PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906267

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906267

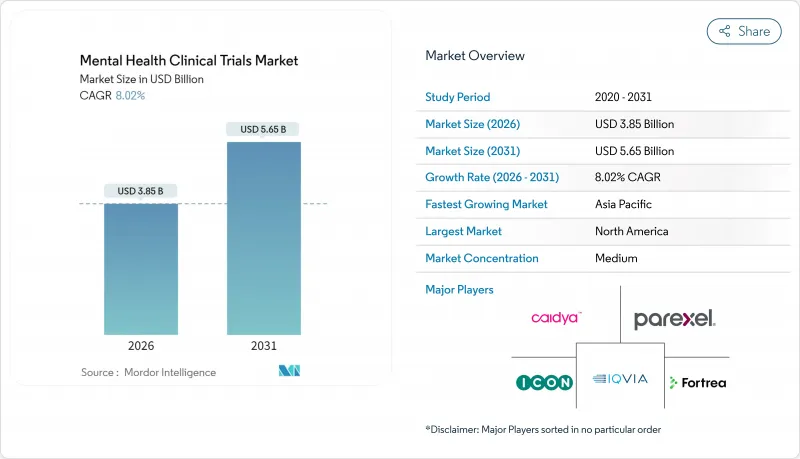

Mental Health Clinical Trials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Mental Health Clinical Trials market is expected to grow from USD 3.56 billion in 2025 to USD 3.85 billion in 2026 and is forecast to reach USD 5.65 billion by 2031 at 8.02% CAGR over 2026-2031.

Strong prevalence growth for psychiatric disorders, surging digital-first study models, and record venture funding for psychedelic therapies are set to sustain this trajectory. Sponsor budgets are expanding as late-stage pipelines mature, while regulators fast-track promising neurotherapeutics, narrowing time-to-market for novel agents. Remote assessments lower participation burden and broaden demographic reach, yet high dropout rates remain a critical cost driver. Competition intensifies as specialized AI-enabled platforms challenge large contract research organizations with leaner, mental-health-centric operating models.

Global Mental Health Clinical Trials Market Trends and Insights

Rising Prevalence of Mental Health Conditions

More than 970 million people live with psychiatric disorders, and untreated cases drain USD 1 trillion annually from global productivity. Post-pandemic awareness accelerated enrollment, with depression studies recruiting 34% faster than 2019 baselines. Sponsors scale Phase II and III programs for treatment-resistant cohorts as breakthrough therapy designations shorten regulatory cycles. Harmonized EMA guidance further eases multi-country protocols. Together, these dynamics enlarge the addressable patient pool and deepen sponsor commitment, propelling the mental health clinical trials market.

Increasing Pharma & Biotech R&D Investment

Neuropsychiatric R&D outlays hit USD 15.2 billion in 2024, up 28% year on year. Mega-deals such as a USD 14.6 billion takeover of Intra-Cellular Therapies underscore confidence in late-stage assets. Biotech pipelines explore AMPA modulation, glutamate pathways, and precision-genetic approaches, demanding longer observation windows that only robust capital flows can sustain. Venture investors directed USD 2.4 billion toward mental-health startups, with psychedelics capturing nearly one-third. Deepening capital pools reinforce a steady influx of trials, expanding the mental health clinical trials market

Limited Mental-Health Literacy in Developing Regions

Surveys in Ghana, Kenya, and South Africa show that 68% of respondents cannot recognize depression symptoms. Stigma curtails participation, while traditional healing norms clash with Western trial designs. Rural infrastructure gaps restrict site access, and multilingual consent processes inflate timelines. Community-level education for health workers shows promise but demands multi-year funding, tempering near-term growth for the mental health clinical trials market.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Decentralized & Digital Trial Models

- Growing VC Funding for Psychedelic-Assisted Therapies

- High Drop-Out Rates Owing to Long Therapy Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Interventional trials accounted for 71.12% of total 2025 revenue, reinforcing sponsor preference for controlled efficacy testing that accelerates product approval. The mental health clinical trials market size for observational approaches is smaller but rising at 11.76% as payers and regulators request real-world evidence. Digital biomarkers let observational cohorts capture continuous mood and cognition signals, giving sponsors granular post-marketing safety insights. Adaptive hybrids now merge intervention rigor with registry-style follow-up, satisfying both approval and reimbursement stakeholders. As FDA policies under the 21st Century Cures Act nurture such flexibility, interventional leaders bolster pipeline velocity while observational innovators prepare for data-centric payer negotiations.

Growth momentum favors interventional designs because breakthrough psychiatry programs demand robust comparative data. Yet observational gains will outstrip over the forecast window, especially in Asia-Pacific where infrastructure expansion aligns with pragmatic trial adoption. Sponsors that integrate remote-sensing endpoints into both design types achieve faster recruitment and richer datasets, reinforcing competitive differentiation across the mental health clinical trials market.

Phase III studies held a 35.45% share in 2025, underscoring the heightened maturity of psychiatric pipelines as several programs near regulatory filing. The mental health clinical trials market size expansion in Phase II is notable, gaining at 10.74% CAGR as adaptive designs and digital endpoints sharpen go/no-go precision. Phase I protocols now incorporate neuroimaging and pharmacogenomic screens, shortening early attrition and curbing downstream cost. Post-approval Phase IV commitments grow in tandem with payer scrutiny, capturing long-term safety and effectiveness data for high-risk therapies such as psychedelics. Multiregional coordination via ICH E17 guidelines smooths operations, letting sponsors run unified late-stage programs while satisfying local compliance.

Innovation concentration in mid-stage pipelines elevates overall cycle velocity. Coupled with regulatory acceleration, this trend positions the mental health clinical trials market for sustained double-digit study volume growth through 2031.

The Mental Health Clinical Trials Market Report Segments the Industry Into Study Design (Interventional, Observational, Other Study Designs), Phase (Phase I, Phase II, Phase III, Phase IV), Disorder (Anxiety Disorders, Depression, and More), Sponsor (Pharmaceutical and Biopharmaceutical Companies, Government Agencies, and More), and Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America generated 43.18% of 2025 value and retains leadership thanks to FDA breakthrough designations for both psychedelic molecules and digital therapeutics. Medicare reimbursement that began in January 2025 anchors payer confidence and stimulates venture backing for U.S. start-ups. Canada accelerates approvals through Health Canada's agile pathways, while Mexico provides cost-efficient bilingual sites that supplement regional capacity. Investors view the region's integrated ecosystem as a hedge against later-stage regulatory risk, sustaining steady capital inflow to the mental health clinical trials market.

Europe advances on the strength of EMA harmonization and public health investment. Germany's PROVIDE-C telehealth study evidences tangible outcome improvements, fuelling insurer support for remote intervention models. Post-Brexit, the United Kingdom leverages MHRA innovation licenses to attract biotech asset trials, while France amplifies academic-industry consortia targeting resistant depression. Italy's Lombardy cluster magnifies site network density, and Spain nurtures digital-therapy start-ups under EU data-sharing frameworks. Collectively, these initiatives expand continental trial throughput and enhance participant diversity.

Asia-Pacific represents the prime momentum hub at 13.38% CAGR. China's National Medical Products Administration expedites psychiatric study approvals in tandem with expanded hospital research centers. Japan's reimbursement pilots for AI-driven mental-health apps elevate remote monitoring toward standard of care. Australia's Therapeutic Goods Administration issues psychedelics trial guidance that attracts global sponsors. India and South Korea upscale academic medical campuses and offer government grants that offset set-up costs. As regulatory dialogues converge across ASEAN and APEC, cross-border multi-site designs shorten timelines and cement the region's status as a growth catalyst for the mental health clinical trials market.

- IQVIA

- ICON

- Parexel International Corp.

- Thermo Fisher Scientific Inc. (PPD)

- Syneos Health

- MedPace

- Fortrea Holdings Inc.

- Altasciences

- Caidya

- Lindus Health

- Worldwide Clinical Trials

- Charles River

- PSI CRO

- WCG Clinical

- CTI Clinical Trial & Consulting

- Pharmaron

- ClinChoice

- Covance (legacy)

- ProTrials Research

- Novotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Mental Health Conditions

- 4.2.2 Increasing Pharma & Biotech R&D Investment

- 4.2.3 Adoption of Decentralized & Digital Trial Models

- 4.2.4 Growing VC Funding for Psychedelic-Assisted Therapies

- 4.2.5 AI-Enabled Patient Stratification Improves Enrollment

- 4.2.6 Employer-Sponsored Mental-Well-Being Programs Drive Trial Demand

- 4.3 Market Restraints

- 4.3.1 Limited Mental-Health Literacy in Developing Regions

- 4.3.2 Scarcity of Pediatric Populations for Ethical Recruitment

- 4.3.3 High Drop-Out Rates Owing to Long Therapy Timelines

- 4.3.4 Reimbursement Uncertainty for Novel Neuro-Therapeutics

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Study Design

- 5.1.1 Interventional

- 5.1.2 Observational

- 5.1.3 Other Study Designs

- 5.2 By Phase

- 5.2.1 Phase I

- 5.2.2 Phase II

- 5.2.3 Phase III

- 5.2.4 Phase IV

- 5.3 By Disorder

- 5.3.1 Anxiety Disorders

- 5.3.2 Depression

- 5.3.3 Dissociative Disorders

- 5.3.4 Schizophrenia

- 5.3.5 Bipolar Affective Disorder

- 5.3.6 Other Disorders

- 5.4 By Sponsor

- 5.4.1 Pharmaceutical & Biopharmaceutical Companies

- 5.4.2 Government Agencies

- 5.4.3 Academic & Non-Profit Organizations

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.3.1 IQVIA Inc.

- 6.3.2 ICON plc

- 6.3.3 Parexel International Corp.

- 6.3.4 Thermo Fisher Scientific Inc. (PPD)

- 6.3.5 Syneos Health

- 6.3.6 Medpace Holdings Inc.

- 6.3.7 Fortrea Holdings Inc.

- 6.3.8 Altasciences

- 6.3.9 Caidya

- 6.3.10 Lindus Health

- 6.3.11 Worldwide Clinical Trials

- 6.3.12 Charles River Laboratories

- 6.3.13 PSI CRO

- 6.3.14 WCG Clinical

- 6.3.15 CTI Clinical Trial & Consulting

- 6.3.16 Pharmaron

- 6.3.17 ClinChoice

- 6.3.18 Covance (legacy)

- 6.3.19 ProTrials Research

- 6.3.20 Novotech

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment