PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906866

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906866

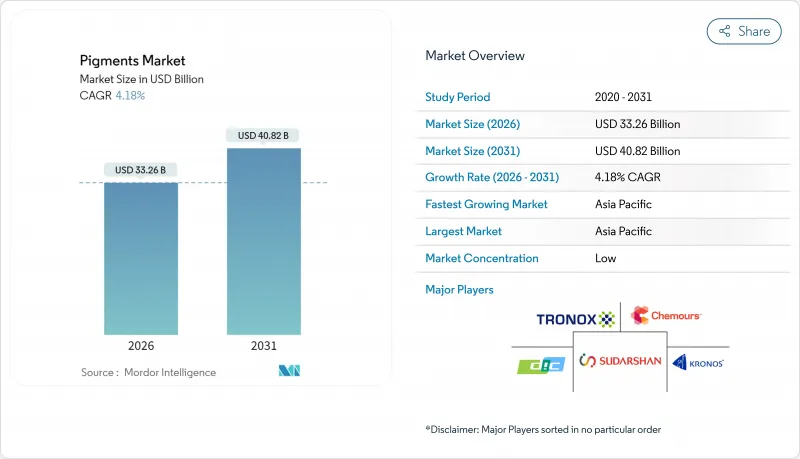

Pigments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Pigments Market was valued at USD 31.93 billion in 2025 and estimated to grow from USD 33.26 billion in 2026 to reach USD 40.82 billion by 2031, at a CAGR of 4.18% during the forecast period (2026-2031).

Resilient demand for construction, packaging, and mobility applications underpins this expansion even as producers navigate supply chain realignments and tightening safety rules. Inorganic grades retain cost-based advantages in bulk architectural coatings, while organic and specialty chemistries capture share in high-performance automotive and electronics uses. Regional diversification of titanium dioxide (TiO2) sourcing, coupled with initiatives to phase out PFAS and other restricted substances, is accelerating product reformulation activity across the pigments market. Competitive dynamics are further shaped by consolidation, exemplified by Kronos Worldwide's July 2024 acquisition of Louisiana Pigment Company, which is allowing scale players to streamline raw-material procurement and reinforce downstream distribution reach.

Global Pigments Market Trends and Insights

Surging Paints and Coatings Demand in Emerging Economies

Infrastructure programs in Indonesia, Nigeria, and Vietnam are driving a steady uptick in architectural coatings volumes, evidenced by Indonesia's paint output surpassing 1.00 million tons in October 2024. Growing cement capacity across sub-Saharan Africa-bolstered by nine Chinese-backed projects completed in 2023 and five more slated for 2024-continues to lift demand for construction-grade pigments. Governments' drive toward water-based, low-VOC formulations is forcing suppliers to deliver cost-competitive dispersions compatible with stricter emission limits. The result is a larger addressable base for mid-tier pigment producers able to localize blending and logistics operations near major construction clusters. Over the medium term, recurring housing and transport infrastructure outlays are expected to translate into multi-year offtake contracts that stabilize volumes even when private sector repaint cycles slow.

Regulatory Push Toward Eco-Friendly/Bio-Based Pigments

Global regulators are methodically narrowing the palette of allowable pigment chemistries. California's AB 418 will prohibit TiO2 in foods from January 2025, while New Zealand's cosmetics ban on PFAS enters force in December 2026. Large formulators such as L'Oreal have pledged to source 95% bio-based ingredients by 2030, signaling an industry-wide pivot toward renewable colorants. Academic and industrial programs are commercializing seaweed-derived phycobiliproteins and fucoxanthin using enzyme-assisted extraction and hydrodynamic cavitation, achieving color strength comparable with conventional azo pigments. As compliance costs rise for incumbent chemistries, early-scale bio-based suppliers can exploit a pricing corridor that was previously unavailable in volume markets. Adoption, however, hinges on overcoming the capital cost of new biorefinery infrastructure and meeting the durability expectations of demanding end uses such as outdoor coatings.

Stringent Environmental and Toxicology Regulations

OEKO-TEX updated its restricted-substance testing protocol in October 2024 to include alkaline hydrolysis screening for PFAS, and Canada enacted a nationwide coal-tar ban in March 2025. EU REACH Entry 79 introduced PFHxA controls in the same month, while several U.S. states imposed PFAS prohibitions on textiles from January 2025. Each new rule forces pigment suppliers to validate alternative chemistries and establish dual inventories to serve jurisdictions with divergent thresholds. Compliance requires sophisticated quality-management systems under ISO 22716, raising fixed costs that smaller producers struggle to absorb. The immediate impact is a wave of capacity rationalization in mature markets, reducing tactical price competition but heightening strategic barriers for new entrants.

Other drivers and restraints analyzed in the detailed report include:

- Rising Adoption of High-Performance and Effect Pigments

- Nano-Enabled Digital and 3-D Printing Applications

- Raw-Material Price Volatility (TiO2, Iron-Oxide Feedstocks)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The inorganic cluster maintained 75.42% share of the pigments market in 2025, a position anchored by TiO2's indispensability for opacity and whiteness in architectural and packaging formulations. Within this cohort, iron oxides continue to dominate masonry coatings and construction materials thanks to cost and durability advantages. Organic pigments, although smaller in volume, are set to advance at a 5.18% CAGR to 2031, leveraging superior chroma and regulatory headroom in applications that demand low heavy-metal content. High-performance quinacridones and perylenes now populate automotive basecoats, while diketopyrrolo-pyrrole reds are penetrating consumer electronics housings. Specialty sub-segments, such as thermochromic and magnetic pigments, are winning premium contracts in security printing and electronic component marking.

Cost inflation for titania feedstock is tilting certain flexible-packaging jobs toward high-opacity organic alternatives, though functional equivalence still limits broader substitution. The introduction of zinc-oxide UV blockers in sun-care cosmetics is driving incremental growth for mineral pigments, offsetting softer demand in legacy paper applications. Carbon blacks retain a stable foothold in conductive polymer compounds and toner systems. Overall, the inorganic segment's maturity has shifted competitive emphasis toward process efficiency, whereas organic suppliers compete on molecular innovation and end-user collaboration.

The Pigments Report is Segmented by Product Type (Inorganic Pigments, Organic Pigments, and Specialty Pigments and Other Product Types), Application (Paints and Coatings, Textiles, Printing Inks, Plastics, Leather, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held a 45.60% share of global revenue in 2025 and is expected to post the fastest 5.32% CAGR through 2031, cementing its lead in both scale and momentum. China accounts for roughly half of regional pigment output and continues to influence global price discovery through its TiO2 capacity swings and energy-intensity levies. India's production-linked incentives for specialty chemistry are encouraging joint ventures with Japanese and European pigment majors, thereby broadening the region's product breadth. Indonesia's output of architectural coatings exceeded 1.00 million tons in late 2024, signaling a maturing domestic market with rising quality expectations.

North America and Europe, though collectively smaller in volume, are pivoting toward value-add niches that reward technical differentiation and supply-chain security. U.S. federal funding for specialty chemicals under defense authorization acts is channeling capital into domestic pigment intermediates, partially insulating buyers from geopolitical disruptions.

The Middle East and Africa are emerging as opportunistic growth zones. Gulf Cooperation Council countries are investing in chloride-route TiO2 as part of downstream diversification, while North African textile clusters are courting European brands seeking near-shore sourcing. South America's trajectory is tied to macroeconomic stabilization and commodity export cycles that affect infrastructure spending and automotive assembly volumes.

- ALTANA

- Cathay Industries

- DIC Corporation

- Heubach GmbH

- Kronos Worldwide, Inc.

- Lanxess

- LB Group

- Shepherd Color

- Sudarshan Chemical Industries Limited (Heubach GmbH)

- The Chemours Company

- Tronox Holdings Plc

- Trust Chem Co., Ltd.

- Venator Materials PLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging paints and coatings demand in emerging economies

- 4.2.2 Regulatory push toward eco-friendly/bio-based pigments

- 4.2.3 Rising adoption of high-performance and effect pigments

- 4.2.4 Nano-enabled digital and 3-D printing applications

- 4.2.5 Supply-chain localization incentives in US-EU

- 4.3 Market Restraints

- 4.3.1 Stringent environmental and toxicology regulations

- 4.3.2 Raw-material price volatility (TiO2, iron-oxide feedstocks)

- 4.3.3 Nano-particle food-grade bans (E171, cosmetics limits)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Inorganic Pigments

- 5.1.1.1 Titanium Dioxide

- 5.1.1.2 Zinc Oxide

- 5.1.1.3 Other Product Types (Carbon Pigments, Dry Earth, Ultramarine Pigments, Cadmium, Lead Chromate, and Others)

- 5.1.2 Organic Pigments

- 5.1.3 Specialty Pigments and Other Product Types (Functional Pigments, Magnetic Pigments, and Others)

- 5.1.1 Inorganic Pigments

- 5.2 By Application

- 5.2.1 Paints and Coatings

- 5.2.2 Textiles

- 5.2.3 Printing Inks

- 5.2.4 Plastics

- 5.2.5 Leather

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ALTANA

- 6.4.2 Cathay Industries

- 6.4.3 DIC Corporation

- 6.4.4 Heubach GmbH

- 6.4.5 Kronos Worldwide, Inc.

- 6.4.6 Lanxess

- 6.4.7 LB Group

- 6.4.8 Shepherd Color

- 6.4.9 Sudarshan Chemical Industries Limited (Heubach GmbH)

- 6.4.10 The Chemours Company

- 6.4.11 Tronox Holdings Plc

- 6.4.12 Trust Chem Co., Ltd.

- 6.4.13 Venator Materials PLC

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment