PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906954

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906954

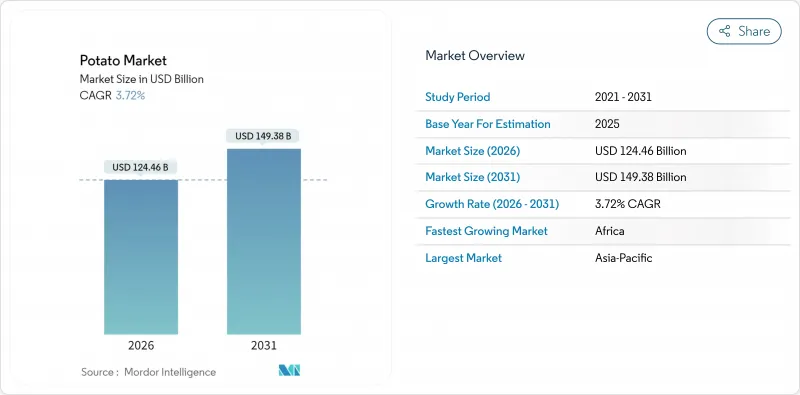

Potato - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The potato market was valued at USD 120 billion in 2025 and estimated to grow from USD 124.46 billion in 2026 to reach USD 149.38 billion by 2031, at a CAGR of 3.72% during the forecast period (2026-2031).

Rising demand from frozen processors, aggressive quick-service restaurant expansion, and adoption of climate-smart agronomy keep volumes growing even as weather shocks and regulatory costs create pricing volatility. Processors are locating new plants closer to croplands to trim freight costs, while growers invest in controlled-environment seed systems that lift yields and reduce disease losses. Government-backed breeding programs for drought and heat tolerance are gaining momentum in Africa, South Asia, and parts of Europe. Together, these forces are reshaping trade flows, prompting exporters to pivot toward higher-value cuts and organic offerings as consumer preferences shift toward premium and sustainably grown products.

Global Potato Market Trends and Insights

Rising Demand From Frozen Potato Product Processors

Industrial buyers now account for 60% of commercial output in developed economies as retail and institutional frozen segments join traditional QSR channels. McCain Foods invested EUR 350 million (USD 385 million) in regenerative supply programs covering 71% of its growers to ensure a steady raw-material flow and sustainability credentials. Premium cuts and organic variants command price uplifts that offset higher input costs for growers. Co-location of plants near croplands is reducing cold-chain spending and shrinkage. The push for plant-based alternatives is actually boosting potato volumes because processors rely on its familiar texture and starch profile.

Growth in Quick-Service Restaurant Chains

McDonald's plans 1,000 new Chinese outlets in 2025, aiming for 10,000 units by 2028, a 67% network jump that will intensify local procurement of fries-grade tubers. Chains are locking in multi-year contracts that reward growers meeting tight solids, sugar, and size specs, pushing specialty varieties into wider cultivation. Digital delivery platforms extend reach beyond shopping malls into suburban districts, raising throughput for central kitchens. Regional QSR operators across Africa and South America are replicating this model, creating cluster demand for frozen inputs and supporting new cold-storage projects.

Volatility of Farm-Gate Prices Due to Weather Shocks

European prices jumped 23% in 2024 after drought curbed yields, forcing buyers to seek imports at premiums. Russia's shortfall redirected flows from China, whose exports leaped fivefold to 46.7 thousand t, demonstrating how regional shocks echo through global trade. Insurance and forward contracts partly buffer risk, but coverage gaps persist in emerging markets where exposure is greatest.

Other drivers and restraints analyzed in the detailed report include:

- Government Support for Climate-Smart Potato Breeding

- Expansion of Controlled-Environment Agriculture for Seed Potatoes

- Stringent Pesticide Residue Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Geography Analysis

Asia-Pacific retains 50.18% of worldwide potato consumption in 2025. China's 95.6 million-ton crop and India's surge in new processing lines approved by the Ministry of Food Processing Industries underpin the region's dominance and accelerate demand for on-farm cold storage and logistics upgrades. The Ministry of Commerce confirmed that McDonald's China subsidiary secured foreign-investment clearance for a network expansion to 10,000 outlets by 2028, a move anticipated to lock in long-term contracts for fries-grade potatoes Regional growth over the next five years will rely on the rollout of aeroponic seed units and sensor platforms to smaller producers, initiatives already funded through the Asian Development Bank's AgriTech corridor program.

Africa delivers the fastest regional gains, with 5.08% CAGR through 2031. Nigeria's National Bureau of Statistics attributes rising output to government-financed irrigation corridors in Kaduna and Plateau States that lifted yields 18% over two seasons. Kenya's Ministry of Agriculture reports that distribution of foundation seed from aeroponic hubs increased certified-seed use among smallholders from 5% to 18% in 2024, translating into a 22% yield jump. South Africa's Department of Trade, Industry and Competition cleared two greenfield processing plants that will double national frozen-fries capacity by 2026, while Egypt's General Authority for Investment approved incentives that encourage multinational processors to locate cold-chain warehouses near Red Sea ports. Sustained growth hinges on timely road and cold-storage upgrades under the African Development Bank's Special Agro-Industrial Processing Zone program.

Russia's Federal State Statistics Service reported that adverse weather cut the 2024 harvest 14.5% to 7.3 million metric tons, underscoring climate risk across the wider region. Maintaining competitiveness through 2030 will require deeper uptake of regenerative farming methods supported by the EU Common Agricultural Policy and rapid deployment of heat-tolerant cultivars certified by the Community Plant Variety Office.

- Market Overview

- Market Drivers

- Market Restraints

- Value and Supply-Chain Analysis

- PESTLE Analysis

- Regulatory Landscape

- Technological Outlook

- List of Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from frozen potato product processors

- 4.2.2 Growth in quick-service restaurant chains

- 4.2.3 Government support for climate-smart potato breeding

- 4.2.4 Expansion of controlled-environment agriculture for seed potatoes

- 4.2.5 Increasing adoption of regenerative farming practices

- 4.2.6 Emerging carbon-credit revenue streams for growers

- 4.3 Market Restraints

- 4.3.1 Volatility of farm-gate prices due to weather shocks

- 4.3.2 Stringent pesticide residue regulations

- 4.3.3 Supply-chain disruptions from geopolitical conflicts

- 4.3.4 Rising competition from alternative carbohydrates (e.g., cassava)

- 4.4 Value and Supply-Chain Analysis

- 4.5 PESTLE Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Mexico

- 5.1.2 South America

- 5.1.2.1 Brazil

- 5.1.2.2 Argentina

- 5.1.3 Europe

- 5.1.3.1 Russia

- 5.1.3.2 France

- 5.1.3.3 United Kingdom

- 5.1.3.4 Italy

- 5.1.3.5 Germany

- 5.1.3.6 Spain

- 5.1.3.7 Belgium

- 5.1.3.8 Netherlands

- 5.1.4 Asia-Pacific

- 5.1.4.1 China

- 5.1.4.2 Japan

- 5.1.4.3 India

- 5.1.5 Middle East

- 5.1.5.1 Turkey

- 5.1.5.2 Iran

- 5.1.6 Africa

- 5.1.6.1 South Africa

- 5.1.6.2 Egypt

- 5.1.1 North America

6 Competitive Landscape

- 6.1 List of Stakeholders

- 6.1.1 McCain Foods Limited

- 6.1.2 J. R. Simplot Company

- 6.1.3 Lamb Weston Holdings, Inc.

- 6.1.4 PepsiCo, Inc. - Frito-Lay Division

- 6.1.5 Aviko B.V.

- 6.1.6 Farm Frites International B.V.

- 6.1.7 HZPC Holding B.V.

- 6.1.8 Agrico U.A.

- 6.1.9 Black Gold Farms, Inc.

- 6.1.10 Parkland Potato Varieties Ltd.

- 6.1.11 Albert Bartlett and Sons Limited

- 6.1.12 Wada Farms Marketing Group, LLC

- 6.1.13 Idahoan Foods, LLC

- 6.1.14 Stet Holland B.V.

- 6.1.15 Patatas Melendez S.L.

7 Market Opportunities and Future Outlook