PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906209

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906209

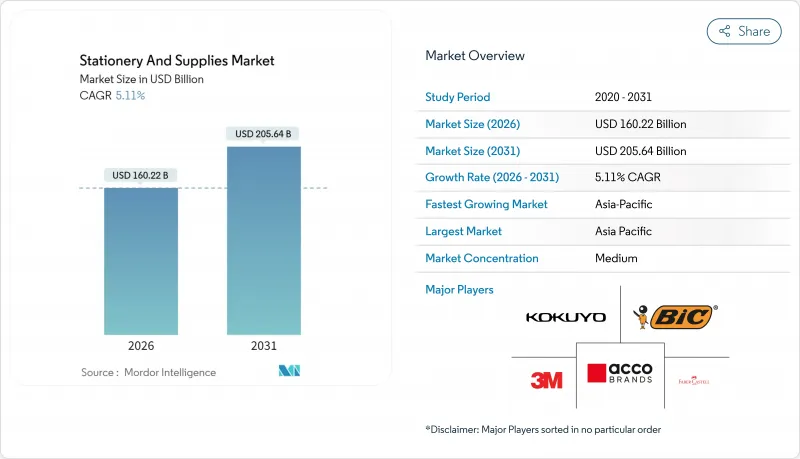

Stationery And Supplies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The stationery and supplies market is expected to grow from USD 152.43 billion in 2025 to USD 160.22 billion in 2026 and is forecast to reach USD 205.64 billion by 2031 at 5.11% CAGR over 2026-2031.

Several forces converge to sustain this expansion even as device proliferation tempers low-value paper demand. Worldwide primary and tertiary enrolment increases keep institutional orders for exercise books, art supplies, and examination sheets buoyant. Corporate procurement teams now anchor purchasing criteria in environmental, social, and governance policies, which lifts revenue from recycled and certified-sustainable lines that sell at a premium. Omnichannel commerce reshapes shopper journeys. Discovery often starts on social or marketplace platforms before consumers complete tactile validation in specialty stores, enabling price discipline on high-touch items such as fountain pens. Finally, product innovation, reusable cloud-linked notebooks, refillable metal-barrel pens, and biodegradable adhesives unlock fresh price ladders that offset raw-material volatility and margin pressure.

Global Stationery And Supplies Market Trends and Insights

Rising E-commerce Penetration for Stationery and Office Supplies

Online marketplaces post a 7.02% CAGR through 2030, far outpacing brick-and-mortar growth in the stationery and supplies market. Digital storefronts compress go-to-market timelines for niche brands, allowing them to test micro-collections of pens, inks, and planner inserts with minimal capital risk. Japanese exporters lifted revenue to JPY 120 billion (USD 0.8 billion) in 2023, a 15% rise from 2018, primarily by fulfilling small-lot cross-border e-commerce orders. Brands that combine highly visual product pages, user-generated reviews, and transparent shipping calculators see reduced return rates and higher average order values. KOKUYO's decision to complement its second Shanghai "Campus STYLE" flagship with a robust Chinese web-app underscores omnichannel complementarity and sets a benchmark for experiential cohesion. Midsize retailers unable to finance proprietary tech increasingly partner with platforms. Dynamic Supplies added 900 ACCO items to its digital catalogue to safeguard relevance.

Expanding Enrolment Rates in K-12 and Tertiary Education Worldwide

Global enrolment trends underpin roughly half of baseline volume in the stationery and supplies market. International student mobility climbed from 2 million in 1998 to 6.4 million in 2020 and is projected to grow 4-4.5% annually to 2030. Developing regions witness parallel momentum: Ghana, Kenya, and Vietnam each allocated at least 20% of annual budgets to education in 2024, funneling capital into textbooks, lab workbooks, and classroom consumables. At the other end of the value spectrum, affluent parents in urban India now prioritize premium artist-grade sketchbooks, reflecting a shift from basic functional spending to aspirational purchases. Though 249 million children remain out of school, multilateral organizations have earned USD 4.5 billion for catch-up learning by 2028, which promises incremental demand as access deficits narrow.

Volatility in Pulp and Petro-Chemical Input Prices

Wild swings in key inputs destabilize production budgets and squeeze gross margins for notebooks, pens, and packaging. Corrugated cardboard benchmark prices jumped USD 70 per ton in early 2025 as pulp shortages, energy surcharges, and freight bottlenecks cascaded through the supply chain. Chinese paper mills quickly followed by raising list prices about USD 31.50 per ton to offset higher wood-fiber and electricity costs, passing fresh pressure onto converters worldwide. At the same time, explosions and shutdowns at Southeast Asian chemical plants created a nitrocellulose shortage that forced ink makers to levy 5-9% surcharges on specialty and bulk formulations. Color-pigment suppliers layered additional tariff-related fees for toluene- and xylene-based intermediates, adding another unpredictable variable to coating and barrel costs. While large multinationals hedge pulp and resin exposure through multi-year contracts, small and midsize stationery brands often must adjust catalog prices within weeks, risking volume loss to lower-cost private labels.

Other drivers and restraints analyzed in the detailed report include:

- Premium and Customized Writing Instruments Gaining Traction

- Smart Reusable Notebooks Integrated with Cloud Services

- Accelerating Digitalization, Reducing Paper Consumption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper goods anchor 42.78% of the stationery and supplies market size in 2025, proving resilient due to classroom mandates for notebooks, exam answer sheets, and art pads. Recycled-content copy paper gains traction after the U.S. federal directive eliminated virgin paper from procurement catalogues. Simultaneously, office essentials-staplers, desk organizers, labeling devices-log a 6.29% CAGR because flexible workspaces emphasize modular desk setups. Writing instruments enjoy value-added lift: metallic body finishes, hybrid gel-ball inks, and quick-dry technology answer user pain points identified in social-media feedback loops.

Smart stationery, though holding less than 5% revenue share in 2025, represents the fastest innovation channel. Start-ups bundle reusable books with cloud storage for a one-year subscription, after which renewal runs USD 2-3 monthly, creating a service layer absent in legacy paper. Art and craft items ride the Gen-Z creativity wave, but premiumization distinguishes winners: cotton-rag watercolor pads and alcohol-marker paper command 3-4 times commodity sheet pricing. Asian powerhouses like M&G booked +16.78% YoY growth in 2023. Product managers increasingly weigh carton cube efficiency and e-commerce damage rates at the design stage, aligning spec decisions with growing online volume in the stationery and supplies market.

The Global Stationery and Supplies Market Report is Segmented by Product Type (Paper-Based Products, Writing Instruments, and More), Distribution Channel (Offline Specialty Stores, and More), End-User (Educational Institutions, Corporate and Home-Office Users, and More), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific owns 35.30% of global sales and climbs at a 6.02% CAGR through 2031. China's M&G leverages automated lines to deliver 23% gross margin even as it scales domestic storefronts in tier-2 cities. Japanese exporters thrive on premium equity: fountain pens with urushi lacquer and notebooks with lightweight "Tomoe River" paper attract collectors worldwide, supporting a 120-billion-yen export figure in 2023. India's National Education Policy expanded textbook outlays, and textbook publishers co-bundle art kits to boost per-student spending. Southeast Asian hubs like Vietnam lure contract manufacturing via competitive labor rates, feeding private-label pipelines for Western retailers and broadening the stationery and supplies market.

North America's demand profile tilts toward smart devices and eco-labelled products. While U.S. office-supply sales dipped to USD 11.5 billion in 2024, Circana expects stabilization by 2027 as hybrid offices normalize ordering patterns. Canada's federal green-procurement guidelines mirror U.S. thresholds, pushing domestic mills to certify FSC status. Europe displays similar maturity but imposes stricter waste-reduction directives. Germany's Blue Angel ecolabel, for example, dominates tender requirements.

Middle East & Africa post double-digit growth off a small base, driven by urbanization, private-school chains, and public-sector digitization drives that still require hybrid stationery supplies. Latin America's consumption rises with middle-class expansion but is tempered by currency swings, however, local pulp availability aids cost competitiveness in notebook exports to the United States. Across emerging regions, distributors that bundle teacher-training content with product orders secure stickier relationships and a higher share in the stationery and supplies market.

- 3M Company

- ACCO Brands Corporation

- Societe BIC S.A.

- Kokuyo Co., Ltd.

- Faber-Castell AG

- Newell Brands Inc. (Paper Mate, Sharpie, Parker)

- Pilot Corporation

- Pentel Co., Ltd.

- Staedtler Mars GmbH

- Deli Group Co., Ltd.

- DOMS Industries Ltd.

- Linc Pens & Plastics Ltd.

- ITC Ltd. (Classmate)

- Schneider Schreibgerate GmbH

- Crayola LLC

- Fellowes Brands

- Staples Inc.

- Office Depot, Inc.

- Montblanc International GmbH

- Mitsubishi Pencil Co. (Uni-Ball)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising e-commerce penetration for stationery and office supplies

- 4.2.2 Expanding enrolment rates in K-12 and tertiary education worldwide

- 4.2.3 Premium and customised writing instruments gaining traction

- 4.2.4 Smart-reusable notebooks integrated with cloud services

- 4.2.5 Corporate ESG mandates driving demand for recycled stationery

- 4.2.6 Revival of journaling/art-therapy trends among Gen-Z

- 4.3 Market Restraints

- 4.3.1 Accelerating digitalisation reducing paper consumption

- 4.3.2 Volatility in pulp & petro-chemical input prices

- 4.3.3 Counterfeiting and grey-import channels eroding branded share

- 4.3.4 Pigment/ink supply shocks from geo-political conflicts

- 4.4 Value / Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Competitive Rivalry

- 4.5.2 Threat of New Entrants

- 4.5.3 Threat of Substitutes

- 4.5.4 Bargaining Power of Buyers

- 4.5.5 Bargaining Power of Suppliers

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Paper-based Products

- 5.1.2 Writing Instruments

- 5.1.3 Art and Craft Supplies

- 5.1.4 Office Essentials (Non-paper)

- 5.2 By Distribution Channel

- 5.2.1 Offline - Specialty Stationery Stores

- 5.2.2 Offline - Super/Hypermarkets & Bookstores

- 5.2.3 Online - E-commerce & Marketplaces

- 5.3 By End-User

- 5.3.1 Educational Institutions

- 5.3.2 Corporate and Home-office Users

- 5.3.3 Individual Consumers

- 5.3.4 Government and Public Sector

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.4.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 3M Company

- 6.4.2 ACCO Brands Corporation

- 6.4.3 Societe BIC S.A.

- 6.4.4 Kokuyo Co., Ltd.

- 6.4.5 Faber-Castell AG

- 6.4.6 Newell Brands Inc. (Paper Mate, Sharpie, Parker)

- 6.4.7 Pilot Corporation

- 6.4.8 Pentel Co., Ltd.

- 6.4.9 Staedtler Mars GmbH

- 6.4.10 Deli Group Co., Ltd.

- 6.4.11 DOMS Industries Ltd.

- 6.4.12 Linc Pens & Plastics Ltd.

- 6.4.13 ITC Ltd. (Classmate)

- 6.4.14 Schneider Schreibgerate GmbH

- 6.4.15 Crayola LLC

- 6.4.16 Fellowes Brands

- 6.4.17 Staples Inc.

- 6.4.18 Office Depot, Inc.

- 6.4.19 Montblanc International GmbH

- 6.4.20 Mitsubishi Pencil Co. (Uni-Ball)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment