PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906969

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906969

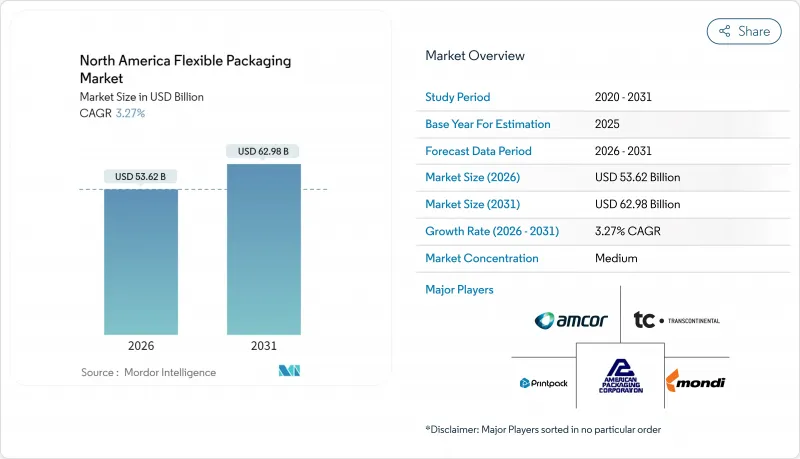

North America Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

North America flexible packaging market size in 2026 is estimated at USD 53.62 billion, growing from 2025 value of USD 51.92 billion with 2031 projections showing USD 62.98 billion, growing at 3.27% CAGR over 2026-2031.

Mature end-user demand, tightening sustainability regulations and incremental technology upgrades underpin this steady trajectory. Growth centers on recyclable mono-material designs, automation in e-commerce fulfillment, and surging health-care packaging volumes, even as polymer-price volatility and multilayer film recycling gaps temper near-term upside. Brand owners now embed post-consumer resin targets directly into long-term procurement contracts, while converters expand fiber-based offerings to serve retailers' plastic-reduction pledges. The competitive field remains fragmented; scale players consolidate to access circular-economy know-how and lock in cost advantages.

North America Flexible Packaging Market Trends and Insights

Surge in Demand for Convenient On-the-Go Snacking Formats

Portable consumption habits continue to expand single-serve packaging investments. Mars and PepsiCo's 2024 portfolio additions relied on flexibles that balance shelf life with portion control, prompting converters to scale high-speed form-fill-seal capacity. packaging-machinery shipments reached USD 10.9 billion in 2023, led by pouching lanes optimized for 70-100 units per minute guidance now clarifies conditions under which recycled polyethylene can enter food-contact applications, enabling brands to pre-blend PCR while protecting product integrity. The regulatory clarity supports snack launches in mono-material PE stand-up pouches that meet How2Recycle "store-drop-off" criteria, reinforcing volume momentum.

Brand-Owner Shift Toward Recyclable Mono-Material Structures

Multilayer films historically solved barrier challenges but suffer from <10% collection rates in North America. Brand owners now redesign portfolios around single-polymer formats; Mondi's polypropylene yogurt pouch for Skanemejerier maintained 60-day shelf life while entering existing recycle streams . Amcor's AmPrima Plus platform reports up to 68% lower cradle-to-gate carbon footprint versus laminated structures. The transition depends on functional barrier resins, including EVOH replacement chemistries that rely on oriented PP plus atomic-layer coatings, enabling oxygen-transmission rates under 0.1 cc/m2/day without co-extruded tie layers. Continuous-improvement protocols now benchmark designs against APR Critical Guidance to secure recyclability claims and retailer listings.

Limited Curb-Side Collection for Multilayer Films

Multilayer laminates make up 26% of flexible-packaging tonnage yet achieve <10% curbside recovery because mixed polymers hinder mechanical separation.Chemical-delamination pilots from BASF and Tomra extract up to 69% clean fractions, but commercialization is at early stages. Municipal programs prioritize higher-value PET bottles, leaving film streams underfunded, thereby restraining the North America flexible packaging market until scalable sortation solutions emerge.

Other drivers and restraints analyzed in the detailed report include:

- Premiumisation in Pet-Food Flexibles

- State-Level PCR Mandates Triggering Long-Term Resin Off-Take Contracts

- Polymer-Price Volatility After Geopolitical Shocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic substrates retained 86.72% share of the North America flexible packaging market in 2025, led by LDPE, HDPE and BOPP films that balance sealability, stiffness and cost efficiency. Yet paperboard grades grow at a 4.41% CAGR as retailers substitute non-recyclable laminates with fiber-based sachets and mailers. Sappi North America's USD 500 million upgrade of Paper Machine 2 boosts solid-bleached-sulfate capacity to 470,000 t/y, signaling confidence in high-barrier coated papers. Aluminum foil continues to protect moisture-sensitive pharmaceuticals but remains a small-volume niche owing to high energy intensity.

Circular-economy imperatives accelerate PCR incorporation, and FDA's 2022 guidance clarifies chemistry requirements for food-grade recycled PE, facilitating PCR rates up to 30% without barrier compromises. The North America flexible packaging market size tied to paper substrates is forecast to add USD 2.18 billion incremental revenue by 2031, while multilayer film producers pivot toward solvent-less lamination and compatibilizer additives to maintain recyclability. Brand owners evaluate fiber-poly hybrid formats where functional waterborne coatings replace metallized layers, creating a transition path that tempers disruptive risk for incumbent plastic suppliers.

The North America Flexible Packaging Market Report is Segmented by Material Type (Plastics, Paper, and Aluminum Foil), Product Type (Pouches, Bags and Sachets, Films and Wraps, Shrink Sleeves and Labels, and More), End-User Industry (Food, Beverage, Pharmaceutical and Medical, Household and Personal Care, and Industrial and Chemical), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor plc

- Sealed Air Corp.

- Mondi plc

- ProAmpac LLC

- Transcontinental Inc.

- American Packaging Corp.

- Sonoco Products Co.

- Printpack Inc.

- Sigma Plastics Group

- Novolex Holdings Inc.

- Constantia Flexibles

- PPC Flexible Packaging

- Charter Next Generation

- Glenroy Inc.

- CCL Industries

- Smurfit Westrock plc

- Coveris Holdings SA

- Emmerson Packaging

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in demand for convenient on-the-go snacking formats

- 4.2.2 Brand-owner shift toward recyclable mono-material structures

- 4.2.3 Premiumisation in pet-food flexibles

- 4.2.4 State-level PCR mandates triggering long-term resin off-take contracts

- 4.2.5 Automation in micro-fulfilment hubs favouring ultra-thin mailer films

- 4.2.6 Retailers' shift to automated micro-fulfilment hubs is spurring demand for ultra-thin

- 4.3 Market Restraints

- 4.3.1 Limited curb-side collection for multilayer films

- 4.3.2 Polymer-price volatility after geopolitical shocks

- 4.3.3 Scarcity of FDA-grade rPE feedstock

- 4.3.4 Extended Producer Responsibility (EPR) laws impose new fees and reporting burdens

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastics

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Biaxially-Oriented Polypropylene (BOPP)

- 5.1.1.3 Cast Polypropylene (CPP)

- 5.1.1.4 Polyvinyl Chloride (PVC)

- 5.1.1.5 Ethylene-Vinyl Alcohol (EVOH)

- 5.1.2 Paper

- 5.1.3 Aluminum Foil

- 5.1.1 Plastics

- 5.2 By Product Type

- 5.2.1 Pouches

- 5.2.2 Bags and Sachets

- 5.2.3 Films and Wraps

- 5.2.4 Shrink Sleeves and Labels

- 5.2.5 Other Product Type

- 5.3 By End-user Industry

- 5.3.1 Food

- 5.3.1.1 Frozen Food

- 5.3.1.2 Dairy Products

- 5.3.1.3 Fruits and Vegetables

- 5.3.1.4 Meat, Poultry and Seafood

- 5.3.1.5 Baked Goods and Snacks

- 5.3.1.6 Confectionery

- 5.3.1.7 Other Food

- 5.3.2 Beverage

- 5.3.3 Pharmaceutical and Medical

- 5.3.4 Household and Personal Care

- 5.3.5 Industrial and Chemical

- 5.3.1 Food

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Sealed Air Corp.

- 6.4.3 Mondi plc

- 6.4.4 ProAmpac LLC

- 6.4.5 Transcontinental Inc.

- 6.4.6 American Packaging Corp.

- 6.4.7 Sonoco Products Co.

- 6.4.8 Printpack Inc.

- 6.4.9 Sigma Plastics Group

- 6.4.10 Novolex Holdings Inc.

- 6.4.11 Constantia Flexibles

- 6.4.12 PPC Flexible Packaging

- 6.4.13 Charter Next Generation

- 6.4.14 Glenroy Inc.

- 6.4.15 CCL Industries

- 6.4.16 Smurfit Westrock plc

- 6.4.17 Coveris Holdings SA

- 6.4.18 Emmerson Packaging

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment