PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906250

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906250

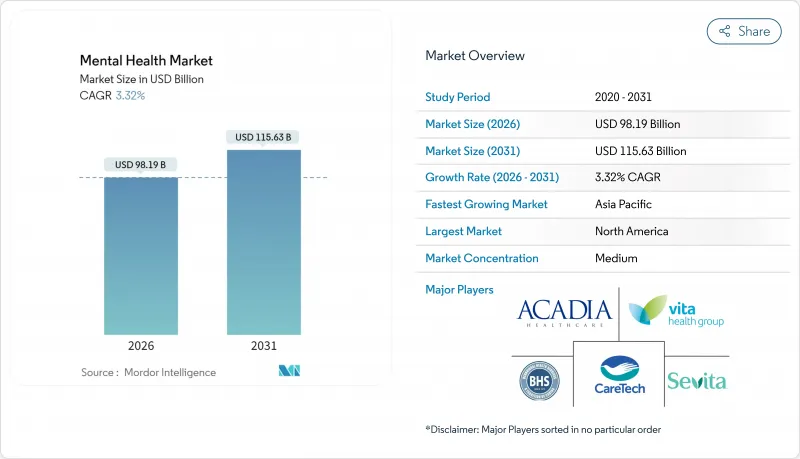

Mental Health - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Mental Health market size in 2026 is estimated at USD 98.19 billion, growing from 2025 value of USD 95.03 billion with 2031 projections showing USD 115.63 billion, growing at 3.32% CAGR over 2026-2031.

Sustained government spending on behavioral health, normalization of virtual care, and accelerating uptake of AI-enabled triage tools underpin this steady trajectory. Employers' ESG-linked wellbeing mandates, parity legislation in the United States and Europe, and growing digital-therapeutics reimbursement further widen access. Competitive intensity is rising as providers blend bricks-and-mortar capacity with scalable virtual models, while data-privacy obligations and workforce shortages limit near-term supply growth. Investors continue to back adolescent-focused platforms and Asia-Pacific entrants, signaling confidence in underserved segments of the mental health market.

Global Mental Health Market Trends and Insights

Rising Prevalence of Mental-Health Disorders

Global incidence climbed sharply after 2020, and recent WHO surveys signal no meaningful reversion. Among college students, 55% reported anxiety and 41% reported depression in 2024, underscoring a widened risk pool. Elevated prevalence drives sustained demand that strains care capacity, particularly in middle-income economies where clinical infrastructure remains thin. Multilateral health agencies now position mental health parity alongside chronic-disease management in national plans, redirecting budget lines toward community-based services and measurement frameworks.

Tele-psychiatry and Virtual-Care Adoption

Permanent reimbursement codes in the 2025 Medicare Physician Fee Schedule validate virtual behavioral health as a mainstream modality. Outcome data show comparable efficacy to in-person sessions, and patient acceptance has reached 71% in large meta-analyses. Market access expands most rapidly in Asia-Pacific where smartphone penetration offsets brick-and-mortar gaps. Cross-state licensing and broadband inequity remain friction points, but bilateral compacts and public-private connectivity projects are narrowing disparities.

Shortage of Qualified Mental-Health Professionals

Only 28% of U.S. mental-health needs are currently met, and more than 30,000 psychiatric positions remained unfilled in 2024. Similar gaps exist in Australia, where mental-health nursing capacity meets just 56% of demand. Training bottlenecks, early-career burnout, and compensation differentials limit pipeline growth. In rural catchment areas, one psychiatrist may cover populations exceeding 30,000, prompting dependence on tele-psychiatry and collaborative-care models.

Other drivers and restraints analyzed in the detailed report include:

- Government Parity Laws

- AI-Driven Triage & Personalized CBT Platforms

- Data-Privacy & Cybersecurity Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Depression held 38.41% of the 2025 mental health market size, reflecting entrenched diagnostic protocols and steady pharmacotherapy uptake. Anxiety disorders, however, are forecast to climb at a 4.05% CAGR, supported by broader screening and culturally sensitive therapy apps. The mental health market share for mood disorders remains secure, yet rising anxiety prevalence in Asia-Pacific signals a pivotal revenue shift. Pharmaceutical pipelines and AI-mediated exposure therapies are positioning to capture this incremental growth.

Improvements in diagnostic precision, powered by natural-language processing that flags sub-clinical symptoms, are expanding treatment candidacy. Integrated care pathways now co-manage comorbid substance-use and anxiety, raising treatment volumes across segments. Schizophrenia and bipolar disorder continue steady expansion through long-acting injectables and specialty network rollouts, while digital relapse-prediction tools reduce hospitalization frequency.

Out-patient counselling generated 41.86% of 2025 revenues, yet digital therapeutics & apps are set for a 4.18% CAGR through 2031. Newly established Medicare codes for FDA-cleared software anchor payor confidence and legitimize device-supported behavioral interventions. The mental health market size for software-as-treatment remains modest today but attracts disproportionate venture funding as efficacy data matures. Virtual & tele-psychiatry retains momentum by resolving geographical mal-distribution of clinicians and aligning with patients' convenience preferences.

Emergency mental-health services observe surging demand that strains ED capacity, propelling collaborations with tele-crisis providers. Hybrid care packages that merge virtual triage with brief in-person stabilization are reducing average length of stay. In-patient treatment volumes remain stable, buffered by comorbidity complexity and compulsory-care statutes, though reimbursement ceilings pressure margins.

The Mental Health Market Report is Segmented by Disorder (Depression, Anxiety, and Others), Service Type (In-Patient Treatment, Out-Patient Counselling, and Others), Age Group (Children & Adolescents, Adults, Geriatric), End User (Hospitals & Clinics, Community Mental-Health Centres, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the epicenter of the mental health market in 2025, posting 41.84% revenue share due to established insurance coverage, mature provider networks, and early digital-health uptake. Ongoing enforcement of parity laws and permanent virtual-care reimbursement codes sustain momentum, while AI-regulated therapeutic devices accelerate service scalability. Workforce scarcity in rural U.S. counties continues to pinch capacity, channeling investment toward tele-psychiatry hubs.

Asia-Pacific is the fastest-growing region at a 4.78% CAGR through 2031, propelled by incremental public-health spending and near-ubiquitous mobile penetration. Governments in Japan, Singapore, and Australia earmark mental health allocations within universal-coverage blueprints, spurring multi-lingual app launches and cross-border clinician marketplaces. Cultural stigma remains a hurdle, but public education campaigns are normalizing help-seeking, especially among younger cohorts. China's tier-two cities adopt AI-based triage at community clinics, signaling eventual diffusion into provincial networks.

Europe's growth remains steady as the region harmonizes digital-health regulations under the European Health Data Space. GDPR heightens data-handling scrutiny, but clear reimbursement schedules for evidence-based software therapies support provider adoption. Central and Eastern European countries pilot tele-crisis hotlines to offset clinician shortages, while Nordic systems integrate mental health dashboards into primary-care EHRs.

South America and the Middle East & Africa trail in absolute spending yet exhibit targeted progress. Brazil's SUS network integrates tele-psychology pilots for remote provinces, while Gulf states embed wellness apps in national e-government portals. Donor-funded initiatives expand basic counseling coverage, and diaspora clinicians augment local capacity via tele-consult contracts. Infrastructure, payment, and workforce barriers temper growth but underscore untapped demand.

List of Companies Covered in this Report:

- Universal Health Services (UHS)

- Acadia Healthcare

- Centene Corp.

- Teladoc Health

- CVS Health

- Carelon Behavioral Health (Elevance Health)

- Talkspace Inc.

- BetterUp Inc.

- Lyra Health

- Spring Health

- CloudMD Software & Services Inc. - MindBeacon

- Calm.com Inc.

- Headspace Health

- MindMaze SA

- SonderMind Inc.

- Modern Health

- Thriveworks

- Elemy

- Meru Health

- Quartet Health

- Beacon Health Options

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of mental health disorders

- 4.2.2 Expanding adoption of tele-psychiatry & virtual care

- 4.2.3 Government parity laws & policy initiatives

- 4.2.4 Increasing healthcare expenditure in low- and middle-income countries

- 4.2.5 AI-driven triage & personalized CBT platforms (under-reported)

- 4.2.6 Employer-mandated wellbeing programs linked to ESG disclosure (under-reported)

- 4.3 Market Restraints

- 4.3.1 Social stigma in seeking treatment

- 4.3.2 Shortage of qualified mental-health professionals

- 4.3.3 Data-privacy & cybersecurity concerns for digital therapeutics (under-reported)

- 4.3.4 Reimbursement loopholes in cross-border tele-health (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Disorder

- 5.1.1 Depression

- 5.1.2 Anxiety

- 5.1.3 Bipolar Disorder

- 5.1.4 Schizophrenia

- 5.1.5 Substance-Use Disorders

- 5.1.6 Other Disorders

- 5.2 By Service Type

- 5.2.1 In-patient Treatment

- 5.2.2 Out-patient Counselling

- 5.2.3 Emergency Mental-Health Services

- 5.2.4 Virtual & Tele-psychiatry

- 5.2.5 Digital Therapeutics & Apps

- 5.2.6 Others

- 5.3 By Age Group

- 5.3.1 Children & Adolescents

- 5.3.2 Adults

- 5.3.3 Geriatric

- 5.4 By End User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Community Mental-Health Centres

- 5.4.3 Home-care Settings

- 5.4.4 Employers

- 5.4.5 Schools & Universities

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South-America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Universal Health Services (UHS)

- 6.4.2 Acadia Healthcare

- 6.4.3 Centene Corp.

- 6.4.4 Teladoc Health Inc.

- 6.4.5 CVS Health

- 6.4.6 Carelon Behavioral Health (Elevance Health)

- 6.4.7 Talkspace Inc.

- 6.4.8 BetterUp Inc.

- 6.4.9 Lyra Health

- 6.4.10 Spring Health

- 6.4.11 CloudMD Software & Services Inc. - MindBeacon

- 6.4.12 Calm.com Inc.

- 6.4.13 Headspace Health

- 6.4.14 MindMaze SA

- 6.4.15 SonderMind Inc.

- 6.4.16 Modern Health

- 6.4.17 Thriveworks

- 6.4.18 Elemy

- 6.4.19 Meru Health

- 6.4.20 Quartet Health

- 6.4.21 Beacon Health Options

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment