PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906240

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906240

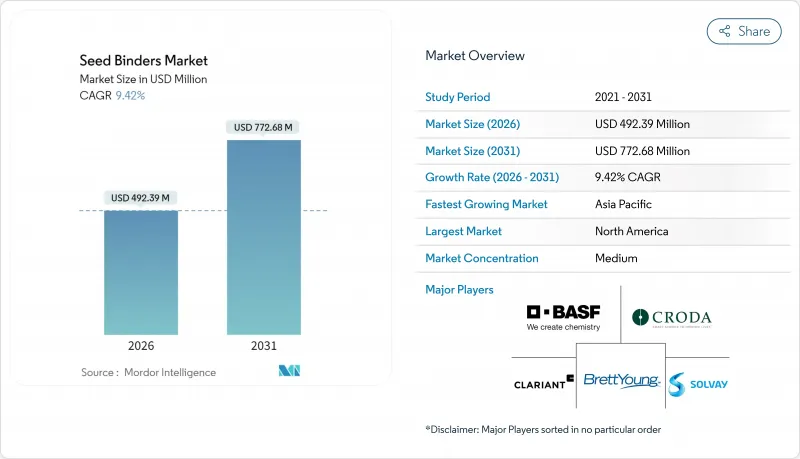

Seed Binders - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The seed binders market size in 2026 is estimated at USD 492.39 million, growing from 2025 value of USD 450 million with 2031 projections showing USD 772.68 million, growing at 9.42% CAGR over 2026-2031.

Higher spending on precision planting hardware, mounting regulations that cap active-ingredient loads, and widespread farm consolidation jointly lift demand for binders that improve seed flow, shape uniformity, and biological coverage. Film coating and pelleting applications now influence planter engineering decisions, turning the seed binders market into a strategic input category for both seed companies and equipment manufacturers. Investment momentum stays strong as venture capital backs biodegradable polymer innovators that reduce microplastic risk while matching the handling properties of polyvinyl alcohol. Petrochemical feedstock volatility and residue-limit compliance costs temper near-term profitability, yet supplier focus on renewable chemistries and integrated biological formulas continues to unlock premium pricing opportunities across high-value crops.

Global Seed Binders Market Trends and Insights

Surging Adoption of Film-Coated Seeds in High-Value Crops

Film coating improves flowability and cuts planter dust, which in turn raises crop establishment rates and limits operator exposure. Corn seed trials show lower skips and doubles, delivering yield gains that outweigh coating costs. Specialty vegetable growers adopt the technology quickly because seed costs form a minor share of total production budgets, making return-on-investment immediate. BASF launched a microplastic-free system that matches polyvinyl alcohol performance without environmental baggage. Penetration is strongest in markets where GPS-enabled planters and real-time sowing analytics quantify the benefit of uniform seed singulation. Regulatory endorsement that film coatings lower pesticide runoff further accelerates uptake.

Growth of Precision Planting Techniques Demanding Uniform Seed Shape

Modern planters require tight seed-size tolerance to maintain 99% singulation, pressing seed companies to adopt pelleting and encrusting that standardize geometry. Agronomic studies link poor seed placement to 15-20% profit loss, which motivates grower adoption of uniformity treatments. Precision agriculture now expands in Brazil, China, and India, spreading the need for shaped seeds beyond traditional U.S. and European strongholds. Equipment makers reciprocate by marketing planters calibrated for coated seeds, further locking the seed binders market into the mechanization trend. Rising farm labor costs cement mechanized sowing as the default in irrigated horticulture, adding long-term momentum.

Fluctuating Petro-Chemical Raw Material Prices

Polymer-grade propylene prices are projected to climb USD 110.23 per metric ton by mid-2025, squeezing margins for polyvinyl alcohol producers. Binder suppliers that rely on formula-pricing contracts struggle to pass costs through quickly, reducing short-term profitability within the seed binders market. Freight premiums linked to geopolitical events elevate feedstock landed cost in Europe more than in Asia, creating a regional imbalance. Some manufacturers hedge with long-term contracts, yet such instruments only delay exposure. Volatility motivates customers to test bio-based substitutes, accelerating the shift away from petroleum derivatives.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Lower Pesticide Loading per Hectare

- Rapid Expansion of Controlled-Release Micro-Nutrient Coatings

- Stringent Residue Limits Delaying Product Approvals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, polyvinyl alcohol commanded 41.10% of the seed binders market share, underscoring a legacy of predictable viscosity, proven adhesion, and low cost. The segment's strength remains anchored in broad compatibility with insecticides, fungicides, and colorants, advantages that keep polyvinyl alcohol dominant in cereals and forage seeds. The seed binders market size for biopolymer-based alternatives is projected to post a 11.55% CAGR, the fastest among product classes, as regulatory scrutiny over microplastic persistence intensifies in the European Union. Recent launches of protein-based and lignin-derived binders cater to premium horticultural seeds where microplastic-free labeling commands price premiums. Copolymer blends and acrylics address niche needs such as alkaline-soil tolerance, while polyacrylates maintain distinct roles in controlled-release nutrient matrices. Innovation in vegetable-oil polyurethane networks unlocks moisture-barrier functions that outperform legacy chemistries when seeds are stored in humid tropical climates.

Biopolymer adoption accelerates as coating lines retrofit to handle lower-temperature drying cycles that prevent thermal degradation of natural polymers. Processors report up to 15% energy savings per metric ton of treated seed, a side benefit that aligns with corporate carbon-reduction pledges. Early-mover seed companies leverage biopolymer claims to differentiate brand portfolios, notably in organic segments where synthetic polymer residue disqualifies certification. Raw-material supply is scaling through sugar-cane fermentation in Brazil, signaling future cost parity. Overall, the product mix is set to rebalance, yet entrenched polyvinyl alcohol capacity and price competitiveness ensure the coexistence of legacy and novel chemistries during the forecast horizon.

The Seed Binders Market Report is Segmented by Product Type (Polyvinyl Alcohol, Polyacrylate, Biopolymer-Based, and Others), Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, and Other Crops), Function (Film Coating, Pelleting, and Encrusting), and Geography (North America, South America, Europe, Asia-Pacific, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 31.60% of global value in 2025, a position anchored by large farm sizes, high planter adoption, and regulations that recognize seed treatments as a mitigation tool for off-field chemical movement. Integration of real-time carbon-tracking modules, such as BASF's Xarvio Bioenergy metric, adds a new layer of decision support that quantifies coating benefits beyond stand establishment. Beck's latest soybean processing plant in Missouri underscores continuing capital flow toward treating capacity, reinforcing a regional service ecosystem that sustains the seed binders market.

Asia-Pacific is the breakout geography with a 11.85% CAGR to 2031 as China's 12 million metric tons annual seed requirement and India's USD 50 billion specialty-chemicals base intersect with government programs that encourage precision sowing. Rapid mechanization of rice and maize production lifts pelleting demand, while widespread zinc-deficient soils accelerate micronutrient encrusting adoption. Local production of biodegradable polymers expands in coastal China, lowering tariff exposure and shortening lead times for regional seed companies.

Europe posts a moderate growth rate as its stringent microplastics directive pushes end-users to transition away from conventional polymers by 2028. Incotec's early launch of microplastic-free offerings positions the company favorably in a compliance-driven purchasing environment. Southern Europe's fruit and vegetable sectors adopt high-load biological coatings that lessen fungicide residue on produce destined for strict retailer audits. South America advances at slow growth rate because Brazil's double-cropping system magnifies the economic return on pelleted and encrusted seeds that speed emergence during compressed planting windows. Argentina's push for local agrochemical manufacturing supports resin availability, reducing foreign-exchange exposure for binder buyers.

- BASF SE

- Incotec Group BV (Croda International Plc)

- Clariant

- BrettYoung

- Covestro AG (Abu Dhabi National Oil Company)

- Germains Seed Technology (Associated British Foods)

- Michelman, Inc.

- SEEDPOLY Biocoatings Private Limited

- Solvay

- Omnia Specialities Pty (Omnia Holdings)

- Sekisui Specialty Chemicals America

- Borregaard AS

- Novonesis

- Centor Group

- SilviBio

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging adoption of film-coated seeds in high-value crops

- 4.2.2 Growth of precision planting techniques demanding uniform seed shape

- 4.2.3 Regulatory push for lower pesticide loading per hectare

- 4.2.4 Rapid expansion of controlled-release micro-nutrient coatings

- 4.2.5 Venture-capital funding in bio-based binder start-ups

- 4.2.6 Integration of binder functionality into biological seed treatments

- 4.3 Market Restraints

- 4.3.1 Fluctuating petro-chemical raw material prices

- 4.3.2 Stringent residue limits delaying product approvals

- 4.3.3 Limited binder efficacy on large-seed species

- 4.3.4 Supply-chain risk for specialty biopolymers

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Polyvinyl Alcohol

- 5.1.2 Polyacrylate

- 5.1.3 Biopolymer-based

- 5.1.4 Others

- 5.2 By Crop Type

- 5.2.1 Cereals and Grains

- 5.2.2 Oilseeds and Pulses

- 5.2.3 Fruits and Vegetables

- 5.2.4 Other Crops

- 5.3 By Function

- 5.3.1 Film Coating

- 5.3.2 Pelleting

- 5.3.3 Encrusting

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 Rest of Asia-Pacific

- 5.4.5 Middle East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Turkey

- 5.4.5.3 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Egypt

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Incotec Group BV (Croda International Plc)

- 6.4.3 Clariant

- 6.4.4 BrettYoung

- 6.4.5 Covestro AG (Abu Dhabi National Oil Company)

- 6.4.6 Germains Seed Technology (Associated British Foods)

- 6.4.7 Michelman, Inc.

- 6.4.8 SEEDPOLY Biocoatings Private Limited

- 6.4.9 Solvay

- 6.4.10 Omnia Specialities Pty (Omnia Holdings)

- 6.4.11 Sekisui Specialty Chemicals America

- 6.4.12 Borregaard AS

- 6.4.13 Novonesis

- 6.4.14 Centor Group

- 6.4.15 SilviBio

7 Market Opportunities and Future Outlook