PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906219

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906219

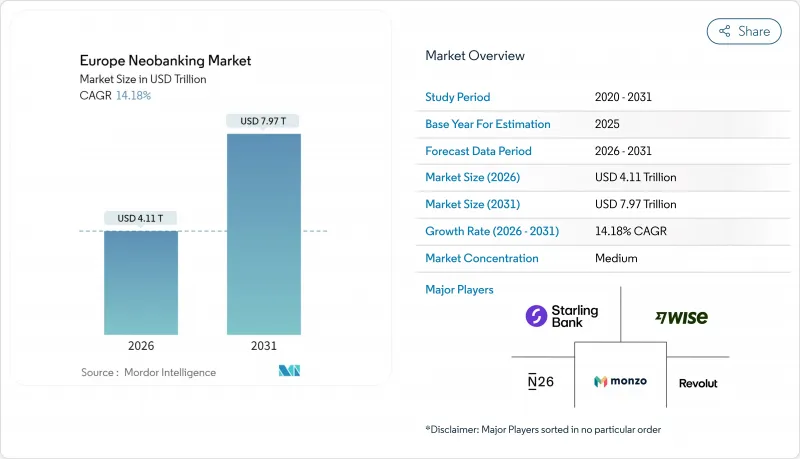

Europe Neobanking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The European neobanking market is expected to grow from USD 3.60 trillion in 2025 to USD 4.11 trillion in 2026 and is forecast to reach USD 7.97 trillion by 2031 at 14.18% CAGR over 2026-2031.

Rising smartphone penetration, supportive open-banking mandates, and the roll-out of SEPA Instant Payments continue to tilt European consumers and enterprises toward digital-first banking models that compete on user experience and cost efficiency instead of branch reach. As incumbents modernize core systems, neobanks increasingly differentiate through embedded-finance partnerships, data-driven personalization, and flexible product bundling that monetize both customer deposits and fee-based services. Interest-rate normalization has widened net-interest margins, allowing leading platforms to reinvest in artificial-intelligence fraud tools and multi-currency payment rails. Meanwhile, the revision of PSD2 and the forthcoming PSD3 framework will further level data access while heightening security standards, encouraging new entrants, but raising the compliance bar for sub-scale players.

Europe Neobanking Market Trends and Insights

Surge in Mobile-Banking App Adoption

Mobile apps have become the default gateway for European financial interactions, with the share of adults using mobile banking exceeding 80% in several Nordic markets. Neobanks build on this behavioural change by delivering instant onboarding, real-time spending alerts, and in-app customer support that traditional banks still struggle to replicate cost-effectively. The resulting uptick in daily logins deepens data capture and powers hyper-personalized offers that lift fee income and retention. Ecosystem features, such as budget planners and crypto wallets, further lock in engagement cycles. As 5G coverage extends, latency-free rich media and biometric security tighten brand stickiness among younger cohorts who rarely visit branches.

PSD2 and Open-Banking Mandates

The revised Payment Services Directive opened bank-held data to licensed third parties and standardized strong-customer authentication, enabling neobanks to aggregate multi-bank accounts alongside proprietary products. The shared-data regime compressed incumbents' information advantage and spurred API-driven partnerships, from payroll portals in Germany to SME accounting bundles in France. PSD3, slated for transposition by 2026, will close fraud loopholes and hard-code refund rights, pushing neobanks to enhance risk analytics yet also widening market addressability by clarifying liability. Cross-border players leverage portable e-money or full banking licenses to navigate still-mixed member-state interpretations while allocating capital toward pan-European scale.

EU Interchange-Fee Caps Squeeze Margins

Regulation 2015/751 restricts interchange to 0.2% on debit and 0.3% on credit, shrinking a historic income pillar for card-centric neobanks. Platforms that once subsidized free accounts with swipe fees now pivot toward subscription tiers and merchant-solutions bundles. Major market players mitigate the impact through economies of scale and supplementary revenue streams, such as crypto trading spreads. In contrast, smaller, thinly capitalized competitors encounter extended timelines to achieve break-even. Additionally, the implementation of the cap is driving a faster adoption of account-to-account instant payment systems. This shift is compelling neobanks to strategically realign their focus toward generating revenue from high-volume foreign exchange transactions and lending activities.

Other drivers and restraints analyzed in the detailed report include:

- Millennial & Gen-Z Digital-First Demand

- SEPA Instant & National A2A Schemes Boost Cost Advantage

- Heightened AML/KYC Compliance Burden

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Business accounts accounted for 64.82% of the European neobanking market in 2025, reflecting fertile demand among SMEs for real-time cash-flow visibility, automated invoicing, and fee-transparent foreign exchange. The European neobanking market size for business banking has benefited from open-API ecosystems that integrate accounting software, tax calculations, and payroll into a single dashboard, slicing administrative overheads that once deterred entrepreneurs from digital migration. Growth momentum accelerates as neobanks layer working-capital loans and credit lines atop transactional bundles, capturing a deeper share of wallet while maintaining risk discipline through data-rich underwriting.

Savings accounts, although a minority today, are posting a 46.86% CAGR through 2031 on the back of rising rate differentials and instant-access pots that mirror money-market yields without branch visits. Platform agility lets operators tweak headline rates daily, responding to treasury spreads faster than legacy competitors. Enhanced liquidity widens the European neobanking market share in deposit gathering and fuels low-cost funding for lending books. Continued regulatory convergence around deposit insurance frameworks is expected to close psychological safety gaps that still nudge higher-balance households to retain legacy current accounts.

The Europe Neobanking Market Report Segments the Industry Into by Account Type (Business Account, Savings Account), by Services (Mobile Banking, Payments, Money Transfers, Savings Account, Loans, Other ), by Application (Personal, Enterprise, and Other Application), and by Country (United Kingdom, Germany, France, Spain, Italy, and Other). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Revolut

- Monzo Bank Ltd

- N26 GmbH

- Starling Bank

- Wise plc

- Qonto

- Bunq N.V.

- Atom Bank

- Tide

- Curve

- Holvi

- Pleo

- Soldo

- Lunar

- Bnext

- Vivid Money

- Payoneer

- Hype

- Nickel

- Penta

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in mobile-banking app adoption

- 4.2.2 PSD2 & open-banking mandates

- 4.2.3 Millennial & Gen-Z digital-first demand

- 4.2.4 SEPA Instant & national A2A schemes boost cost advantage

- 4.2.5 Rising-rate interest income monetisation

- 4.2.6 Embedded-finance/BaaS revenue pipelines

- 4.3 Market Restraints

- 4.3.1 EU interchange-fee caps squeeze margins

- 4.3.2 Heightened AML/KYC compliance burden

- 4.3.3 Fraud/false-positive spikes erode trust

- 4.3.4 Secondary-account status limits deposit depth

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Account Type

- 5.1.1 Business Account

- 5.1.2 Savings Account

- 5.2 By Services

- 5.2.1 Mobile-Banking

- 5.2.2 Payments

- 5.2.3 Money-Transfers

- 5.2.4 Savings Account

- 5.2.5 Loans

- 5.2.6 Others

- 5.3 By Application

- 5.3.1 Personal

- 5.3.2 Enterprise

- 5.3.3 Other Application

- 5.4 By Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Italy

- 5.4.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Revolut

- 6.4.2 Monzo Bank Ltd

- 6.4.3 N26 GmbH

- 6.4.4 Starling Bank

- 6.4.5 Wise plc

- 6.4.6 Qonto

- 6.4.7 Bunq N.V.

- 6.4.8 Atom Bank

- 6.4.9 Tide

- 6.4.10 Curve

- 6.4.11 Holvi

- 6.4.12 Pleo

- 6.4.13 Soldo

- 6.4.14 Lunar

- 6.4.15 Bnext

- 6.4.16 Vivid Money

- 6.4.17 Payoneer

- 6.4.18 Hype

- 6.4.19 Nickel

- 6.4.20 Penta

7 Market Opportunities & Future Outlook

- 7.1 Monetising SEPA-Instant rails for SME payroll & Request-to-Pay

- 7.2 Green banking & ESG-linked savings products