PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906243

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906243

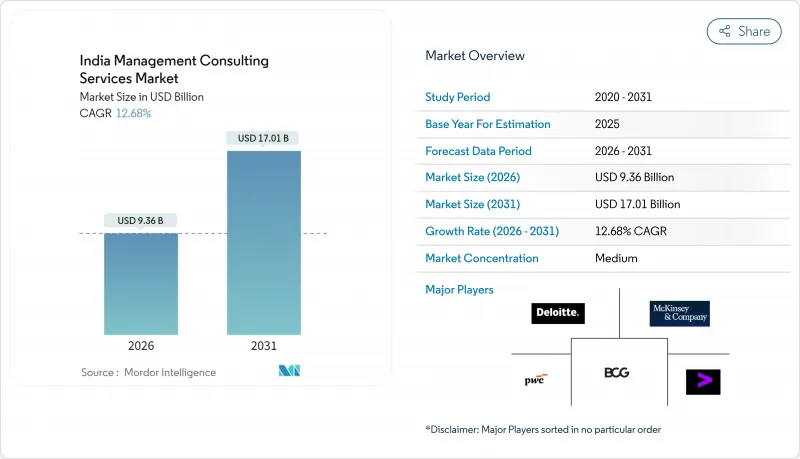

India Management Consulting Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India management consulting services market was valued at USD 8.31 billion in 2025 and estimated to grow from USD 9.36 billion in 2026 to reach USD 17.01 billion by 2031, at a CAGR of 12.68% during the forecast period (2026-2031).

Strong digital-transformation programs among large corporates, the step-wise rollout of SEBI's Business Responsibility and Sustainability Reporting (BRSR) rules, and sustained investment in artificial-intelligence (AI) adoption create durable demand for advisory projects that blend technology, strategy, and compliance expertise. Mandatory ESG disclosures are widening the advisory addressable base from the top 150 companies to the full cohort of 1,000 listed firms by FY 2026-27. Parallel momentum comes from Global Capability Centers (GCCs) that now exceed 1,580 sites, generating USD 46 billion revenue and demanding hybrid engagement models with implementation depth. Competitive intensity is rising as IT-services majors bundle low-priced advisory into implementation deals, forcing pure-play consulting firms to sharpen differentiation and value articulation.

India Management Consulting Services Market Trends and Insights

Accelerated Digital-Transformation Spend by Large Indian Corporates

Seizing gains beyond cost efficiency, large Indian corporations are channeling bigger budgets into AI, machine learning, and cloud-native architectures to modernize core processes.Consulting engagements now cover design-thinking workshops, talent reskilling, and data-governance blueprints that go well beyond legacy IT upgrades. Initiatives under Digital India and Smart Cities Mission are amplifying project pipelines in areas such as citizen service automation and urban infrastructure analytics. As enterprises migrate from pilot projects to scaled deployments, demand tilts toward advisory partners able to weave business-case rigor with hands-on implementation oversight. In turn, technology consulting fees are holding a premium that offsets pricing compression in commoditized advisory niches.

Mandatory ESG-Reporting Advisory Needs Post-SEBI BRSR Rollout

SEBI's BRSR mandate obliges the top 1,000 listed companies to disclose ESG metrics aligned with nine national principles, escalating the need for specialist advisory on data architecture, governance, and assurance. Third-party verification for the first 150 firms and phased inclusion of the remaining 850 enterprises broaden recurring consulting revenue. Data-quality gaps persist-only 96% of filers disclose energy use faithfully-driving demand for carbon-accounting system design and value-chain partner audits. Advisory firms that fuse compliance mechanics with sustainable-strategy road-mapping win larger mandates as clients seek to translate reporting into operational gains.

Persistent Pricing Pressure from IT-Services Majors Bundling "Free" Advisory

Large technology integrators increasingly include strategic advisory inside broader implementation deals at marginal rates, lowering perceived standalone consulting value. Mid-market clients embrace these bundled propositions, intensifying margin pressure on pure-play advisory firms. To protect premium pricing, consultancies now emphasize differentiated insight, cross-industry benchmarks, and C-suite-level stewardship unavailable in delivery-centric propositions.

Other drivers and restraints analyzed in the detailed report include:

- Rise of GCCs Demanding Hybrid Consulting Engagements

- Rapid VC-Backed SME Scaling Requiring Growth-Strategy Consulting

- Talent Attrition to Product-Management and VC Ecosystem

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large enterprises contributed 77.62% of India management consulting services market revenue in 2025, underpinned by multilayered transformation programs linked to ESG and digital mandates. Engagement scopes frequently span board-level strategy, operating-model redesign, and compliance integration across business units. At the other end, SMEs are the velocity engine, posting a 12.79% CAGR through 2031, a growth arc supported by venture-capital funding and modular consulting delivery that lowers cost of access for smaller budgets.

SMEs gravitate toward outcome-based pricing, standardized toolkits, and remote advisory sessions that compress project timelines and costs. Government seed-fund and credit-guarantee programs enlarge the potential client universe, especially in fintech, edtech, and software-as-a-service domains. For consulting providers, the twin-speed demand pattern calls for segment-specific go-to-market models, bespoke C-suite teams for large enterprises and scaled playbooks delivered via virtual squads for high-growth startups.

Operations consulting held the largest 36.10% share in 2025, yet technology consulting is set to clock 15.92% CAGR, the highest within the mix, reflecting AI and cloud adoption urgency. The India management consulting services market size for technology engagements is projected to widen quickest as clients pivot from one-off implementation advice to continuous improvement mandates that embed data-science accelerators.

Generative-AI pilots across HR, marketing, and supply-chain processes create experimental budgets that often convert into multi-year transformation roadmaps. Strategy, human-capital, and risk consulting preserve steady demand but increasingly intertwine with digital themes, ESG strategy encompasses carbon-data platforms; HR change programs integrate AI-enabled talent analytics. Providers that nurture deep technical partnerships while maintaining classical problem-solving disciplines position best for cross-selling.

India Management Consulting Services Market Report is Segmented by Organization Size (Large Enterprises, and Small and Medium-Sized Enterprises), Service Type (Strategy Consulting, Operations Consulting, and More), Delivery Model (On-Site Consulting, and Remote/Virtual Consulting), End-User Industry (IT and Telecommunications, Healthcare and Life Sciences, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- McKinsey & Company Inc.

- Boston Consulting Group Inc.

- Bain & Company Inc.

- Deloitte Touche Tohmatsu India LLP

- PricewaterhouseCoopers Services LLP

- Ernst & Young LLP

- KPMG Assurance and Consulting LLP

- Accenture Solutions Pvt. Ltd.

- IBM India Pvt. Ltd.

- Infosys Consulting Ltd.

- Tata Consultancy Services Ltd.

- Cognizant Technology Solutions India Pvt. Ltd.

- Wipro Consulting Services Ltd.

- LTI Mindtree Ltd.

- Grant Thornton Bharat LLP

- BDO India LLP

- Alvarez & Marsal India Pvt. Ltd.

- Protiviti Member Firm (India) Pvt. Ltd.

- Roland Berger Pvt. Ltd.

- Kearney India Pvt. Ltd.

- Frost & Sullivan India Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated digital-transformation spend by large Indian corporates

- 4.2.2 Mandatory ESG-reporting advisory needs post-SEBI BRSR rollout

- 4.2.3 Rise of GCCs (Global Capability Centres) demanding hybrid consulting engagements

- 4.2.4 Rapid VC-backed SME scaling requiring growth-strategy consulting

- 4.2.5 Outsourced shared-services optimisation projects in Tier-2 cities

- 4.3 Market Restraints

- 4.3.1 Persistent pricing pressure from IT services majors bundling "free" advisory

- 4.3.2 Talent attrition to product-management and VC ecosystem

- 4.3.3 Regulatory scrutiny on Big-Four independence restricting cross-sell

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Organization Size

- 5.1.1 Large Enterprises

- 5.1.2 Small and Medium-sized Enterprises

- 5.2 By Service Type

- 5.2.1 Strategy Consulting

- 5.2.2 Operations Consulting

- 5.2.3 HR Consulting

- 5.2.4 Technology Consulting

- 5.2.5 Other Service Types

- 5.3 By Delivery Model

- 5.3.1 On-site Consulting

- 5.3.2 Remote / Virtual Consulting

- 5.4 By End-user Industry

- 5.4.1 IT and Telecommunications

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Financial Services (BFSI)

- 5.4.4 Manufacturing and Industrial

- 5.4.5 Energy and Utilities

- 5.4.6 Government and Public Sector

- 5.4.7 Real Estate and Construction

- 5.4.8 Retail and Consumer Goods

- 5.4.9 Media, Entertainment and Sports

- 5.4.10 Hospitality and Travel

- 5.4.11 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 McKinsey & Company Inc.

- 6.4.2 Boston Consulting Group Inc.

- 6.4.3 Bain & Company Inc.

- 6.4.4 Deloitte Touche Tohmatsu India LLP

- 6.4.5 PricewaterhouseCoopers Services LLP

- 6.4.6 Ernst & Young LLP

- 6.4.7 KPMG Assurance and Consulting LLP

- 6.4.8 Accenture Solutions Pvt. Ltd.

- 6.4.9 IBM India Pvt. Ltd.

- 6.4.10 Infosys Consulting Ltd.

- 6.4.11 Tata Consultancy Services Ltd.

- 6.4.12 Cognizant Technology Solutions India Pvt. Ltd.

- 6.4.13 Wipro Consulting Services Ltd.

- 6.4.14 LTI Mindtree Ltd.

- 6.4.15 Grant Thornton Bharat LLP

- 6.4.16 BDO India LLP

- 6.4.17 Alvarez & Marsal India Pvt. Ltd.

- 6.4.18 Protiviti Member Firm (India) Pvt. Ltd.

- 6.4.19 Roland Berger Pvt. Ltd.

- 6.4.20 Kearney India Pvt. Ltd.

- 6.4.21 Frost & Sullivan India Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment