PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906919

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906919

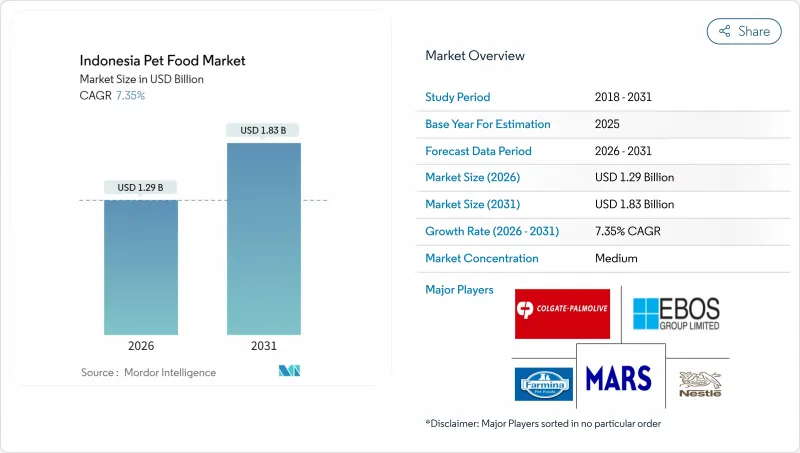

Indonesia Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indonesian pet food market was valued at USD 1.20 billion in 2025 and estimated to grow from USD 1.29 billion in 2026 to reach USD 1.83 billion by 2031, at a CAGR of 7.35% during the forecast period (2026-2031).

Healthy household income growth, a visible shift toward pet humanization, and accelerating e-commerce adoption collectively strengthen demand, while stringent halal certification rules reshape production strategies. Food products remain the core revenue engine, yet functional nutraceuticals quickly expand as owners prioritize preventive care. Java maintains its leadership position due to its dense urban population and superior logistics infrastructure, although Sumatra and Kalimantan are becoming increasingly attractive expansion corridors. Competitive intensity persists as multinational leaders deepen local manufacturing footprints and nimble Indonesian producers capitalize on price-sensitive segments, leaving room for differentiated propositions across price tiers.

Indonesia Pet Food Market Trends and Insights

Rising disposable income among middle-class pet owners

Disposable income in households earning more than IDR 7 million (USD 467) monthly expanded by 4.2% annually between 2020 and 2024. The additional spending power moves commercial pet food from a perceived luxury to a routine grocery item, particularly for first-time urban pet parents. Average monthly outlays on nutrition now reach IDR 300,000 (approximately USD 20.00) in Jakarta, far surpassing rural levels. This structural uplift fuels the demand for premium dry kibble, wet food, and functional treats, driving overall volume and value. Financial service firms launched accident and illness cover policies in 2024 that reimburse specialized diets, reinforcing owners' willingness to upgrade formulas. Brands positioned in the upper-mainstream tier benefit the most, as households trade up while still monitoring affordability. The driver remains strongest in Java, yet disposable income gains in the provincial capitals of Sumatra and Kalimantan replicate the pattern over the medium term.

Pet humanization driving premiumization

Urban millennials and Gen Z owners now consider pets as family members, raising expectations for ingredient transparency, life-stage specificity, and functional benefits . Human-grade meat proteins, grain-free recipes, and clean-label claims transition from niche to mainstream shelf presence. The mindset shift manifests in social media purchasing decisions, with viral product reviews on Instagram and TikTok accelerating brand discovery. Veterinarians amplify the trend through wellness education that links balanced diets with disease prevention, reinforcing demand for scientifically backed lines. As perceptions shift from "feed" to "nutrition," unit prices rise while owners opt for smaller pack sizes to manage their budgets. Premiumization also prompts manufacturers to invest in halo claims, such as sustainably sourced fishmeal and responsibly farmed poultry, thereby enhancing brand equity among affluent buyers.

Price sensitivity among lower-income owners

Owners often supplement their diets with table scraps or low-protein home-cooked meals, which can dampen the uptake of premium products. Local brands attempt to defend share via economy kibble containing regional carbohydrate fillers, but margins remain thin. Promotional bundling during Ramadan and school holidays temporarily boosts off-take, however, sustainable penetration requires further cost relief. Mobile payment discounts and sachet-size packaging show promise for gradually onboarding budget-constrained households into regular purchasing cycles.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of e-commerce pet food sales

- Growing cat population in urban households

- Limited cold-chain beyond tier-1 cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The food segment accounted for a significant 68.85% share of the Indonesian pet food market in 2025, primarily due to the widespread adoption of dry kibble and the growing presence of wet food in urban areas. The segment offers broad price ladders, enabling participation from economy to ultra-premium tiers, and captures cross-promotions with treats and toppers that lift average basket values. Manufacturers localize flavor palettes with chicken, tuna, and milk-based variants to align with Indonesian taste preferences. Shelf-stable dry offerings benefit from climate resilience, while pet owners in Java are increasingly experimenting with wet pouches as the reliability of cold chains improves. Pet nutraceuticals chart the fastest 10.10% CAGR and progressively reshape perceptions around preventive pet healthcare. Supplements featuring omega-3s, joint support collagen, or probiotic blends ride on veterinarian endorsements that link functional ingredients to tangible health outcomes.

The treats subcategory mirrors human snack trends, with freeze-dried meats and limited-ingredient jerky outperforming classic biscuits. Veterinary diets, although niche in volume, secure high margins and solidify professional channel credibility for multinationals. Domestic producers explore co-manufacturing agreements to tap the rising demand for prescription formulas without undertaking expensive R&D pipelines. Across all product lines, flavor authenticity, palatability, and texture innovation remain recurring themes that sway repeat purchases in the Indonesia pet food market.

Indonesia Pet Food Market is Segmented by Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, Pet Veterinary Diets), by Pets (Cats, Dogs, Other Pets), and by Distribution Channel (Convenience Stores, Online, Specialty Stores, Supermarkets/Hypermarkets, Other Channels). The Market Forecasts are Provided in Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Adabi Consumer Industries Sdn Bhd

- ADM

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- EBOS Group Limited

- FARMINA Pet Foods

- Mars Incorporated

- Nestle (Purina)

- PLB International

- Schell and Kampeter Inc. (Diamond Pet Foods)

- Vafo Praha s.r.o.

- PT Central Proteina Prima Tbk

- WellPet LLC

- Perfect Companion Group Co. Ltd

- Spectrum Brands Holdings Inc. (United Pet Nutrition)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY AND PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain and Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Rising disposable income among middle-class pet owners

- 5.5.2 Pet humanization driving premiumization

- 5.5.3 Expansion of e-commerce pet food sales

- 5.5.4 Growing cat population in urban households

- 5.5.5 Government incentives lowering ingredient costs

- 5.5.6 Halal certification as a purchase differentiator

- 5.6 Market Restraints

- 5.6.1 Price sensitivity among lower-income owners

- 5.6.2 Limited cold-chain beyond tier-1 cities

- 5.6.3 Volatile domestic fishmeal and poultry by-products supply

- 5.6.4 Sustainability-driven reformulation costs

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals and Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft and Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Derma Diets

- 6.1.4.1.2 Diabetes

- 6.1.4.1.3 Digestive Sensitivity

- 6.1.4.1.4 Obesity Diets

- 6.1.4.1.5 Oral Care Diets

- 6.1.4.1.6 Renal

- 6.1.4.1.7 Urinary Tract Disease

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.6.1 Adabi Consumer Industries Sdn Bhd

- 7.6.2 ADM

- 7.6.3 Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- 7.6.4 EBOS Group Limited

- 7.6.5 FARMINA Pet Foods

- 7.6.6 Mars Incorporated

- 7.6.7 Nestle (Purina)

- 7.6.8 PLB International

- 7.6.9 Schell and Kampeter Inc. (Diamond Pet Foods)

- 7.6.10 Vafo Praha s.r.o.

- 7.6.11 PT Central Proteina Prima Tbk

- 7.6.12 WellPet LLC

- 7.6.13 Perfect Companion Group Co. Ltd

- 7.6.14 Spectrum Brands Holdings Inc. (United Pet Nutrition)

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOs