PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907243

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907243

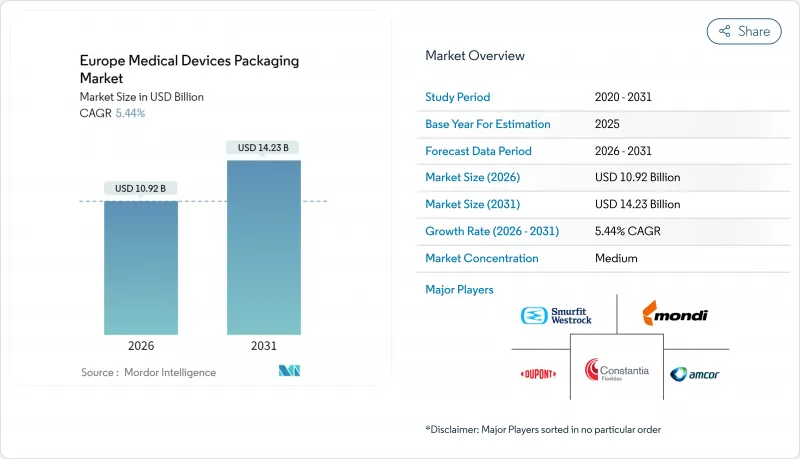

Europe Medical Devices Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe Medical Devices Packaging market size in 2026 is estimated at USD 10.92 billion, growing from 2025 value of USD 10.36 billion with 2031 projections showing USD 14.23 billion, growing at 5.44% CAGR over 2026-2031.

Demand is underpinned by strict EU Medical Device Regulation (MDR) requirements that push for unique device identification, higher traceability, and serialized labeling. Investments in smart labeling, sterile-barrier innovations, and bio-based materials continue to rise as manufacturers align with the EU Packaging and Packaging Waste Regulation. Germany keeps its lead through deep manufacturing capabilities, while Spain's rapid healthcare digitalization fuels expansion. Sustainability programs, growing home-healthcare adoption, and device miniaturization collectively amplify opportunities for the Europe Medical Devices Packaging market, even as polymer price volatility and recycling infrastructure gaps temper gains.

Europe Medical Devices Packaging Market Trends and Insights

MDR Traceability and UDI Labeling Requirements

EU MDR enforcement drives investment in serialization, smart labels, and digital identifiers that secure full supply-chain visibility. The Commission's phased UDI rollout through 2028 guarantees steady spending on high-resolution on-pack codes and human-readable data. German converters now embed oxygen-barrier labels that integrate UDI data and maintain drug stability, illustrating how regulatory needs and performance targets converge. Large device OEMs demand suppliers with ISO 13485-aligned quality systems, propelling specialized printers and sensor-label innovators. European plants also leverage cloud-based tracking to cut recall risk. As compliance costs climb, vendors offering turnkey MDR-ready packaging gain a competitive edge across the Europe Medical Devices Packaging market.

Accelerating Device Miniaturization Driving Innovative Pack Formats

Ultra-compact catheter assemblies and implantables require thin-wall thermoformed trays able to tolerate gamma, steam, or nitrogen-oxide sterilization without collapse. Microsystems tooling developed for wearables transfers effectively to packaging, giving converters flexibility in geometry control. Research on BioMEMS shows demand for biocompatible substrates that deliver moisture protection while supporting wireless telemetry. OEMs lean on quick-change forming lines that swap pocket depths mid-run to handle mixed kit SKUs. Regulatory bodies now draft size-specific vibration and drop-test protocols, guiding material selection. These pressures collectively push the trays and clamshells segment of the Europe Medical Devices Packaging market toward high-value engineering solutions.

Stringent Multi-layer EU Regulations and Compliance Costs

Small converters face overlapping MDR, Packaging Waste, and language-label directives that demand capital-intensive validation and multilingual artwork. Notified-body backlogs slow certificate renewals, stretching lead times and tying up working capital. Firms allocate engineers to maintain EUDAMED submissions, diverting resources from R&D. High upfront documentation burdens encourage outsourcing, yet partnership vetting adds further complexity. These hurdles disproportionately affect SMEs, restraining supply expansion in the Europe Medical Devices Packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Home-based and Remote Patient Monitoring Devices

- Sustainability Mandates Boosting Recyclable and Bio-based Packs

- Polymer Raw-material Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics retained 63.68% of Europe Medical Devices Packaging market share in 2025, as established sterilization compatibility and cost efficiency kept demand high. Over the forecast horizon, bio-based polymers will deliver 8.28% CAGR, reflecting EU sustainability goals and advancements such as MedEco renewable-content resins. Paperboard remains entrenched for secondary packs, while metals fill niche barrier roles in implantables needing ultra-low permeability.

Manufacturers now run twin-screw extruders that co-process bio-attributed feedstocks without requalifying entire lines, easing transition risks. Investments in chemical recycling scale pilot volumes capable of producing virgin-grade styrene for medical apps. These advances position bio-materials to capture incremental volumes, reshaping long-term material mix inside the Europe Medical Devices Packaging market.

Pouches and bags led with 35.10% Europe Medical Devices Packaging market size in 2025 due to versatility across catheter sets and surgical kits. Tray and clamshell formats will outpace others at 7.29% CAGR as micro-electronics push for precise cavity protection. Thin-wall thermoforming lines now achieve 60% resin savings without compromising stack strength, shrinking logistics costs.

High-clarity PETG trays that integrate molded lid channels enhance sterile integrity under ethylene-oxide cycles and eliminate lidding delamination. Smart sensors embedded in tray corners log temperature excursions, aligning with MDR post-market surveillance rules. These traits propel tray uptake among cardiovascular and neuro device OEMs, sustaining growth across the Europe Medical Devices Packaging market.

The Europe Medical Devices Packaging Market Report is Segmented by Material (Plastics, Paper and Paperboard, Metal, and Bio-Based Polymers), Packaging Type (Pouches and Bags, Trays and Clamshells, and More), Application (Sterile Packaging, Non-Sterile Packaging), End-User (Hospitals and Clinics, Home-Health Settings, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor plc

- Constantia Flexibles

- Klockner Pentaplast

- Smurfit WestRock

- DuPont de Nemours Inc.

- Tekni-Plex Inc.

- Wipak Group

- Nelipak Healthcare Packaging

- Technipaq Inc.

- Riverside Medical Packaging

- Gerresheimer AG

- Sealed Air Corporation

- Mondi Group

- Aptar Group Inc.

- Alpla Werke

- Nolato AB

- Huhtamaki Oyj

- SCHOTT AG

- Europlastec Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for longer shelf-life packaging solutions

- 4.2.2 Accelerating device miniaturisation driving innovative pack formats

- 4.2.3 EU MDR-driven traceability and UDI labelling requirements

- 4.2.4 Growth of home-based and remote patient monitoring devices

- 4.2.5 Sustainability mandates boosting recyclable and bio-based packs

- 4.2.6 AI-enabled inline inspection improving quality and reducing recalls

- 4.3 Market Restraints

- 4.3.1 Stringent multi-layer EU regulations and compliance costs

- 4.3.2 Volatility in polymer raw-material prices

- 4.3.3 Limited recycling infrastructure for multi-material sterile packs

- 4.3.4 Supply-chain carbon reduction targets shrinking blister use

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.2 Paper and Paperboard

- 5.1.3 Metal

- 5.1.4 Bio-based Polymers

- 5.2 By Packaging Type

- 5.2.1 Pouches and Bags

- 5.2.2 Trays and Clamshells

- 5.2.3 Boxes and Cartons

- 5.2.4 Other Packaging Type

- 5.3 By Application

- 5.3.1 Sterile Packaging

- 5.3.2 Non-Sterile Packaging

- 5.4 By End-User

- 5.4.1 Hospitals and Clinics

- 5.4.2 Home-Health Settings

- 5.4.3 Diagnostic Centres and Laboratories

- 5.4.4 Contract Manufacturing Organisations (CMOs and CDMOs)

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Capacity, Partnerships)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Constantia Flexibles

- 6.4.3 Klockner Pentaplast

- 6.4.4 Smurfit WestRock

- 6.4.5 DuPont de Nemours Inc.

- 6.4.6 Tekni-Plex Inc.

- 6.4.7 Wipak Group

- 6.4.8 Nelipak Healthcare Packaging

- 6.4.9 Technipaq Inc.

- 6.4.10 Riverside Medical Packaging

- 6.4.11 Gerresheimer AG

- 6.4.12 Sealed Air Corporation

- 6.4.13 Mondi Group

- 6.4.14 Aptar Group Inc.

- 6.4.15 Alpla Werke

- 6.4.16 Nolato AB

- 6.4.17 Huhtamaki Oyj

- 6.4.18 SCHOTT AG

- 6.4.19 Europlastec Group

- 6.5 Analysis of Major Contract Packagers

- 6.5.1 Wasdell Packaging Group

- 6.5.2 Westfield Medical

- 6.5.3 SteriPack Group

- 6.5.4 Sky Medical

- 6.5.5 Boomerang Distribution

- 6.5.6 DaklaPack Group

- 6.5.7 Dr. Muller Pharma

- 6.5.8 Labo Phytophar

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment