PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906975

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906975

Middle-East And Africa Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

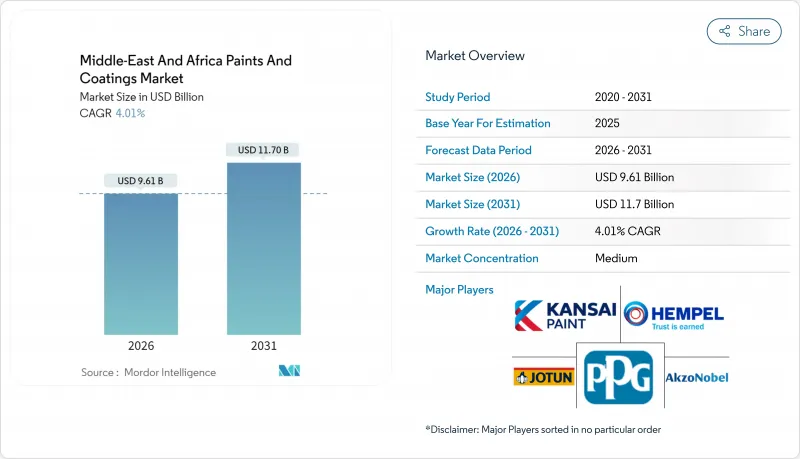

The Middle-East and Africa Paints and Coatings Market is expected to grow from USD 9.24 billion in 2025 to USD 9.61 billion in 2026 and is forecast to reach USD 11.7 billion by 2031 at 4.01% CAGR over 2026-2031.

Solid residential and tourism-oriented construction pipelines, industrial localization mandates, and infrastructure modernization across the Gulf and North Africa are the foremost forces sustaining demand. A shift toward premium, durable, and environmentally safer formulations is clearly visible as developers specify low-VOC water-based systems to comply with Dubai Municipality's TVOC ceiling for new buildings. Protective coating consumption also stays robust because LNG megaprojects and petrochemical complexes require high-performance epoxy and polyurethane systems resistant to chemicals, salt spray, and UV radiation. However, the volatile cost of petrochemical feedstocks, which account for roughly two-thirds of formulation costs, continues to compress margins during crude price spikes, and the automotive repaint segment softens in South Africa and Iran as assembly volumes retreat. Despite these headwinds, consolidation gains momentum, with multinationals scaling regional capacity while agile local producers strengthen distribution reach, leaving the competitive field moderately fragmented but increasingly technology-driven.

Middle-East And Africa Paints And Coatings Market Trends and Insights

Tourism-Led Construction Boom Across GCC and Red Sea

Gulf governments are investing in world-scale airports, theme parks, and waterfront resorts to diversify their economies and attract international visitors. The Al Maktoum International airport expansion, Emaar's adjacent hospitality districts, and Saudi Arabia's Red Sea Project collectively require large volumes of fade-resistant exterior paints, anti-fouling marine coatings, and LEED-compliant interior emulsions. Developers require coating systems that can tolerate sand abrasion, saline humidity, and sharp diurnal temperature swings, prompting formulators to embed ceramic microspheres, UV absorbers, and rust-inhibiting pigments. As project tender documents increasingly specify low-VOC thresholds, manufacturers that localize water-borne blending and tinting capacity capture specification advantages. The tourism boom, therefore, elevates both architectural and protective sub-segments simultaneously, underpinning long-term volume visibility across the Middle East and Africa paints and coatings market.

Public Megaproject Pipelines (NEOM, Lusail, Expo City)

NEOM's multi-cluster development progresses in phases, requiring self-cleaning facade coatings, antimicrobial interior finishes, and solar-reflective roof membranes that can lower cooling loads. In Qatar, the North Field LNG build-out requires heat-resistant epoxy phenolic linings for gas processing trains and corrosion-resistant polyurethane topcoats for storage spheres, keeping heavy-duty industrial specifications at the forefront. The UAE's Ruwais LNG terminal, scheduled for 2028, also relies on high-build anti-corrosion systems capable of withstanding hydrogen-sulfide exposure. Because these projects extend six to eight years, suppliers benefit from predictable call-off schedules that justify regional resin synthesis and tinting investments. Such megaproject pipelines reinforce the premiumization trend within the Middle East and Africa paints and coatings market, unlocking margin headroom for technology leaders.

Automotive Assembly Slowdown in South Africa and Iran

South Africa's 2024 vehicle output declined amid power shortages that disrupted steel stamping capacity, resulting in reduced demand for OEM primer, basecoat, and clearcoat. Iranian assemblers similarly trimmed production as part shortages and electricity curbs converged, causing refinish volumes to contract as vehicle replacement cycles extended. Suppliers diversify toward industrial maintenance and architectural lines, but retraining sales teams and recalibrating mixing plants for higher-volume decorative grades takes time. Although South Africa's government now incentivizes electric vehicle production, near-term coatings demand in the automotive sector industry remains subdued, shaving incremental growth from the Middle East and Africa paints and coatings market.

Other drivers and restraints analyzed in the detailed report include:

- Industrial Localization Policies Lifting OEM Coatings Demand

- Urban Housing Rebound in Key African Economies

- Volatile Crude-Linked Raw-Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The acrylic segment generated the largest revenue in 2025, accounting for 33.98% of the Middle-East and Africa paints and coatings market. Its flexibility, color retention, and cost efficiency underpin widespread use in exterior masonry and interior emulsion lines across hot, high-UV geographies such as Saudi Arabia and Sudan. Polyurethane, although smaller in volume, is forecast to compound at 4.28%, driven by LNG vessels, chemical storage tanks, and high-traffic flooring, where abrasion and chemical resistance justify premium pricing. The Middle East and Africa paints and coatings market size for polyurethane systems is projected to widen steadily as downstream petrochemical integration supplies local diisocyanate feedstocks. Epoxy enjoys strong uptake around Gulf refineries and pipeline corridors, whereas polyester gains share within powder coating for aluminum window frames and household appliances, improving scratch resistance and transfer efficiency. Specialty resins, including fluoropolymers for self-cleaning skyscraper facades and silicones for heat-stable stacks, expand albeit from a low base, reflecting the progressive diversification of resin chemistries across the region.

The acrylic share is expected to erode modestly as sustainability regulations intensify and polyurethanes, epoxies, and hybrid chemistries deliver superior lifecycle costs in aggressive service environments. Nevertheless, decorative formulators continue to innovate within acrylic by integrating graphene oxide, hollow glass beads, and bio-based plasticizers, thereby sustaining relevance in mass housing and mid-tier commercial projects. Multinationals leverage global research and development to localize weathering-accelerated formulas, while regional champions exploit cost-advantaged bulk acrylic latex imports to defend share in budget lines. These dynamics ensure that resin choice remains a critical battlefield within the Middle East and Africa paints and coatings market.

The Middle-East and Africa Paints and Coatings Market Report is Segmented by Resin Type (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, and Others), Technology (Water-Borne, Solvent-Borne, Powder Coating, and UV-Cured Coating), End-User Industry (Architectural, Automotive, Industrial Wood, Protective, and More), and Geography (Saudi Arabia, Qatar, Kuwait, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Akzo Nobel N.V.

- Al-Tabieaa Company

- Atlas Peintures

- Axalta Coating Systems

- Basco Paints

- BASF SE

- Beckers Group

- Crown Paints Kenya PLC

- DAW SE (Caparol)

- Hempel A/S

- Jazeera Paints

- Jotun

- Kansai Paint Co. Ltd.

- National Paints Factories Co. Ltd.

- Nippon Paint Holdings

- PACHIN

- PPG Industries Inc.

- Qemtex

- RPM International Inc.

- Saba Shimi Aria

- Terraco Holdings Limited

- The Sherwin-Williams Company

- Thermilate Middle East

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tourism-led construction boom across GCC and Red Sea

- 4.2.2 Public megaproject pipelines (NEOM, Lusail, Expo City)

- 4.2.3 Industrial localisation policies lifting OEM coatings demand

- 4.2.4 Urban housing rebound in key African economies

- 4.2.5 Heritage-site restoration funding for breathable mineral paints

- 4.3 Market Restraints

- 4.3.1 Automotive assembly slowdown in South Africa and Iran

- 4.3.2 Volatile crude-linked raw-material prices

- 4.3.3 Trade sanctions limiting raw-material inflows into Iran

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Others (Silicone, Vinly, Fluoropolymer)

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV-cured Coating

- 5.3 By End-user Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Industrial Wood

- 5.3.4 Protective

- 5.3.5 Transportation

- 5.3.6 General Industrial

- 5.3.7 Packaging

- 5.4 By Geography

- 5.4.1 Saudi Arabia

- 5.4.2 Qatar

- 5.4.3 Kuwait

- 5.4.4 United Arab Emirates

- 5.4.5 Iran

- 5.4.6 Iraq

- 5.4.7 Nigeria

- 5.4.8 South Africa

- 5.4.9 Turkey

- 5.4.10 Tanzania

- 5.4.11 Kenya

- 5.4.12 Algeria

- 5.4.13 Morocco

- 5.4.14 Egypt

- 5.4.15 Rest of Middle-East and Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Al-Tabieaa Company

- 6.4.3 Atlas Peintures

- 6.4.4 Axalta Coating Systems

- 6.4.5 Basco Paints

- 6.4.6 BASF SE

- 6.4.7 Beckers Group

- 6.4.8 Crown Paints Kenya PLC

- 6.4.9 DAW SE (Caparol)

- 6.4.10 Hempel A/S

- 6.4.11 Jazeera Paints

- 6.4.12 Jotun

- 6.4.13 Kansai Paint Co. Ltd.

- 6.4.14 National Paints Factories Co. Ltd.

- 6.4.15 Nippon Paint Holdings

- 6.4.16 PACHIN

- 6.4.17 PPG Industries Inc.

- 6.4.18 Qemtex

- 6.4.19 RPM International Inc.

- 6.4.20 Saba Shimi Aria

- 6.4.21 Terraco Holdings Limited

- 6.4.22 The Sherwin-Williams Company

- 6.4.23 Thermilate Middle East

- 6.4.24 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment