PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907005

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907005

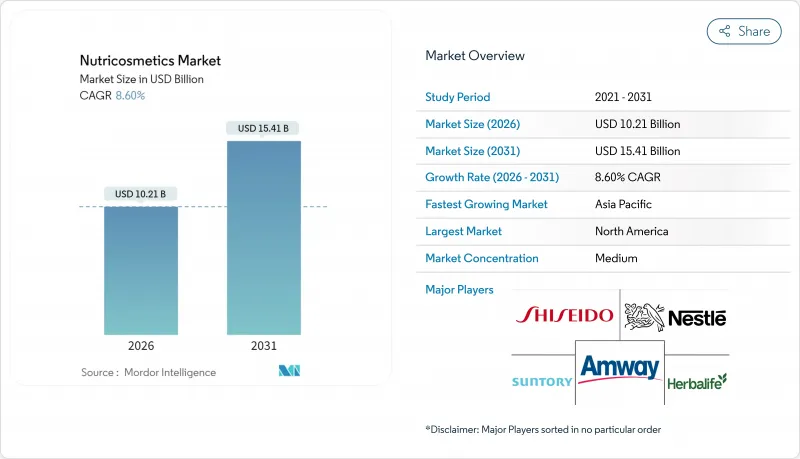

Nutricosmetics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The nutricosmetics market is expected to grow from USD 9.4 billion in 2025 to USD 10.21 billion in 2026 and is forecast to reach USD 15.41 billion by 2031 at 8.6% CAGR over 2026-2031.

The rising demand for beauty-from-within products, a surge in preventive health spending, and strong clinical validation have combined to shift ingestible beauty supplements from discretionary purchases to daily wellness staples. Millennials and Gen-Z account for the bulk of adoption and show a 60% higher propensity to pay for science-backed products than older cohorts, allowing premium price points to hold. Social-media advocacy reinforces clinical data, accelerating product lifecycles and creating viral demand spikes that traditional topical cosmetics rarely match. Asia-Pacific presently leads the nutricosmetics market with nearly half of global revenue on the strength of long-standing functional-food acceptance, yet North America is expanding the fastest as regulatory clarity and subscription-driven e-commerce elevate average selling prices. On the supply side, R&D-rich pharmaceutical groups and agile D2C brands are redefining competition through AI-assisted formulation, vegan collagen breakthroughs, and microbiome-driven personalization tools.

Global Nutricosmetics Market Trends and Insights

Growth of Holistic Wellness & Beauty-From-Within Factors

The notion that skin health mirrors internal wellness is now widely accepted, supported by clinical studies linking specific nutrients to improved elasticity and hydration. Post-pandemic consumers prioritize integrated solutions that touch skin, gut, and brain, driving demand for products that address multiple outcomes simultaneously. Brands bundle collagen with adaptogens and antioxidants to create cross-category SKUs commanding price premiums that topical products seldom achieve. Retailers merchandise supplements alongside serums to foster whole-routine purchasing. As holistic wellness migrates from a fringe concept to a mainstream expectation, the nutricosmetics market broadens its consumer base beyond appearance-driven buyers to include longevity enthusiasts and performance athletes.

Collagen-Centric Product Innovation Cycles (Peptides, Marine, Vegan)

Marine collagen peptides exhibit superior bioavailability versus bovine forms. Sustainability-minded consumers are shifting toward plant-based and precision-fermented collagen that mirrors human Type I molecular structure without animal inputs. Companies such as Brenntag and Cambrium launched NovaColl vegan collagen in early 2025, opening new segments for ethically driven shoppers. Early adopters secure competitive moats as regulatory pathways for fermented collagen settle. Concurrently, hydrolyzed peptide technology reduces particle size for faster absorption, supporting functional claims around wrinkle depth reduction and joint mobility. These innovation waves collectively strengthen category pricing power while expanding addressable audiences.

Stringent & Fragmented Regulatory Frameworks (FDA/EFSA/NMPA)

Divergent rules complicate global rollouts. EFSA's Novel Foods process mandates lengthy dossiers for botanical ingredients, and FDA warning letters rose to 670 companies in 2024 for inadequate claims evidence. China's evolving health-food filing scheme requires country-specific testing, adding cost and delaying launch timelines. Market-specific packaging and formulation tweaks erode economies of scale, especially for small entrants. Larger incumbents leverage in-house regulatory teams to navigate filings, reinforcing their competitive edge and nudging the nutricosmetics industry toward gradual consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Rising Adoption of Dietary Supplements Among Millennials & Gen-Z

- E-Commerce Personalization Engines Boosting D2C Supplement Sales

- Claims Substantiation & Rising Class-Action Lawsuits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Skin-care ingestibles held 57.92% of the nutricosmetics market in 2025, anchoring consumer trust with visible impact metrics such as hydration and wrinkle depth reduction. Collagen peptides, ceramides, and antioxidant complexes dominate, buoyed by decades of dermatological evidence. Frequent repurchase behavior stabilizes revenue and supports premium tiering. Subscription services pair supplements with topical regimens, deepening loyalty and smoothing cash flow. Clinical endpoints-measured through corneometry and 3-D skin imaging-provide marketers defensible proof points, reinforcing the category's leadership position.

Hair-care supplements are projected to post a 9.05% CAGR through 2031, outpacing all other product types. Stress-related alopecia spikes and increased male engagement widen the customer pool. Multi-mechanism formulas combine keratin, zinc, and autophagy-activating botanicals, responding to Shiseido's findings on follicular cell health. Nail-care offerings remain niche yet benefit from cross-selling within combo beauty packs. Overall, diversification across product types lifts the nutricosmetics market size while ensuring that no single sub-category overconcentrates portfolio risk.

Collagen and peptides contributed 34.88% to the nutricosmetics market size in 2025, underpinned by robust clinical dossiers and consumer familiarity. Hydrolyzed marine collagen enjoys superior bioavailability, allowing lower dosages to hit efficacy endpoints. Precision-fermented vegan collagen, free from animal origins, satisfies ethical shoppers and reduces allergen concerns, expanding total addressable demand.

Probiotics and postbiotics are forecast to grow at a 9.35% CAGR, fueled by burgeoning research on the gut-skin axis. Strain-specific supplements that modulate inflammation and barrier function attract dermatologists' endorsement. Brands now co-encapsulate collagen with probiotics, pursuing synergistic effects. Vitamins, carotenoids, omega-3s, and botanical extracts sustain incremental gains through reformulation aimed at higher bioavailability and clean-label compliance, rounding out ingredient diversification in the nutricosmetics market.

The Nutricosmetics Market is Segmented by Product Type (Skin Care, Hair Care, Nail Care, Others), Ingredient Type (Collagen and Peptides, Vitamins and Minerals, and More), Form (Tablets and Capsules, Powders and Liquids, Gummies and Soft-Chews, Others), Distribution Channel (Supermarkets & Hypermarkets, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 48.35% nutricosmetics market share in 2025, a position built on decades of familiarity with functional foods and supportive regulatory frameworks in Japan and South Korea. Japanese consumers, motivated by healthy-aging goals, routinely integrate collagen powders into daily routines. South Korea's beauty-centric culture supports rapid experimentations with fermented botanicals, while China's emerging approval of confectionery as health-food carriers signals format expansion potential.

North America is anticipated to post the highest regional CAGR at 9.25% through 2031, supported by FDA oversight that boosts consumer confidence, venture-capital funding for personalized nutrition, and premium price elasticity. Retailer GNC's pivot toward metabolic health aisles underscores the mainstreaming of targeted nutricosmetics. Accelerated patent filings around microbiome modulators further validate the region's innovation pipeline.

Europe registers steady gains driven by rigorous EFSA standards that assure product safety and environmental stewardship. Sustainability agendas push brands to redesign packaging, exemplified by Vital Proteins' 90% plastic reduction via paper canisters. South America, the Middle East, and Africa remain emerging markets where rising disposable income fuels gradual adoption; however, fragmented regulations and limited cold-chain logistics temper near-term momentum.

- Amway Corporation

- Herbalife Nutrition Ltd.

- Nestle Health Science

- Shiseido Company Ltd.

- Suntory Holdings Ltd.

- GNC Holdings LLC

- Kirin Holdings Co. Ltd.

- Haleon plc

- Kora Organics

- Wow Skin Science

- HUM Nutrition Inc.

- Olly Public Benefit Corp.

- Vital Proteins LLC

- The Bountiful Company

- Garden of Life LLC

- BASF SE (Care Creations)

- BioCell Technology LLC

- Blackmores Ltd.

- Unilever (Nutrafol)

- H&H Group (Swisse)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of dietary supplements among Millennials & Gen-Z

- 4.2.2 Growth of holistic wellness & beauty-from within factors

- 4.2.3 Collagen-centric product innovation cycles (peptides, marine, vegan)

- 4.2.4 E-commerce personalisation engines boosting D2C supplement sales

- 4.2.5 Microbiome-skin axis research enabling probiotic nutricosmetics

- 4.2.6 Influence of SocialMedia Platforms and Beauty Bloggers

- 4.3 Market Restraints

- 4.3.1 Stringent & fragmented regulatory frameworks (FDA/EFSA/NMPA)

- 4.3.2 Claims substantiation & rising class-action lawsuits

- 4.3.3 Lack of Product awareness in Developing Regions

- 4.3.4 Consumer -pill-fatigue- limiting dosage compliance

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Skin Care

- 5.1.2 Hair Care

- 5.1.3 Nail Care

- 5.1.4 Others

- 5.2 By Ingredient Type

- 5.2.1 Collagen and Peptides

- 5.2.2 Vitamins and Minerals

- 5.2.3 Carotenoids and Antioxidants

- 5.2.4 Omega-3 and EFAs

- 5.2.5 Probiotics and Postbiotics

- 5.2.6 Botanical Extracts

- 5.3 By Form

- 5.3.1 Tablets and Capsules

- 5.3.2 Powders and Liquids

- 5.3.3 Gummies and Soft-Chews

- 5.3.4 Others

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets & Hypermarkets

- 5.4.2 Health & Beauty Stores

- 5.4.3 Online Retail & D2C

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America, Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Amway Corporation

- 6.4.2 Herbalife Nutrition Ltd.

- 6.4.3 Nestle Health Science

- 6.4.4 Shiseido Company Ltd.

- 6.4.5 Suntory Holdings Ltd.

- 6.4.6 GNC Holdings LLC

- 6.4.7 Kirin Holdings Co. Ltd.

- 6.4.8 Haleon plc

- 6.4.9 Kora Organics

- 6.4.10 Wow Skin Science

- 6.4.11 HUM Nutrition Inc.

- 6.4.12 Olly Public Benefit Corp.

- 6.4.13 Vital Proteins LLC

- 6.4.14 The Bountiful Company

- 6.4.15 Garden of Life LLC

- 6.4.16 BASF SE (Care Creations)

- 6.4.17 BioCell Technology LLC

- 6.4.18 Blackmores Ltd.

- 6.4.19 Unilever (Nutrafol)

- 6.4.20 H&H Group (Swisse)

7 Market Opportunities and Future Outlook