PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911725

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911725

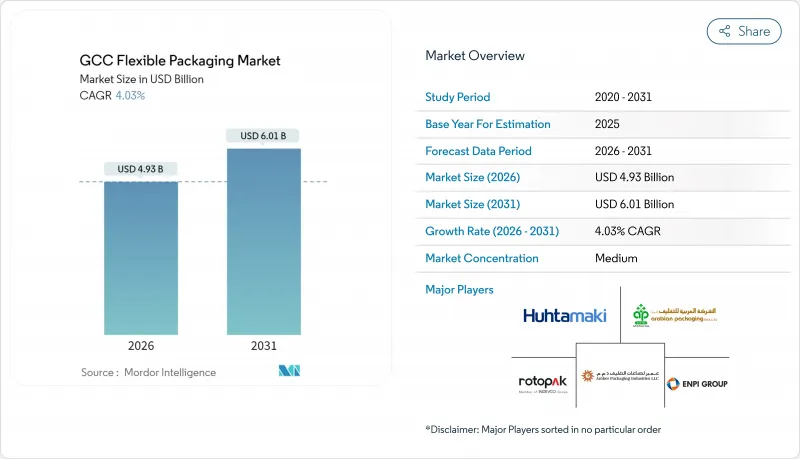

GCC Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The GCC flexible packaging market was valued at USD 4.74 billion in 2025 and estimated to grow from USD 4.93 billion in 2026 to reach USD 6.01 billion by 2031, at a CAGR of 4.03% during the forecast period (2026-2031).

The outlook is supported by record logistics investments, rapid industrial diversification, and sustained demand for consumer goods, which together anchor a favorable demand cycle for flexible formats. Saudi Arabia's USD 106.6 billion commitment to freight corridors, combined with the UAE's positioning as a manufacturing and re-export hub, ensures steady throughput for converters as brands localize their supply chains for shorter lead times. Brand owners prioritize cost-efficient barrier performance, quick artwork changeovers, and lighter shipping weights, benefits that keep flexible formats at the center of packaging procurement strategies. Parallel government circular-economy policies drive incremental shifts toward recyclable substrates, even as access to petrochemical feedstock keeps virgin-resin economics highly competitive. Competitive intensity rises as global converters establish regional plants, spurring technology upgrades and sustainability investments among entrenched local suppliers.

GCC Flexible Packaging Market Trends and Insights

Urban Population Boom Boosting Modern Retail

Eight-plus percent annual urban growth in core GCC economies concentrates purchasing power in large, modern retail formats that rely on display-ready, lightweight, and durable packaging. Flexible pouches enable deeper shelving, single-serve merchandising, and in-store waste reduction, advantages that resonate with multinational retailers entering the high-street corridors of Riyadh and Dubai. Growing metro rail and tourism mega-projects further funnel consumers into organized retail channels, where eye-catching laminates and portioned packs command premium price points. The same density supports high-frequency e-commerce drops, magnifying the value of space-saving flexible mailers that lower last-mile costs.

Rapid FMCG SKU Proliferation

Regional food and personal-care brands are expanding their offerings by multiplying flavors, pack sizes, and seasonal editions to meet increasingly segmented shopper preferences. Digital presses that run variable data without requiring a cylinder change have reduced lead times from weeks to days, enabling manufacturers to execute localized launches with minimal inventory risk. Coupled with small-batch co-packing facilities around the Jebel Ali Free Zone, flexible formats unlock agile market testing for retailers' private-label lines, reinforcing demand for top-up orders and micro-runs. The virtuous circle of more SKUs and faster refresh cycles sustains material volume growth even when per-SKU run-lengths fall.

Recycling-Infrastructure Gap

Less than 15% of Saudi municipal solid waste was entered into recycling streams in 2024, resulting in flexible laminates being under-collected and under-processed. Although Riyadh earmarked USD 32 billion for 840 material-recovery facilities, build-out lags packaging growth, keeping recycled-content films scarce and costly. Converters face uncertain compliance horizons for emerging extended producer responsibility schemes and must invest ahead of clear off-take markets, which squeezes cash flows and prolongs payback on washing and densifying lines.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Halal-Packaged Food Exports

- E-Commerce Grocery Fulfillment Acceleration

- Single-Use Plastics Regulatory Pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic retained a 63.78% share of the GCC flexible packaging market in 2025, backed by advantaged feedstock from integrated petrochemical complexes in Jubail and Ruwais that secure resin at globally competitive costs. This foundation enables volume discounts for converters servicing large FMCG and industrial accounts, cementing plastics' price-performance appeal. The GCC flexible packaging market size for plastic substrates is projected to grow steadily even as governments introduce recycling targets, because mono-PE and BOPE structures now meet mandated recyclability thresholds. Paper-based formats are expected to book a 4.93% CAGR, driven by the adoption of grease-resistant wraps by quick-service restaurants to replace banned multilayer plastics. Brand storytelling around renewable fibers drives shopper pull, although humidity and barrier gaps still confine paper uptake to dry and secondary applications.

Momentum toward foil-based laminates remains specialized. Aluminum maintains niche relevance in pharmaceutical blister lidding and high-value dairy desserts where total oxygen and light barrier trump cost. As regional drug plants scale under import-substitution policies, metalized laminate tonnage increases, yet the overall metal share remains in single digits. Sustainability scrutiny spurs interest in ultra-thin gauge foil to reduce aluminum content without compromising shelf life, leading to collaboration between foil mills and GCC converters on downgauging initiatives.

Bags and pouches dominated the GCC flexible packaging market, accounting for 41.20% of the volume in 2025, due to their suitability for staple foods, rice, snacks, and pet care. Continuous-motion forming lines in Dammam and Dubai crank out high speeds that tame unit costs, and bottom-gusset stand-up designs deliver in-store billboard space brands crave. The format's compatibility with reseal sliders, spouts, and laser scoring supports premiumization campaigns across edible-oil refills and liquid detergents. Sachets and stick packs, though smaller in tonnage, claim the fastest 5.22% CAGR as millennials embrace single-serve coffee, nutraceutical powders, and on-the-go condiments. Unit-dose medicine packs are also transitioning to easy-tear sticks that aid in regimen adherence. Films and wraps sustain mid-single-digit expansion on the back of export-grade meat, cheese, and industrial pallet shrink bands, with blown-film lines upgrading to five-layer configurations that dial in oxygen and moisture barriers for extended distribution.

The GCC Flexible Packaging Market Report is Segmented by Material Type (Plastic, Paper, and Metal), Product Type (Bags and Pouches, Films and Wraps, Sachets and Stick Packs, and Other Product Types), End-User Industry (Food, Beverage, Pharmaceutical and Medical, and More), Printing Technology (Flexography, and More), and Geography (Saudi Arabia, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Huhtamaki Oyj

- Rotopacking Materials Industry Company LLC

- ENPI Group LLC

- Amber Packaging Industries LLC

- Radiant Packaging Industry LLC

- Emirates Printing Press LLC

- Arabian Flexible Packaging LLC

- Hotpack Packaging Industries LLC

- Napco National Co.

- Gulf East Paper and Plastic Industries LLC

- Gulf Packaging Industries Limited

- Integrated Plastics Packaging LLC

- Taghleef Industries LLC

- Al Ghurair Printing and Publishing LLC

- Saudi Printing and Packaging Company

- Beta Pack

- Al Watania Plastics

- National Packaging Factory

- Arabian Packaging Company LLC

- Polykem LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Urban population boom boosting modern retail

- 4.1.2 Rapid FMCG SKU proliferation

- 4.1.3 Surge in halal-packaged food exports

- 4.1.4 Petrochemical feedstock cost advantage

- 4.1.5 Government backed circular-economy initiatives

- 4.1.6 E-commerce grocery fulfilment acceleration

- 4.2 Market Restraints

- 4.2.1 Recycling-infrastructure gap

- 4.2.2 Single-use plastics regulatory pressure

- 4.2.3 Supply volatility of imported barrier resins

- 4.2.4 Brand-owner shift to rigid mono-materials

- 4.3 Industry Value Chain Analysis

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Impact of Macroeconomic Factors

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Geo-Political Scenarios on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.2 Paper

- 5.1.3 Metal

- 5.2 By Product Type

- 5.2.1 Bags and Pouches

- 5.2.2 Films and Wraps

- 5.2.3 Sachets and Stick Packs

- 5.2.4 Other Product Types

- 5.3 By End-User Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Pharmaceutical and Medical

- 5.3.4 Household and Personal Care

- 5.3.5 Industrial and Chemicals

- 5.4 By Printing Technology

- 5.4.1 Flexography

- 5.4.2 Rotogravure

- 5.4.3 Digital

- 5.4.4 Offset

- 5.5 By Geography

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Qatar

- 5.5.4 Kuwait

- 5.5.5 Oman

- 5.5.6 Bahrain

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Huhtamaki Oyj

- 6.4.2 Rotopacking Materials Industry Company LLC

- 6.4.3 ENPI Group LLC

- 6.4.4 Amber Packaging Industries LLC

- 6.4.5 Radiant Packaging Industry LLC

- 6.4.6 Emirates Printing Press LLC

- 6.4.7 Arabian Flexible Packaging LLC

- 6.4.8 Hotpack Packaging Industries LLC

- 6.4.9 Napco National Co.

- 6.4.10 Gulf East Paper and Plastic Industries LLC

- 6.4.11 Gulf Packaging Industries Limited

- 6.4.12 Integrated Plastics Packaging LLC

- 6.4.13 Taghleef Industries LLC

- 6.4.14 Al Ghurair Printing and Publishing LLC

- 6.4.15 Saudi Printing and Packaging Company

- 6.4.16 Beta Pack

- 6.4.17 Al Watania Plastics

- 6.4.18 National Packaging Factory

- 6.4.19 Arabian Packaging Company LLC

- 6.4.20 Polykem LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment