PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906185

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906185

North America Commercial Vehicle Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

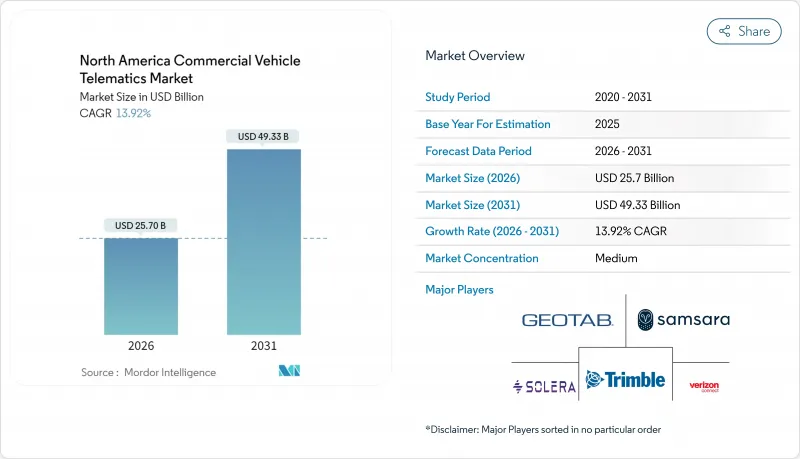

The North America commercial vehicle telematics market is expected to grow from USD 22.56 billion in 2025 to USD 25.7 billion in 2026 and is forecast to reach USD 49.33 billion by 2031 at 13.92% CAGR over 2026-2031.

Strong adoption momentum arises from tightening compliance enforcement, electrification analytics, and artificial intelligence capabilities that transform descriptive dashboards into predictive decision engines. Freight-market softness paradoxically fueled penetration as carriers used telematics to uncover granular cost savings, while accelerating 5G rollouts unlocked high-bandwidth, millisecond-latency vehicle-to-everything data flows. OEMs widened the addressable pool by factory-installing connected hardware, and insurers offered sizable premium incentives for fleets demonstrating verifiable safety improvements.

North America Commercial Vehicle Telematics Market Trends and Insights

Regulatory Mandates for Compliance

Federal Motor Carrier Safety Administration (FMCSA) removals of non-compliant electronic logging devices created mandatory replacement cycles that lifted 2024-2025 unit shipments. Enforcement actions signal a shift from one-time certification to ongoing technical audits, compelling fleets to select providers with proven update cadences and secure data pipelines. June 2025 engine-vintage extensions and pending automatic emergency-braking rules expand the compliance footprint, positioning telematics as the central hub that automates log capture, remote diagnostics, and recall management. Providers differentiating on audit-ready reporting and over-the-air firmware updates gain pricing power, particularly among long-haul carriers balancing federal and cross-border mandates.

Video-Based Safety and AI Analytics

Artificial-intelligence cameras transitioned from passive recorders to edge-processed coaching devices that predict collision risk and trigger in-cab alerts. Geotab reports 40% collision reduction on fleets using predictive safety scoring, while insurers grant premium cuts of up to 30% for documented loss frequency improvements. Real-time lane-departure warnings, tailgating metrics, and automatic incident uploads generate defensible evidence for liability mitigation, prompting rising procurement even among small fleets. Rapid sensor price declines and cloud-native analytics encourage bundled video and tracking subscriptions that lift average revenue per user. Privacy-preserving on-device processing assuages driver concerns, accelerating union acceptance in major urban markets.

Cyber-Security and Data-Sovereignty Liability

High-profile lawsuits under the Illinois Biometric Information Privacy Act and class actions alleging unauthorized data resale heightened financial exposure for both telematics vendors and fleets. Settlements such as Lytx's USD 4.25 million payment catalyzed demand for end-to-end encryption, regional data residency, and explicit driver consent workflows. Fleets now stipulate contractual security audits and cyber insurance proof, increasing vendor qualification hurdles. Providers investing in SOC 2 certifications and zero-trust architectures convert risk into differentiation, whereas small vendors often lack the balance sheet to meet escalated assurance standards.

Other drivers and restraints analyzed in the detailed report include:

- Fleet Electrification Analytics

- 5G-Enabled Real-Time V2X Data

- Rising 5G and AI Hardware Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aftermarket devices controlled 62.35% of the North America commercial vehicle telematics market share in 2025 as fleets retrofitted mixed-brand trucks without waiting for new-model cycles. Growth, however, tilts toward OEM embedded platforms, which are forecast to post a 14.62% CAGR through 2031 as manufacturers pre-install 4G- and 5G-enabled gateways at the factory. Factory-fit hardware eliminates installation downtime, enables deeper CAN bus data access, and improves tamper resistance, appealing to large carriers with rigorous security protocols. Aftermarket vendors retain advantages in legacy fleet coverage, rapid feature iterations, and brand-agnostic dashboards. The coexistence of both models demands that providers offer dual integration strategies, thereby widening software ecosystems while preserving backward compatibility.

Second-generation aftermarket suppliers increasingly partner with OEMs for data-through-connector access, blurring lines between the two categories. Platform Science's acquisition of Trimble's transportation telematics assets exemplifies a convergence play that marries OEM-certified software with configurable hardware-abstraction layers. Over the forecast horizon, market leaders are expected to sell modular subscription tiers that allow fleets to toggle seamlessly from plug-in units on older equipment to embedded gateways on new builds, strengthening customer lock-in amid fleet turnover cycles.

Light commercial vehicles accounted for 51.20% of the North America commercial vehicle telematics market size in 2025 due to high fleet volumes and quick service-van replacement intervals. E-commerce last-mile fleets leverage basic GPS and proof-of-delivery workflows, generating steady but lower revenue per unit. Heavy commercial vehicles, although smaller in count, are set to compound at 15.08% through 2031 because stringent hours-of-service rules and costly downtime justify comprehensive sensor suites that command premium subscriptions.

Growth in heavy-duty segments accelerates as shippers demand chain-of-custody transparency for food, pharmaceuticals, and high-value electronics. Predictive maintenance modules avert catastrophic engine failures, and trailer-temperature monitoring safeguards perishables, bolstering value perception. Medium commercial and off-highway equipment occupy niche but stable roles, with adoption tied to construction cycles and agriculture seasonality rather than line-haul freight economics.

The North America Commercial Vehicle Telematics Market Report is Segmented by Type (OEM Embedded and Aftermarket), Vehicle Type (Light Commercial Vehicles, Medium Commercial Vehicles, and More), Deployment Model (Cloud-Based and On-Premise), Solution (Fleet Tracking and Monitoring, Driver Management, and More), and Country (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Geotab Inc.

- Verizon Connect Inc.

- Samsara Inc.

- Trimble Inc.

- Solera Holdings LLC

- Motive Technologies Inc.

- Teletrac Navman US Ltd.

- CalAmp Corp.

- Zonar Systems Inc.

- Lytx Inc.

- Spireon Holdings LP

- Fleet Complete USA Inc.

- GPS Insight LLC

- Gurtam UAB

- Powerfleet Inc.

- Platform Science Inc.

- EROAD Inc.

- Netradyne Inc.

- IntelliShift (BrainWave LLC)

- Geoforce LLC

- Azuga Inc.

- Michelin Connected Fleet SAS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory Mandates for Compliance

- 4.2.2 Video-Based Safety and AI Analytics

- 4.2.3 Fleet Electrification Analytics

- 4.2.4 OEM Factory-Fit Telematics Standardisation

- 4.2.5 5G-Enabled Real-Time V2X Data

- 4.2.6 Freight Recession Cost Optimisation

- 4.3 Market Restraints

- 4.3.1 Cyber-Security and Data-Sovereignty Liability

- 4.3.2 Rising 5G and AI Hardware Costs

- 4.3.3 Integration Debt with Legacy IT

- 4.3.4 Driver Privacy Litigation Risk

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 OEM Embedded

- 5.1.2 Aftermarket

- 5.2 By Vehicle Type

- 5.2.1 Light Commercial Vehicles

- 5.2.2 Medium Commercial Vehicles

- 5.2.3 Heavy Commercial Vehicles

- 5.2.4 Off-Highway Vehicles

- 5.3 By Deployment Model

- 5.3.1 Cloud-Based

- 5.3.2 On-Premise

- 5.4 By Solution

- 5.4.1 Fleet Tracking and Monitoring

- 5.4.2 Driver Management

- 5.4.3 Insurance Telematics

- 5.4.4 Safety and Compliance

- 5.4.5 Video Telematics

- 5.4.6 V2X Solutions

- 5.4.7 Other Solutions

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Geotab Inc.

- 6.4.2 Verizon Connect Inc.

- 6.4.3 Samsara Inc.

- 6.4.4 Trimble Inc.

- 6.4.5 Solera Holdings LLC

- 6.4.6 Motive Technologies Inc.

- 6.4.7 Teletrac Navman US Ltd.

- 6.4.8 CalAmp Corp.

- 6.4.9 Zonar Systems Inc.

- 6.4.10 Lytx Inc.

- 6.4.11 Spireon Holdings LP

- 6.4.12 Fleet Complete USA Inc.

- 6.4.13 GPS Insight LLC

- 6.4.14 Gurtam UAB

- 6.4.15 Powerfleet Inc.

- 6.4.16 Platform Science Inc.

- 6.4.17 EROAD Inc.

- 6.4.18 Netradyne Inc.

- 6.4.19 IntelliShift (BrainWave LLC)

- 6.4.20 Geoforce LLC

- 6.4.21 Azuga Inc.

- 6.4.22 Michelin Connected Fleet SAS

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment