybrid headcounts. These factors inject a structural uplift into the France office furniture market even as overall square footage contracts.

Corporate ESG Mandates Favor Low-VOC Wood Sourcing

The 2024 EU deforestation regulation bans timber from newly cleared forests, compelling suppliers to map origin chains down to parcel level and pass auditor checks before clearance. Buyers now specify E1 formaldehyde boards or demand substitution with rapidly renewable fibres. Domestic brands capitalize on their geographical proximity, employ advanced data logging techniques, and emphasize their adherence to PEFC/FSC certifications to substantiate their premium pricing strategies. This approach enables them to mitigate the challenges associated with customs delays, which frequently disrupt the operations of importers. Government support, such as the EUR 800,000 (USD 833,248) modernization grant to Gautier's Vendee plant, underpins upgrades to RFID-enabled traceability and low-emission finishing lines. Together, regulation and funding redirect material flows, reinforcing local sourcing and enhancing the sustainability profile of the France office furniture market.

Soaring Timber Input Costs Post-2024 Storms

In 2024, severe storms had a pronounced impact on the forests of Nouvelle-Aquitaine, disrupting essential rail corridors and causing a notable reduction in domestic harvest volumes. These adverse weather events have driven up log prices, exerting pressure on regional supply chains and creating volatility in the market. The situation underscores the vulnerability of the forestry sector to climatic disruptions and highlights the need for enhanced resilience strategies to mitigate future risks. Panel boards, veneer sheets, and solid-wood blanks all saw multi-quarter surcharges. Margin-thin SMEs struggled to hedge, prompting accelerated adoption of metal frames and recycled polymer shells. Product engineers scrambled to re-certify designs for strength and aesthetics, lengthening development lead times. Although reforestation and infrastructure repairs are underway, full supply recovery is unlikely before 2027.

Other drivers and restraints analyzed in the detailed report include:

- France's SME Digital-Office Grants Accelerate Online Furniture Procurement

- Rapid Growth of Serviced Offices & Co-Working Chains

- Tightened EU Carbon-Footprint Labelling Slows Imports

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wood dominates at 47.14% of the France office furniture market share, underscoring its cultural cachet and design versatility. Yet repeat timber shocks and compliance hurdles prompt a pivot toward composite solutions, such as veneer-wrapped recycled-plastic cores that cut weight without sacrificing warmth. Recycled plastics grow 8.93% CAGR as corporate buyers seek quantified carbon savings. Manufacturers invest in odour-neutral additives and matte finishes that mimic native wood, widening acceptance among architects. Metal follows a steady upward arc as modular aluminium frames integrate with plug-and-play accessories, monitor arms, power hubs, and occupancy sensors, that future-proof installations.

Lifecycle metrics have become a critical factor in procurement decisions, surpassing the emphasis on upfront costs. Procurement teams now assess bids based on parameters such as repairability, component interchangeability, and buy-back guarantees. In response to these evolving priorities, suppliers are integrating QR-coded product passports that provide comprehensive information on material composition, carbon emissions, and refurbishment possibilities. This strategic move enhances brand differentiation within the French office furniture market while aligning with corporate sustainability objectives, including net-zero targets and green-leasing frameworks.

France Office Furniture Market is Segmented by Material (Wood, Metal, Plastic and Other Materials), Product (Meeting Chairs, Lounge Chairs, Swivel Chairs, Office Tables, Storage Cabinets, and Desks), Distribution Channel (Multi-Branded Stores, Specialty Stores, Online Platforms, Other Distribution Channels) and Region (Ile-De-France and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Steelcase Inc.

- Haworth Inc.

- Herman Miller Inc.

- Ikea Group

- Kinnarps AB

- Bene GmbH

- Nowy Styl Group

- Sedus Stoll AG

- Vitra International AG

- Okamura Corporation

- Majencia SA

- Buronomic SA

- EOL Group

- Gautier Office

- Sokoa SA

- Certeo France

- Planet Office SARL

- France Bureau SARL

- Ligne Roset Contract

- Burofactory

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Hybrid-working policy refresh drives ergonomic seating demand

- 4.2.2 Corporate ESG mandates favor low-VOC wood sourcing

- 4.2.3 France's SME digital-office grants accelerate online furniture procurement

- 4.2.4 Rapid growth of serviced offices & co-working chains

- 4.2.5 Circular-design incentives for modular metal frames (under-the-radar)

- 4.2.6 AI-enabled demand forecasting reduces inventory waste (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Soaring timber input costs post-2024 storms

- 4.3.2 Tightened EU carbon-footprint labelling slows imports

- 4.3.3 Shrinking public-sector office footprint

- 4.3.4 Limited recycling capacity for mixed-plastic chairs (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Material

- 5.1.1 Wood

- 5.1.2 Metal

- 5.1.3 Plastics

- 5.1.4 Other Materials

- 5.2 By Product

- 5.2.1 Meeting Chairs

- 5.2.2 Lounge Chairs

- 5.2.3 Swivel Chairs

- 5.2.4 Office Tables

- 5.2.5 Storage Cabinets

- 5.2.6 Desks

- 5.3 By Distribution Channel

- 5.3.1 Multi-branded Stores

- 5.3.2 Specialty Stores

- 5.3.3 Online Platforms

- 5.3.4 Other Distribution Channels

- 5.4 By Region

- 5.4.1 Ile-de-France

- 5.4.2 Auvergne-Rhone-Alpes

- 5.4.3 Provence-Alpes-Cote d'Azur

- 5.4.4 Nouvelle-Aquitaine

- 5.4.5 Occitanie

- 5.4.6 Hauts-de-France

- 5.4.7 Grand Est

- 5.4.8 Pays de la Loire

- 5.4.9 Brittany

- 5.4.10 Centre-Val de Loire

- 5.4.11 Normandy

- 5.4.12 Bourgogne-Franche-Comte

- 5.4.13 Corsica

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Steelcase Inc.

- 6.4.2 Haworth Inc.

- 6.4.3 Herman Miller Inc.

- 6.4.4 Ikea Group

- 6.4.5 Kinnarps AB

- 6.4.6 Bene GmbH

- 6.4.7 Nowy Styl Group

- 6.4.8 Sedus Stoll AG

- 6.4.9 Vitra International AG

- 6.4.10 Okamura Corporation

- 6.4.11 Majencia SA

- 6.4.12 Buronomic SA

- 6.4.13 EOL Group

- 6.4.14 Gautier Office

- 6.4.15 Sokoa SA

- 6.4.16 Certeo France

- 6.4.17 Planet Office SARL

- 6.4.18 France Bureau SARL

- 6.4.19 Ligne Roset Contract

- 6.4.20 Burofactory

7 Market Opportunities & Future Outlook

- 7.1 Rise of "zero-carbon renovation" subsidies for furniture retro-fit projects

- 7.2 Integration of IoT-embedded desks for real-time space analytics