PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940900

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940900

UK Pet Nutraceuticals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

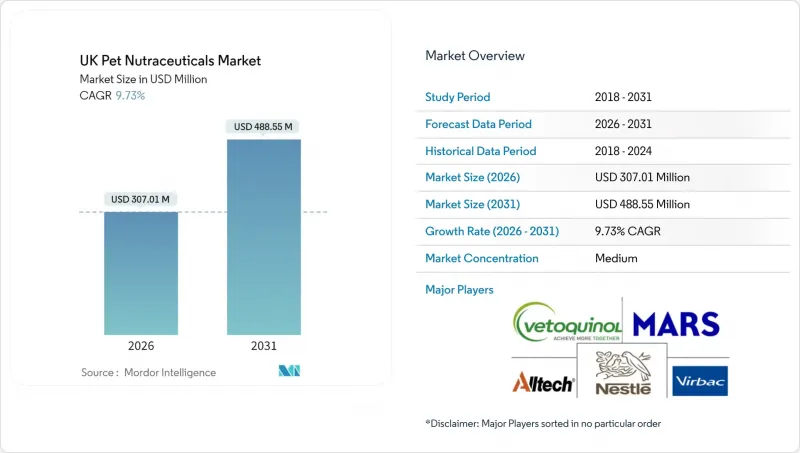

The UK pet nutraceuticals market was valued at USD 279.80 million in 2025 and estimated to grow from USD 307.01 million in 2026 to reach USD 488.55 million by 2031, at a CAGR of 9.73% during the forecast period (2026-2031).

Demand accelerates as owners treat pets like family members, veterinarians embrace preventive supplements, and manufacturers deploy cold-extrusion and microencapsulation to protect bioactives. Brexit has clarified domestic rules, shortening approval timelines and triggering fresh investment in local production, while dual regulation in Northern Ireland creates entry barriers for under-resourced foreign brands. Volatile fish-oil pricing prompts formulators to shift toward algal and precision-fermentation omega-3 sources, while artificial-intelligence platforms that personalize dosing enhance adherence, particularly in e-commerce subscription channels. Competitive intensity remains moderate as global majors expand their technology capabilities and direct-to-consumer innovators capitalize on niche spaces, such as postbiotics.

UK Pet Nutraceuticals Market Trends and Insights

Rising Pet Humanization and Willingness to Pay for Premium Health Products

More owners treat pets as family members, prompting demand for preventive health solutions that mirror human supplements. Industry surveys show a jump in owners rating preventive care as essential, and this shift supports higher average transaction values in the UK pet nutraceuticals market. Veterinary clinics are confirming a growing number of client inquiries about micronutrient balance and mobility support, underscoring the importance of targeted formulations. The premium focus extends to packaging that emulates the aesthetic of human nutraceuticals. Reduced availability of low-cost European imports post-Brexit nudges consumers toward premium domestic brands that emphasize traceability and clinical backing. Elevated discretionary income in 2025 further sustains the trend of trading up.

Growing Veterinary Recommendations of Functional Supplements

Following the Competition and Markets Authority's tightening of rules on prescription mark-ups, many clinics now rely on over-the-counter nutritional products to offset revenue pressure. Manufacturers have responded with continuing education modules that equip veterinarians to discuss strain-specific probiotics and bioavailable omega-3 ratios. Digital portals grant instant access to dosing guides, reducing hesitation around supplement dispensing. Pet insurance expansion steers owners toward preventive purchases that insurers often reimburse, reinforcing the prescription-to-supplement migration.

Stringent United Kingdom/Europe Labeling and Health-Claim Rules

The UK's post-Brexit regulatory environment has maintained EU-level stringency in health claim substantiation, while also introducing domestic compliance requirements that create dual regulatory burdens for manufacturers serving both the United Kingdom and European markets. The Food Standards Agency's continued alignment with European Food Safety Authority standards for health claims requires extensive clinical documentation that smaller manufacturers often cannot afford, effectively consolidating market power among larger players with dedicated regulatory teams. The VMD's interpretation of feed material regulations has proven more restrictive than anticipated, with several previously approved ingredients requiring re-registration under new domestic standards. Northern Ireland's dual compliance requirements under the Windsor Framework add further complexity, as products must meet both UK and EU standards for cross-border distribution.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce and Subscription Models are Expanding Access

- Regulatory Clarity on Feed Material Registration Post-Brexit

- Inflationary Raw Material and Fish Oil Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vitamins and minerals account for 25.85% of the UK pet nutraceuticals market share in 2025 and are expanding at a 10.12% CAGR, the swiftest among tracked categories. The UK pet nutraceuticals market size associated with this segment benefits from cold-extrusion lines that lock in heat-labile B-complex vitamins, enabling lower inclusion rates without compromising efficacy. Veterinary practitioners are increasingly screening for trace mineral deficits in commercial diets, validating daily booster products that cater to life-stage needs. Omega-3 fatty acids remain the second-largest value pool, although raw material insecurity and sustainability scrutiny are steering formulation scientists toward algae-sourced EPA and DHA concentrates, which are verified by Marine Stewardship Council protocols.

Probiotics post robust double-digit growth, driven by widening clinical evidence of strain-specific gastrointestinal and immune modulation. Consumer uncertainty regarding live versus postbiotic forms hinders trade-up opportunities. Proteins and peptides serve as niche senior and recovery SKUs that command high per-unit pricing due to the high costs associated with hydrolysate production. Emerging botanicals, adaptogens, and antioxidant complexes are gaining traction among holistic pet owners seeking alternatives to synthetic actives, although regulatory hurdles are slowing the launch pace.

The UK Pet Nutraceuticals Market Report is Segmented by Sub Product (Milk Bioactives, Omega-3 Fatty Acids, Probiotics, Proteins and Peptides, Vitamins and Minerals, and Other Nutraceuticals), by Pets (Cats, Dogs, and Other Pets), and by Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Mars, Incorporated

- Nestle (Purina)

- Vetoquinol S.A.

- Virbac S

- Dechra Pharmaceuticals PLC

- Alltech Inc.

- Vafo Praha s.r.o.

- Nutramax Laboratories, Inc.

- Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- ADM

- Zesty Paws (H&H Group International)

- Leo Group Ltd.

- Hill's Pet Nutrition (Colgate-Palmolive Co.)

- General Mills Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY & KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY & PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain & Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Rising pet humanization and willingness to pay for premium health products

- 5.5.2 Growing veterinary recommendations of functional supplements

- 5.5.3 E-commerce and subscription models are expanding access

- 5.5.4 Regulatory clarity on feed-material registration post-Brexit

- 5.5.5 Cold-extrusion technology protecting probiotic viability

- 5.5.6 AI-driven personalized dosing apps increasing adherence

- 5.6 Market Restraints

- 5.6.1 Stringent United Kingdom/Europe labeling and health-claim rules

- 5.6.2 Inflationary raw-material and fish-oil price volatility

- 5.6.3 Growing consumer confusion over probiotic vs postbiotic efficacy

- 5.6.4 Sustainability-linked diversion of fish oil to non-food industries

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 Sub Product

- 6.1.1 Milk Bioactives

- 6.1.2 Omega-3 Fatty Acids

- 6.1.3 Probiotics

- 6.1.4 Proteins and Peptides

- 6.1.5 Vitamins and Minerals

- 6.1.6 Other Nutraceuticals

- 6.2 Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.6.1 Mars, Incorporated

- 7.6.2 Nestle (Purina)

- 7.6.3 Vetoquinol S.A.

- 7.6.4 Virbac S

- 7.6.5 Dechra Pharmaceuticals PLC

- 7.6.6 Alltech Inc.

- 7.6.7 Vafo Praha s.r.o.

- 7.6.8 Nutramax Laboratories, Inc.

- 7.6.9 Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- 7.6.10 ADM

- 7.6.11 Zesty Paws (H&H Group International)

- 7.6.12 Leo Group Ltd.

- 7.6.13 Hill's Pet Nutrition (Colgate-Palmolive Co.)

- 7.6.14 General Mills Inc.

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS