PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906965

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906965

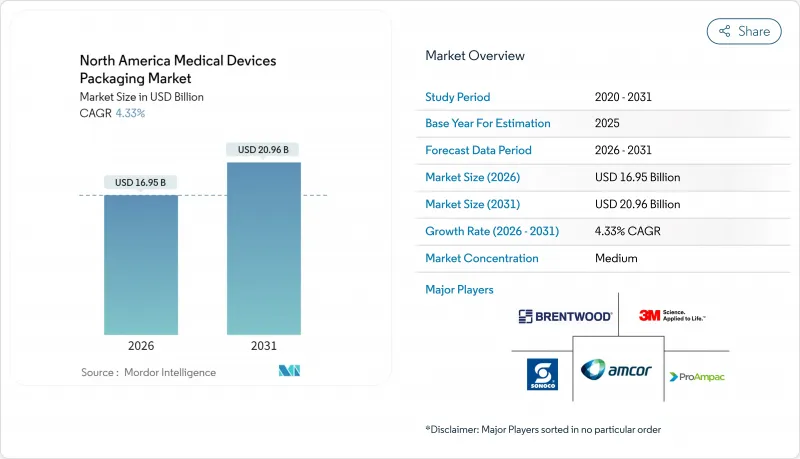

North America Medical Devices Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America medical devices packaging market was valued at USD 16.25 billion in 2025 and estimated to grow from USD 16.95 billion in 2026 to reach USD 20.96 billion by 2031, at a CAGR of 4.33% during the forecast period (2026-2031).

Current expansion reflects a pivot from conventional sterile-barrier concepts toward intelligent, low-carbon packs that satisfy complex FDA traceability mandates and bolster supply-chain resilience. A surge in elective procedures, tighter UDI labeling rules, and hospital purchasing policies that rank sustainability alongside sterility continue to lift demand. Producers that pair validated ISO 11607 systems with data-rich cold-chain monitoring gain preference as providers rebuild inventories. Meanwhile, capital is flowing into bio-based polymers and sensor-enabled formats that tolerate multiple sterilization modalities while cutting lifecycle emissions.

North America Medical Devices Packaging Market Trends and Insights

Elective-Surgery Rebound Fuels Higher Procedure Volumes

Recovering surgical backlogs have reignited demand for high-throughput sterile packs across cardiovascular and orthopedic lines. Hospitals now emphasize end-to-end validated barrier systems that can handle faster turnover while preserving shelf life. Vendors offering ISO 11607-compliant formats supported by real-time inventory data are securing long-term contracts. Larger order quantities are stabilizing price-per-unit margins even as resin costs rise. Investment in automated packaging lines is gaining traction to meet service-level guarantees.

Rapid Shift Toward Single-Use and Minimally-Invasive Devices

Single-use devices eliminate costly reprocessing and cut cross-contamination risk, driving uptake of EtO-, gamma-, and e-beam tolerant laminate structures. Packagers are launching thermoformed trays with multi-cavity inserts that protect delicate scopes yet enable peel-open convenience in the OR. Component miniaturization in minimally invasive kits has spurred demand for antistatic films and micro-perforated lids that balance breathability and particle control. Integration of machine-readable UDI codes within these compact formats is becoming a procurement prerequisite.

Escalating Cost of High-Barrier Medical-Grade Resins

Medical-grade PP, HDPE, and PETG prices remain elevated as cracker outages and logistics bottlenecks constrain supply. Some converters substitute multi-layer coextrusions with thinner single-layer alternatives, but validation timelines slow adoption. Contract terms with pass-through clauses temper margin erosion for large-volume buyers. Smaller converters hedge via multi-sourcing but face working-capital strain. Resin producers are expanding recycled-content offerings, although limited medical-grade streams restrict volumes.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Home-Based Care and Tele-Health Kits

- FDA UDI and Traceability Mandates Tighten Sterility Demands

- Volatility in Ethylene-Oxide (EtO) Sterilization Capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sterile formats accounted for 87.98% of the North America medical devices packaging market size in 2025, advancing at a 5.48% CAGR toward 2031. Hospitals reaffirm single-use policies and demand rigorous barrier integrity that withstands extended distribution cycles. Multi-layer laminates integrating HDPE, EVOH, and Tyvek maintain low oxygen transmission rates while enabling clean peel in the OR. Emerging nitric-oxide sterilization technologies are prompting compatibility testing across these laminate structures.

Innovation centers on trays with thermoformed living hinges that cradle delicate robot-assisted surgical arms and preserve aseptic presentation. Thin-wall designs reduce plastic consumption without sacrificing puncture resistance, as validated by ASTM F88 seal tests. Integrated RFID enables last-mile traceability while in-line inspection cameras document seal uniformity for audit trails. Smaller suppliers face high validation costs that consolidate volume toward global converters with captive test labs.

Plastics retained 64.05% revenue share in 2025; however, bio-based polymers are scaling fastest with a 6.85% CAGR through 2031, reflecting procurement scorecards that now allocate up to 20% weighting to environmental metrics. Poly(lactic-acid) rigid vials cut cradle-to-gate energy by 42% and comply with FDA food-contact regulations, easing adoption in diagnostic kits. Poly(hydroxyalkanoate) films demonstrate intrinsic sterilization resilience yet contend with high capex for fermentation lines.

Converters combine mechanical-recycled PETG layers with virgin contact layers to lower carbon footprints while meeting ISO 10993 biocompatibility. Foamed PET structural core sheets further decrease material consumption in transport trays. Hospitals in California and British Columbia now mandate Environmental Product Declarations for capital equipment packs, encouraging faster transition. Yet, limited recycling streams for clinical waste hamper full-circularity visions.

The North America Medical Devices Packaging Market Report is Segmented by Product Type (Sterile Packaging, and Non-Sterile Packaging), Material Type (Plastics, Paper and Paperboard, and More), Application (Diagnostic Substances, Surgical and Medical Instruments, and More ), Packaging Type (Pouches and Bags, Trays and Clamshells, Boxes and Cartons, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor plc

- Sonoco Products Co.

- DuPont (de Nemours)

- 3M Company

- Spectrum Plastics Group

- Technipaq Inc.

- West Pharmaceutical Services

- ProAmpac LLC

- Beacon Converters Inc.

- Charter Next Generation

- Brentwood Industries

- Nelipak Healthcare Packaging

- Tekni-Plex Inc.

- Placon Corporation

- Pacur LLC

- Dordan Manufacturing

- Eagle Flexible Packaging

- Aptar Group

- Clondalkin Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Elective-surgery rebound fuels higher procedure volumes

- 4.2.2 Rapid shift toward single-use and minimally-invasive devices

- 4.2.3 Growth in home-based care and tele-health kits

- 4.2.4 FDA UDI and traceability mandates tighten sterility demands

- 4.2.5 Rise of hospital sustainability tenders for low-carbon packs

- 4.2.6 Smart-sensor packs enabling cold-chain compliance

- 4.3 Market Restraints

- 4.3.1 Escalating cost of high-barrier medical-grade resins

- 4.3.2 Volatility in ethylene-oxide (EtO) sterilization capacity

- 4.3.3 OEM qualification delays for novel sustainable materials

- 4.3.4 Capital intensity of ISO 11607 validation testing

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Innovations and Developments

- 4.9 Production Technologies for Plastic-based Packs

- 4.10 Medical Device Packaging Trays - Demand and Supply Landscape

- 4.11 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product Type

- 5.1.1 Sterile Packaging

- 5.1.2 Non-Sterile Packaging

- 5.2 By Packaging Type

- 5.2.1 Pouches and Bags

- 5.2.2 Trays and Clamshells

- 5.2.3 Boxes and Cartons

- 5.2.4 Wraps and Films

- 5.2.5 Other Packaging Type

- 5.3 By Material Type

- 5.3.1 Plastics

- 5.3.2 Paper and Paperboard

- 5.3.3 Metal

- 5.3.4 Bio-based Polymers

- 5.4 By Application

- 5.4.1 Diagnostic Substances

- 5.4.2 Surgical and Medical Instruments

- 5.4.3 Surgical Appliances and Supplies

- 5.4.4 Dental Equipment and Supplies

- 5.4.5 Ophthalmic Goods

- 5.4.6 Wearable and Home-care Devices

- 5.4.7 Other Applications

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Sonoco Products Co.

- 6.4.3 DuPont (de Nemours)

- 6.4.4 3M Company

- 6.4.5 Spectrum Plastics Group

- 6.4.6 Technipaq Inc.

- 6.4.7 West Pharmaceutical Services

- 6.4.8 ProAmpac LLC

- 6.4.9 Beacon Converters Inc.

- 6.4.10 Charter Next Generation

- 6.4.11 Brentwood Industries

- 6.4.12 Nelipak Healthcare Packaging

- 6.4.13 Tekni-Plex Inc.

- 6.4.14 Placon Corporation

- 6.4.15 Pacur LLC

- 6.4.16 Dordan Manufacturing

- 6.4.17 Eagle Flexible Packaging

- 6.4.18 Aptar Group

- 6.4.19 Clondalkin Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment