PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906957

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906957

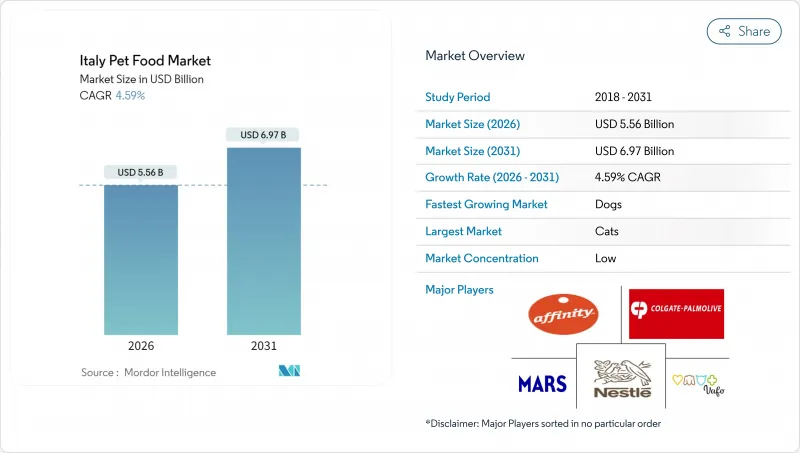

Italy Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Italy pet food market is expected to grow from USD 5.32 billion in 2025 to USD 5.56 billion in 2026 and is forecast to reach USD 6.97 billion by 2031 at 4.59% CAGR over 2026-2031.

Robust premiumization, rapid digital adoption, and sustained pet humanization keep the Italy pet food market on a steady upward course despite macro-economic headwinds. Discretionary purchasing power in Northern regions, regulatory approval for novel proteins, and a shift toward functional nutrition amplify value creation, while private-label rollouts widen access to quality offerings. Online subscription models, single-serve wet-food innovation, and domestic capacity investments strengthen supply resilience and product diversity. Competitive fragmentation allows regional specialists, veterinary-endorsed brands, and direct-to-consumer entrants to flourish alongside multinational leaders, intensifying innovation cycles and category differentiation across the Italy pet food market.

Italy Pet Food Market Trends and Insights

Premiumization Driven by Pet Humanization

Italian households increasingly treat companion animals as family members, reinforcing willingness to pay for human-grade ingredients, transparent labeling, and clinically substantiated functional benefits. Remote work patterns cemented during the pandemic deepened emotional bonds, with 73% of owners confirming higher nutrition spending in 2024. Premium claims now focus on organic certification, grain-free or limited-ingredient formulations, and targeted health outcomes such as joint mobility, cognitive support, or gut wellness. Regulatory guidance under FEDIAF compels evidence-based messaging, preventing cosmetic price mark-ups and fostering credible product development. Brands that marry scientific validation with storytelling resonate strongly, particularly among millennials and empty-nesters who channel discretionary income toward pet well-being. Single-serve wet-food lines, fresh-frozen subscriptions, and insect-protein recipes exemplify how the Italy pet food market converts human culinary trends into pet formats. As premiumization climbs the value ladder, volume growth slows yet average selling prices advance, sustaining revenue momentum even during inflationary cycles. This dynamic elevates margins for manufacturers capable of sourcing novel ingredients, executing small-batch production, and articulating verifiable functional claims.

Supermarket Private-Label Rollouts Expanding Volume

Leading grocery chains have deepened private-label penetration, widening affordable access and protecting margin during economic uncertainty. Coop Italia's 2024 range extension priced 20%-30% below national brands without sacrificing nutrient adequacy, leveraging contract manufacturing economies. Esselunga and Carrefour mirrored the strategy, pairing exclusive recipes with loyalty-card promotions that amplified household penetration in Northern catchment areas. Private-label ascendance disciplines incumbent brands to accelerate differentiation via science-backed claims, sustainable sourcing, or bespoke breed-specific diets. Retailers use real-time scanner data to refine assortments, prune slow-moving SKUs, and calibrate price architecture in line with disposable-income shifts. For Italian suppliers, supermarket affiliation secures scale, lowers logistics costs, and shortens innovation cycles thanks to collaborative product-development sprints. Consumer confidence in supermarket quality seals the proposition, expanding overall category volume and cushioning the Italy pet food market against down-trading to home-prepared meals.

Inflation-Linked Down-Trading to Economy Brands

Escalating feedstock and energy costs raise shelf prices, nudging budget-constrained households toward larger pack sizes, simplified ingredient decks, or economy labels. ISTAT recorded 34% of owners switching brands in 2024 to preserve feeding routines within tightened budgets . Although emotional attachment limits wholesale abandonment of quality standards, premium and super-premium tiers witness slowed volume, compelling manufacturers to optimize formulations and packaging weights. Retail data show accelerated rotation of mid-tier SKUs as shoppers stretch paychecks yet refuse nutritionally inferior options, placing private-label lines in a sweet spot between affordability and adequacy. Margin compression at the top end may temper R&D spending if inflationary pressure persists, though category innovation remains necessary to defend value. Over time, easing cost inflation or wage growth could restore premium momentum, but the immediate drag trims the Italy pet food market growth curve.

Other drivers and restraints analyzed in the detailed report include:

- Veterinary Endorsement of Functional Diets

- Rapid Growth of E-commerce Channels

- Declining Birth Rate Limiting New Pet Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food products commanded 67.48% of the Italy pet food market in 2025, underscoring their non-discretionary role in daily feeding routines and stable loyalty dynamics. Within this domain, dry kibble offers calorie-dense convenience and price efficiency, while wet formats intensify palatability and hydration, lifting average revenue per kilogram. The Italy pet food market size for Food is projected to rise steadily as premium fortification and protein diversification boost unit value. Pet Nutraceuticals and Supplements, though smaller in absolute terms, outpace all other categories with an 10.81% CAGR, propelled by preventive health awareness, senior pet population growth, and veterinary endorsement. Functional chews, probiotic powders, and omega-3 capsules widen the spectrum of use-cases, from joint support to gastrointestinal health, enriching the Italy pet food industry product mix.

The Italy pet food market also benefits from treat innovation that merges indulgence with measurable wellness benefits. Training treats fortified with collagen or dental chews featuring enzymatic coatings bridge emotional reward and clinical functionality, expanding share-of-wallet beyond core meals. Veterinary diets remain a high-margin enclave governed by strict clinical evidence, with demand supported by rising chronic-disease prevalence in aging pets. Regulatory alignment under EU feed law assures cross-category safety, while domestic capacity investments in flexible pouching lines accommodate shorter runs and rapid flavor rotation. Collectively, product-mix evolution favors premium-value layers that offset volume maturation, ensuring resilient growth for the Italy pet food market.

The Italy Pet Food Market Report is Segmented Into Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, and Pet Veterinary Diets), Pets (Cats, Dogs, and Other Pets), and Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, and Other Channels). Get Five Years of Historical Data and Market Forecasts in Value (USD) and Volume (Tons)

List of Companies Covered in this Report:

- Nestle S.A. (Purina PetCare)

- Mars, Incorporated

- Affinity Petcare, S.A.

- Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- Dechra Pharmaceuticals PLC

- General Mills, Inc.

- Schell and Kampeter, Inc. (Diamond Pet Foods)

- VAFO Praha s.r.o.

- Virbac S.A.

- Alltech, Inc.

- Archer Daniels Midland Company

- DSM-Firmenich AG

- Evonik Industries AG

- Lallemand Inc.

- Kemin Industries, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 Report Offers

3 Executive Summary and Key Findings

4 Key Industry Trends

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 Supply and Production Dynamics

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain and Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Premiumization driven by pet humanization

- 5.5.2 Supermarket private-label rollouts expanding volume

- 5.5.3 Veterinary endorsement of functional diets

- 5.5.4 Rapid growth of e-commerce channels

- 5.5.5 Scale-up of domestic single-serve wet-food capacity

- 5.5.6 EU approval of insect protein for companion animals

- 5.6 Market Restraints

- 5.6.1 Inflation-linked down-trading to economy brands

- 5.6.2 Declining birth rate limiting new pet adoption

- 5.6.3 Compounding pharmacies cannibalizing veterinary diet demand

- 5.6.4 Omega-3 supply gaps from Adriatic fishing quotas

6 Market Size and Growth Forecasts (Value and Volume)

- 6.1 By Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals/Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft and Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Derma Diets

- 6.1.4.1.2 Diabetes

- 6.1.4.1.3 Digestive Sensitivity

- 6.1.4.1.4 Obesity Diets

- 6.1.4.1.5 Oral Care Diets

- 6.1.4.1.6 Renal

- 6.1.4.1.7 Urinary Tract Disease

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 By Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 By Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

7 Competitive Landscape

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments)

- 7.6.1 Nestle S.A. (Purina PetCare)

- 7.6.2 Mars, Incorporated

- 7.6.3 Affinity Petcare, S.A.

- 7.6.4 Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- 7.6.5 Dechra Pharmaceuticals PLC

- 7.6.6 General Mills, Inc.

- 7.6.7 Schell and Kampeter, Inc. (Diamond Pet Foods)

- 7.6.8 VAFO Praha s.r.o.

- 7.6.9 Virbac S.A.

- 7.6.10 Alltech, Inc.

- 7.6.11 Archer Daniels Midland Company

- 7.6.12 DSM-Firmenich AG

- 7.6.13 Evonik Industries AG

- 7.6.14 Lallemand Inc.

- 7.6.15 Kemin Industries, Inc.

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS