PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906247

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906247

GCC Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

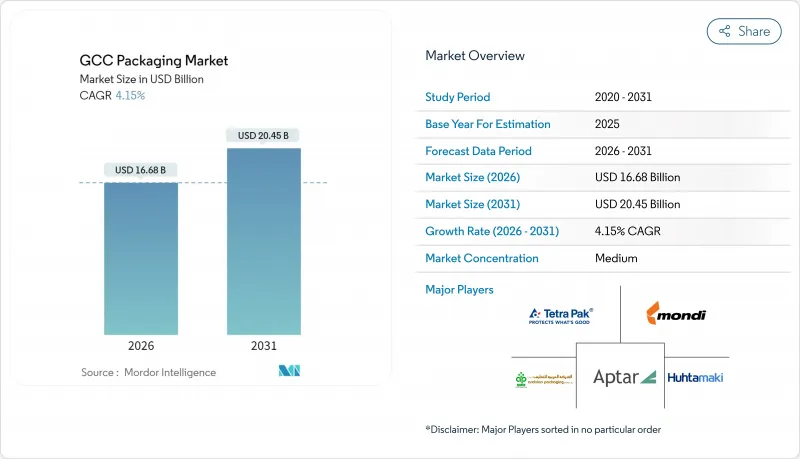

The GCC packaging market was valued at USD 16.02 billion in 2025 and estimated to grow from USD 16.68 billion in 2026 to reach USD 20.45 billion by 2031, at a CAGR of 4.15% during the forecast period (2026-2031).

The current expansion follows large-scale diversification programs, e-commerce growth, and increased spending on food security across all six member states. Demand continues to favor plastics because the region hosts integrated petrochemical hubs offering cost-competitive resins. A decisive policy push for sustainability is expected to elevate bioplastic adoption, thereby fast-tracking the development of new polylactic acid (PLA) capacity in the United Arab Emirates. Flexible formats still dominate retail shelves, although paper-based rigid solutions are gathering momentum as retailers seek premium shelf appeal and recyclability. Shifts in the end-user mix add another layer of growth, as pharmaceuticals now outpace food in year-on-year volume gains, driven by local drug production accelerating under Vision 2030 health objectives. Finally, ongoing mergers among raw-material suppliers secure feedstock for regional converters, sharpening price competitiveness for export shipments.

GCC Packaging Market Trends and Insights

Rapid Growth in E-commerce Fulfillment Packaging

Digital retail platforms in the Gulf scale quickly, prompting a sudden need for durable shipping mailers, void fill, and tamper-evident seals. Logistics outlays exceeding USD 106.6 billion in Saudi Arabia improve last-mile efficiency and enlarge the addressable pool of parcels. Airports and free zones expand freight capacity, with Dubai International Airport targeting 6 million tons of air cargo by 2030. As more sellers adopt same-day delivery promises, converters supply lighter film laminates and right-sized cartons that reduce material waste while protecting goods in desert climatic extremes. Packaging specification teams now test ambient, chilled, and frozen lanes together to meet the growing demand for e-commerce in food and pharma. Automation lines equipped with print-on-demand systems shorten lead times, cementing the GCC packaging market as a regional fulfillment hub.

Government Bans on Single-Use Plastics Spurring Alternative Materials

Policy action drives a decisive shift away from conventional polyolefins. The UAE banned single-use bags in January 2024 and plans to expand the ban to food containers in 2026. Oman followed with a retail bag prohibition in July 2025 that immediately lifted demand for paper sacks and starch-based films. Compliance requirements stimulate investment in new coatings that preserve barrier performance while improving compostability. The Emirates' Circular Packaging Association unites Borouge, Tetra Pak, and Unilever to pilot closed-loop models by collecting and recycling their own products at scale. As neighboring states align with the Gulf Standardization Organization (GSO) norms, converters gain uniform specifications for substrates and inks, thereby lowering certification costs across borders.

Persistent Volatility in Polymer Feedstock Prices

Brent crude price swings rapidly ripple through resin costs, putting pressure on converter margins. Smaller import-reliant states lack the hedging benefit enjoyed by integrated producers in Saudi Arabia and the UAE. Global oversupply compounds uncertainty: new polyethylene capacity in China and Southeast Asia keeps spot prices low yet unpredictable. When oil-to-naphtha ratios exceed the 7:1 threshold, GCC ethane-based plants strengthen their cost edge, but downstream buyers still struggle with price pass-through. Contract strategies evolve toward shorter tenures and indexed adjustments, but volatility remains a key planning risk for the GCC packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Food Security Investments Driving Cold-Chain Packaging Demand

- Mega-Events Accelerating Retail Packaging Upgrades

- Limited Post-Consumer Recycling Infrastructure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic substrates retained 52.74% of the GCC packaging market share in 2025, supported by abundant ethane feedstock and well-established extrusion assets. The GCC packaging market size for plastics is forecast to keep expanding, albeit at a slower clip than emerging alternatives. Bioplastics, although still niche, are expected to show a 7.52% CAGR outlook through 2031, thanks to a USD 13.4 billion PLA plant currently under construction in the UAE. This flagship complex will deliver an annual output of 200,000 tons, securing regional supply and export volumes to Europe. Paper-based solutions are gaining traction in Oman and Qatar, where single-use legislation is encouraging substitution; however, water scarcity is increasing operating costs for pulp refiners in Bahrain and Kuwait, limiting the competitiveness of fiber. Metal and glass maintain relevance in the beverage and cosmetics niches but face pressure to lighten their weight.

Parallel capacity expansions by Borouge and Sipchem introduce polyethylene grades engineered for higher recycled content, addressing the sustainability scorecards of brand owners. Yet adoption hinges on harmonized GSO certification, which mandates performance standards for biodegradable resins. Cross-border alignment simplifies qualification for converters, but it still requires investment in dedicated tooling to manage the lower heat resistance of compostable films. In the longer term, life-cycle analysis favors multi-material solutions that combine paper, biopolymer coatings, and thin aluminum layers, thereby opening up design space for downgauged laminates. Material suppliers consult closely with fillers to mitigate concerns about seal integrity and oxygen ingress, ensuring consumer safety while supporting circular claims within the GCC packaging market.

Flexible films accounted for 63.78% of the GCC packaging market in 2025, reflecting their cost efficiency and convenience for snack, dairy, and condiment lines. The segment leverages advanced barrier structures produced on multi-layer blown film towers, offering puncture resistance suited to desert freight conditions. Still, rigid solutions post a stronger 5.18% CAGR to 2031 as paperboard tubs, molded pulp trays, and returnable PET bottles gain favor. Mondi installed new kraft paper and recycled containerboard lines that directly feed converters across the Gulf, reducing reliance on imports. Rigid innovation involves the use of microfibrillated cellulose coatings to replace polyethylene liners, facilitating mono-material recovery.

Semi-rigid thermoformed bowls for ready-meal deliveries capitalize on e-commerce demand spikes, offering consumer-friendly re-heating options. Digital artwork changeovers facilitate seasonal promotions for gifting holidays such as Ramadan. Sustainability ratings are further influencing buyer preferences: retailers are now publishing environmental score labels on shelf-edge tags, encouraging shoppers to opt for recyclable or fiber-based packaging. Consequently, supply chains invest in automated inspection to validate barrier properties after light-weighting steps. Resin producers supply clarified polypropylene that achieves glass-like transparency at lower density, meeting premium aesthetics while shaving grams from jar walls. The trajectory affirms a balanced portfolio in the GCC packaging market as scale economies converge with greener mandates.

The GCC Packaging Market Report is Segmented by Material (Plastic, Metal, Glass, Paper and Paperboard, and Bioplastics), Packaging Type (Rigid, Flexible, and Semi-Rigid), End-User Industry (Food, Beverage, Pharmaceutical, Personal and Homecare, and Industrial), Packaging Technology (Thermoforming, Blow Molding, and More), and Geography (United Arab Emirates, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Tetra Pak International SA

- Mondi plc

- Najmuddin Packaging and Refilling Industry LLC

- AptarGroup Inc.

- Can-Pack SA

- Rotopacking Materials Industry Co. LLC

- Gulf East Paper and Plastic Industries LLC

- Arabian Packaging LLC

- Amber Packaging Industries LLC

- Huhtamaki Oyj

- Corys Packaging LLC

- Integrated Plastics Packaging LLC

- Emirates Printing Press LLC

- Hotpack Packaging Industries LLC

- Napco National CJSC

- Express Pack Print LLC

- Green Packaging Boxes Industries LLC

- Tarboosh Packaging Company LLC

- Unipack Containers and Carton Products LLC

- Al Rumanah Packaging LLC

- Al Ghurair Packaging LLC

- SIG Combibloc Group AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth in e-commerce fulfilment packaging

- 4.2.2 Government bans on single-use plastics spurring alternative materials

- 4.2.3 Food security investments driving cold-chain packaging demand

- 4.2.4 Mega-events (Vision 2030, Expo legacies) accelerating retail packaging upgrades

- 4.2.5 GCC petrochemical capacity providing low-cost resin advantage

- 4.2.6 AI-driven packaging automation adoption at converters

- 4.3 Market Restraints

- 4.3.1 Persistent volatility in polymer feedstock prices

- 4.3.2 Limited post-consumer recycling infrastructure

- 4.3.3 Water scarcity increasing paper and board processing costs

- 4.3.4 Skills gap for Industry 4.0 packaging operations

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Metal

- 5.1.3 Glass

- 5.1.4 Paper and Paperboard

- 5.1.5 Bioplastics

- 5.2 By Packaging Type

- 5.2.1 Rigid

- 5.2.2 Flexible

- 5.2.3 Semi-rigid

- 5.3 By End-user Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Pharmaceutical

- 5.3.4 Personal and Homecare

- 5.3.5 Industrial

- 5.4 By Packaging Technology

- 5.4.1 Thermoforming

- 5.4.2 Blow Molding

- 5.4.3 Injection Molding

- 5.4.4 Vacuum Forming

- 5.5 By Country

- 5.5.1 United Arab Emirates

- 5.5.2 Saudi Arabia

- 5.5.3 Qatar

- 5.5.4 Kuwait

- 5.5.5 Oman

- 5.5.6 Bahrain

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments}

- 6.4.1 Tetra Pak International SA

- 6.4.2 Mondi plc

- 6.4.3 Najmuddin Packaging and Refilling Industry LLC

- 6.4.4 AptarGroup Inc.

- 6.4.5 Can-Pack SA

- 6.4.6 Rotopacking Materials Industry Co. LLC

- 6.4.7 Gulf East Paper and Plastic Industries LLC

- 6.4.8 Arabian Packaging LLC

- 6.4.9 Amber Packaging Industries LLC

- 6.4.10 Huhtamaki Oyj

- 6.4.11 Corys Packaging LLC

- 6.4.12 Integrated Plastics Packaging LLC

- 6.4.13 Emirates Printing Press LLC

- 6.4.14 Hotpack Packaging Industries LLC

- 6.4.15 Napco National CJSC

- 6.4.16 Express Pack Print LLC

- 6.4.17 Green Packaging Boxes Industries LLC

- 6.4.18 Tarboosh Packaging Company LLC

- 6.4.19 Unipack Containers and Carton Products LLC

- 6.4.20 Al Rumanah Packaging LLC

- 6.4.21 Al Ghurair Packaging LLC

- 6.4.22 SIG Combibloc Group AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment