PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906188

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906188

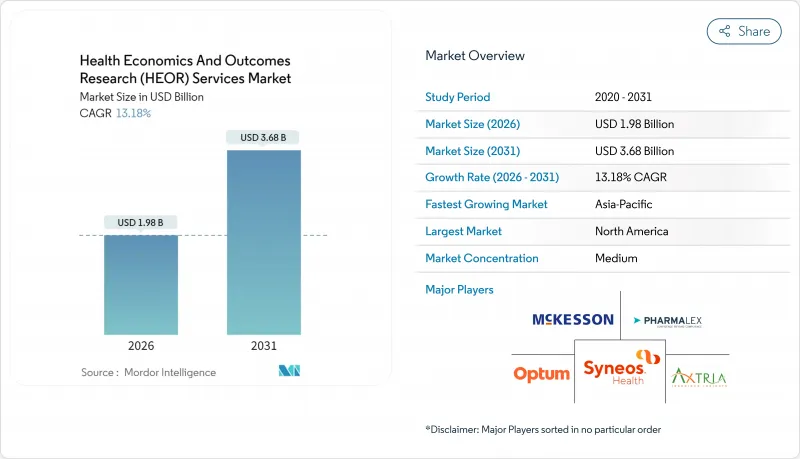

Health Economics And Outcomes Research (HEOR) Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Health Economics And Outcomes Research Services market is expected to grow from USD 1.75 billion in 2025 to USD 1.98 billion in 2026 and is forecast to reach USD 3.68 billion by 2031 at 13.18% CAGR over 2026-2031.

Heightening reimbursement scrutiny, the shift to value-based payment models, and widening health technology assessment (HTA) mandates are fueling demand for faster, more defensible evidence packages. Generative AI cuts literature-review cycle times by 60%, reshaping project economics and enabling early payer engagement. Multinational pharmaceutical pipelines, especially in obesity, oncology, and gene therapy, generate sustained needs for sophisticated cost-effectiveness modeling. Service providers deploy large language models on federated real-world data (RWD) networks to unlock multi-jurisdiction evidence without breaching privacy guardrails. Providers that combine therapeutic depth with AI-enabled workflow automation are widening their competitive moat as clients consolidate vendor panels for integrated clinical-to-economic evidence generation.

Global Health Economics And Outcomes Research (HEOR) Services Market Trends and Insights

Growing Demand for Real-World Evidence for Reimbursement

Payers increasingly require real-world effectiveness data to justify premium pricing and coverage terms. The FDA's 2024 guidance endorsing electronic health record and claims data for regulatory decision making firmly positions RWD as a primary evidence stream. The Centers for Medicare & Medicaid Services widened outcomes-based contract structures to 40% more therapeutic areas versus 2023, raising the stakes for manufacturers that lack mature RWE programs. Europe's HTA Regulation adds a second compliance layer by obliging multinational dossiers to include comparative effectiveness data across 27 member states. Collectively, these mandates shift budgets toward analytics platforms capable of transforming dispersed claims, registry, and device telemetry data into payer-ready economic narratives. Premium pricing commanded by specialized RWE boutiques highlights the urgency with which sponsors are closing evidence gaps ahead of post-launch price negotiations.

Expansion of HTA / Value-Based Care Frameworks

Global HTA bodies now evaluate therapies using broader societal value criteria, extending beyond traditional cost-per-QALY thresholds. The EU Joint Clinical Assessment in effect since January 2025 establishes a harmonized evidence dossier for oncology and ATMPs while allowing member-state price autonomy. Japan, South Korea, and China are strengthening HTA review depth, integrating budget impact and patient-reported outcomes. French National Authority for Health's 2025-2030 roadmap prioritizes AI screening tools to vet manufacturer submissions, signaling digital transformation inside the assessors themselves. In the United States, hospital systems enrolled in alternative payment models must demonstrate procedure-level cost-effectiveness, accelerating provider-led outcomes research purchases. Heightened methodological expectations push sponsors toward specialist consultants with credentialed pharmacoeconomists and multi-country data rights.

Scarcity of Skilled HEOR Specialists

Industry surveys forecast a 35% global shortfall in qualified health economists by 2030 as demand outstrips academic pipeline output. Axtria alone plans to hire 1,000 data scientists in India to shore up modeling capacity. Wage premiums climb and project lead times lengthen, squeezing service-provider margins even as top-line demand accelerates. Specialized fields such as cell-therapy modeling suffer most because standard pharmacoeconomic curricula lag behind therapeutic innovation, forcing firms to retrain clinical statisticians on value-assessment frameworks.

Other drivers and restraints analyzed in the detailed report include:

- Generative-AI-Enabled Rapid Evidence Synthesis

- Surge in Novel Drug Launches & Clinical Trials

- Privacy Restrictions Limiting RWD Access

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Real-World Data Analytics & Information Systems held 37.35% revenue share in 2025, reflecting sponsors' need for defensible economic evaluations grounded in routine-care evidence. Consultancies and CROs invest in scalable cloud architectures that query claims, registries, and wearables data in near real time, shortening evidence cycles and reducing manual abstraction labor. The segment benefits from regulators' explicit RWD endorsement, with FDA guidance accelerating purchase decisions among late-stage biotech developers. Competitive pressure spurs innovation: IQVIA rebadged its HTA Accelerator as Market Access Insights in 2024, bundling dossier automation with budget impact simulation . Looking ahead, automated platform adoption, regional data-access partnerships, and integration of payer adjudication feeds will keep the segment expanding faster than the overall health economics and outcomes research services market as sponsors double-down on post-launch real-world performance monitoring.

Market Access & Reimbursement is the fastest-growing service line with a 16.82% CAGR through 2031. Rising HTA rigor and divergent sub-national payer rules require continuous benefit re-assessment, especially for one-time therapies whose value unfolds over decades. Vendors are embedding policy trackers and scenario engines that flag threshold breaches for list-price renegotiations, helping clients pre-empt formulary delisting risks. Economic Modeling & Evaluation remains indispensable; sophisticated microsimulation and partitioned-survival models underpin nearly every HTA submission. Clinical Outcomes Research gains tailwinds from decentralized trial modalities that capture richer patient-reported outcomes. Collectively, these dynamics underscore how buyers are converging on integrated partners capable of spanning RWD ingestion, methodological design, and policy engagement within a single contract.

The Health Economics and Outcomes Research Services Report is Segmented by Service (Economic Modelling/Evaluation, Real-World Data Analytics & Information Systems, and More), Service Provider (Consultancies, and More), End User (Biotech & Pharma Companies, and More), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 45.95% revenue in 2025, underpinned by sophisticated reimbursement schemes that demand robust economic evidence. The FDA's RWD framework validation propels analytic spending and cements the United States as the reference market for methodological standards. Canada's transformation of CADTH into the Canadian Drug Agency strengthens national HTA capacity and is expected to widen economic scrutiny of specialty drugs. Shortfalls in data-science talent and wage inflation could temper regional growth; nonetheless, mid-term expansion remains resilient because pipeline intensity translates directly into HEOR workload.

Asia Pacific posts the fastest 17.93% CAGR through 2031, driven by rising clinical-trial volume, drug-pricing reforms, and digital-health infrastructure upgrades. Japan's 2025 drug-price adjustments tie reimbursement to real-world utilization, spurring pharmaceutical demand for proactive budget-impact tracking. China's NMPA alignment with ICH guidelines increases global dossier commonality, yet provincial tendering rules still require province-level evidence cuts. India's RWD network pilots provide cost-effective data sources for multinationals seeking broader ethnic representation. Service providers are localizing staff and forging data-licensing ventures with hospital consortia to comply with data -localization statutes. Europe maintains substantial share owing to the newly operational Joint Clinical Assessment that standardizes clinical-effectiveness components of submissions across 27 member states. While dossier unification reduces duplication, national payers retain price-setting autonomy, compelling sponsors to run country-specific budget-impact analyses. The French National Authority for Health's AI evaluation program sets a precedent for algorithm-assisted appraisal, potentially accelerating review times for AI-ready dossiers. Middle East & Africa and South America display mixed trajectories. Saudi Arabia operationalized managed entry agreements, pulling in HEOR expertise to structure risk-sharing deals. Brazil's judiciary overrules negative HTA recommendations in most patient litigation cases, inserting uncertainty that forces extensive scenario modeling. Vendors that master heterogeneous evidence rules position themselves for outsized wins as payer systems mature.

- IQVIA

- ICON

- Syneos Health

- Optum (UnitedHealth Group)

- Thermo Fisher Scientific (PPD)

- Pharmalex GmBH

- Clarivate

- Axtria

- ZS Associates

- OPEN Health

- Avalere Health

- Pharmerit International

- Fishawack Health

- Avalon Health Economics

- Medlior

- Cactus Life Sciences

- Envision Pharma Group

- Cardinal Health

- Mckesson

- Certara

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Real-World Evidence (RWE) for Reimbursement

- 4.2.2 Expansion of HTA / Value-Based Care Frameworks

- 4.2.3 Generative-Ai-Enabled Rapid Evidence Synthesis

- 4.2.4 Surge in Novel Drug Launches & Clinical Trials

- 4.2.5 Increasing Adoption of HEOR by Biotech & Pharma

- 4.2.6 Decentralised Patient-Level RWD Networks in Emerging Markets

- 4.3 Market Restraints

- 4.3.1 Scarcity of Skilled HEOR Specialists

- 4.3.2 Privacy Restrictions Limiting RWD Access

- 4.3.3 High Cost & Lead-Time of Complex Economic Models

- 4.3.4 Algorithmic Bias Eroding Payer Confidence in AI Models

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Service

- 5.1.1 Economic Modelling / Evaluation

- 5.1.2 Real-World Data Analytics & Information Systems

- 5.1.3 Clinical Outcomes Research

- 5.1.4 Market Access & Reimbursement

- 5.1.5 Other Services

- 5.2 By Service Provider

- 5.2.1 Consultancies

- 5.2.2 Contract Research Organisations (CROs)

- 5.3 By End User

- 5.3.1 Biotech & Pharma Companies

- 5.3.2 Healthcare Providers

- 5.3.3 Government & HTA Agencies

- 5.3.4 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 IQVIA

- 6.3.2 ICON plc

- 6.3.3 Syneos Health

- 6.3.4 Optum (UnitedHealth Group)

- 6.3.5 Thermo Fisher Scientific (PPD)

- 6.3.6 Pharmalex GmBH

- 6.3.7 Clarivate

- 6.3.8

Axtria, Inc.

- 6.3.9 ZS Associates

- 6.3.10 OPEN Health

- 6.3.11 Avalere Health

- 6.3.12 Pharmerit International

- 6.3.13 Fishawack Health

- 6.3.14 Avalon Health Economics

- 6.3.15 Medlior

- 6.3.16 Cactus Life Sciences

- 6.3.17 Envision Pharma Group

- 6.3.18 Cardinal Health

- 6.3.19 McKesson Corporation

- 6.3.20 Certara

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment