PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906251

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906251

Italy Geospatial Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

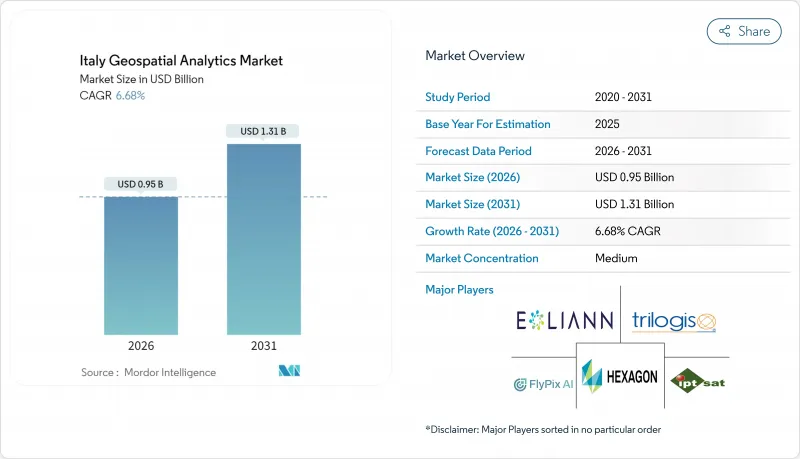

The Italy geospatial analytics market is expected to grow from USD 0.89 billion in 2025 to USD 0.95 billion in 2026 and is forecast to reach USD 1.31 billion by 2031 at 6.68% CAGR over 2026-2031.

Growth rests on EU-funded digital transformation, infrastructure safety mandates after the Genoa bridge collapse, and mandatory BIM-GIS convergence under the 2025 Public Works Code. Municipal digital-twin rollouts in Milan, Turin, and Bologna generate sustained platform demand, while the IRIDE earth-observation constellation enriches data supply. Cloud deployment accelerates as HERE Technologies leverages a USD 1.1 billion AWS alliance to deliver AI-powered location services. Parametric insurance needs, catalyzed by compulsory climate coverage from January 2025, further expand high-resolution risk analytics consumption, and services vendors grow as firms outsource scarce spatial data science skills.

Italy Geospatial Analytics Market Trends and Insights

Smart-city programme scale-up across major Italian municipalities

Milan deployed a city-scale digital twin that integrates 181 sq km of urban data, combining IoT sensors with geospatial analytics platforms to optimize traffic flow and building energy use. Turin extends lessons from the Lavazza campus twin to district-wide asset monitoring that cuts space-utilization costs by 12%. Bologna's smart-mobility control room processes 487,700 km of road data daily, lowering peak-hour congestion by 9%. Fifth-generation mobile coverage underpins data streaming, pushing cities to procure scalable cloud-native geospatial solutions. These projects serve as blueprints for replicable EU smart-city frameworks that reinforce Italy's geospatial analytics market demand.

Infrastructure health-monitoring push for bridges, dams and rail

After the Genoa disaster, Autostrade per l'Italia ran 1,407 drone sorties in 2024, improving defect detection by 11% through SAR-enhanced analytics. National guidelines now require millimeter-level deformation tracking across 60,000 bridges and 542 dams via satellite interferometry. Digital twins link satellite feeds with ground sensors, supplying predictive maintenance dashboards for rail assets spanning 16,800 km. Resulting budget reallocations secure multiyear contracts for analytics vendors and fuel Italy geospatial analytics market growth.

Shortage of advanced spatial-data-science talent

Seventy-six percent of Italian firms report hiring difficulties for spatial analytics roles as annual STEM graduates tally just 6,200. AI investment sits at 8.2% of overall IT budgets in 2024, lagging the EU average of 13.5%, underscoring under-skilled labor pipelines. Universities struggle to refresh curricula on cloud-native geospatial architectures, prompting enterprises to outsource functions to service providers, which, in turn, inflates project costs and slows Italy's geospatial analytics market penetration.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory BIM-GIS convergence under Public Works Code

- Parametric-insurance growth using geospatial risk scores

- Fragmented municipal procurement and long sales cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions accounted for 56.00% of Italy geospatial analytics market share in 2025 as buyers preferred end-to-end platforms for compliance and monitoring. Services posted a 12.55% CAGR, however, and are projected to narrow the gap, propelled by mandatory BIM-GIS rollouts that require specialized configuration expertise. The escalating skills shortage drives outsourcing, letting consultancies integrate cloud, AI, and geospatial functions on behalf of clients.

Italy geospatial analytics market size gains within services reflect demand for managed digital-twin operations, predictive-maintenance modeling, and automated feature extraction. Northern municipalities award multi-year contracts covering platform setup, workflow automation, and continuous data stewardship. SMEs pick subscription-based managed services to sidestep capital outlays, reinforcing double-digit growth momentum through 2031.

Surface analysis delivered 45.30% of the Italy geospatial analytics market size in 2025, underpinned by cadastral mapping and utility asset management. Geo-visualization analysis grows fastest at 13.4% CAGR as three-dimensional city twins and immersive dashboards hit mainstream adoption. Network analysis retains steady uptake in logistics by optimizing freight corridors that handle 144 billion tonne-kilometers annually.

Italy's geospatial analytics market share gains for geo-visualization stem from WebGL-enabled platforms that stream photorealistic models on commodity devices. Heritage-site custodians, including Milan's Castello Sforzesco, employ these tools to reconcile preservation mandates with urban-development pressures. Enterprises leverage 3D insights to shorten environmental-impact assessments and accelerate permit approvals.

The Italy Geospatial Analytics Market Report is Segmented by Offering (Solution, Service), Type (Surface Analysis, and More), End-User (Transportation and Logistics, Government and Defence, and More), Technology (GIS Software, Remote-Sensing and Earth Observation, and More), Deployment (Cloud, On-Premise), Organisation Size (Large Enterprises, Smes), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Airbus Defence and Space GmbH

- Ariespace S.r.l.

- e-Geos S.p.A.

- ESRI Italia S.r.l.

- Flypix AI GmbH

- Fugro N.V.

- GECOsistema S.r.l.

- Genius Loci S.r.l.

- HERE Technologies Italia S.r.l.

- Hexagon AB

- IPTSAT S.r.l.

- Latitudo 40 S.r.l.

- Planet Labs Italy S.r.l.

- Rheticus S.r.l.

- Telespazio S.p.A.

- TomTom Italia S.p.A.

- Trilogis S.r.l.

- TeamDev S.r.l.

- Topcon Positioning Italy S.r.l.

- Trimble Italy S.r.l.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Smart-city programme scale-up across major Italian municipalities

- 4.2.2 Infrastructure health-monitoring push for bridges, dams and rail

- 4.2.3 Copernicus and private EO constellations expanding data supply

- 4.2.4 Mandatory BIM-GIS convergence under new Public Works Code

- 4.2.5 Parametric-insurance growth using geospatial risk scores

- 4.2.6 EU RRF digital-twin funds for TEN-T corridors

- 4.3 Market Restraints

- 4.3.1 Availability of free/open geospatial data sets

- 4.3.2 Shortage of advanced spatial-data-science talent

- 4.3.3 Fragmented municipal procurement and long sales cycles

- 4.3.4 Heightened privacy scrutiny by Garante per la Protezione dati

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Type

- 5.2.1 Surface Analysis

- 5.2.2 Network Analysis

- 5.2.3 Geo-visualisation Analysis

- 5.3 By End-user

- 5.3.1 Transportation and Logistics

- 5.3.2 Government and Defence

- 5.3.3 Energy, Utilities and Mining

- 5.3.4 Banking, Financial Services and Insurance

- 5.3.5 Agriculture and Forestry

- 5.3.6 Real-Estate and Construction

- 5.3.7 Other End-users

- 5.4 By Technology

- 5.4.1 GIS Software

- 5.4.2 Remote-Sensing and Earth Observation

- 5.4.3 GNSS and Positioning

- 5.4.4 Spatial Data-Science and AI Platforms

- 5.5 By Deployment

- 5.5.1 Cloud

- 5.5.2 On-premise

- 5.6 By Organisation Size

- 5.6.1 Large Enterprises

- 5.6.2 SMEs

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Airbus Defence and Space GmbH

- 6.4.2 Ariespace S.r.l.

- 6.4.3 e-Geos S.p.A.

- 6.4.4 ESRI Italia S.r.l.

- 6.4.5 Flypix AI GmbH

- 6.4.6 Fugro N.V.

- 6.4.7 GECOsistema S.r.l.

- 6.4.8 Genius Loci S.r.l.

- 6.4.9 HERE Technologies Italia S.r.l.

- 6.4.10 Hexagon AB

- 6.4.11 IPTSAT S.r.l.

- 6.4.12 Latitudo 40 S.r.l.

- 6.4.13 Planet Labs Italy S.r.l.

- 6.4.14 Rheticus S.r.l.

- 6.4.15 Telespazio S.p.A.

- 6.4.16 TomTom Italia S.p.A.

- 6.4.17 Trilogis S.r.l.

- 6.4.18 TeamDev S.r.l.

- 6.4.19 Topcon Positioning Italy S.r.l.

- 6.4.20 Trimble Italy S.r.l.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment