PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906216

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906216

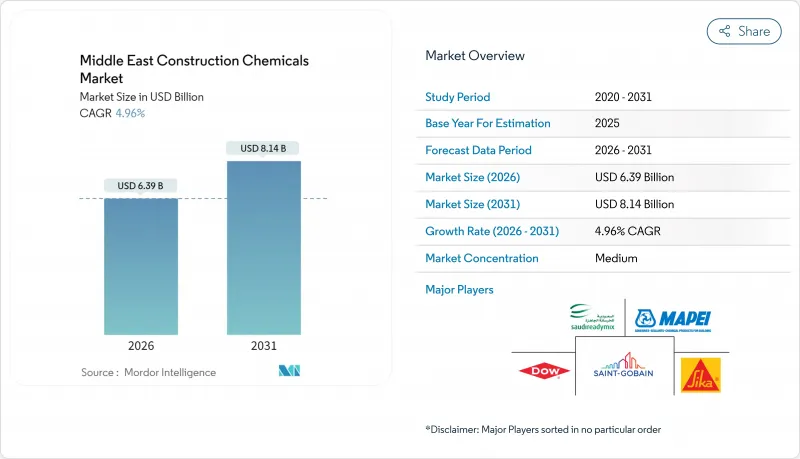

Middle East Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Middle East Construction Chemicals Market market size in 2026 is estimated at USD 6.39 billion, growing from 2025 value of USD 6.09 billion with 2031 projections showing USD 8.14 billion, growing at 4.96% CAGR over 2026-2031.

The expansion stems from sovereign wealth fund spending tied to national Vision programs, a pivot away from oil dependence, and technical regulations that reward high-performance, low-emission formulations. Saudi Arabia's giga-projects, the UAE's airport and data-center surge, and Qatar's LNG infrastructure together form a demand backbone that favors concrete admixtures, waterproofing systems, and corrosion-resistant coatings. Suppliers that can align with long-term framework agreements, guarantee multi-phase performance, and document low-VOC footprints capture price premiums, while consolidation among global leaders amplifies scale advantages. Competitive barriers also rise as project developers insist on full-cycle supply security, local content, and proven compliance with green-building mandates.

Middle East Construction Chemicals Market Trends and Insights

Accelerated Infrastructure Spending under National Vision Programs

Unprecedented public-sector funding under Vision strategies has locked in multi-year pipelines for airports, rail corridors, industrial zones, and new-city projects. Saudi Arabia alone channels more than USD 1.1 trillion into schemes such as NEOM and Red Sea Global, a capital flow that effectively doubles historical construction-chemicals consumption baselines. Developers negotiate supply commitments of up to five years to de-risk phase-overlap, causing bulk admixture demand to spike in advance of actual concrete pours. Parallel ambitions in the UAE, including the USD 35 billion Al Maktoum International Airport expansion, sharpen inter-GCC competition and keep unit prices firm. The combined effect lengthens regional order books, stabilizes plant-utilization rates, and anchors supplier investment in local production.

Mandated Adoption of Green Building Rating Systems

Regulations such as Abu Dhabi's Estidama Pearl and Qatar's GSAS embed low-VOC, low-embodied-carbon thresholds into project approvals, making eco-compliant formulations a ticket-to-play rather than a niche premium. The UAE climate law of 2024 forces enterprises to disclose greenhouse-gas metrics, compelling contractors to request environmental product declarations from chemical vendors. In response, multinationals deploy water-borne technologies that maintain set-time and compressive-strength thresholds while cutting solvent levels below 100 g/L. Early adopters secure preferred-supplier status and enjoy specification lock-ins that span entire master-planned communities.

Tightening VOC-Emission Caps on Solvent-Borne Products

Regional authorities adopt U.S. EPA aerosol-coating amendments as reference, obliging manufacturers to reformulate or withdraw legacy materials above 100 g/L VOC. Smaller suppliers lacking research and development depth face sunk-cost write-offs and retreat to commodity lines with lower margins. Large players leverage aqueous dispersion and powder-based systems to retain mechanical performance, using the regulatory shift to gain shelf space. Contractors grapple with application-rate adjustments and climate-cure challenges, but specification penalties for non-compliance outweigh adaptation costs.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Giga-Projects Requiring Specialty, High-Performance Admixtures

- Desalination-Plant Boom Driving Demand for Anti-Corrosion Coatings

- Supply-Chain Volatility for Key Raw Materials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Concrete admixtures commanded 35.07% of the Middle East construction chemicals market share in 2025 as giga-projects elevated performance requirements beyond conventional mixes. Proprietary blends that lengthen workability in 50 °C heat while meeting 80 MPa compressive strengths remain the procurement benchmark. Tier-one vendors trial nano-silica infusions and CO2-curing accelerators, hedging against potential carbon-levy regulations on cement plants.

Waterproofing systems, ranging from HDPE geomembranes to polyurethane liquid-applied membranes, chart the fastest 5.32% CAGR through 2031. Here, green-building mandates that promote tight building envelopes and moisture-migration ratings under 0.1 perm-in. drive specification. Demand also flows from rising below-grade structures in dense urban cores, where groundwater salinity accelerates deterioration. Suppliers capitalizing on this trajectory now bundle warranties that match 30-year design lives, giving them leverage in lifecycle-cost discussions with developers.

The Middle East Construction Chemicals Report is Segmented by Product Type (Concrete Admixtures, Surface Treatments, Repair and Rehabilitation, Protective Coatings, Industrial Flooring, Waterproofing, Adhesives, Sealants, and More), End-User Industry (Infrastructure and Public Spaces, Commercial, Industrial, and Residential), and Geography (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Egypt, and Rest of Middle East).

List of Companies Covered in this Report:

- Ahlia Chemicals Company

- Akzo Nobel N.V.

- Caparol Paints

- Dow

- GulfBitumen

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Jotun A/S

- LATICRETE International, Inc.

- Mapei S.p.A.

- Pidilite Industries Ltd

- Saint-Gobain

- Saudi Readymix

- Saveto Group

- Sika AG

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Infrastructure Spending Under National Vision Programs

- 4.2.2 Mandated Adoption of Green Building Rating Systems (e.g., Estidama, GSAS)

- 4.2.3 Rise of Giga-Projects Requiring Specialty, High-Performance Admixtures

- 4.2.4 Rapid Expansion of Data-Center Construction Needs Antistatic Flooring

- 4.2.5 Desalination-Plant Boom Driving Demand for Anti-Corrosion Coatings

- 4.3 Market Restraints

- 4.3.1 Tightening VOC-Emission Caps on Solvent-Borne Products

- 4.3.2 Supply-Chain Volatility for Key Raw Materials (Epoxy Resins, Polycarboxylates)

- 4.3.3 Skilled-Labor Shortages Limiting Correct On-Site Application

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Concrete Admixtures

- 5.1.2 Surface Treatments

- 5.1.3 Repair and Rehabilitation

- 5.1.4 Protective Coatings

- 5.1.5 Industrial Flooring

- 5.1.6 Waterproofing

- 5.1.7 Adhesives

- 5.1.8 Sealants

- 5.1.9 Grouts and Anchors

- 5.1.10 Cement Grinding Aids

- 5.2 By End-user Industry

- 5.2.1 Infrastructure and Public Spaces

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.2.4 Residential

- 5.3 By Country

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 Qatar

- 5.3.4 Kuwait

- 5.3.5 Egypt

- 5.3.6 Rest of Middle-East

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ahlia Chemicals Company

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Caparol Paints

- 6.4.4 Dow

- 6.4.5 GulfBitumen

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Jotun A/S

- 6.4.9 LATICRETE International, Inc.

- 6.4.10 Mapei S.p.A.

- 6.4.11 Pidilite Industries Ltd

- 6.4.12 Saint-Gobain

- 6.4.13 Saudi Readymix

- 6.4.14 Saveto Group

- 6.4.15 Sika AG

- 6.4.16 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment