PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906227

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906227

Europe Facade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

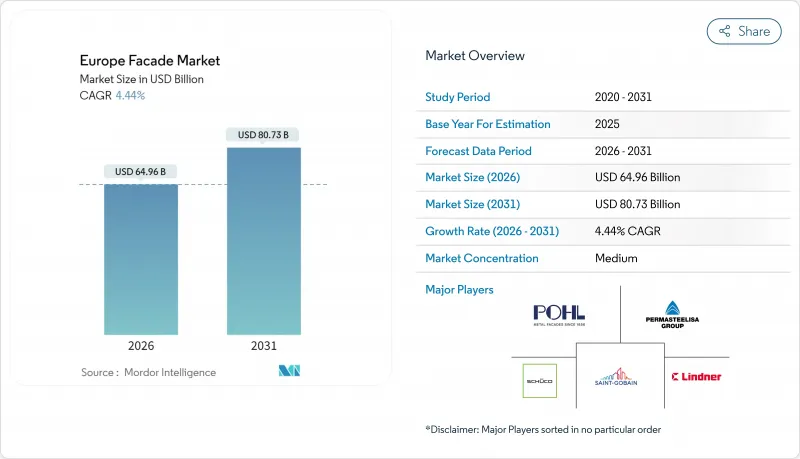

The Europe facade market was valued at USD 62.2 billion in 2025 and estimated to grow from USD 64.96 billion in 2026 to reach USD 80.73 billion by 2031, at a CAGR of 4.44% during the forecast period (2026-2031).

Renovation and retrofit demand dominate because post-Grenfell regulations and EU "Fit-for-55" energy targets impose mandatory envelope upgrades. Commercial clients still account for most spending, yet residential activity is accelerating as hyperscale data-center clusters and modular off-site construction reshape housing supply chains. Technological differentiation rather than raw scale defines competition, with facade specialists integrating low-carbon aluminum, building-integrated photovoltaics (BIPV), and AI-enabled adaptive panels to satisfy embodied-carbon caps. Material cost swings and installer shortages temper near-term momentum, but sustained policy pressure keeps the order pipeline resilient across core European economies.

Europe Facade Market Trends and Insights

Post-Grenfell Recladding Surge Across EU High-Rise Stock

Heightened fire-safety scrutiny after the 2017 tragedy forces owners of buildings above 18 m to replace combustible systems. Insurers have removed coverage for legacy cladding, making compliance non-negotiable. Germany mirrored the UK's stance following the 2024 Valencia apartment blaze, and France upgraded facade testing under Construction Products Regulation updates. The compulsory nature of replacement shields the Europe facade market from macro construction downturns because legal liability overrides cost concerns, ensuring steady retrofit orders.

Net-Zero-2050 Envelope Mandates Under "Fit-for-55"

The Energy Performance of Buildings Directive calls for all new structures to reach zero-emission status by 2030 and for deep retrofits of existing stock by 2050. France's RE2020 sets a 640 kg CO2eq/m2 ceiling that is already forcing product redesign. The renovation wave aims to upgrade 35 million buildings, with facades responsible for roughly 35% of potential energy savings. Germany's latest building code now requires thermal-bridge-free connections, raising specification complexity and favoring sophisticated curtain-wall and ventilated concepts.

Aluminum and Float-Glass Price Volatility

Aluminum traded between USD 2,300-2,600 per ton during 2024, while float-glass quotes soared 10-15%. Specialized jumbo-pane lead times stretched to 20 weeks, disrupting project schedules. Contractors incorporate escalation clauses that transfer cost risk to owners, which can stall approvals and compress margins.

Other drivers and restraints analyzed in the detailed report include:

- Modular Off-Site Facade Manufacturing Uptake

- Hyperscale Data-Center Build Boom in FLAP-D Clusters

- Certified Facade-Installer Labor Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ventilated solutions captured 50.35% of 2025 revenue and will expand at a 4.78% CAGR because they create an air cavity that lowers cooling loads by up to 25%. This dominant share underlines how the Europe facade market integrates performance and compliance. As regulators tighten thermal-bridge rules, ventilated assemblies, with natural airflow and moisture outflow, overcome condensation risks that plague solid claddings. Their compatibility with BIPV modules strengthens appeal, letting installers dissipate photovoltaic heat and protect cell efficiency. Non-ventilated panels still serve heritage retrofits where structural intervention is limited, but growth lags the Europe facade market average.

Advanced designs now embed smart louvers, kinetic shading, and sensor-driven airflow dampers. Factory-built ventilated cassettes dovetail with off-site trends, boosting quality assurance and shortening site programs. Fire-safety codes further support this architecture because the cavity acts as a thermal buffer that limits flame spread, a coveted attribute after Grenfell. Collectively, the configuration cements ventilated solutions as the go-to choice for meeting EU nZEB criteria in offices, schools, and high-rise housing.

Curtain-wall assemblies owned 44.60% of 2025 value, yet rainscreen cladding outpaces them with a 4.83% CAGR through 2031 as architects specify versatile skins for retrofits. The Europe facade market size for rainscreens is growing on the back of material freedom that stretches from ceramic tiles to bio-receptive concrete that nurtures moss for urban biodiversity. Curtain-wall incumbents remain indispensable in skyline projects that demand panoramic glazing, airtightness, and seismic tolerance.

Market innovations include electrochromic glazing, integrated photovoltaics, and unitized systems that arrive on site as complete story-height panels. ISO 12631 and EN 13830 standards steer performance testing, pushing makers to refine thermal and acoustic metrics. Consequently, rainscreen vendors now experiment with modular sub-frames and recyclable brackets, positioning the category as a sustainability platform rather than value engineering fallback.

The Europe Facade Market Report is Segmented by Type (Ventilated, Non-Ventilated, Others), Facade System Type (Rainscreen Cladding, Curtain-Wall Systems, Others), Material (Glass, Metal, Plastic & Fibers, and More), Installation (New Construction, Renovation & Retrofit), End-User (Commercial, Residential, Others), and Geography (Germany, UK, France, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Permasteelisa Group

- Schuco International KG

- Saint-Gobain S.A.

- Lindner Group

- Reynaers Aluminium NV

- Kawneer (Arconic) Europe

- AluK Group

- Kingspan Group (Facade & Insulated Panels)

- Hydro Building Systems (Technal, Wicona)

- Yuanda Europe

- STO SE & Co. KGaA

- Etex Group - EOS Facades

- Sapa Building Systems

- Gartner (Permasteelisa)

- Trimo d.o.o.

- Glas Trosch Group

- AGC Glass Europe

- Focchi SpA

- Josef Gartner GmbH

- Alucraft Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-Grenfell style recladding surge across EU high-rise stock

- 4.2.2 Net-zero-2050 envelope mandates under "Fit-for-55"

- 4.2.3 Modular off-site facade manufacturing uptake

- 4.2.4 Hyperscale data-centre build boom in FLAP-D clusters

- 4.2.5 VAT-relief & feed-in tariffs accelerating BIPV facades

- 4.2.6 CBAM-driven reshoring of low-carbon aluminium

- 4.3 Market Restraints

- 4.3.1 Aluminium & float-glass price volatility

- 4.3.2 Certified facade-installer labor shortage

- 4.3.3 Insurance exclusions for combustible systems

- 4.3.4 Embodied-carbon caps in EU taxonomy & local plans

- 4.4 Brief on Structural Systems Used in European Facades

- 4.5 Pricing Analysis

- 4.6 Value / Supply-Chain Analysis

- 4.7 Regulatory Landscape

- 4.8 Technological Outlook

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Competitive Rivalry

- 4.10 Consumer Behaviour Analysis (Architects, Contractors, Developers, Owners)

- 4.11 Sustainability Trends

5 Market Size & Growth Forecasts (Value, € billion)

- 5.1 By Type

- 5.1.1 Ventilated

- 5.1.2 Non-Ventilated

- 5.1.3 Others

- 5.2 By Facade System Type

- 5.2.1 Rainscreen Cladding

- 5.2.2 Curtain-Wall Systems

- 5.2.3 Others

- 5.3 By Material

- 5.3.1 Glass

- 5.3.2 Metal

- 5.3.3 Plastic & Fibres

- 5.3.4 Stone

- 5.3.5 Others

- 5.4 By Installation

- 5.4.1 New Construction

- 5.4.2 Renovation & Retrofit

- 5.5 By End-User

- 5.5.1 Commercial

- 5.5.2 Residential

- 5.5.3 Others

- 5.6 By Region

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Nordics (Sweden, Denmark, Norway, Finland)

- 5.6.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 Permasteelisa Group

- 6.4.2 Schuco International KG

- 6.4.3 Saint-Gobain S.A.

- 6.4.4 Lindner Group

- 6.4.5 Reynaers Aluminium NV

- 6.4.6 Kawneer (Arconic) Europe

- 6.4.7 AluK Group

- 6.4.8 Kingspan Group (Facade & Insulated Panels)

- 6.4.9 Hydro Building Systems (Technal, Wicona)

- 6.4.10 Yuanda Europe

- 6.4.11 STO SE & Co. KGaA

- 6.4.12 Etex Group - EOS Facades

- 6.4.13 Sapa Building Systems

- 6.4.14 Gartner (Permasteelisa)

- 6.4.15 Trimo d.o.o.

- 6.4.16 Glas Trosch Group

- 6.4.17 AGC Glass Europe

- 6.4.18 Focchi SpA

- 6.4.19 Josef Gartner GmbH

- 6.4.20 Alucraft Systems

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment