PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910802

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910802

Europe Office Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

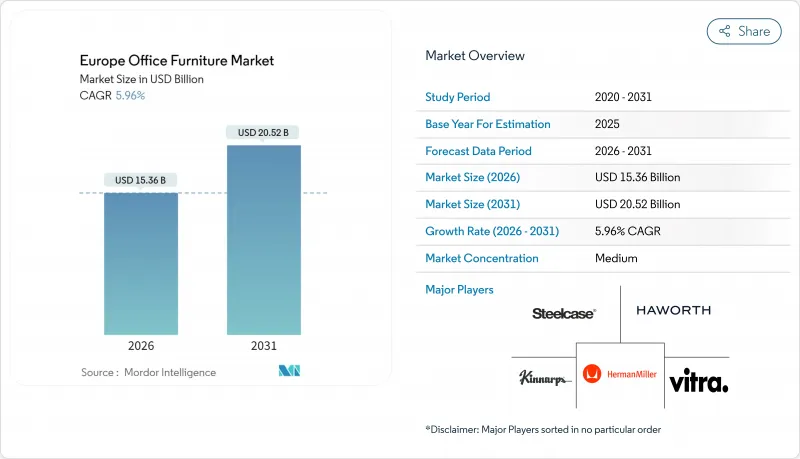

The Europe office furniture market is expected to grow from USD 14.50 billion in 2025 to USD 15.36 billion in 2026 and is forecast to reach USD 20.52 billion by 2031 at 5.96% CAGR over 2026-2031.

Current growth is fuelled by organizations that are redesigning spaces to support hybrid work, mandating more ergonomic seating, and favouring modular configurations that can be re-used or re-sold to meet circularity targets. Companies are also responding to environmental, social, and governance benchmarks by insisting on in-house take-back programs and guaranteed recycled content, while EU ergonomics standards are pushing seating upgrades across every major geography. Supply-chain resilience has become another priority because spot prices for timber rose 30% and steel 25% in 2024, prompting firms with diversified sourcing to outperform those relying on single suppliers. Competitive advantages now revolve around full-service lifecycle offerings, sensor-enabled products that track utilization, and premium aesthetics that help employers stand out in tight labour markets. The Europe office furniture market consequently remains a bellwether for how corporate real-estate strategies, regulatory requirements, and sustainability goals converge in physical workspace investments.

Europe Office Furniture Market Trends and Insights

Post-pandemic hybrid-work boom sustaining replacement cycle

Corporate shifts to flexible attendance models have lengthened daily seat-rotation patterns and reduced total fixed desks, yet the same shift is prolonging replacement cycles for modular furniture that accommodates more users per seat. Companies are introducing height-adjustable desks, mobile cabinets, and tool-free reconfiguration systems to align seating density with fluctuating occupancy. Utilization metrics already show collaborative zones at 32% occupancy versus 26% for assigned workstations, steering investment toward multi-purpose furniture that helps facilities teams redeploy square footage rapidly. The Europe office furniture market benefits because such modular lines require frequent add-ons and accessories, lifting average ticket value when leases renew. Furniture manufacturers now capture recurring revenue through subscription models that allow clients to swap out pieces on demand, drastically reducing unused stock and landfill waste. Real-estate teams also value the data captured by sensor-enabled desks and chairs that feed utilization dashboards in real time, guiding proactive maintenance schedules that extend product lifespans.

Corporate ESG mandates fuelling demand for circular and recycled furniture

Procurement departments across Europe now treat carbon reduction as a formal purchasing criterion, accelerating the push for remanufactured tables, chair refurbishments, and as-a-service subscriptions. Providers such as NORNORM report 50% yearly growth in leased square meters while claiming up to 70% lower CO2 impact compared with first-sale purchases. Circular offerings often include guaranteed take-back, refurbishment, and transparent end-of-life reporting, helping corporate clients meet scope-three emission targets. The strategy confers a sales advantage because buyers can now avoid upfront capital expenditure and pay from operating budgets, an approach that realigns financial planning with sustainability goals. Manufacturers simultaneously integrate ocean-bound plastics and post-consumer PET felt into panelling and seating shells, prompting plastics to emerge as the fastest material segment by 2030. The circular trend is further propelled by EU policy proposals that would extend eco-design rules to furniture and force detailed life-cycle disclosure on every item sold.

Inflation-driven capex deferrals by corporates

Persistent consumer-price inflation across Europe is pushing finance teams to freeze non-essential capital outlays, which directly impedes furniture refresh cycles. German furniture revenue dipped 7.40% to USD 17.8 billion (EUR 16.4 billion) in 2024, and office sub-categories contracted 4% as companies diverted cash to technology and working-capital cushions. Instead of purchasing new chairs, facilities teams engage refurbishment vendors that deliver 30-50% savings while still meeting ergonomic guidelines. Deferred makeover budgets skew mid-range volumes downward even as premium lines survive, because executives seek "statement" areas that communicate stability amid economic turbulence. The slowdown induces backlog in the Europe office furniture market but also creates latent demand that could surface in a spending sprint once macroeconomic uncertainty subsides.

Other drivers and restraints analyzed in the detailed report include:

- Stricter EU ergonomics directives accelerating ergonomic seating adoption

- Premiumization of workspace aesthetics to attract talent in tight labour markets

- Volatile timber and steel prices squeezing OEM margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Chairs retained 37.85% of 2025 revenue because every workstation still requires an ergonomically compliant seat, making chairs the single indispensable product line in the Europe office furniture market share. Mandatory EN 1335 re-certifications plus corporate wellness programs extend chair lifecycles to roughly five years, triggering predictable replacement orders that stabilize factory output. Height-adjustable desks and large conference tables remain mainstays in medium to large offices, yet the post-pandemic emphasis on collaboration spurs a pivot toward lounge-style seating zones that mix sofas, stools, and coffee tables. Open-plan floorplates, however, suffer from noise fatigue, which propels booths and privacy pods to a 6.55% forecast CAGR through 2031, the fastest of any category.

Booths and divider systems thrive due to lightweight composite cores, magnetized assembly kits, and built-in ventilation fans that meet fire-safety and air-quality codes. Start-ups deploy pods immediately after signing lease agreements because the modules bypass landlord fit-out approval, shaving weeks from move-in timelines. Multinational enterprises integrate pods with booking software that tracks occupancy, optimizing seating density as return-to-office rates fluctuate. Chairs, meanwhile, remain critical for compliance but are diversifying quickly into multipurpose hybrids think perch stools that tilt to boost posture or soft task chairs that double as visitor seating.

Wood maintained a 45.20% Europe office furniture market share in 2025, sustained by client preference for natural textures that signal warmth and biophilia. Chain-of-custody certifications such as FSC and PEFC give wood an environmental edge, allowing manufacturers to charge premiums in ESG-oriented tenders. Oak, ash, and walnut finishes remain popular for executive conference tables and reception counters, though veneer sheets over particleboard cores help reduce weight and cost. Metal sub-frames add structural integrity to sit-stand desks, yet soaring steel prices pressure bill-of-materials budgets, prompting the sector to investigate alternative alloys. Simultaneously, recycled polymer formulations register the highest 6.39% CAGR because they fit circular procurement mandates and enable complex geometries in one-piece molds.

Innovative polymers embed cable-management channels, NFC tags, and antimicrobial additives during molding, supporting new hygiene and tech-integration requirements without secondary assembly. This capability shortens production times and reduces part counts, lowering warranty risk while boosting design freedom. Furniture made from recycled PET felt also gains traction as acoustic baffles behind monitor arms, providing sound absorption and colour customization at scale.

The Europe Office Furniture Market Report is Segmented by Product (Chairs, Tables, and More), Material (Wood, Metal, and More), Price Range (Economy, Mid-Range, Premium), End-User (Corporate Offices, Healthcare Offices, and More), Distribution Channel (B2C/Retail, B2B/Directly From Manufacturers), and Geography (Germany, United Kingdom, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Steelcase Inc.

- Herman Miller Inc.

- Haworth Inc.

- Kinnarps AB

- Vitra International AG

- HNI Corporation

- Okamura Corporation

- Wilkhahn Wilkening+Hahne GmbH

- Flokk AS

- Sedus Stoll AG

- Ahrend Holding NV

- Bene GmbH

- USM U. Scharer Sohne AG

- Martela Oyj

- Senator Group

- Nowy Styl Group

- Interstuhl Buromobel GmbH

- Bisley Office Furniture Ltd.

- Euromof S.A.

- Humanscale Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-pandemic hybrid-work boom sustaining replacement cycle

- 4.2.2 Corporate ESG mandates fueling demand for circular & recycled furniture

- 4.2.3 Stricter EU ergonomics directives (EN 1335-1:2020) accelerating ergonomic seating adoption

- 4.2.4 Premiumisation of workspace aesthetics to attract talent in tight labour markets

- 4.2.5 AI-driven mass-custom design platforms reducing lead-times & inventory risk

- 4.2.6 Smart-sensor-embedded desks & chairs enabling workplace analytics spend

- 4.3 Market Restraints

- 4.3.1 Inflation-driven capex deferrals by corporates

- 4.3.2 Volatile timber & steel prices squeezing OEM margins

- 4.3.3 Shrinking office-space footprints due to remote work

- 4.3.4 EU Waste-from-Electricals (WEEE-style) take-back obligations adding cost (under-the-radar)

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

- 4.8 Insights on Regulatory Framework and Industry Standards for Office Furniture

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Chairs

- 5.1.1.1 Employee Chairs

- 5.1.1.2 Meeting Chairs

- 5.1.1.3 Guest Chairs

- 5.1.2 Tables

- 5.1.2.1 Conference Tables

- 5.1.2.2 Desks

- 5.1.2.3 Other Tables

- 5.1.3 Storage Units

- 5.1.3.1 Filing Cabinets

- 5.1.3.2 Bookcases & Shelving

- 5.1.4 Sofas/Soft Seating

- 5.1.5 Booths and Office Dividers

- 5.1.6 Other Office Furniture (Stools, Reception Area Furniture, Accessories, Others)

- 5.1.1 Chairs

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Other Materials

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-range

- 5.3.3 Premium

- 5.4 By End-user

- 5.4.1 Corporate Offices

- 5.4.2 Healthcare Offices

- 5.4.3 Educational Institutions

- 5.4.4 Government & Public Offices

- 5.4.5 Hospitality & Retail Back-office

- 5.4.6 Others

- 5.5 By Distribution Channel

- 5.5.1 B2C / Retail

- 5.5.1.1 Home Centers

- 5.5.1.2 Specialty Furniture Stores

- 5.5.1.3 Online

- 5.5.1.4 Other Distribution Channels

- 5.5.2 B2B / Directly from Manufacturers

- 5.5.1 B2C / Retail

- 5.6 By Geography

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Russia

- 5.6.7 Benelux

- 5.6.8 Nordics

- 5.6.9 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Steelcase Inc.

- 6.4.2 Herman Miller Inc.

- 6.4.3 Haworth Inc.

- 6.4.4 Kinnarps AB

- 6.4.5 Vitra International AG

- 6.4.6 HNI Corporation

- 6.4.7 Okamura Corporation

- 6.4.8 Wilkhahn Wilkening+Hahne GmbH

- 6.4.9 Flokk AS

- 6.4.10 Sedus Stoll AG

- 6.4.11 Ahrend Holding NV

- 6.4.12 Bene GmbH

- 6.4.13 USM U. Scharer Sohne AG

- 6.4.14 Martela Oyj

- 6.4.15 Senator Group

- 6.4.16 Nowy Styl Group

- 6.4.17 Interstuhl Buromobel GmbH

- 6.4.18 Bisley Office Furniture Ltd.

- 6.4.19 Euromof S.A.

- 6.4.20 Humanscale Corporation

7 Market Opportunities & Future Outlook

- 7.1 Hybrid Work Culture Driving Modular Designs

- 7.2 Ergonomic Wellness Furniture Becoming Workplace Norm

- 7.3 Sustainable Materials Shaping Procurement Decisions