PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906988

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906988

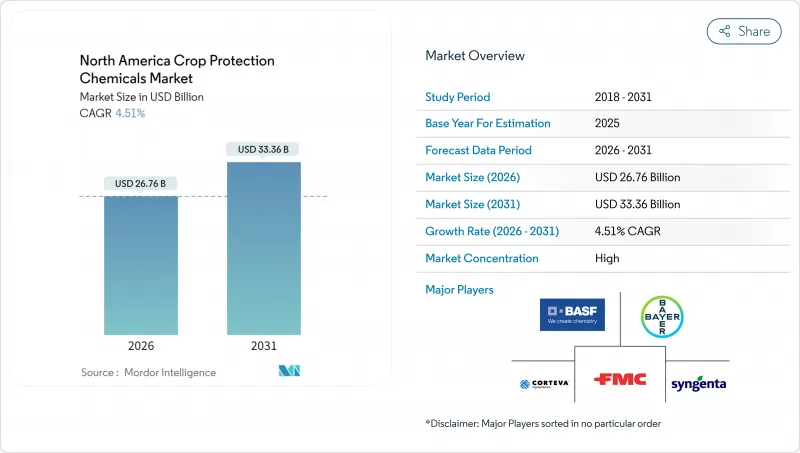

North America Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America crop protection chemicals market size in 2026 is estimated at USD 26.76 billion, growing from 2025 value of USD 25.6 billion with 2031 projections showing USD 33.36 billion, growing at 4.51% CAGR over 2026-2031.

Rising weed resistance, surging fungal outbreaks, and the widening regulatory preference for reduced-risk actives are reinforcing chemical demand even as precision-agriculture tools curb waste. Growers continue to favor synthetic herbicides for broad-acre efficiency, yet biological and biorational products are scaling rapidly under the United States Environmental Protection Agency (EPA) fast-track pathway. The region's large grain footprint, stable export channels under the United States-Mexico-Canada Agreement, and carbon-credit incentives for conservation tillage all sustain spending despite litigation over legacy chemistries. Competitive intensity remains high as leading firms bundle seeds, chemistry, and digital agronomy to capture wallet share while navigating tightening residue thresholds.

North America Crop Protection Chemicals Market Trends and Insights

Accelerated herbicide-tolerant trait adoption

Adoption rates of herbicide-tolerant soybeans now exceed 95% while corn reaches 89% across principal production areas. These traits allow wider post-emergence windows that lift seasonal herbicide volumes and expand rotational flexibility. The EPA clearance of dicamba- and 2,4-D-based platforms delivers new modes of action just as glyphosate-resistant weeds such as Palmer amaranth intensify. Stacked technologies like Corteva Enlist E3 and Bayer XtendFlex foster premium pricing and encourage bundled chemistry-seed packages. Integrated variable-rate spraying optimizes dose by zone, further embedding these traits into modern agronomy. The resulting synergy between genetics and precision hardware sustains demand for selective herbicides despite price pressure from generics.

Precision-spraying equipment lowering cost per acre

Computer-vision sprayers identify individual weeds and reduce chemical volumes by up to 77% while maintaining control levels, as field trials of John Deere See and Spray demonstrate. Public support through the United States Department of Agriculture (USDA) FARMER grants accelerates adoption by offsetting equipment costs. On-board sensors adjust rates in real time, minimizing overlaps and drift, which lowers input spend and addresses regulatory scrutiny of off-target movement. The time saved on refills and the labor reductions boost operational efficiency for large farms that manage thousands of acres. Equipment dealers now bundle data analytics subscriptions that help growers verify savings, reinforcing repeat purchases of compatible chemistries.

Canada's proposed MRL cutbacks limiting exports

Health Canada proposes halving MRLs for several actives, such as 2,4-D, in agricultural exports at risk if foreign buyers adopt stricter thresholds. Divergent standards compel growers to meet the lowest common denominator, adding analytical testing costs and encouraging shifts toward lower-residue actives. Export-dependent producers in British Columbia and Ontario foresee tighter shipment windows and higher compliance documentation. Chemical firms allocate extra budget to residue studies and label amendments, elongating return-on-investment timelines for new products.

Other drivers and restraints analyzed in the detailed report include:

- Surge in soybean rust and tar spot outbreaks

- U.S. EPA fast-track approvals for biorational actives

- Rising biological alternatives squeezing synthetic margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Herbicides generated 51.65% of the North America crop protection chemicals market revenue in 2025, reflecting widespread reliance on chemical weed control across 180 million corn and soybean acres. Precision application and trait-driven selectivity support continuous grower preference for post-emergence products that safeguard season-long yield potential. The segment is projected to expand at a 4.88% CAGR through 2031 as resistance management requires multiple modes of action and as conservation tillage increases herbicide intensity. At the same time, fungicide usage accelerates due to expanding tar spot and soybean rust zones, further diversifying overall spending. Insecticides face pressure from biological competitors and tightened pollinator safety rules, yet remain essential in integrated programs for sporadic outbreaks of Western corn rootworm.

A shift toward stackable biological herbicides is emerging, particularly in fruit and vegetable acreage where buyers impose residue caps. Leading firms launch micro-encapsulated formulations that combine synthetic and microbial actives to prolong efficacy while meeting environmental standards. Product stewardship initiatives now educate growers on rotating chemistries and incorporating cover crops to slow resistance. Collectively these trends ensure that herbicides remain market linchpins even as the broader mix evolves.

The North America Crop Protection Chemicals Market Report is Segmented by Function (Fungicide, Herbicide, Insecticide, and More), Application Mode (Chemigation, Foliar, Fumigation, Seed Treatment and More), Crop Type (Commercial Crops, Fruits and Vegetables, Grains and Cereals, and More), and Geography (Canada, Mexico, and More). The Market Forecasts are Provided in Terms of Both Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Corteva Agriscience

- Syngenta Group

- Bayer AG

- BASF SE

- FMC Corporation

- Sumitomo Chemical Co. Ltd.

- UPL Limited

- Nufarm Ltd.

- Albaugh LLC

- American Vanguard Corp.

- Bioceres Crop Solutions

- Gowan Company LLC

- Atticus LLC

- Helm Agro US Inc.

- Certis Biologicals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Consumption of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Accelerated herbicide-tolerant trait adoption

- 4.5.2 Precision-spraying equipment lowering cost per acre

- 4.5.3 Surge in soybean rust and tar spot outbreaks

- 4.5.4 U.S. EPA fast-track approvals for biorational actives

- 4.5.5 Carbon-credit programs rewarding reduced tillage

- 4.5.6 Mexican government subsidies for IPM tools

- 4.6 Market Restraints

- 4.6.1 Glyphosate litigation-driven retailer delisting

- 4.6.2 Canada's proposed MRL cutbacks limiting exports

- 4.6.3 Rising biological alternatives squeezing synthetic margins

- 4.6.4 West Coast port congestion inflating input prices

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits and Vegetables

- 5.3.3 Grains and Cereals

- 5.3.4 Pulses and Oilseeds

- 5.3.5 Turf and Ornamental

- 5.4 Geography

- 5.4.1 Canada

- 5.4.2 Mexico

- 5.4.3 United States

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Corteva Agriscience

- 6.4.2 Syngenta Group

- 6.4.3 Bayer AG

- 6.4.4 BASF SE

- 6.4.5 FMC Corporation

- 6.4.6 Sumitomo Chemical Co. Ltd.

- 6.4.7 UPL Limited

- 6.4.8 Nufarm Ltd.

- 6.4.9 Albaugh LLC

- 6.4.10 American Vanguard Corp.

- 6.4.11 Bioceres Crop Solutions

- 6.4.12 Gowan Company LLC

- 6.4.13 Atticus LLC

- 6.4.14 Helm Agro US Inc.

- 6.4.15 Certis Biologicals

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS