PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911729

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911729

GCC Event Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

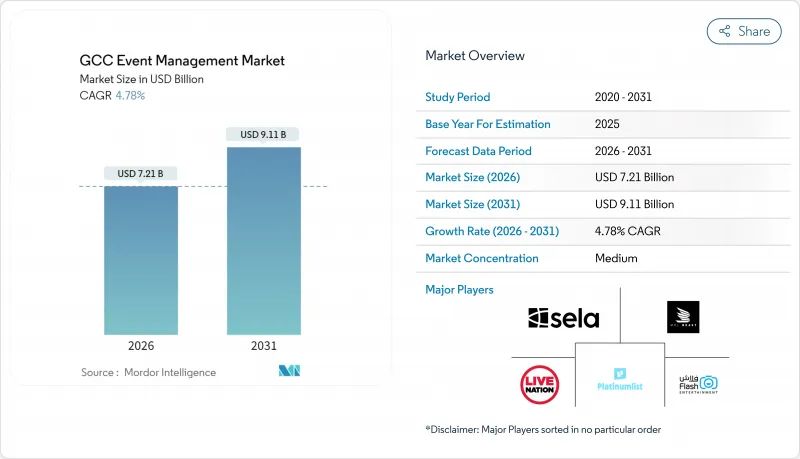

The GCC event management market was valued at USD 6.88 billion in 2025 and estimated to grow from USD 7.21 billion in 2026 to reach USD 9.11 billion by 2031, at a CAGR of 4.78% during the forecast period (2026-2031).

Growth rests on sovereign diversification plans, post-pandemic MICE recovery, and a large, digitally fluent youth cohort that craves immersive festivals and esports tournaments. Saudi Arabia's Vision 2030 and Dubai's visitor-economy agenda incentivize next-generation venues while Qatar leverages World Cup legacy facilities to pull blue-chip conferences. Mobile ticketing, AI-driven audience analytics, and augmented-reality crowd engagement tools lift monetization and sponsorship conversion, thereby nudging the GCC event management market toward data-centric business models. Meanwhile, the revenue mix is tilting away from pure exhibitions toward hybrid business-plus-lifestyle gatherings that string together conferences, concerts, and influencer-led pop-ups. Operators that fuse global standards with Arabic-first digital experiences and low-carbon operations hold a clear competitive advantage when vying for state contracts or ultra-premium brand activations.

GCC Event Management Market Trends and Insights

Saudi Arabia Vision 2030 Mega-Projects & Dubai Tourism Push

Saudi Arabia's Vision 2030 anchors USD-scale leisure cities such as NEOM, Qiddiya, and the Red Sea giga-project, each embedding arenas, beachfront performance zones, and mixed-reality museums that require full-cycle event services. Government entities finance enabling infrastructure-from 20,000-seat domes to on-site e-sports coliseums-reducing capex burdens for private operators and accelerating time-to-market. Parallel to this, Dubai's Department of Economy and Tourism invests in multi-purpose districts like Expo City, adding 123,000 m2 of exhibition floor that competes head-to-head with Riyadh Front. This state-led rivalry prompts rapid upgrades in acoustics, 5G backbone, and facial-recognition ticketing that lift attendee satisfaction and headline pricing in the GCC event management market. Crucially, policy authorities on both sides offer one-week visa clearances and single-window import permissions, eliminating logistical pain points that previously deterred mega-concert promoters. Over the long term, public subsidies tied to local-talent quotas will push organizers to partner with Saudi vocational colleges and Emirati coding bootcamps, embedding upskilling deliverables into every major RFP.

Government Event-Friendly Policies & Funds

Across the Gulf, sovereign funds earmark billions for creative-economy accelerators that explicitly reference events and exhibitions as priority verticals. ADQ's AED 100 million Growth Lab channels R&D grants into eco-friendly show infrastructure, exemplified by TerraTile's recyclable flooring that slashes waste at ADNEC halls. Bahrain's Tourism & Exhibitions Authority offers 50% venue-rental rebates for conferences exceeding 1,000 international delegates, a scheme that has already secured two fintech summits for 2025. Saudi Arabia's SCECA issues three-year, multi-city event licenses, allowing operators to amortize compliance fees across Riyadh, Jeddah, and Al-Ula circuits. Governments also deploy high-reach marketing via state television and diplomatic missions, giving organizers earned media worth millions in advertising equivalence. Finally, GCC-wide customs harmonization on AV gear imports lowers border-crossing downtime, fostering a touring ecosystem where stage inventory travels efficiently from Muscat Opera to Doha Corniche festivals without bureaucratic drag.

Seasonality & Extreme GCC Climate for Outdoor Events

Summer temperatures exceeding 45 °C compress high-yield event calendars into October-March, inflating venue rentals, AV equipment rates, and hotel ADR by as much as 30% versus shoulder months. Organizers either invest in cooled domes-costing USD 400 per square meter-or pivot to indoor formats that undermine the open-air appeal central to music festivals. Infrastructure stress mounts when multiple mega-events collide: Riyadh Season, Formula 1 Jeddah, and Dubai Design Week often overlap, stretching the regional supply of LED walls, bilingual stage crews, and luxury coaches. Transport congestion compounds attendee fatigue, threatening Net Promoter Scores and repeat visitation. Climate-adaptation investments such as solar-powered misting tunnels and heat-reflective stage trussing alleviate some pain but require heavy up-front capital that smaller promoters struggle to raise. Consequently, weather risk remains a structural headwind to the GCC event management market's year-round monetization potential.

Other drivers and restraints analyzed in the detailed report include:

- Post-Pandemic Surge in Corporate MICE Demand

- Rising Disposable Incomes & Youth Demographics

- Shortage of Certified Event-Management Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corporate gatherings accounted for USD 4.19 billion of the GCC event management market size in 2025, driven by the region's status as a neutral, tax-efficient meeting point for Europe-Asia deal flows. Firms hold quarterly leadership off-sites in Dubai Expo City, Riyadh Front, or Doha Lusail, booking multi-day stays that guarantee hotel block revenue for destination marketing organizations. Public-sector demand, though smaller today, benefits from state-sponsored mega-forums such as the Future Investment Initiative, which alone booked 5,000 VIP delegates and 150 charter jets. Ministries often bundle supplier guarantees such as minimum local-employment ratios, giving well-capitalized agencies a chance to lock multi-year contracts. Individual consumer events remain price-elastic yet profitable because of merchandise and F&B upsells; organizers routinely secure 35% gross margins on premium lounge passes aimed at affluent Gen-Z attendees.

In the next five years, B2B firms will redefine ROI benchmarks, requesting attendee-intent data, AI matchmaking scores, and carbon-offset equivalence metrics prior to contract renewals. Event managers embedding these analytics into post-show dashboards will widen their lead over logistics-only competitors. Meanwhile, government entities will ramp up nation-branding extravaganzas tied to climate summits and space exploration milestones, reinforcing the strategic heft of the public-sector slice within the GCC event management market.

The GCC Event Management Market Report is Segmented by End-User (Corporate, Individual, Public), Type (Music Concert, Festivals, Sports, Exhibitions and Conferences, Corporate Events and Seminars, Other Types), Revenue Sources (Ticket Sale, Sponsorship, Other Revenue Sources), and Geography (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Bahrain, Oman). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Live Nation Middle East

- MDLBEAST

- SELA

- Flash Entertainment

- Platinumlist

- Cvent

- Eventbrite

- Bizzabo

- Hopin

- Aventri

- Eventagrate

- TicketMX

- Q-Tickets

- Ticketsmarche

- Freeman Company

- GES

- 360 Destination Group

- Access Destination Services

- BI Worldwide

- Creative Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Saudi Arabia

- 4.2.1 Mega-projects under Vision 2030 & Dubai Tourism push

- 4.2.2 Government event-friendly policies & funds

- 4.2.3 Post-pandemic surge in corporate MICE demand

- 4.2.4 Rising disposable incomes & youth demographics

- 4.2.5 Mobile, fraud-proof digital ticketing adoption

- 4.2.6 AI/AR immersive experiences draw global audiences

- 4.3 Market Restraints

- 4.3.1 Seasonality & extreme GCC climate for outdoor events

- 4.3.2 Shortage of certified event-management talent

- 4.3.3 Geopolitical/security risks dampening attendance

- 4.3.4 Low event-insurance penetration raises organiser risk

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts

- 5.1 By End-User

- 5.1.1 Corporate

- 5.1.2 Individual

- 5.1.3 Public

- 5.2 By Type

- 5.2.1 Music Concert

- 5.2.2 Festivals

- 5.2.3 Sports

- 5.2.4 Exhibitions and Conferences

- 5.2.5 Corporate Events and Seminars

- 5.2.6 Other Types

- 5.3 By Revenue Sources

- 5.3.1 Ticket Sale

- 5.3.2 Sponsorship

- 5.3.3 Other Revenue Sources

- 5.4 By Geography

- 5.4.1 Saudi Arabia

- 5.4.2 United Arab Emirates

- 5.4.3 Qatar

- 5.4.4 Kuwait

- 5.4.5 Bahrain

- 5.4.6 Oman

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Live Nation Middle East

- 6.4.2 MDLBEAST

- 6.4.3 SELA

- 6.4.4 Flash Entertainment

- 6.4.5 Platinumlist

- 6.4.6 Cvent

- 6.4.7 Eventbrite

- 6.4.8 Bizzabo

- 6.4.9 Hopin

- 6.4.10 Aventri

- 6.4.11 Eventagrate

- 6.4.12 TicketMX

- 6.4.13 Q-Tickets

- 6.4.14 Ticketsmarche

- 6.4.15 Freeman Company

- 6.4.16 GES

- 6.4.17 360 Destination Group

- 6.4.18 Access Destination Services

- 6.4.19 BI Worldwide

- 6.4.20 Creative Group

7 Market Opportunities & Future Outlook

- 7.1 Carbon-neutral certification & consulting for GCC events

- 7.2 AI-powered, Arabic-first multilingual attendee-experience platforms