PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906233

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906233

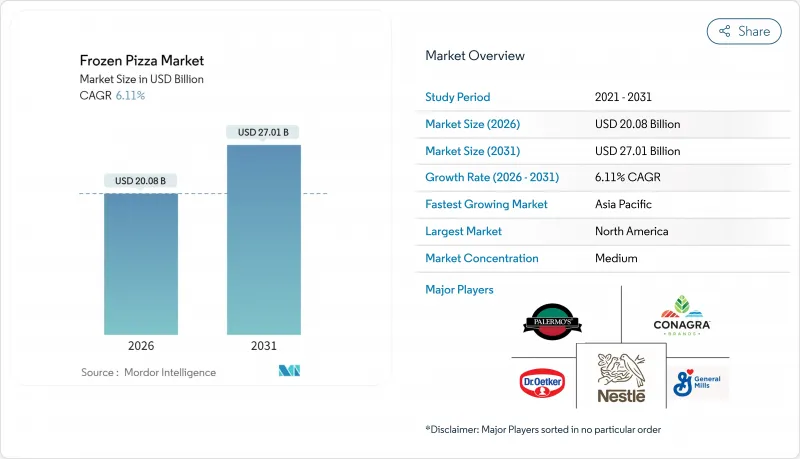

Frozen Pizza - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The frozen pizza market was valued at USD 18.92 billion in 2025 and estimated to grow from USD 20.08 billion in 2026 to reach USD 27.01 billion by 2031, at a CAGR of 6.11% during the forecast period (2026-2031).

The market growth is driven by increasing urban incomes, consumer preference for convenient premium meals, and advancements in freezing technology that maintain product quality. The market expansion is supported by product innovations including thin-crust varieties, plant-based options, and air-fryer-compatible products. Major manufacturers are implementing sustainability measures, such as reduced storage temperatures, to optimize operational costs. The Asia-Pacific region presents significant growth opportunities due to increasing adoption of western food preferences and expanding supermarket networks, while North American consumers are shifting towards premium wood-fired varieties. The market demonstrates moderate competition, with global companies benefiting from economies of scale in research and development, while regional players differentiate through artisanal products and transparent ingredient lists.

Global Frozen Pizza Market Trends and Insights

Rising Demand for Convenient Meal Solutions

The rise in remote and hybrid work has increased demand for high-quality frozen meals that can be prepared quickly. Air fryer-compatible pizzas, which provide crispy crusts with reduced cooking times, have driven substantial growth in air fryer-suitable frozen products. Manufacturers are adapting to changing consumer preferences by developing single-serve portions, bite-sized formats, and products with shorter cooking times, transforming traditional snacks into complete meals. This adaptation includes modifications to crust moisture content and topping distribution to enhance heat penetration. The combination of convenience and premium quality has enabled higher retail prices while maintaining sales volume growth, resulting in improved gross margins for market leaders.

Introduction of Vegan and Plant-based Pizza Options

The plant-based pizza market is experiencing substantial growth, primarily due to technological breakthroughs in cheese alternatives and protein substitutes. These innovations effectively address both consumer dietary preferences and growing environmental awareness. In February 2025, Daiya made significant improvements to its plant-based frozen pizza line by introducing a proprietary Oat Cream blend, which substantially enhanced the product's texture and taste profile. The company's product pipeline includes the upcoming launch of Meatless Spicy Salami and Cheeseburger Pizza varieties, responding to consumer demand for familiar flavors in plant-based options. Recent developments in plant protein processing technologies have enabled manufacturers to successfully recreate the distinctive textures of traditional cheese while maintaining optimal nutritional content, making these products increasingly attractive to health-conscious consumers.

Health Concerns over Processed and Frozen Foods

Consumer health consciousness is reshaping the frozen pizza market, presenting challenges to traditional product formulations, particularly concerning sodium levels, preservatives, and processing methods. The frozen food segment continues to witness robust expansion in gut-friendly products as consumers increasingly seek healthier alternatives. This market evolution presents substantial opportunities for manufacturers to innovate with clean-label ingredients, reduced sodium content, and enhanced nutritional profiles. In response to these market dynamics, manufacturers are making strategic investments in ingredient innovation and advanced processing technologies, focusing on maintaining product taste and texture while improving nutritional value and extending shelf life.

Other drivers and restraints analyzed in the detailed report include:

- Influence of Western Food Culture in Emerging Markets

- Availability of Specialty and Gourmet Frozen Pizzas

- Stringent Food Safety and Labeling Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thin crust pizzas dominate the market with a 57.08% share in 2025, reflecting the growing consumer preference for lighter, crispier textures that align with health-conscious eating habits. The stuffed crust segment demonstrates robust growth potential, with a projected CAGR of 6.95% during 2026-2031, as consumers embrace products that balance indulgence with convenience. In August 2024, DiGiorno responded to this trend by introducing its Thin & Crispy STUFFED Crust Pizza, showcasing how manufacturers can successfully combine traditional elements with premium features to enhance profit margins. Regular/traditional crust continues to attract price-sensitive consumers, maintaining its stable market position.

The pizza crust market is experiencing significant transformation through technological advancements in processing methods, enabling manufacturers to develop unique textures and flavors while preserving convenience. Alternative crusts, including cauliflower and gluten-free options, are gaining momentum among consumers adhering to specialty diets. A notable example of product innovation is the introduction of Cheez-It frozen pizzas featuring ultra-thin Cheez-It flavored crusts, which demonstrates the potential for distinctive crust variations. This evolution in consumer preferences and manufacturing capabilities suggests that crust type segmentation will continue to expand as companies invest in proprietary formulations and processing techniques to create unique product offerings.

The frozen pizza market shows meat-based toppings, combined with vegetables, dominating with a 59.43% share in 2025. This dominance stems from consumers' continued preference for protein-rich options and familiar flavors. Meanwhile, vegan and plant-based cheese toppings are experiencing substantial growth at 7.15% CAGR from 2026-2031, as consumers become more environmentally conscious and manufacturers respond with innovative products. Vegetable toppings have found their niche, attracting consumers who seek healthier options without fully committing to plant-based alternatives.

The plant-based segment is undergoing significant transformation, with companies like Daiya introducing advanced formulations such as the Oat Cream blend technology. These improvements deliver taste and texture that closely resemble dairy cheese, making plant-based options more appealing to a broader consumer base, including flexitarians and health-conscious individuals. As manufacturers develop specialized plant-based meat alternatives specifically for frozen pizza applications, the traditional boundaries between topping categories continue to blur, pointing to further market evolution through technological innovation.

The Frozen Pizza Market Report is Segmented by Crust Type (Thin Crust, Regular/Traditional Crust, Stuffed Crust, and Other Crust), Topping (Meat-Based, Vegetable, and More), Category (Free-Form, and Conventional), Distribution Channel (Foodservice, and Retail), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds a dominant 36.05% share of the frozen pizza market in 2025. The region's strong position stems from established consumer preferences for frozen convenience foods and a robust cold chain infrastructure. American households consistently purchase frozen pizza products and maintain loyalty to established brands such as DiGiorno and Red Baron. In this mature market, manufacturers emphasize value creation through premium products, exemplified by Nestle's June 2025 launch of wood-fired DiGiorno varieties targeting consumers seeking authentic, artisanal options. Companies in the region focus on product differentiation and premium positioning to maintain profitability rather than volume growth.

The Asia-Pacific region represents the most dynamic growth opportunity in the frozen pizza market, projecting a robust CAGR of 6.36% from 2026-2031. This growth stems from fundamental market shifts, including rapid urbanization, substantial increases in consumer disposable income, and growing adoption of western dietary preferences. The expansion of modern retail infrastructure, particularly supermarket chains, combined with significant improvements in cold chain logistics, has opened new distribution channels in previously untapped markets, creating a strong foundation for sustained growth.

Europe maintains a strong presence in the global frozen pizza market due to established frozen food consumption patterns and strict quality control regulations. The region's consumer preferences are shifting, with increasing demand for premium frozen pizzas, reflecting the broader trend of restaurant-quality meals at home. Environmental initiatives are shaping market development, as demonstrated by the "Move to -15°C" coalition, where companies like Nomad Foods are implementing energy-efficient storage solutions. This combination of premium product demand and environmental consciousness presents opportunities for manufacturers who can address both market requirements while remaining competitive.

- Nestle S.A.

- General Mills Inc.

- Dr. Oetker GmbH

- Conagra Brands Inc.

- Palermo Villa Inc.

- Schwan's Company

- Amy's Kitchen Inc.

- Otsuka Holdings Co., Ltd.

- CAULIPOWER, LLC

- Newman's Own Inc.

- Champion Foods LLC

- Cappello's

- Crosta & Mollica Limited

- Italpizza S.p.A.

- Freiberger Lebensmittel GmbH

- Nomad Foods

- Orkla ASA

- McCain Foods Limited

- FroPro

- Home Run Inn, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Convenient Meal Solutions

- 4.2.2 Increasing Consumer Preference for Products with Extended Shelf Life

- 4.2.3 Introduction of Vegan and Plant-based Pizza Options

- 4.2.4 Influence of Western Food Culture in Emerging Markets

- 4.2.5 Customizable and Diverse Topping Options

- 4.2.6 Availability of Specialty and Gourmet Frozen Pizzas

- 4.3 Market Restraints

- 4.3.1 Health Concerns over Processed and Frozen Foods

- 4.3.2 Stringent Food Safety and Labeling Regulations

- 4.3.3 Limited Shelf Space in Retail Stores

- 4.3.4 Allergens and Dietary Restrictions Limiting Consumer Base

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE and GROWTH FORECASTS (VALUE)

- 5.1 By Crust Type

- 5.1.1 Thin Crust

- 5.1.2 Regular/Traditional Crust

- 5.1.3 Stuffed Crust

- 5.1.4 Other Crust Type

- 5.2 By Topping

- 5.2.1 Meat-Based (includes Combination with Vegetables)

- 5.2.2 Vegetable

- 5.2.3 Vegan and Plant-Based Cheese

- 5.3 By Category

- 5.3.1 Free-Form

- 5.3.2 Conventional

- 5.4 By Distribution Channel

- 5.4.1 Foodservice

- 5.4.2 Retail

- 5.4.2.1 Supermarkets and Hypermarkets

- 5.4.2.2 Convenience Stores

- 5.4.2.3 Online Retail

- 5.4.2.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nestle S.A.

- 6.4.2 General Mills Inc.

- 6.4.3 Dr. Oetker GmbH

- 6.4.4 Conagra Brands Inc.

- 6.4.5 Palermo Villa Inc.

- 6.4.6 Schwan's Company

- 6.4.7 Amy's Kitchen Inc.

- 6.4.8 Otsuka Holdings Co., Ltd.

- 6.4.9 CAULIPOWER, LLC

- 6.4.10 Newman's Own Inc.

- 6.4.11 Champion Foods LLC

- 6.4.12 Cappello's

- 6.4.13 Crosta & Mollica Limited

- 6.4.14 Italpizza S.p.A.

- 6.4.15 Freiberger Lebensmittel GmbH

- 6.4.16 Nomad Foods

- 6.4.17 Orkla ASA

- 6.4.18 McCain Foods Limited

- 6.4.19 FroPro

- 6.4.20 Home Run Inn, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK