PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906206

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906206

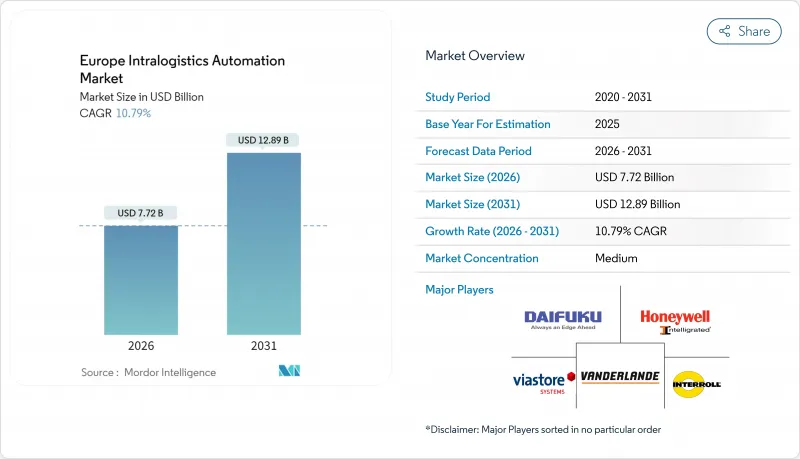

Europe Intralogistics Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe intralogistics automation market size in 2026 is estimated at USD 7.72 billion, growing from 2025 value of USD 6.97 billion with 2031 projections showing USD 12.89 billion, growing at 10.79% CAGR over 2026-2031.

Surging e-commerce volumes, structural labor shortages, and tightening EU sustainability mandates are accelerating capital spending on automated storage, picking, and material-handling solutions. Real-time orchestration made possible by facility-wide private 5G networks is raising asset utilization, while AI-driven predictive maintenance and digital-twin software are boosting system uptime. Germany remains the pivotal demand center and technology incubator, yet emerging Eastern European suppliers are beginning to lower price points and shorten payback periods. Taken together, these forces position the Europe intralogistics automation market for a decade of double-digit expansion.

Europe Intralogistics Automation Market Trends and Insights

E-commerce Boom and Omnichannel Fulfillment Pressure

Explosive online sales growth is rewriting fulfillment blueprints across Europe. Otto Group invested EUR 260 million in a high-throughput facility in Ilowa that processes 18,000 items per hour and targets next-day delivery for 60% of orders. Retailers and 3PLs are specifying modular cube and shuttle systems that can flex between bulk replenishment and single-item picking without halting operations. Urban real-estate constraints are accelerating adoption of goods-to-person micro-fulfillment centers, while cube-based storage allows operators to triple SKU density in legacy buildings. The resulting productivity gains are shortening the payback period on automation investments even for mid-tier merchants. These dynamics are expected to keep capital flowing toward scalable, software-defined solutions that future-proof fulfillment against shifting order profiles.

Labor Shortages and Wage Inflation Across EU27

An aging workforce, post-Brexit migration patterns, and stringent working-time regulations have pushed vacancy rates in logistics above 12% in many EU regions. Robot installations climbed 28% in Central and Eastern Europe as companies offset staff gaps with collaborative automation, and Germany's mechanical-engineering sector is exporting turnkey systems eastward to capture that demand. Wage inflation averaging 6-8% annually is further tilting the cost-benefit equation toward capital investment. The shift is also qualitative: facilities seek technicians who can manage fleet software rather than manual pickers, spurring partnerships between OEMs and vocational institutes to upskill workers. Collectively, labor scarcity is transforming automation from optional to essential across the Europe intralogistics automation market.

High CAPEX and Long ROI Horizons

Comprehensive intralogistics automation often requires EUR 5-10 million upfront, a hurdle for SMEs that dominate regional logistics. Survey work shows 82% of warehouse leaders remain uneasy about investment volumes despite proven productivity gains; rising interest rates add to financing strain. A growing Robotics-as-a-Service model spreads costs over multi-year contracts, yet most banks still prefer asset-backed lending. Projects demonstrating sub-four-year payback-such as Heemskerk Fresh & Easy's produce facility-are easing concerns, but many operators still delay scope expansion until macro-economic clarity improves. CAPEX sensitivity therefore constrains penetration of the Europe intralogistics automation market in lower-margin verticals.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Advances in AI-Powered Mobile Robotics and IoT

- 5G/Private-LTE Roll-outs Enabling Real-Time Orchestration

- Legacy IT/OT Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Autonomous Mobile Robots (AMRs) accounted for a comparatively modest slice of 2025 revenue but are forecast to grow at 11.21% CAGR, the fastest within the Europe intralogistics automation market. The segment's momentum rests on minimal fixed infrastructure requirements: a fleet can be added or relocated in weeks rather than months. In contrast, Automated Storage and Retrieval Systems (AS/RS) retained the largest 27.32% share of Europe intralogistics automation market size in 2025 thanks to proven cube and shuttle platforms widely adopted in grocery and fashion fulfillment.

AMR adoption is spreading from e-commerce to spare-parts distribution as vision-SLAM navigation lowers commissioning costs. KION Group's modular robots illustrate this pivot by offering plug-and-play deployment for mid-cap firms. AS/RS suppliers are countering with hybrid designs that embed robot shuttles inside dense cubes, protecting their installed base. Automated sorting, palletizing, and conveyor subsystems remain critical complements that tie goods-to-person workstations into outbound docks. Convergence across these categories is prompting buyers to favor platform providers able to harmonize control software across mixed fleets, reinforcing the Europe intralogistics automation market's move toward integrated ecosystems.

Automotive plants locked in 32.10% of Europe intralogistics automation market share in 2025 as decades of lean-manufacturing expertise made them early adopters of automated tugger trains, torque-tracking pick systems, and real-time quality analytics. Yet the pharmaceuticals and healthcare vertical is accelerating at 11.40% CAGR, reflecting stricter serialization rules and cold-chain demands. Pharmacy chain Dr. Max commissioned an automated distribution hub that supports 55% e-commerce growth and illustrates how traceability requirements convert directly into automation budgets.

Post and parcel operators are embedding high-speed sorters to keep pace with B2C parcel surges, while food and beverage processors automate case picking to protect freshness under 24-hour delivery windows. Airports and general manufacturers round out demand with baggage-handling overhauls and just-in-sequence kitting respectively. The result is a broadening customer base that shields the Europe intralogistics automation market from sector-specific downturns and underscores the need for adaptable, regulation-aware solutions.

The Europe Intralogistics Automation Market Report is Segmented by Product Type (Mobile Robots, AS/RS, and More), End-User Industry (Airport, Post and Parcel, General Manufacturing, Automotive, Retail and Distribution, and More), Component (Hardware, Software, and Services), Function (Storage, Order Picking, Sorting, Packaging, Transportation), and Geography. Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABB Ltd.

- AutoStore ASA

- BEUMER Group GmbH and Co. KG

- Daifuku Co., Ltd.

- Dematic GmbH (KION Group)

- Exotec SAS

- Honeywell International Inc.

- Interroll Holding AG

- Jungheinrich Aktiengesellschaft

- Kardex Holding AG

- KNAPP AG

- KUKA Aktiengesellschaft

- Linde Material Handling GmbH

- Murata Machinery, Ltd.

- Ocado Group plc

- SSI Schafer AG

- Swisslog Holding AG

- TGW Logistics Group GmbH

- Toyota Industries Corporation

- Vanderlande Industries B.V.

- Viastore Systems GmbH

- WITRON Logistik + Informatik GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom and omnichannel fulfilment pressure

- 4.2.2 Labour shortages and wage inflation across EU27

- 4.2.3 Rapid advances in AI-powered mobile robotics and IoT

- 4.2.4 5G / private-LTE roll-outs enabling real-time orchestration

- 4.2.5 EU Green Deal incentives for low-carbon intralogistics

- 4.2.6 Urban micro-fulfilment model driving high-density automation

- 4.3 Market Restraints

- 4.3.1 High CAPEX and long ROI horizons

- 4.3.2 Legacy IT / OT integration complexity

- 4.3.3 Rising cyber-security threats to networked robotics

- 4.3.4 Semiconductor supply-chain disruptions delaying projects

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Adjacent Market Influence Analysis

- 4.7.1 Stretch-Wrapping Machines Market

- 4.7.2 Goods Elevator Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Mobile Robots

- 5.1.2 Automated Storage and Retrieval Systems (AS/RS)

- 5.1.3 Automated Sorting Systems

- 5.1.4 Palletising and De-palletising Systems

- 5.1.5 Automated Conveyors

- 5.1.6 Order-Picking Systems

- 5.2 By End-user Industry

- 5.2.1 Airport

- 5.2.2 Post and Parcel

- 5.2.3 General Manufacturing

- 5.2.4 Automotive

- 5.2.5 Food and Beverage

- 5.2.6 Retail, Warehousing and Distribution

- 5.2.7 Other End-user Industries

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Function

- 5.4.1 Storage

- 5.4.2 Order Picking and Retrieval

- 5.4.3 Sorting and Consolidation

- 5.4.4 Packaging and Palletising

- 5.4.5 Transportation and Conveyance

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 AutoStore ASA

- 6.4.3 BEUMER Group GmbH and Co. KG

- 6.4.4 Daifuku Co., Ltd.

- 6.4.5 Dematic GmbH (KION Group)

- 6.4.6 Exotec SAS

- 6.4.7 Honeywell International Inc.

- 6.4.8 Interroll Holding AG

- 6.4.9 Jungheinrich Aktiengesellschaft

- 6.4.10 Kardex Holding AG

- 6.4.11 KNAPP AG

- 6.4.12 KUKA Aktiengesellschaft

- 6.4.13 Linde Material Handling GmbH

- 6.4.14 Murata Machinery, Ltd.

- 6.4.15 Ocado Group plc

- 6.4.16 SSI Schafer AG

- 6.4.17 Swisslog Holding AG

- 6.4.18 TGW Logistics Group GmbH

- 6.4.19 Toyota Industries Corporation

- 6.4.20 Vanderlande Industries B.V.

- 6.4.21 Viastore Systems GmbH

- 6.4.22 WITRON Logistik + Informatik GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment