PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906169

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906169

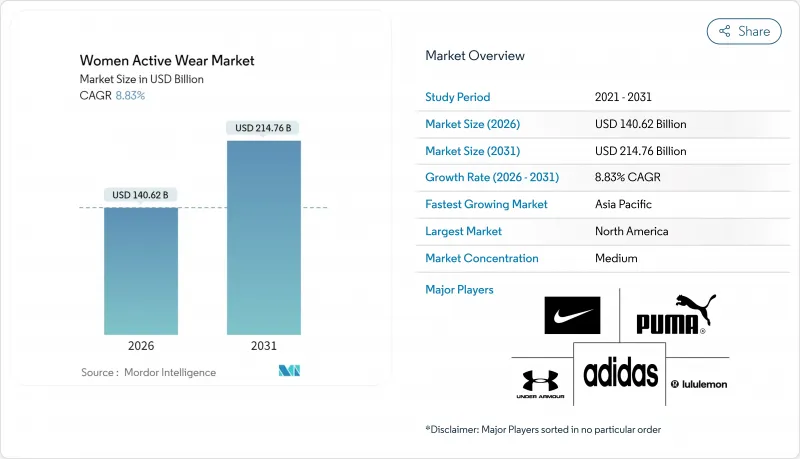

Women Active Wear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Women's Activewear market size in 2026 is estimated at USD 140.62 billion, growing from 2025 value of USD 129.21 billion with 2031 projections showing USD 214.76 billion, growing at 8.83% CAGR over 2026-2031.

Activewear has transformed beyond traditional gym use to become a fundamental component of everyday fashion and lifestyle. This growth is propelled by heightened wellness consciousness and lifestyle integration, as women increasingly seek versatile apparel that seamlessly combines fitness functionality with daily comfort. The market's robust expansion reflects the rising female participation across diverse fitness activities, from yoga and Pilates to traditional gym workouts. This diversification in exercise preferences generates substantial demand for adaptable, high-performance apparel that effectively merges style, comfort, and functionality, driving continuous innovation in fabric technology and design. The widespread adoption of athleisure further strengthens the market by establishing activewear as a practical, contemporary fashion that comprehensively addresses modern lifestyle requirements.

Global Women Active Wear Market Trends and Insights

Rising Female Participation in Sports and Fitness Activities

The growth of the global women's activewear market is primarily driven by the substantial increase in female participation across sports and fitness activities. This rising participation reflects the broader social acceptance and empowerment of women in sports, generating significant demand for functional, performance-oriented activewear that combines technical features with contemporary design elements. According to the Sport England survey (2023-2024), 76% of women in England actively engaged in sports or physical activities, demonstrating a fundamental shift toward health-conscious, active lifestyles . This widespread participation drives continuous market expansion and product innovation as women seek specialized apparel for diverse athletic pursuits. The trend gains momentum through increasing health awareness, sophisticated targeted marketing campaigns, and the growing influence of professional female athletes who inspire and motivate more women to incorporate athletic activities into their daily routines.

Growing Health and Wellness Consciousness

Health and wellness consciousness fundamentally drives the global women's activewear market by revolutionizing consumer behavior and reshaping market demand. Women increasingly prioritize comprehensive holistic well-being, generating substantial demand for high-performance activewear that maximizes physical capabilities and promotes optimal health outcomes. This transformative trend has accelerated the development of sophisticated functional apparel engineered for intensive exercise, enhanced recovery, superior comfort, and comprehensive body care. In August 2024, Tighties launched three specialized pairs of leggings meticulously engineered for targeted pain relief, advanced muscle strengthening, and optimized active recovery. This strategic product development exemplifies the market's fundamental shift toward innovative performance apparel that seamlessly integrates advanced wellness benefits with superior fitness functions to address sophisticated consumer requirements.

High Production and Raw Material Costs

Raw material cost fluctuations significantly impact profit margins, compelling brands to implement strategic pricing approaches while maintaining profitability targets, especially in mass-market segments where consumer price sensitivity limits the ability to transfer costs. The volatility in polyester and nylon prices, driven by dynamic petroleum market conditions and ongoing supply chain disruptions, directly influences the production costs of essential performance fabrics in modern activewear manufacturing. These cost pressures intensify substantially as brands transition to sustainable materials and implement advanced manufacturing processes, which demand premium input costs and require extensive research and development investments. The escalating labor costs across major manufacturing regions further amplify these challenges, prompting brands to explore comprehensive supply chain diversification strategies that effectively balance cost optimization with stringent quality standards and consistent delivery performance.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand for Sustainable and Eco-friendly Materials

- Influence of Social Media and Celebrity Endorsements

- Counterfeiting and Intellectual Property Challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Topwear maintains a significant 39.42% market share in women's activewear, establishing its position through superior versatility and strategic integration of functionality and style. The segment's success stems from sophisticated fabric technologies, incorporating advanced moisture-wicking capabilities, enhanced breathability features, and optimized stretch properties that deliver superior comfort and performance benefits. The widespread adoption of athleisure has transformed topwear into an indispensable wardrobe element that transcends traditional athletic boundaries. The comprehensive product range effectively addresses diverse body types and fashion preferences, generating sustained market demand. Manufacturers consistently implement innovative design approaches that harmonize contemporary fashion elements with high-performance athletic features.

The outerwear segment demonstrates exceptional market potential, achieving a substantial CAGR of 9.37% through 2031. This remarkable growth trajectory is propelled by increasing consumer preferences for sophisticated multi-functional garments that effectively integrate weather protection capabilities with refined sport-inspired aesthetic elements. Significant technological advancements in lightweight materials, enhanced weather-resistant properties, and advanced temperature-regulating systems have fundamentally transformed outerwear, elevating it from conventional protective clothing to sophisticated performance wear. This evolution directly addresses contemporary consumer requirements for adaptable clothing solutions that seamlessly transition between athletic activities and everyday casual wear.

Gym and fitness activities account for 45.62% of the global women's activewear market in 2025. This significant share stems from increased women's participation in gym and fitness activities worldwide, indicating a broader shift toward health-focused lifestyles. For instance, the AusPlay Survey 2024 reports that 3.1 million women in Australia participated in fitness or gym activities in 2024, demonstrating the substantial consumer base in this segment . This high participation drives demand for specialized activewear designed for gym and fitness activities, including performance tops, leggings, sweatpants, and outerwear. The integration of fashion elements with functional features, alongside growing health awareness, reinforces this segment's position in the women's activewear market.

The yoga and Pilates segment shows the highest growth rate in the global women's activewear market with a CAGR of 8.99%. This growth results from increasing consumer interest in low-impact, mindful fitness activities. These practices offer physical benefits, including improved flexibility, core strength, balance, and posture, while providing mental health advantages such as reduced stress and increased mindfulness. The comprehensive health benefits have attracted a diverse range of practitioners, expanding beyond traditional fitness enthusiasts to include individuals seeking overall wellness in their daily routines.

The Global Women's Activewear Market is Market Segmented by Product Type (Topwear, Bottomwear, Outerwear, and Accessories), Activity (Running and Cycling, Gym and Fitness, and More), Category (Mass, and Premium), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail Stores, and Other Distribution Channels), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds a dominant 47.72% market share in 2025, supported by an established fitness culture, high disposable incomes, and consumer demand for premium activewear products. The region's market maturity is evident in strong brand loyalty and consumer willingness to purchase specialized fitness garments. While this creates stable demand for established companies, it also presents market entry challenges for new competitors. The region shows moderating growth rates due to market saturation in key demographics, prompting companies to focus on product innovation and international expansion.

Asia-Pacific demonstrates the highest growth rate at 9.41% CAGR through 2031, driven by urbanization, increasing disposable incomes, and growing health awareness. In China, consumer preferences are shifting toward premium activewear products, with social media marketing effectively reaching younger consumers. India's expanding yoga market showcases how traditional practices influence product development, combining cultural elements with modern performance features.

Europe shows consistent market growth through consumer emphasis on sustainability and regulations promoting eco-friendly materials and circular business practices. The region benefits from shopping tourism, with the Italian National Tourist Board recording 2.3 million shopping-focused tourists in 2023 . South America, the Middle East, and Africa present growth opportunities through improving infrastructure and economic development, though market expansion faces challenges from political uncertainty and currency fluctuations, requiring strategic local partnerships.

- Adidas AG

- Nike, Inc.

- Puma SE

- Under Armour, Inc.

- Lululemon Athletica Inc.

- Columbia Sportswear Company

- ASICS Corporation

- Gap Inc. (Athleta)

- Decathlon Group

- Mizuno Corporation

- Hanesbrands Inc.

- Fila Holdings Corp.

- VF Corporation

- New Balance Athletics

- Skechers USA, Inc.

- Gymshark Ltd.

- Alo Yoga

- Vuori

- Fabletics

- 2XU Pty Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising female participation in sports and fitness activities

- 4.2.2 Growing health and wellness consciousness

- 4.2.3 Increasing demand for sustainable and eco-friendly materials

- 4.2.4 Influence of social media and celebrity endorsements

- 4.2.5 Fashion-forward designs and body-positive fits

- 4.2.6 Innovation in performance fabrics and smart textiles

- 4.3 Market Restraints

- 4.3.1 High production and raw material costs

- 4.3.2 Counterfeiting and intellectual property challenges

- 4.3.3 Intense market competition and brand saturation

- 4.3.4 Complex and risk-prone global supply chains

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Topwear

- 5.1.2 Bottomwear

- 5.1.3 Outerwear

- 5.1.4 Accessories

- 5.2 By Activity

- 5.2.1 Running and Cycling

- 5.2.2 Gym and Fitness

- 5.2.3 Yoga and Pilates

- 5.2.4 Dance Fitness

- 5.3 By Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 Supermarket/Hypermarket

- 5.4.2 Specialty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adidas AG

- 6.4.2 Nike, Inc.

- 6.4.3 Puma SE

- 6.4.4 Under Armour, Inc.

- 6.4.5 Lululemon Athletica Inc.

- 6.4.6 Columbia Sportswear Company

- 6.4.7 ASICS Corporation

- 6.4.8 Gap Inc. (Athleta)

- 6.4.9 Decathlon Group

- 6.4.10 Mizuno Corporation

- 6.4.11 Hanesbrands Inc.

- 6.4.12 Fila Holdings Corp.

- 6.4.13 VF Corporation

- 6.4.14 New Balance Athletics

- 6.4.15 Skechers USA, Inc.

- 6.4.16 Gymshark Ltd.

- 6.4.17 Alo Yoga

- 6.4.18 Vuori

- 6.4.19 Fabletics

- 6.4.20 2XU Pty Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK