PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906208

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906208

Europe Event Management Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

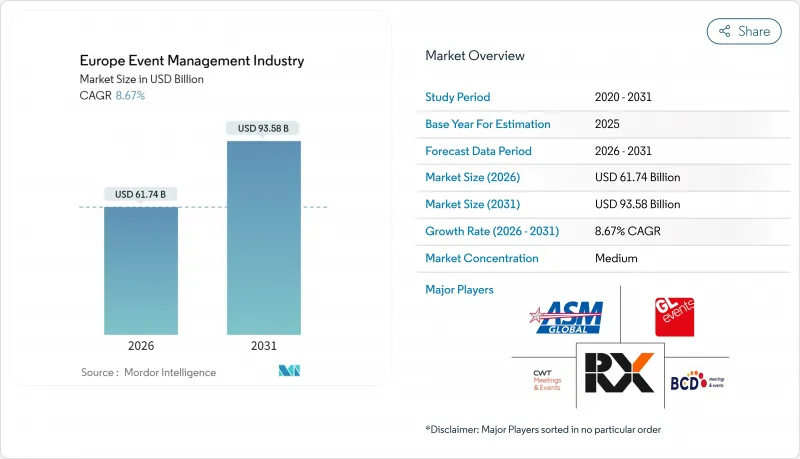

The Europe event management industry market was valued at USD 56.81 billion in 2025 and estimated to grow from USD 61.74 billion in 2026 to reach USD 93.58 billion by 2031, at a CAGR of 8.67% during the forecast period (2026-2031).

This trajectory affirms a strong rebound underpinned by renewed corporate travel, the normalization of large gatherings, and the widespread integration of hybrid delivery models that blend on-site interaction with digital reach. Upward momentum reflects a balance between pent-up demand for in-person networking and persistent investment in virtual infrastructure that insulates organizers from travel disruptions. Sustained marketing outlays on immersive activations, steady government backing for sustainable practices, and improving data analytics capabilities further raise the growth ceiling of the Europe event management industry market. Meanwhile, mid-sized agencies exploit flexible cost bases to win niche mandates, and venue operators pursue premium pricing to recoup inflation-linked overheads.

Europe Event Management Industry Trends and Insights

Resurgence of In-Person MICE Gatherings

Face-to-face meetings re-emerged as a strategic priority when European business-travel outlays started climbing toward USD 450 billion for 2027. Corporations cite higher deal-conversion rates, quicker product-validation cycles, and deeper client trust as the principal benefits of convening onsite. Trade-show organizers report that AI-powered matchmaking lifted scheduled meetings by 44% compared with the 2023 editions. Convention-center occupancy recovered to 74.8% in 2024, yet venue operators still wrestle with margin compression caused by cost inflation. Enterprise willingness to pay premium day-rates despite inflation underscores the revived importance of physical interaction inside the Europe event management industry market.

Digitalization and Platform Adoption

Event technology now spans registration, content streaming, CRM integration, and real-time analytics in one unified stack. Sweden-based InvitePeople posted 95% retention and 48% higher attendee interactions after embedding AI-driven personalization. Across Europe, 73% of planners deem hybrid capability non-negotiable, while privacy-by-design architecture remains a gating factor for procurement. Nordic leadership in broadband quality and cashless payments accelerates experimentation, which then diffuses into Central Europe. These dynamics add fresh tailwinds to the Europe event management industry market.

Inflation-Driven Venue and Staffing Costs

Average daily venue rates in the Netherlands climbed 38% over 2019 levels, yet profit margins fell to 35.3% as wage expenses surged. Staff shortages across catering and production disciplines hamper service quality and inflate overtime payments. Elevated energy tariffs oblige venues to implement dynamic pricing and minimum-spend clauses, squeezing corporate budgets. Smaller agencies face liquidity strain, driving consolidation that marginally tempers the Europe event management industry market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Rising Experiential Marketing Budgets

- EU Drive for Sustainable and Inclusive Events

- GDPR and Cybersecurity Compliance Burden

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corporate Events commanded 35.02% of the Europe event management industry market in 2025, a lead reinforced by executives eager to rebuild culture and client rapport post-remote work. Incentive gatherings, albeit smaller in baseline volume, grow at a brisk 9.88% CAGR as companies use travel and experiences to differentiate retention packages. Association conferences returned to large auditoriums, adding hybrid layers to serve remote professionals. Charity organizers pair live galas with online auctions to widen donor funnels. Festivals and entertainment productions trail the pre-2020 peak because of insurance premiums and crowd-control mandates, but open-air formats draw steady footfall. Meanwhile, sports events reboot hospitality suites, capitalizing on pent-up fan appetite. Hybrid-first events crystallize as a durable niche, granting risk-hedged reach to cautious planners. This diversified mix anchors recurring revenue streams across the Europe event management industry market.

The Europe event management industry market size for Corporate Events climbed alongside board-approved experiential budgets, while the Europe event management industry market share of Incentive Events still sits below 10%, leaving white space for providers fluent in curated travel logistics. Vendors that fuse carbon tracking with experiential storytelling win mid-decade bids from sustainability-minded multinational clients.

In-person formats retained 62.76% market share in 2025 because trust-building and complex negotiation favor physical presence. Hybrid models, advancing at 12.27% CAGR, extend content to global users and hedge against travel uncertainties. Virtual sessions stabilize near 15% share, serving internal trainings and onboarding. Organizers designing multi-touchpoint journeys observe higher conversion from pre-event webinars into on-site attendance. AV suppliers and cloud-streaming integrators profit from elevated technical specifications that accompany simultaneous live and digital audiences. This segmentation underscores how the Europe event management industry market adopts a portfolio approach rather than a zero-sum substitution path.

Hybrid's ascent expands the Europe event management industry market size for platform vendors, while the incremental Europe event management industry market share gain for virtual-only providers plateaus due to audience fatigue. Execution complexity encourages large enterprises to outsource end-to-end production, widening the service revenue pool.

The Europe Event Management Market Report is Segmented by Event Type (Corporate Events, Association & Conference Events, and More), by Mode (In-Person, Hybrid, Virtual), by Service (Strategy & Planning, Communication & Logistics, and More), by End User (Corporate Organizations, Smes, and More), and by Geography (United Kingdom, Germany, France, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- GL events

- Reed Exhibitions

- ASM Global

- CWT Meetings & Events

- BCD Meetings & Events

- Informa (RX)

- Forum Europe

- Smart Works Events

- Absolute Event Services

- DFA Productions

- Eclipse Leisure

- Felix Events

- Hughes Productions

- Irwin Video

- JP Events Ltd

- Off Limits

- Owl Live

- GL Events Live

- Maritz Global Events

- Messe Frankfurt Venue GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

5 Market Overview

- 5.1 Market Drivers

- 5.1.1 Resurgence of in-person MICE events post-pandemic

- 5.1.2 Digitalisation & adoption of event-management platforms

- 5.1.3 Experiential marketing spend by corporates

- 5.1.4 EU & government push for sustainable, inclusive events

- 5.1.5 AI-driven matchmaking & ROI analytics

- 5.1.6 EU Digital Product Passport spurring data-sharing services

- 5.2 Market Restraints

- 5.2.1 Inflation-driven venue & staffing cost surge

- 5.2.2 GDPR / cyber-security compliance burdens

- 5.2.3 Mandatory carbon-foot-print reporting raises costs

- 5.2.4 Virtual alternatives dent demand in Tier-2 cities

- 5.3 Value / Supply-Chain Analysis

- 5.4 Regulatory Landscape

- 5.5 Technological Outlook

- 5.6 Industry Attractiveness - Porter's Five Forces Analysis

- 5.6.1 Threat of New Entrants

- 5.6.2 Bargaining Power of Buyers

- 5.6.3 Bargaining Power of Suppliers

- 5.6.4 Threat of Substitutes

- 5.6.5 Intensity of Competitive Rivalry

6 Market Size & Growth Forecasts (Value, In USD Billion)

- 6.1 By Event Type

- 6.1.1 Corporate Events

- 6.1.2 Association & Conference Events

- 6.1.3 Non-profit & Charity Events

- 6.1.4 Festivals & Entertainment

- 6.1.5 Sports Events

- 6.1.6 Hybrid / Virtual-First Events

- 6.1.7 Others

- 6.2 By Mode

- 6.2.1 In-person

- 6.2.2 Hybrid

- 6.2.3 Virtual

- 6.3 By Service

- 6.3.1 Strategy & Planning

- 6.3.2 Communication & Logistics

- 6.3.3 Venue / Location Rental

- 6.3.4 Attendee Management & Engagement

- 6.3.5 Virtual / Hybrid Enablement

- 6.3.6 Catering & Hospitality

- 6.3.7 Team-building & Experiences

- 6.4 By End User

- 6.4.1 Corporate Organisations

- 6.4.2 SMEs

- 6.4.3 Public Sector / Government

- 6.4.4 Individual Consumers

- 6.4.5 Non-profits & Associations

- 6.5 By Geography

- 6.5.1 United Kingdom

- 6.5.2 Germany

- 6.5.3 France

- 6.5.4 Italy

- 6.5.5 Spain

- 6.5.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 6.5.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 6.5.8 Rest of Europe

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 7.4.1 GL events

- 7.4.2 Reed Exhibitions

- 7.4.3 ASM Global

- 7.4.4 CWT Meetings & Events

- 7.4.5 BCD Meetings & Events

- 7.4.6 Informa (RX)

- 7.4.7 Forum Europe

- 7.4.8 Smart Works Events

- 7.4.9 Absolute Event Services

- 7.4.10 DFA Productions

- 7.4.11 Eclipse Leisure

- 7.4.12 Felix Events

- 7.4.13 Hughes Productions

- 7.4.14 Irwin Video

- 7.4.15 JP Events Ltd

- 7.4.16 Off Limits

- 7.4.17 Owl Live

- 7.4.18 GL Events Live

- 7.4.19 Maritz Global Events

- 7.4.20 Messe Frankfurt Venue GmbH

8 Market Opportunities & Future Outlook

- 8.1 White-space & Unmet-Need Assessment