PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907334

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907334

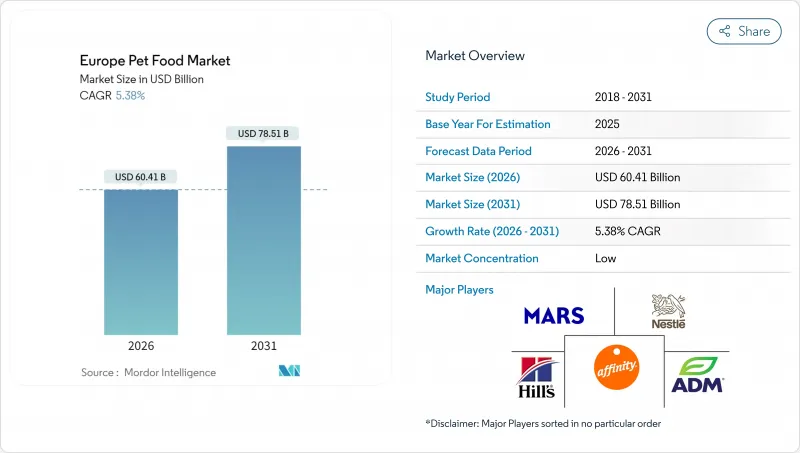

Europe Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe pet food market size in 2026 is estimated at USD 60.41 billion, growing from 2025 value of USD 57.33 billion with 2031 projections showing USD 78.51 billion, growing at 5.38% CAGR over 2026-2031.

Momentum is powered by premiumization, pet humanization, and demographic shifts toward single-person households that devote steady discretionary budgets to companion-animal nutrition. Functional ingredients, such as probiotics, omega fatty acids, and joint-support complexes, are now appearing in mainstream SKUs (Stock Keeping Units), underpinning a value mix that favors higher price points. Online and direct-to-consumer channels are scaling quickly as European shoppers adopt subscription models that deliver personalized diets. Top manufacturers are investing in alternative proteins to align with the European Green Deal and future-proof raw-material supply chains.

Europe Pet Food Market Trends and Insights

Premiumization and Pet Humanization

European pet owners are increasingly viewing animals as family members, fundamentally reshaping their purchasing decisions toward premium, science-backed nutrition products. This humanization trend has accelerated post-pandemic, as remote work arrangements have deepened human-animal bonds. In 2024, 73% of European pet owners consider their pets' nutritional needs to be equivalent to those of their human family members. The shift is evident in the growing demand for organic, grain-free, and veterinary-recommended formulations, with premium products commanding price premiums of 40-60% over conventional alternatives. The trend's sustainability is reinforced by European consumers' willingness to reduce personal spending without compromising the quality of pet nutrition.

Rising Pet Ownership and Single-Person Households

Europe's demographic shift toward single-person households, which accounted for 41.4% of all households in 2024, compared to 32.8% in 2010, creates sustained demand for companion animals and their associated nutritional products . This demographic shift is particularly pronounced in urban centers, where aging populations and delayed family formation lead to pet adoption as a means of emotional companionship. Single-person households typically allocate higher per-capita spending to pet care, with an average annual expenditure on pet food that is 35% higher than in multi-person households, due to fewer competing financial priorities. The trend is reinforced by European housing policies that increasingly accommodate pet ownership in rental properties, thereby removing traditional barriers to pet adoption.

Raw Material Price Volatility for Meat and Grains

Commodity price fluctuations for meat meals, grains, and specialized ingredients have intensified since 2024, with wheat prices experiencing 25-30% volatility and meat meal costs surging 35-40% due to African swine fever outbreaks and climate-related supply disruptions . These input cost pressures particularly impact mid-tier manufacturers lacking vertical integration or commodity hedging capabilities, forcing difficult decisions between margin compression and retail price increases that risk consumer defection. Premium brands with strong consumer loyalty demonstrate greater pricing power, while private-label producers benefit from retailer support in managing cost volatility. The challenge is compounded by European consumers' price sensitivity during economic uncertainty, limiting manufacturers' ability to pass through full cost increases.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Growth of E-commerce and Direct-to-Consumer Subscriptions

- Private-Label Consolidation Expanding Price-Competitive Capacity

- Stringent European Union Additive and Labeling Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food dominates the market with a 66.65% market share in 2025, reflecting European preferences for comprehensive nutrition solutions over supplemental treats and accessories. This substantial market share is primarily driven by the essential nature of pet food products in meeting daily nutritional requirements. Within this segment, dry pet foods emerge as the preferred choice among pet owners due to their convenience, long shelf life, nutritional balance, and cost-effectiveness compared to wet pet food market products. The segment's growth is further supported by the increasing shift from homemade meals to commercial pet food products, particularly in urban areas where convenience and nutritional optimization are prioritized.

Pet nutraceuticals/supplements represent the fastest-growing product segment, with a 7.95% CAGR through 2031, driven by increasing pet health awareness and veterinary recommendations for preventive nutrition strategies. The segment's expansion is particularly notable in premium markets where pet owners are increasingly investing in supplements containing vitamins, minerals, omega-3 fatty acids, and probiotics to enhance their pets' overall health and well-being. The growth is further supported by veterinarians' recommendations and the rising adoption of holistic approaches to pet care, especially in countries like the United Kingdom, Germany, and France, where pet health awareness is particularly high.

The Europe Pet Food Market Report is Segmented by Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, and More), Pets (Cats, Dogs, and Other Pets), Distribution Channel (Convenience Stores, Online Channel, and More), and Geography (France, Germany, Italy, Netherlands, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Mars, Incorporated

- Nestle (Purina)

- Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- General Mills Inc.

- Affinity Petcare S.A

- Archer Daniels Midland (ADM)

- Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- Schell & Kampeter, Inc. (Diamond Pet Foods)

- Heristo aktiengesellschaft

- Virbac

- Deuerer GmbH

- Partner in Pet Food

- Monge & C. S.p.A.

- Farmina Pet Foods

- Vafo Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY AND PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain and Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Premiumization and pet humanization

- 5.5.2 Rising pet ownership and single-person households

- 5.5.3 Rapid growth of e-commerce and DTC (Direct-to-Consumer) subscriptions

- 5.5.4 Private-label consolidation expanding price-competitive capacity

- 5.5.5 European Union Green Deal pressure spurring alternative-protein innovation

- 5.5.6 Veterinary-service inflation pushing owners toward preventive nutrition

- 5.6 Market Restraints

- 5.6.1 Raw-material price volatility for meat and grains

- 5.6.2 Stringent European Union additive and labeling regulations

- 5.6.3 Diversion of Category-3 animal fats to biofuels, tightening supply

- 5.6.4 Escalating veterinary costs squeezing discretionary pet-food spend

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals/Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft and Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Diabetes

- 6.1.4.1.2 Digestive Sensitivity

- 6.1.4.1.3 Oral Care Diets

- 6.1.4.1.4 Renal

- 6.1.4.1.5 Urinary tract disease

- 6.1.4.1.6 Obesity Diets

- 6.1.4.1.7 Derma Diets

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

- 6.4 Geography

- 6.4.1 Germany

- 6.4.2 France

- 6.4.3 Spain

- 6.4.4 Italy

- 6.4.5 United Kingdom

- 6.4.6 Poland

- 6.4.7 Russia

- 6.4.8 Netherlands

- 6.4.9 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments)

- 7.6.1 Mars, Incorporated

- 7.6.2 Nestle (Purina)

- 7.6.3 Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- 7.6.4 General Mills Inc.

- 7.6.5 Affinity Petcare S.A

- 7.6.6 Archer Daniels Midland (ADM)

- 7.6.7 Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- 7.6.8 Schell & Kampeter, Inc. (Diamond Pet Foods)

- 7.6.9 Heristo aktiengesellschaft

- 7.6.10 Virbac

- 7.6.11 Deuerer GmbH

- 7.6.12 Partner in Pet Food

- 7.6.13 Monge & C. S.p.A.

- 7.6.14 Farmina Pet Foods

- 7.6.15 Vafo Group

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS