PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906200

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906200

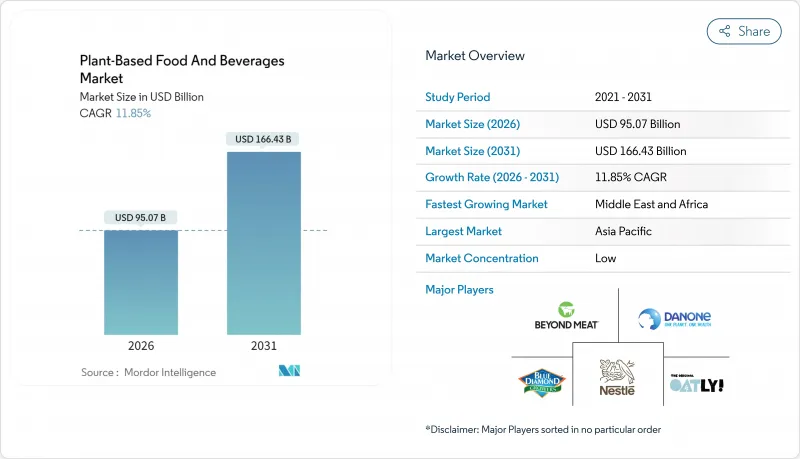

Plant-Based Food And Beverages - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The plant-based food and beverages market is expected to grow from USD 85 billion in 2025 to USD 95.07 billion in 2026 and is forecast to reach USD 166.43 billion by 2031 at 11.85% CAGR over 2026-2031.

Market growth is primarily driven by increasing consumer preference for alternatives to animal-based products, technological advancements in product development, and regulatory changes, including the United States Food and Drug Administration's January 2025 draft guidance on standardized source labeling. Investments in precision fermentation, high-moisture extrusion, and AI-enabled formulation technologies are simplifying market entry and reducing product development timelines, allowing manufacturers to introduce new products more efficiently. Asia-Pacific remains the largest regional market, supported by higher disposable income, urbanization, and government policies promoting sustainable protein production. The Middle East and Africa region shows the highest growth rate, attributed to production capacity expansion in the Gulf Cooperation Council countries. Western markets continue to expand distribution through supermarkets, specialty stores, and e-commerce platforms. The market structure remains fragmented, with multiple companies competing for market share, creating opportunities for both established food manufacturers with strong distribution networks and startups focused on product innovation.

Global Plant-Based Food And Beverages Market Trends and Insights

Rising vegan and flexitarian population

The increasing number of vegan and flexitarian consumers is driving market expansion, as reported by the USDA Foreign Agricultural Service. This demographic shift includes changes in dietary preferences and lifestyle choices driven by health consciousness, environmental sustainability, and ethical considerations. According to the Good Food Institute, in 2024, around 40% of adults in Germany and the UK plan to increase their plant-based food consumption. Health reasons account for 48% of this shift, while environmental concerns represent 29%, and animal welfare considerations comprise 25%. The flexitarian consumer segment contributes significantly to market growth through their substantial purchasing power and readiness to pay higher prices for quality plant-based alternatives. These consumers typically seek products that replicate the taste, texture, and nutritional profile of traditional animal-based foods, prompting manufacturers to enhance their product formulations through research and development.

Increasing prevalence of lactose intolerance and food allergies

Lactose intolerance affects the majority of the global adult population, creating a substantial market for plant-based dairy alternatives beyond vegan consumers. The increasing awareness of food allergies, particularly to dairy, eggs, and nuts, drives demand for clearly labeled, allergen-free plant-based products that provide safe options for sensitive consumers. This medical necessity ensures market stability during economic downturns, as consumers with dietary restrictions maintain their purchasing patterns regardless of price changes. The growing understanding of lactose intolerance and food allergies has prompted regulatory bodies to implement stricter labeling requirements. The FDA's January 2025 draft guidance on plant-based food labeling addresses this by requiring clear disclosure of plant sources and potential allergens, ensuring consumers can make informed purchasing decisions. Companies are developing new formulations to meet lactose-free product demand, focusing on taste, texture, and nutritional equivalence to conventional dairy products.

Persistent taste and texture gap

Taste and texture disparities between plant-based alternatives and conventional animal products remain the primary barrier to mainstream adoption, particularly in emerging markets where consumer expectations align with traditional culinary practices. The complexity of replicating animal protein structures through plant-based ingredients requires sophisticated processing technologies that many manufacturers have not mastered at scale. Companies are investing in technological solutions to address these challenges. In June 2024, Clextral, a French firm specializing in food production machinery, developed Galaxy Texturation Technology for producing realistic plant-based meat and fish whole cuts. This patented technology enables the production of larger, softer, more fibrous products that mimic the texture of meat or fish while maintaining a production capacity of 400 kg per hour. The development of hybrid products shows promise in addressing these challenges. In March 2025, the University of Copenhagen developed a hybrid paneer, a popular South Asian cheese, incorporating 25% pea protein while maintaining traditional taste and texture. This breakthrough demonstrates progress in creating sustainable dairy alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Retail expansion and product availability

- Innovations in plant-based product offerings

- Higher price compared to traditional products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plant-based dairy held 37.12% of sales in 2025, with milk, yogurt, and cheese alternatives driving growth by meeting established consumption patterns. The segment maintains consistent demand, primarily from lactose-intolerant consumers. The dairy alternatives market continues to expand through product innovation, improved taste profiles, and enhanced nutritional formulations that replicate conventional dairy products. Meat substitutes are expected to grow at the highest CAGR of 12.60% from 2026 to 2031 in the market. This growth stems from improvements in high-moisture extrusion technology, expanded quick-service restaurant offerings, and increased consumer acceptance of plant-based proteins as meat alternatives. Family-sized packaging is increasing its market presence, as evidenced by Impossible Foods' October 2024 launch of three family-oriented products: Impossible Disney The Lion King Chicken Nuggets, Impossible Meal Makers, and Impossible Corn Dogs.

Nutrition bars, bakery products, and beverages represent growing segments as manufacturers expand beyond traditional plant-based dairy and meat alternatives. The beverage segment shows innovation in coffee and tea applications, including plant-based creamers and functional drinks for specific consumer needs. These beverages incorporate oats, almonds, soy, and pea protein, providing consumers with multiple dietary options. The food and beverages category encompasses condiments, snacks, and prepared meals, indicating a shift toward comprehensive plant-based food options. This expansion benefits from advances in ingredient processing, texture development, and flavor systems that create more authentic taste profiles.

Soy maintains a dominant 39.55% market share in 2025, supported by well-established global supply chains, efficient processing methods, and highly cost-effective protein concentration capabilities. Its versatile neutral flavor profile and comprehensive amino-acid composition make it the preferred choice for high-protein beverages, tofu products, and numerous plant-based applications. Oat-based products demonstrate exceptional growth potential with a substantial 13.03% CAGR through 2031, primarily driven by their natural creamy texture, sustainable farming practices, and increasing consumer preference for clean-label products. The oat segment of the plant-based food and beverages market is projected to double within the decade, reflecting strong consumer acceptance and technological advancements in processing.

Almond and pea proteins continue to maintain significant market positions, with almond leveraging its established reputation in dairy alternatives through superior taste profiles and versatile applications. Pea protein offers comprehensive allergen-free solutions for meat alternatives, supported by improved extraction technologies and enhanced functionality. Emerging ingredients like watermelon seed milk represent innovative market expansion, effectively reducing supply chain dependencies and creating unique opportunities for product differentiation. This diversifying ingredient selection strengthens formulation capabilities, enables product innovation, and expands competitive options across various segments of the plant-based food and beverages market.

The Plant-Based Food and Beverages Market Report is Segmented by Type (Plant-Based Dairy, Meat Substitutes, and More), Ingredient Source (Soy, Almond, Pea, and More), Form (Refrigerated/Chilled, Frozen, and More) Distribution Channel (On-Trade and Off-Trade), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounts for 35.84% of 2025 revenue, driven by large populations, rapid urbanization trends, and substantial government funding initiatives for alternative proteins. China's comprehensive plant-based dairy regulations and India's deeply rooted vegetarian culture create significant market opportunities, while Singapore demonstrates regulatory leadership through its groundbreaking cultivated meat approvals. Regional investments in advanced precision-fermentation facilities and large-scale oat beverage manufacturing enhance operational efficiency, reduce production costs, and strengthen supply chain capabilities in the plant-based food and beverages market.

The Middle East and Africa region projects a 12.05% CAGR through 2031, supported by comprehensive food security initiatives and expanding local production capacity. IFFCO's THRYVE facility in Dubai Industrial City represents the region's first dedicated plant-based meat factory, specializing in products tailored to Gulf-specific taste preferences and cultural requirements. Market growth is further supported by increasing demand from affluent millennial consumers and extensive halal certification requirements, strengthening local brands' competitive market position.

North America maintains market strength through extensive established retail networks and prominent innovation hubs in California and Colorado, with industry leaders Beyond Meat and Impossible Foods significantly expanding consumer adoption rates. Europe advances through stringent environmental regulations and substantial research support, highlighted by the United Kingdom's comprehensive GBP 15 million National Alternative Protein Innovation Center in August 2024. South America's growth builds on Brazil's extensive soybean production capacity and Base Planta's strategic advocacy for favorable labeling regulations. These diverse regional developments create a robust and diversified global market structure for plant-based foods and beverages.

- Danone SA

- Nestle SA

- Beyond Meat Inc.

- Oatly Group AB

- Blue Diamond Growers

- Conagra Brands Inc.

- Campbell Soup Company

- Impossible Foods Inc.

- The Hain Celestial Group Inc.

- SunOpta Inc.

- Tofutti Brands Inc.

- VBites Food Ltd.

- Eden Foods Inc.

- Califia Farms LLC

- Kellanova (MorningStar Farms)

- Upfield BV

- Tattooed Chef Inc.

- Tyson Foods Inc. (Raised and Rooted)

- Valio Ltd.

- Yili Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Vegan and Flexitarian Population

- 4.2.2 Increasing Prevalence of Lactose Intolerance and Food Allergies

- 4.2.3 Retail Expansion and Product Availability

- 4.2.4 Innovations in Plant-based Product Offerings

- 4.2.5 Sustainability and Environmental Concerns

- 4.2.6 Increasing Investments and Product Launches

- 4.3 Market Restraints

- 4.3.1 Persistent Taste/Texture Gap

- 4.3.2 Allergen Concerns Around Soy and Tree-Nuts

- 4.3.3 Higher Price Compared to Traditional Products

- 4.3.4 Regulatory and Labeling Conflicts

- 4.4 Supply Chain Analysis

- 4.5 Consumer Behavior Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Plant-based Dairy

- 5.1.1.1 Yogurt

- 5.1.1.2 Cheese

- 5.1.1.3 Frozen Desserts and Ice-Cream

- 5.1.1.4 Other Plant-based Dairy

- 5.1.2 Meat Substitutes

- 5.1.2.1 Tofu

- 5.1.2.2 Tempeh

- 5.1.2.3 Textured Vegetable Protein

- 5.1.2.4 Other Meat Substitutes

- 5.1.3 Plant-based Nutrition/Snack Bars

- 5.1.4 Plant-based Bakery Products

- 5.1.5 Plant-based Beverages

- 5.1.5.1 Packaged Milk

- 5.1.5.2 Packaged Smoothies

- 5.1.5.3 Coffee

- 5.1.5.4 Tea

- 5.1.5.5 Other Plant-based Beverages

- 5.1.6 Other Food and Beverages

- 5.1.1 Plant-based Dairy

- 5.2 By Ingredient Source

- 5.2.1 Soy

- 5.2.2 Almond

- 5.2.3 Pea

- 5.2.4 Oat

- 5.2.5 Wheat

- 5.2.6 Rice

- 5.2.7 Coconut

- 5.2.8 Other Sources

- 5.3 By Form

- 5.3.1 Refrigerated/Chilled

- 5.3.2 Frozen

- 5.3.3 Shelf-stable/Ambient

- 5.3.4 Ready-to-Eat/Ready-to-Cook

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience Stores

- 5.4.2.3 Online Stores

- 5.4.2.4 Other Off-Trade Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Danone SA

- 6.4.2 Nestle SA

- 6.4.3 Beyond Meat Inc.

- 6.4.4 Oatly Group AB

- 6.4.5 Blue Diamond Growers

- 6.4.6 Conagra Brands Inc.

- 6.4.7 Campbell Soup Company

- 6.4.8 Impossible Foods Inc.

- 6.4.9 The Hain Celestial Group Inc.

- 6.4.10 SunOpta Inc.

- 6.4.11 Tofutti Brands Inc.

- 6.4.12 VBites Food Ltd.

- 6.4.13 Eden Foods Inc.

- 6.4.14 Califia Farms LLC

- 6.4.15 Kellanova (MorningStar Farms)

- 6.4.16 Upfield BV

- 6.4.17 Tattooed Chef Inc.

- 6.4.18 Tyson Foods Inc. (Raised and Rooted)

- 6.4.19 Valio Ltd.

- 6.4.20 Yili Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK