PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940761

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940761

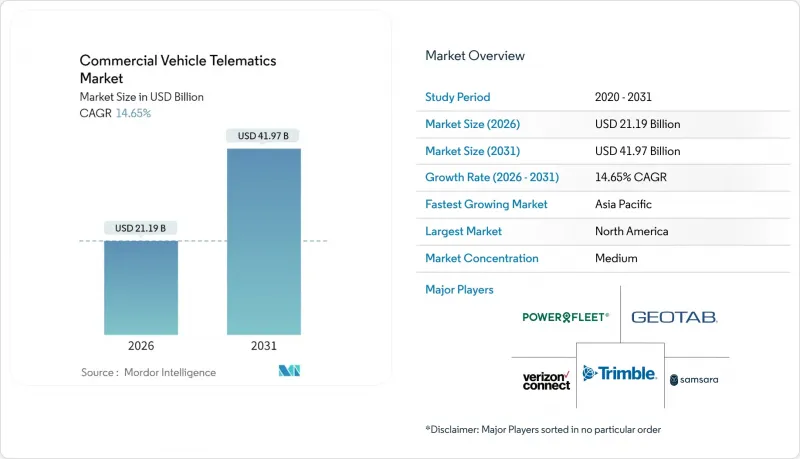

Commercial Vehicle Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Commercial Vehicle Telematics Market was valued at USD 18.48 billion in 2025 and estimated to grow from USD 21.19 billion in 2026 to reach USD 41.97 billion by 2031, at a CAGR of 14.65% during the forecast period (2026-2031).

Demand accelerates as fleets shift from reactive maintenance to predictive, data-driven optimization, aided by regulatory mandates such as electronic logging devices and safety regulations. Modern heavy-duty trucks generate up to 20 GB of data per minute across more than 100 sensors, enabling machine-learning models that prevent 77% of unplanned breakdowns . Growth is reinforced by subscription-based data monetization models, hybrid cellular-satellite connectivity for remote routes, and the economic imperative to reduce total cost of ownership. Consolidation is reshaping the competitive landscape, as illustrated by Platform Science's acquisition of Trimble's telematics units for USD 300 million in trailing revenue.

Global Commercial Vehicle Telematics Market Trends and Insights

Increasing adoption of factory-installed OEM telematics in heavy trucks

OEM integration shifts value from aftermarket retrofits to factory systems that leverage native vehicle networks, enhancing data integrity and reducing installation costs. Volvo's latest platform connects 85,000 trucks across Europe, issuing 4,000 predictive-maintenance alerts per month and preventing 77% of breakdowns. Fleets gain higher ROI through warranty alignment and seamless over-the-air updates. OEMs now bundle telematics as standard equipment, altering competitive dynamics against stand-alone providers.

Mandatory electronic logging-device and safety regulations

The FMCSA's 2025 update incorporates automatic emergency braking, speed limiters, and expanded drug and alcohol testing into existing ELD requirements, thereby increasing compliance pressure. The EU mirrors this trend with Regulation 2024/2220, which mandates the use of event data recorders by January 2026 . Uniform standards increase scale economies for vendors and automate documentation, reducing audit burdens for carriers.

Cyber-security vulnerabilities in connected commercial vehicles

Expanded attack surfaces expose critical systems such as braking and steering to malicious actors. EU safety regulations now require automotive cybersecurity management, imposing compliance complexity but also highlighting potential liability exposure . Over-the-air updates widen entry points, making robust security frameworks and third-party audits essential for fleet trust.

Other drivers and restraints analyzed in the detailed report include:

- Demand for AI-driven fleet optimization to cut total cost of ownership

- Rapid expansion of last-mile e-commerce delivery fleets

- Fragmented connectivity infrastructure in developing regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions retained 62.85% of the commercial vehicle telematics market share in 2025 as fleets relied on core modules for tracking, compliance, and predictive maintenance. Managed services, however, are growing at 16.04% CAGR because rising system complexity pushes operators to outsource analytics and administration. The commercial vehicle telematics market's expansion in services reflects a shift from technology adoption to value extraction.

Geotab's marketplace hosts hundreds of third-party apps that layer analytics and workflow automation onto base data feeds. Fleets increasingly pay subscription fees for continuous insight rather than purchasing hardware outright. This service's momentum rebalances revenue streams and creates stickier customer relationships for vendors.

OEM solutions controlled a 57.40% share of the commercial vehicle telematics market in 2025, as truck makers embedded connectivity at the factory. Aftermarket providers still post a 15.46% CAGR by addressing retrofits and niche applications that OEM bundles overlook. The commercial vehicle telematics market size tied to OEM platforms grows with every new vehicle roll-off, yet openness to third-party software ecosystems blurs traditional boundaries.

Platform Science's purchase of Trimble's units for USD 300 million creates an integrated in-cab marketplace that can run on OEM hardware while supporting customized workflows. Data access wars center on proprietary CAN signals, with regulators monitoring to ensure fair access for independent service providers.

The Commercial Vehicle Telematics Market Report is Segmented by Offering (Solutions, Services), Provider Type (OEM, Aftermarket), Vehicle Class (Light Commercial Vehicles, Heavy and Medium Commercial Vehicles), Communication Technology (Cellular, Satellite, Hybrid), End-User Vertical (Transportation and Logistics, Construction and Mining, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 32.20% revenue in 2025, underpinned by FMCSA's tight safety regime and broad cellular coverage. Automatic emergency braking mandates, effective 2025, further elevate adoption, while high labor costs magnify ROI calculations. Platform Science acquired Trimble assets, and GPS Trackit merged with Zonar Systems, reshaping the competitive landscape. Data monetization pilots, where fleets sell anonymized insights to insurers, reflect the region's appetite for subscription models.

The Asia-Pacific region is the fastest-growing region, with a 17.05% CAGR through 2031. China commands 80% of global electric freight-truck sales, requiring telematics that integrate battery-swap scheduling and charger analytics. Battery swapping already covers 40% of Chinese heavy-duty e-trucks, demanding specialized APIs for real-time energy management. Australia and New Zealand anticipate a rise in penetration from 26.6% to 39.5% by 2028, as agriculture and mining fleets digitize their operations. V2X inclusion in China's NCAP prompts OEMs to embed C-V2X modules, accelerating the deployment of systemic telematics.

Europe maintains a robust presence due to General Safety Regulation provisions on cybersecurity and event data recorders, which will take effect starting in 2026. Digital tachograph rules, which extend to vehicles weighing more than 2.5 tonnes, broaden the addressable base. Dual-track DSRC and C-V2X standardization allows multi-vendor hardware without fragmentation. Sustainability goals promote zero-emission truck telematics that co-optimize route planning with charge scheduling. Public procurement often requires proof of telematics capability for municipal contracts, further boosting uptake.

- Verizon Connect (Verizon Communications Inc.)

- Geotab Inc.

- Samsara Inc.

- Trimble Inc.

- Teletrac Navman (Vontier Corporation)

- Powerfleet Inc.

- Omnitracs LLC

- Lytx Inc.

- CalAmp Corp.

- Webfleet Solutions

- PTC Inc.

- Octo Telematics SpA

- Zonar Systems, Inc.

- Gurtam Inc.

- Motive Technologies Inc.

- GPS Insight

- Sierra Wireless (Semtech Corporation)

- Cartrack Holdings Limited

- IntelliShift (Vehicle Tracking Solutions, LLC (VTS))

- Azuga Inc.

- Platform Science, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing adoption of factory-installed OEM telematics in heavy trucks

- 4.2.2 Mandatory electronic logging-device (ELD) and safety regulations

- 4.2.3 Demand for AI-driven fleet optimisation to cut total cost of ownership

- 4.2.4 Rapid expansion of last-mile e-commerce delivery fleets

- 4.2.5 Emergence of subscription-based telematics data marketplaces

- 4.2.6 Integration of telematics with zero-emission truck energy and charge management

- 4.3 Market Restraints

- 4.3.1 Cyber-security vulnerabilities in connected commercial vehicles

- 4.3.2 Fragmented connectivity infrastructure in developing regions

- 4.3.3 Cost and ROI concerns for small fleet operators

- 4.3.4 Data-ownership and privacy-compliance hurdles

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Fleet Tracking and Monitoring

- 5.1.1.2 Driver Management

- 5.1.1.3 Insurance Telematics

- 5.1.1.4 Safety and Compliance

- 5.1.1.5 V2X Solutions

- 5.1.1.6 Predictive Maintenance and Diagnostics

- 5.1.1.7 Asset and Trailer Tracking

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Provider Type

- 5.2.1 OEM

- 5.2.2 Aftermarket

- 5.3 By Vehicle Class

- 5.3.1 Light Commercial Vehicles

- 5.3.2 Heavy and Medium Commercial Vehicles

- 5.4 By Communication Technology

- 5.4.1 Cellular (2G/3G/4G/5G)

- 5.4.2 Satellite

- 5.4.3 Hybrid (Cellular + Satellite)

- 5.5 By End-user Vertical

- 5.5.1 Transportation and Logistics

- 5.5.2 Construction and Mining

- 5.5.3 Public Sector and Emergency Services

- 5.5.4 Utilities

- 5.5.5 Insurance and Leasing

- 5.5.6 Retail and E-commerce

- 5.5.7 Others (Agriculture, Waste Management, etc.)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia and New Zealand

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Verizon Connect (Verizon Communications Inc.)

- 6.4.2 Geotab Inc.

- 6.4.3 Samsara Inc.

- 6.4.4 Trimble Inc.

- 6.4.5 Teletrac Navman (Vontier Corporation)

- 6.4.6 Powerfleet Inc.

- 6.4.7 Omnitracs LLC

- 6.4.8 Lytx Inc.

- 6.4.9 CalAmp Corp.

- 6.4.10 Webfleet Solutions

- 6.4.11 PTC Inc.

- 6.4.12 Octo Telematics SpA

- 6.4.13 Zonar Systems, Inc.

- 6.4.14 Gurtam Inc.

- 6.4.15 Motive Technologies Inc.

- 6.4.16 GPS Insight

- 6.4.17 Sierra Wireless (Semtech Corporation)

- 6.4.18 Cartrack Holdings Limited

- 6.4.19 IntelliShift (Vehicle Tracking Solutions, LLC (VTS))

- 6.4.20 Azuga Inc.

- 6.4.21 Platform Science, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment