PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906952

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906952

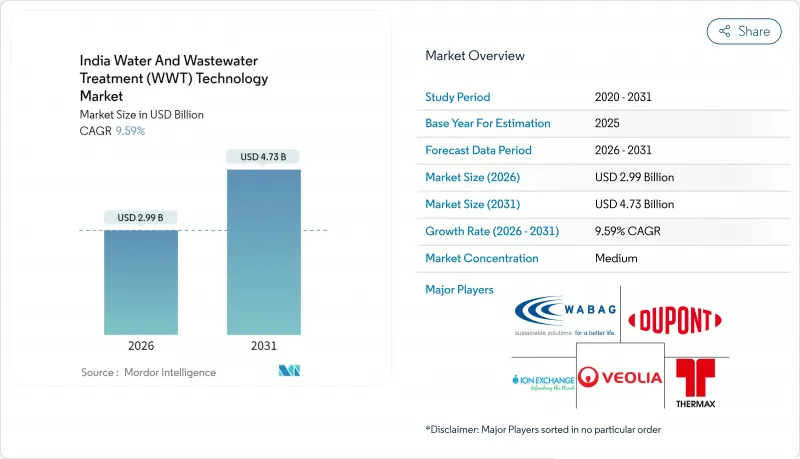

India Water And Wastewater Treatment (WWT) Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India Water and Wastewater Treatment Technology (WWT) market is expected to grow from USD 2.73 billion in 2025 to USD 2.99 billion in 2026 and is forecast to reach USD 4.73 billion by 2031 at 9.59% CAGR over 2026-2031.

Rapid urbanisation, stricter discharge norms, and accelerating corporate sustainability programs lift demand for advanced purification, reuse, and recycling assets. The India water treatment market benefits from Zero-Liquid-Discharge (ZLD) mandates that push red-category industries toward high-recovery membrane trains, while federal schemes such as AMRUT 2.0 and Swachh Bharat Mission channel record funding into tertiary reuse at municipal plants. Persistent freshwater stress has led to a decline in national per-capita availability, which has slipped below 1,500 m3 per year, keeping the spotlight on desalination, brine minimization, and decentralized modular systems. The India water treatment market now represents a crucial lever for factories, utilities, and data-centre developers seeking license-to-operate and brand credibility.

India Water And Wastewater Treatment (WWT) Technology Market Trends and Insights

Intensifying Scarcity of Per-capita Freshwater Reserves

Per-capita freshwater availability has slipped to 1,486 m3 annually, classifying the country as water-stressed by international benchmarks. About 70% of surface reserves exhibit varying contamination levels, forcing utilities and industries to escalate treatment capacity. The India water treatment market sees robust uptake of high-recovery reverse-osmosis (RO) lines now delivering 60-80% water reclamation in refinery, textile, and pharma facilities. Integrated watershed projects demonstrate potential impact; Indian Multinational Conglomerate (ITC)'s basin-restoration program generated a 152 million kL surplus in the South Pennar basin after reversing a 62 million kL deficit. Water-intensive factories increasingly test closed-loop operations and atmospheric water generators to de-risk supply shocks. These trends reinforce long-term demand for modular zero liquid discharge (ZLD) systems, nano-filtration polishing steps, and smart leak-detection networks across the India water treatment market.

Mandatory Zero-Liquid-Discharge (ZLD) Legislation for Red-Category Industries

The Ministry of Environment, Forest and Climate Change has tightened ZLD enforcement across chemicals, dyes, and pharmaceuticals, spawning a multibillion-dollar compliance pool. Gujarat leads with cluster-wide implementation, while Maharashtra recently extended textiles and food processing coverage. Hindustan Unilever achieved ZLD at 26 of 28 factories via vacuum evaporation coupled with advanced RO, underscoring viable pathways for large corporates. Contract awards to VA Tech Wabag and Thermax for fully integrated ZLD trains illustrate rising technology complexity and scale. Compliance cost ranges from INR 15-25 crore for mid-sized pharma units to more than INR 100 crore (USD 11.6 Million) for large petrochemical hubs, cementing the India water treatment market as a strategic capex priority.

High Capex and O&M Cost of Advanced Treatment Trains

ZLD-ready facilities cost INR 15-25 crore for mid-scale pharma plants and surpass INR 100 crore (USD 11.6 Million) in large chemical estates, while membrane bioreactors consume 0.4-0.8 kWh/m3-double conventional activated-sludge energy draw. Upfront and recurring outlays deter small enterprises, often swallowing 3-5% of total production expense. Nevertheless, green-building projects such as Oberoi Realty's mixed-use complexes cut lifecycle spend 15-25% by bundling variable-frequency drives and smart blowers. Phased modularity and performance-based leases further dilute capex, gradually easing this brake on the India water treatment market.

Other drivers and restraints analyzed in the detailed report include:

- Swachh Bharat and AMRUT 2.0 Funding Push for Tertiary Reuse

- Corporate ESG-Linked Financing Tied to Wastewater Recycling Targets

- Fragmented Municipal Procurement and Delayed Payment Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Treatment Equipment commanded 89.53% of the India Water and Wastewater Treatment (WWT) Technology Market share in 2025. Reverse-osmosis skids from 250 LPH to multi-MLD dominate industrial installations, achieving 60-80% recovery with anti-scalant dosing and energy-recovery turbines. Membrane bioreactors tolerate mixed-liquor levels up to 12,000 mg/L, compressing plant footprint by 40-60% versus aerated lagoons while delivering effluent fit for cooling towers and landscape reuse. Dissolved-solids removal couples multi-pass RO with ion-exchange polishers in pharmaceutical and semiconductor lines to meet water for injection (WFI) and ultrapure water specs. Oil-water separators and dissolved-air flotation continue to protect downstream membranes in refinery, petrochemical, and metal-finishing sectors.

Process Control Equipment and Pumps represent the fastest-rising slice of the India Water and Wastewater Treatment (WWT) Technology Market, posting an 11.23% CAGR through 2031. Variable-frequency drives, magnetically levitated blowers, and high-efficiency IE4 motors trim aeration and pumping energy by 15-25%. IoT-enabled sensors trigger predictive maintenance, letting operators swap cartridges or membranes before fouling spikes. Edge-deployed PLC-SCADA panels now integrate cloud dashboards, turning mobile apps into compliance guardians for resource-constrained Tier-3 facilities. These layers of digitalization cement the India water treatment market as a nucleus for Industry 4.0 in utilities.

The India Water and Wastewater Treatment (WWT) Technology Market Report is Segmented by Equipment Type (Treatment Equipment (Oil/Water Separation and More) and Process Control Equipment and Pumps), End-User Industry (Municipal, Food and Beverage, Pulp and Paper, Oil and Gas, Healthcare, Poultry and Agriculture, Chemical and Petrochemical, and Other End-User Industries). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Aquatech

- Deccan Water Treatment Pvt. Ltd.

- DuPont

- Ecolab

- Hitachi India

- IEI

- Mott MacDonald

- NETSOL WATER SOLUTIONS PVT. LTD.

- Siemens

- Thermax Limited

- Triveni Engineering and Industries Limited

- Veolia

- WABAG

- Xylem

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Intensifying Scarcity of Per-capita Freshwater Reserves

- 4.2.2 Mandatory Zero-liquid-discharge (ZLD) Legislation for "red-category" Industries

- 4.2.3 Swachh Bharat and AMRUT 2.0 Funding Push for Tertiary Reuse

- 4.2.4 Corporate ESG-linked Financing Tied to Wastewater Recycling Targets

- 4.2.5 Industrial Clusters' Demand for On-site Modular MBR Units

- 4.3 Market Restraints

- 4.3.1 High Capex and O and M Cost of Advanced Treatment Trains

- 4.3.2 Fragmented Municipal Procurement and Delayed Payment Cycles

- 4.3.3 Scarcity of Skilled O and M Workforce Outside Tier-1 Cities

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Equipment Type

- 5.1.1 Treatment Equipment

- 5.1.1.1 Oil/Water Separation

- 5.1.1.2 Suspended Solids Removal

- 5.1.1.3 Dissolved Solids Removal

- 5.1.1.4 Biological Treatment/Nutrient and Metals Recovery

- 5.1.1.5 Disinfection/Oxidation

- 5.1.1.6 Other Treatment Equipment

- 5.1.2 Process Control Equipment and Pumps

- 5.1.1 Treatment Equipment

- 5.2 By End-user Industry

- 5.2.1 Municipal

- 5.2.2 Food and Beverage

- 5.2.3 Pulp and Paper

- 5.2.4 Oil and Gas

- 5.2.5 Healthcare

- 5.2.6 Poultry and Agriculture

- 5.2.7 Chemical and Petrochemical

- 5.2.8 Other End-user Industries

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Aquatech

- 6.4.2 Deccan Water Treatment Pvt. Ltd.

- 6.4.3 DuPont

- 6.4.4 Ecolab

- 6.4.5 Hitachi India

- 6.4.6 IEI

- 6.4.7 Mott MacDonald

- 6.4.8 NETSOL WATER SOLUTIONS PVT. LTD.

- 6.4.9 Siemens

- 6.4.10 Thermax Limited

- 6.4.11 Triveni Engineering and Industries Limited

- 6.4.12 Veolia

- 6.4.13 WABAG

- 6.4.14 Xylem

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Innovations in Water Treatment Technologies