PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906270

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906270

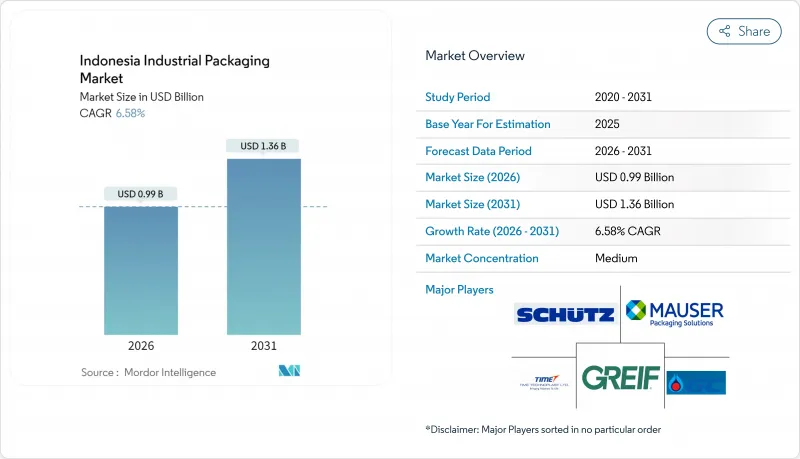

Indonesia Industrial Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indonesia industrial packaging market was valued at USD 0.93 billion in 2025 and estimated to grow from USD 0.99 billion in 2026 to reach USD 1.36 billion by 2031, at a CAGR of 6.58% during the forecast period (2026-2031).

This outlook reflects the country's position as Southeast Asia's largest economy, where rising petrochemical capacity, government-led nutrition programs, and an e-commerce boom continue to expand end-user demand for bulk and transit packaging solutions. Investments such as Chandra Asri's 4.2 MTPA integrated petrochemical complex and the Ministry of Finance's IDR 422.7 trillion (USD 25.8 billion) infrastructure budget in 2024 strengthen domestic supply chains and stimulate packaging consumption across chemicals, food, and construction verticals. At the same time, regulations targeting sachet waste, new food-contact standards, and evolving Extended Producer Responsibility (EPR) rules are reshaping material choices and accelerating paper- and fiber-based alternatives for direct-food applications.

Indonesia Industrial Packaging Market Trends and Insights

Accelerating Food and Beverage Processing Investments

Indonesia's Free Nutritious Meals program requires packaging for 190 million meals every day beginning in 2025, creating consistent demand for portion-controlled food-grade containers. PepsiCo's USD 200 million Cikarang plant, the country's largest single F&B investment in 2025, is outfitted with high-speed, aseptic lines that rely on barrier drums, retort pouches, and temperature-stable cartons. Domestic majors Indofood and Mayora expanded capacity in 2024, with Mayora investing IDR 2.526 trillion (USD 154 million) in new facilities that require modified-atmosphere and multilayer paper-based solutions. Growing middle-class consumption and a 270 million-strong population underpin continuing output growth across snacks, ready-to-drink beverages, and convenience meals. Together these factors reinforce a steady uptick in the Indonesia industrial packaging market as processors diversify pack formats to meet portability, shelf-life, and sustainability mandates.

Expansion of Chemicals and Petrochemicals Output

ExxonMobil's USD 15 billion integrated petrochemical complex and Lotte Chemical's ethylene cracker expansion represent the largest inflows of foreign capital into Indonesia's chemical value chain. Domestic resin supply from Chandra Asri's new 4.2 MTPA plant stabilizes input prices and drives higher adoption of large-volume drums, IBCs, and corrosion-resistant composite containers. Downstream growth in pharmaceuticals, agrochemicals, and specialty intermediates multiplies secondary demand for UN-approved packs and tamper-evident closures. National downstreaming policies that restrict raw material exports ensure more chemicals are processed locally, extending the addressable Indonesia industrial packaging market size for higher-value containment systems. Over the long term, chemical-cluster build-outs in Cilegon and Gresik support ongoing double-digit volume growth in bulk resin and solvent shipments.

Escalating Plastic-Waste Regulation and Compliance Costs

The Ministry of Environment has mandated a national phase-out of multilayer sachets by 2030, compelling converters to redesign packs and invest in mono-material laminates that are recyclable at scale. EPR rules require brand owners and pack producers to finance collection and recycling, adding 15-20% to unit production costs. BPOM's November 2024 food-contact regulation, notified to the WTO, imposes broad-spectrum migration testing and factory audits prior to commercialization. A new plastic-credit market introduced under Indonesia's January 2025 carbon trading platform further increases compliance burdens but opens revenue opportunities for high-recovery operators. These overlapping policies tighten margins and lengthen certification cycles within the Indonesia industrial packaging market, particularly for SME converters with limited capital.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce-Fuelled Surge in Logistics Parcel Volumes

- Infrastructure and Construction Boom Increasing Palletised Flows

- Volatile Polymer and Steel Feed-Stock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The plastic segment captured 47.12% of the Indonesia industrial packaging market share in 2025, supported by abundant domestic resin and well-established extrusion and blow-molding infrastructure. The Indonesia industrial packaging market size for plastic solutions is expected to remain sizeable through 2030 despite tightening single-use rules, as petrochemical expansion in West Java and Banten ensures stable feedstock. High-density polyethylene drums, polypropylene woven sacks, and multilayer films underpin bulk transport across chemicals, agrocommodities, and e-commerce sectors.

Paper and fiber-based materials post the highest 7.62% CAGR, propelled by BPOM's new SNI 8218:2024 food-contact standard that favors paperboard over polystyrene for direct-food packs. Corrugated grades for high-speed e-commerce lines, molded-fiber inserts, and laminated kraft sacks gain traction as brand owners adopt easy-recycling strategies. Metal, composite, and bio-based polymers fill niche requirements in corrosive chemical containment, high-temperature filling, and compostable foodservice items. Coke bottler PT Amandina Bumi Nusantara's 3,000 tons/month rPET line highlights the shift toward recycled content in beverage secondary packaging. Continuous material substitution and improved resin circularity will shape future demand patterns in the Indonesia industrial packaging industry.

Drums and barrels retained 34.92% of the Indonesia industrial packaging market size in 2025, serving as the default format for chemicals, lubricants, and construction additives. Their ubiquity stems from standardized pallets, forklift compatibility, and UN certification familiarity among Indonesian logistics providers.

Intermediate bulk containers are growing at an 7.97% CAGR, as smart factories adopt 1,000 L units with integrated level sensors and RFID tags that streamline inventory tracking. Mauser Packaging's 2024 partnership with RIKUTEC demonstrates a shift to double-walled, recycled-content IBC bottles that meet circularity targets. Pallets and crates benefit from e-commerce parcel handling and construction equipment logistics, while insulated containers expand in vaccine and biologics distribution across remote islands. Specialized packs for hazardous materials, battery electrolytes, and temperature-sensitive food ingredients round out the diversified product landscape in the Indonesia industrial packaging market.

The Indonesia Industrial Packaging Market Report is Segmented by Material (Plastics, Metal, and More), Product Type (Jerry Cans, Ibcs, and More), End-User Industry (Chemicals and Pharmaceuticals, Food and Beverage, Automotive, Oil Gas and Petrochemicals, and More), Packaging Capacity (<=50L, 51-500L, 501-1000L, 1001-2000L, >2000L). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Greif Inc.

- Mauser Packaging Solutions Holding Company

- SCHUTZ GmbH & Co. KGaA

- Time Technoplast Ltd.

- PTT Global Chemical Public Company Limited

- PT Kadujaya Perkasa

- PT Rheem Indonesia

- PT Repal Internasional Indonesia

- PT Prajamita Internusa

- PT Novo Complast Indonesia

- PT Yanasurya Bhaktipersada

- PT Dinito Jaya Sakti

- PT Indragraha Nusaplasindo

- PT Java Taiko

- Amcor plc

- Brambles Limited (CHEP Indonesia)

- Cabka N.V.

- Grecon Holding B.V.

- PT Plastpack Indonesia

- PT Mitra Indo Plast

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating food and beverage processing investments

- 4.2.2 Expansion of chemicals and petrochemicals output

- 4.2.3 E-commerce-fuelled surge in logistics parcel volumes

- 4.2.4 Infrastructure and construction boom increasing palletised flows

- 4.2.5 Added domestic resin capacity lowering input costs

- 4.2.6 AI-enabled smart-factory adoption demanding sensor-ready packaging

- 4.3 Market Restraints

- 4.3.1 Escalating plastic-waste regulation and compliance costs

- 4.3.2 Volatile polymer and steel feed-stock prices

- 4.3.3 Under-developed recycling/collection infrastructure

- 4.3.4 Trade-remedy tariffs on key inputs and finished packs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 The Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.2 Metal

- 5.1.3 Paper and Fiber-based

- 5.1.4 Other Materials

- 5.2 By Product Type

- 5.2.1 Jerry Cans

- 5.2.2 Intermediate Bulk Containers (IBCs)

- 5.2.3 Drums and Barrels

- 5.2.4 Crates and Pallets

- 5.2.5 Insulated Shipping Containers

- 5.2.6 Other Packaging Types

- 5.3 By End-user Industry

- 5.3.1 Chemicals and Pharmaceuticals

- 5.3.2 Food and Beverage

- 5.3.3 Automotive

- 5.3.4 Oil, Gas and Petrochemicals

- 5.3.5 Building and Construction

- 5.3.6 Other End-user Industries

- 5.4 By Packaging Capacity

- 5.4.1 <= 50 L

- 5.4.2 51 - 500 L

- 5.4.3 501 - 1,000 L

- 5.4.4 1,001 - 2,000 L

- 5.4.5 > 2,000 L

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Greif Inc.

- 6.4.2 Mauser Packaging Solutions Holding Company

- 6.4.3 SCHUTZ GmbH & Co. KGaA

- 6.4.4 Time Technoplast Ltd.

- 6.4.5 PTT Global Chemical Public Company Limited

- 6.4.6 PT Kadujaya Perkasa

- 6.4.7 PT Rheem Indonesia

- 6.4.8 PT Repal Internasional Indonesia

- 6.4.9 PT Prajamita Internusa

- 6.4.10 PT Novo Complast Indonesia

- 6.4.11 PT Yanasurya Bhaktipersada

- 6.4.12 PT Dinito Jaya Sakti

- 6.4.13 PT Indragraha Nusaplasindo

- 6.4.14 PT Java Taiko

- 6.4.15 Amcor plc

- 6.4.16 Brambles Limited (CHEP Indonesia)

- 6.4.17 Cabka N.V.

- 6.4.18 Grecon Holding B.V.

- 6.4.19 PT Plastpack Indonesia

- 6.4.20 PT Mitra Indo Plast

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment