PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906869

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906869

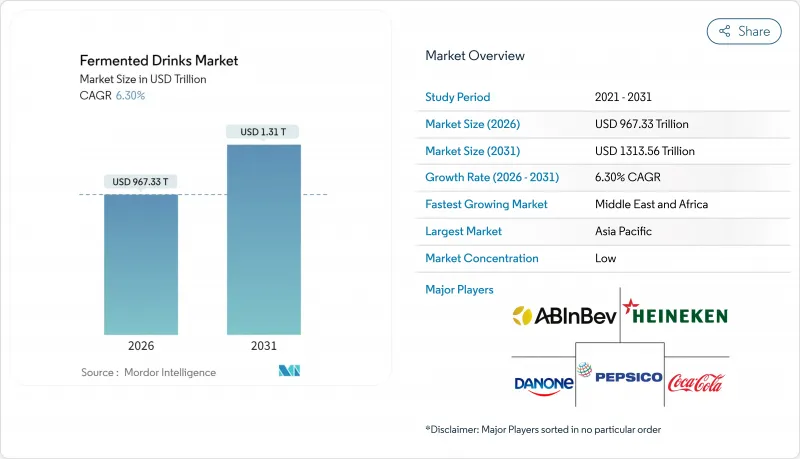

Fermented Drinks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The fermented drinks market was valued at USD 910 billion in 2025 and estimated to grow from USD 967.33 billion in 2026 to reach USD 1,313.56 billion by 2031, at a CAGR of 6.30% during the forecast period (2026-2031).

Sustained momentum reflects a confluence of long-term shifts-ranging from growing interest in functional gut-health solutions to widespread sustainability commitments-that are broadening the category well beyond traditional alcohol consumption. Consumers are gravitating toward low- or no-alcohol alternatives, probiotics, and circular-economy product stories, allowing manufacturers to address multiple lifestyle priorities in one purchase. Precision-controlled fermentation enables superior flavor consistency and sugar reduction, letting brands comply with tightening front-of-pack rules without compromising taste. Meanwhile, relaxed regulations for beverages at or below 0.5% ABV are lowering barriers for innovators to introduce sophisticated, lightly fermented options that appeal to sober-curious audiences. On the supply side, investments in high-throughput microbial screening, CO2 recovery systems, and waste-to-substrate conversion are enhancing cost efficiency, product quality, and environmental performance, reinforcing the sector's resilience.

Global Fermented Drinks Market Trends and Insights

Rising Demand for Probiotic-Rich Functional Beverages

Consumer focus on digestive wellness is spurring record demand for live-culture drinks. Research demonstrates that probiotic beverages improve absorption of bioactive compounds and provide measurable immune benefits, with kombucha exhibiting antimicrobial and anti-inflammatory effects. The United States Food and Drug Administration is clarifying structure-function claim wording, allowing brands to communicate probiotic counts and strain-specific advantages more confidently. Plant-based offerings such as water kefir and fermented fruit juices cater to lactose-intolerant and vegan consumers, broadening category reach while aligning with personalized-nutrition trends. As global functional beverage sales near USD 49 billion, fermented formulations remain at the forefront.

"Sober-Curious" Movement Accelerating Non-Alcoholic Options

Health-minded younger adults are trimming alcohol intake, accelerating demand for sophisticated low- and no-alcohol ferments. United Kingdom retail value for these offerings is set to rise 56% between 2024 and 2029, indicating enduring momentum. Breweries are employing non-conventional yeasts to build flavor complexity without boosting ethanol and are recycling spent substrates to meet circularity targets. Premium pricing shields margins, proving that reduced alcohol content need not erode profitability.

Volatile Supply of Quality SCOBY & Kefir Grains

Commercial production relies on starter cultures whose microbial complexity resists standardization, making supply tight and prices volatile. Water-kefir grain viability fluctuates with substrate shifts, disrupting batch consistency and shelf-life performance. Small enterprises in emerging markets often depend on imported cultures, adding cost and supply-chain risk. Biotechnological solutions such as banked microbial libraries and controlled propagation facilities require capital outlays that many artisanal brewers cannot yet afford.

Other drivers and restraints analyzed in the detailed report include:

- Craft Fermentation Tech Enabling Low-Sugar, Shelf-Stable Drinks

- Circular-Economy Upcycling of Food Waste into Substrates

- Sugar Taxes & Front-of-Pack Labeling Constraints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Beer commanded 62.74% of the fermented drinks market size in 2025, underscoring its entrenched consumption patterns and expansive distribution footprint. Brewers are refurbishing plants-Krombacher's EUR 100 million modernization is one example-to enable rapid SKU switching between classic lagers and alcohol-free extensions. Circular brewing initiatives recover CO2 and repurpose spent grain into high-value ingredients, supporting premium positioning while trimming carbon impacts. In parallel, large groups such as Asahi are leveraging proprietary postbiotics to differentiate functional extensions within the core portfolio.

Kombucha, though currently a niche, is advancing at a 13.05% CAGR, the fastest among beverage types, and is broadening beyond tea bases into apple and black carrot juices with superior flavonoid and phenolic profiles. Investments in microbial mapping deliver batch-to-batch flavor reliability, supporting mainstream grocer listings. Shelf-stable variants reduce reliance on refrigerated distribution, further amplifying reach.

The Fermented Drinks Market Report is Segmented by Beverage Type (Alcoholic Fermented Beverages, Non-Alcoholic Fermented Beverages), Distribution Channel (On-Trade, Off-Trade), Packaging Type (Bottles, Cans, Tetra Packs/Cartons, Kegs & Barrels, Others), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific leads the fermented products market due to cultural ties and robust domestic supply chains. Himalayan residents rely on fermented beverages for high-altitude nutrition, a practice supported by clinical studies highlighting cardiometabolic benefits. Urban millennials are adopting kombucha, blending ancient traditions with modern wellness trends. Governments in India, Thailand, and Vietnam are fostering rural employment and product innovation through grants to micro-processors.

In the Middle East and Africa, population growth and an underdeveloped retail network create opportunities for fermented drinks. Gulf consumers, with high disposable incomes, favor premium products, prompting brands to explore unique flavors like saffron-infused kefir. Sub-Saharan Africa faces cold-chain limitations, driving demand for shelf-stable or powdered probiotic formats. In Europe and North America, mature retail markets push brands to differentiate through functional claims such as immune support, energy, or beauty benefits, supported by transparent strain labeling. Regulatory changes like the expanded Soft Drinks Industry Levy are shaping formulations, promoting precision-controlled fermentation to reduce taxable sugar levels.

List of Companies Covered in this Report:

- Anheuser-Busch InBev SA/NV

- Heineken N.V.

- Carlsberg Group

- Paine Schwartz Partners (Suja Life LLC)

- The Boston Beer Company

- GT's Living Foods

- PepsiCo Inc. (KeVita)

- The Coca-Cola Company (Health-Ade)

- Danone SA

- Nestle SA

- Yakult Honsha Co. Ltd

- Bright Food (Group) Co. Ltd

- Schreiber Foods Inc.

- Bio-tiful Dairy Ltd

- Asahi Group Holdings

- Pernod Ricard SA

- Fentimans Ltd

- Remedy Drinks

- Kombucha Wonder Drink

- Lactalis Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for probiotic?rich functional beverages

- 4.2.2 "Sober-curious" movement accelerating non-alcoholic options

- 4.2.3 Craft fermentation tech enabling low-sugar, shelf-stable Drinks

- 4.2.4 Circular-economy upcycling of food waste into substrates

- 4.2.5 Regulatory relaxation for ?0.5 % ABV ready-to-drink products

- 4.2.6 Precision-fermentation starter cultures for novel flavours

- 4.3 Market Restraints

- 4.3.1 Volatile supply of quality SCOBY & kefir grains

- 4.3.2 Sugar taxes & front-of-pack labelling constraints

- 4.3.3 Cold-chain dependence in emerging markets

- 4.3.4 Microbial-contamination recall risks

- 4.4 Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Sustainability & Environmental Impact

- 4.8 Porter's Five Forces

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers/Consumers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Beverage Type

- 5.1.1 Alcoholic Fermented Beverages

- 5.1.1.1 Beer

- 5.1.1.2 Cider

- 5.1.1.3 Sake

- 5.1.1.4 Other Alcoholic

- 5.1.2 Non-alcoholic Fermented Beverages

- 5.1.2.1 Kombucha

- 5.1.2.2 Kefir

- 5.1.2.3 Fermented Dairy Drinks

- 5.1.2.4 Other Non-alcoholic

- 5.1.1 Alcoholic Fermented Beverages

- 5.2 By Distribution Channel

- 5.2.1 On-Trade

- 5.2.2 Off-Trade

- 5.2.2.1 Supermarkets/Hypermarkets

- 5.2.2.2 Convenience/Grocery Stores

- 5.2.2.3 Specialty Stores

- 5.2.2.4 Online Retail Stores

- 5.3 By Packaging Type

- 5.3.1 Bottles (Glass & PET)

- 5.3.2 Cans

- 5.3.3 Tetra Packs/Cartons

- 5.3.4 Kegs & Barrels

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Netherlands

- 5.4.2.8 Poland

- 5.4.2.9 Belgium

- 5.4.2.10 Sweden

- 5.4.2.11 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Thailand

- 5.4.3.7 Singapore

- 5.4.3.8 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Anheuser-Busch InBev SA/NV

- 6.4.2 Heineken N.V.

- 6.4.3 Carlsberg Group

- 6.4.4 Paine Schwartz Partners (Suja Life LLC)

- 6.4.5 The Boston Beer Company

- 6.4.6 GT's Living Foods

- 6.4.7 PepsiCo Inc. (KeVita)

- 6.4.8 The Coca-Cola Company (Health-Ade)

- 6.4.9 Danone SA

- 6.4.10 Nestle SA

- 6.4.11 Yakult Honsha Co. Ltd

- 6.4.12 Bright Food (Group) Co. Ltd

- 6.4.13 Schreiber Foods Inc.

- 6.4.14 Bio-tiful Dairy Ltd

- 6.4.15 Asahi Group Holdings

- 6.4.16 Pernod Ricard SA

- 6.4.17 Fentimans Ltd

- 6.4.18 Remedy Drinks

- 6.4.19 Kombucha Wonder Drink

- 6.4.20 Lactalis Group

7 Market Opportunities and Future Outlook