PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911820

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911820

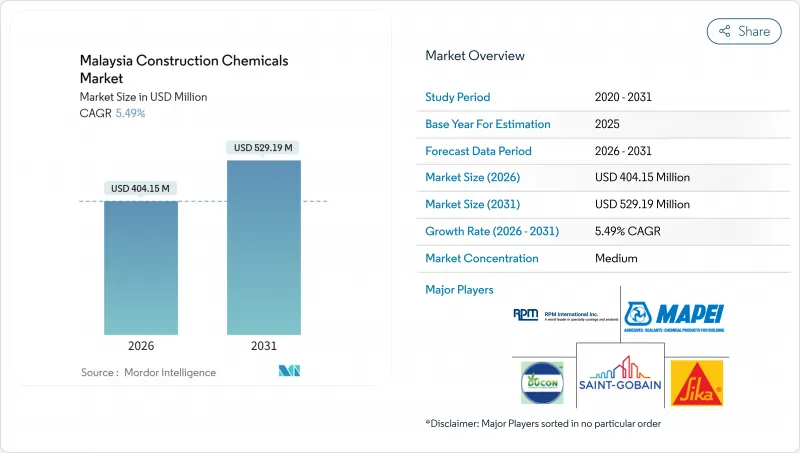

Malaysia Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Malaysia Construction Chemicals Market is expected to grow from USD 383.12 million in 2025 to USD 404.15 million in 2026 and is forecast to reach USD 529.19 million by 2031 at 5.49% CAGR over 2026-2031.

Sustained infrastructure momentum, including RMB 183.7 billion in projects awarded during the first 11 months of 2024, underpins steady volume growth as developers specify higher-performance admixtures, waterproofing membranes, and protective coatings. Mega-projects, such as the Johor-Singapore Special Economic Zone, signed in January 2025, are expected to accelerate demand for durable chemistries suited to marine and high-humidity environments. The Malaysia construction chemicals market also benefits from the government's 90% BIM adoption mandate for public works, which favors precision-engineered products that integrate seamlessly with automated construction workflows. In parallel, the momentum for green-building certification stimulates the uptake of low-VOC and recyclable formulations, enabling manufacturers to command premium price points while capturing sustainability-driven opportunities.

Malaysia Construction Chemicals Market Trends and Insights

Sustainable Public and Private Infrastructure Investment Acceleration

Malaysia's robust infrastructure pipeline, valued at RMB 183.7 billion in contracts awarded during 2024, sustains growth for specialty waterproofing membranes, polymer-modified grouts, and corrosion-inhibiting coatings used in bridges, tunnels, and urban rail systems. The Johor-Singapore Special Economic Zone alone aims to target 50 cross-border projects within five years, thereby amplifying demand for marine-grade sealants and anti-carbonate admixtures that can withstand brackish conditions. Public-private partnerships that include manufacturing giants such as Tesla and Intel further elevate performance benchmarks, driving the development of specifications for electrostatic-dissipative flooring resins and chemical-resistant wall coatings. Upgraded roads, ports, and digital pathways attract secondary commercial projects, reinforcing a virtuous cycle of product demand across the Malaysian construction chemicals market.

Affordable Housing Programs Driving Residential Chemical Consumption

The National Housing Policy's accelerated rollout of subsidized units standardizes the use of ready-mix concrete and prefabricated wall panels, expanding admixture volumes while tightening quality tolerances. Developers engaged in low-income housing voluntarily adopt green building criteria, fueling demand for water-based acrylic sealants and low-VOC tile adhesives that align with carbon reduction goals outlined by the Green Building Index. The policy's geographic spread into secondary cities, such as Ipoh and Kuching, enlarges distribution networks, prompting suppliers to introduce small-pack formulations and mobile technical service teams. Cost-sensitive projects rely on high-durability yet price-competitive chemistries, incentivizing local manufacturers to scale automated production lines for consistent batch quality.

Feedstock Price Volatility Constraining Market Expansion

Imported polymers, specialty solvents, and performance additives account for up to 60% of the raw material cost in premium formulations, exposing manufacturers to currency fluctuations and crude oil price spikes. PETRONAS has locked in forward supply contracts through 2026, but small and mid-sized players purchase on spot terms, eroding EBITDA margins when feedstock costs rise. The Pengerang-based USD 3.5 billion petrochemical complex, under construction since mid-2025, will enhance local supply integration but is not expected to reach nameplate output before 2028. Until then, volatility may accelerate consolidation as under-capitalized firms cede share to integrated multinationals.

Other drivers and restraints analyzed in the detailed report include:

- Green Building Certification Momentum Reshaping Chemical Specifications

- Ready-Mix Concrete and Prefabrication Technology Integration

- Environmental Health and Safety Compliance Cost Escalation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Waterproofing solutions captured 48.42% of the Malaysian construction chemicals market share in 2025, driven by mandatory rooftop and podium deck specifications in high-rise developments across Kuala Lumpur and Johor Bahru. Bitumen-modified membranes retain their leadership in volume, while polymer-cementitious hybrids gain favor for their rapid-setting underground applications. The Malaysian construction chemicals market size for waterproofing is projected to expand in lockstep with transit-oriented developments, ports, and data center basements that require a long service life in humid conditions.

Surface-treatment chemicals are expected to register the fastest 6.78% CAGR through 2031, driven by advanced curing agents and mold-release emulsions optimized for precast facade panels. Anti-graffiti sealers and hydrophobic silane gels enjoy rising demand from municipal infrastructure programs aimed at reducing maintenance costs. Innovation is pivoting toward nano-engineered particles that enhance abrasion resistance without increasing VOC levels, aligning with green-building credits.

The Malaysia Construction Chemicals Market Report is Segmented by Product (Adhesives, Anchors and Grouts, Concrete Admixtures, Concrete Protective Coatings, Flooring Resins, Repair and Rehabilitation Chemicals, Sealants, Surface-Treatment Chemicals, and Waterproofing Solutions) and End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, Residential). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ARDEX-QUICSEAL SINGAPORE

- Arkema (Bostik)

- Cementaid International

- Dribond Construction Chemicals

- Ducon Construction Chemicals

- Henkel AG & Co. KGaA

- MAPEI S.p.A.

- MC-Bauchemie

- PENETRON MALAYSIA SDN BHD.

- RPM International

- Saint-Gobain

- Sika AG

- Terraco Holdings Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sustainable public and private investments in infrastructure projects

- 4.2.2 Affordable-housing push expanding residential starts

- 4.2.3 Green-building certification fueling demand for low-VOC and durable chemistries

- 4.2.4 Rapid adoption of ready-mix concrete and prefab raising admixture penetration

- 4.2.5 SEZ tax breaks localising specialty-chemical production

- 4.3 Market Restraints

- 4.3.1 Feedstock price volatility squeezing producer margins

- 4.3.2 Rising EHS compliance costs (VOC, hazardous solvent bans)

- 4.3.3 Shortage of trained applicators for advanced chemistries

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Adhesives

- 5.1.1.1 Hot-Melt

- 5.1.1.2 Reactive

- 5.1.1.3 Solvent-borne

- 5.1.1.4 Water-borne

- 5.1.2 Anchors and Grouts

- 5.1.2.1 Cementitious Fixing

- 5.1.2.2 Resin Fixing

- 5.1.3 Concrete Admixtures

- 5.1.3.1 Accelerator

- 5.1.3.2 Air-Entraining

- 5.1.3.3 Super-plasticizer

- 5.1.3.4 Retarder

- 5.1.3.5 Shrinkage-Reducer

- 5.1.3.6 Viscosity-Modifier

- 5.1.3.7 Plasticizer

- 5.1.3.8 Other Types

- 5.1.4 Concrete Protective Coatings

- 5.1.4.1 Acrylic

- 5.1.4.2 Alkyd

- 5.1.4.3 Epoxy

- 5.1.4.4 Polyurethane

- 5.1.4.5 Other Resins

- 5.1.5 Flooring Resins

- 5.1.5.1 Acrylic

- 5.1.5.2 Epoxy

- 5.1.5.3 Polyaspartic

- 5.1.5.4 Polyurethane

- 5.1.5.5 Other Resins

- 5.1.6 Repair and Rehabilitation Chemicals

- 5.1.6.1 Fiber-Wrapping Systems

- 5.1.6.2 Injection Grouting

- 5.1.6.3 Micro-concrete Mortars

- 5.1.6.4 Modified Mortars

- 5.1.6.5 Rebar Protectors

- 5.1.7 Sealants

- 5.1.7.1 Acrylic

- 5.1.7.2 Epoxy

- 5.1.7.3 Polyurethane

- 5.1.7.4 Silicone

- 5.1.7.5 Other Resins

- 5.1.8 Surface-Treatment Chemicals

- 5.1.8.1 Curing Compounds

- 5.1.8.2 Mold-Release Agents

- 5.1.8.3 Other Types

- 5.1.9 Waterproofing Solutions

- 5.1.9.1 Chemicals

- 5.1.9.2 Membranes

- 5.1.1 Adhesives

- 5.2 By End-Use Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 ARDEX-QUICSEAL SINGAPORE

- 6.4.2 Arkema (Bostik)

- 6.4.3 Cementaid International

- 6.4.4 Dribond Construction Chemicals

- 6.4.5 Ducon Construction Chemicals

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 MAPEI S.p.A.

- 6.4.8 MC-Bauchemie

- 6.4.9 PENETRON MALAYSIA SDN BHD.

- 6.4.10 RPM International

- 6.4.11 Saint-Gobain

- 6.4.12 Sika AG

- 6.4.13 Terraco Holdings Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment