PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907209

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907209

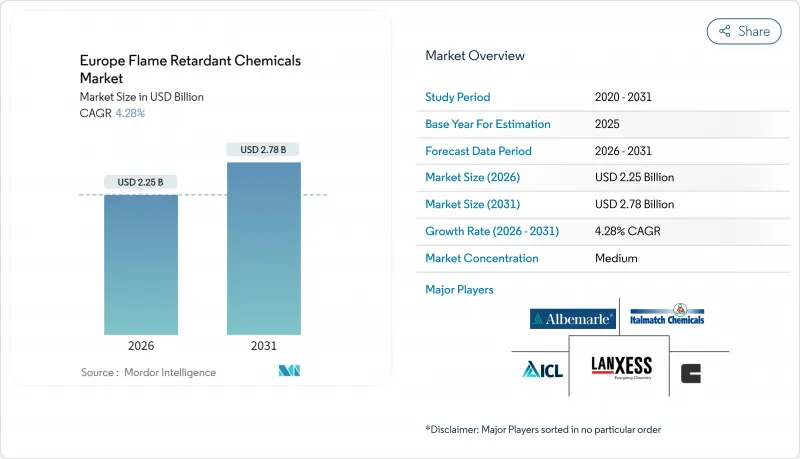

Europe Flame Retardant Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe Flame Retardant Chemicals Market size in 2026 is estimated at USD 2.25 billion, growing from 2025 value of USD 2.16 billion with 2031 projections showing USD 2.78 billion, growing at 4.28% CAGR over 2026-2031.

Regulatory alignment with REACH, accelerated replacement of brominated systems, and sustained infrastructure investment make the region a dependable demand center for non-halogenated additives. Construction leads the volume offtake owing to tightened fire-safety rules for cladding, insulation, and structural steel. Electronics production, revitalized by semiconductor sovereignty initiatives and 5G rollouts, adds a second growth engine, while automotive lightweighting and furniture manufacturing in Central and Eastern Europe expand the downstream customer base. Competitive intensity is rising as producers race to launch PFAS-free, circular-economy-ready grades that satisfy upcoming EU sustainability targets. Raw-material price swings in aluminum, phosphorus, and magnesium markets remain the chief risk, yet supply-side volatility is partly cushioned by diversified sourcing strategies and higher inventory buffers.

Europe Flame Retardant Chemicals Market Trends and Insights

Rising Consumer Electrical and Electronics Manufacturing

European electronics producers have intensified reshoring programs that shorten supply lines and align with the EU Chips Act. Flame-retardant selection is governed by halogen-free mandates for battery housings and 5G radio units. Recent polyamide 6 grades introduced by LANXESS achieve UL 94 V-0 at 1.5 mm, helping automakers integrate thicker battery covers without sacrificing safety. Formulators targeting USB-C cables now deploy halogen-free TPE blends that also meet low-smoke zero-halogen criteria, a requirement for data centers and charging infrastructure. Demand strength is reinforced by EU subsidies for local semiconductor fabs that prioritize in-region procurement of compliant polymers.

Stricter Fire-Safety Regulations in Construction

The 2024 update of EN 13501-1 and national rules for wood cladding imposed class D-s3,d1 for low-rise residential facades and maintained B-s3,d1 for taller buildings, spurring uptake of intumescent coatings and aluminum hydroxide fillers. Germany's DIBt expanded its list of non-combustible boards and coated steel systems, giving manufacturers clear pathways for approval. Projects funded under the EU Green Deal specify phosphorus-based intumescent systems that provide both flame retardancy and embodied-carbon reductions. The legal framework locks in long-term consumption growth as new dwellings and retrofits must meet higher standards.

Toxicity Concerns Over Brominated FRs

ECHA signaled potential authorization requirements for several aromatic brominated compounds in its April 2025 report, intensifying market aversion toward this chemistry. The Nordic Council of Ministers continues to lobby for a complete phase-out by 2030, further dampening demand. While brominated systems excel in thin-wall electronics, substitution pressures compel OEMs to redesign housing geometries or shift to dual-synergy phosphorus-nitrogen systems. Compliance costs and potential obsolescence reduce investment appetite for new brominated capacity, lowering future sales.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Furniture and Upholstery Production in CEE

- Shift to Circular-Economy Compliant FR Additives

- Pending EU Microplastics Legislation Limiting Polymer Uses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Europe flame retardant chemicals market size for non-halogenated systems is equal to 88.83% share. Growth continues at 5.52% CAGR through 2031 as construction and electronics buyers adopt phosphorus, inorganic, and nitrogen chemistries that simplify REACH compliance. Aluminum hydroxide remains volume leader in wallboard and wire-cable owing to its smoke-suppressant action, while magnesium hydroxide penetrates higher-temperature applications. Phosphorus-based additives deliver thin-wall efficiency critical for electric vehicle battery enclosures.

Innovation activity clusters around reactive phosphorus oligomers that polymerize into polyurethane or epoxide networks, preventing migration during recycling. Market entrants from specialty chemicals leverage metal phosphinate-based synergies to lower loading levels, preserving material mechanics. Cost competitiveness improves as captive phosphorus producers forward-integrate into high-purity derivatives, smoothing price spikes. Access to recycled feedstock grades remains a bottleneck; however, pilot trials in Germany demonstrate successful incorporation of reclaimed polycarbonate blended with locked-in phosphorus esters at 25% levels without sacrificing UL-94 V-0 ratings.

The Europe Flame Retardant Chemicals Report is Segmented by Product Type (Non-Halogenated and Halogenated), End-User Industry (Electrical and Electronics, Buildings and Construction, Transportation, and Textiles and Furniture), and Geography (Germany, United Kingdom, Italy, France, Spain, and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Adeka Corporation

- Albemarle Corporation

- BASF

- Clariant

- DIC Corporation

- Dow

- Eti Maden

- ICL

- Italmatch Chemicals SpA

- J.M. Huber Corp. (Huber Engineered Materials)

- LANXESS

- MPI Chemie BV

- Nabaltec AG

- RTP Company

- THOR Group

- TOR Minerals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising consumer electrical and electronics manufacturing

- 4.2.2 Stricter fire-safety regulations in construction

- 4.2.3 Growth in furniture and upholstery production in CEE

- 4.2.4 Shift to circular-economy compliant FR additives

- 4.2.5 Surge in 5G cable and data-center installations

- 4.3 Market Restraints

- 4.3.1 Toxicity concerns over brominated FRs

- 4.3.2 Raw-material price volatility (Al, P, Mg ores)

- 4.3.3 Pending EU micro-plastics legislation limiting polymer uses

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Non-Halogenated

- 5.1.1.1 Inorganic

- 5.1.1.1.1 Aluminum Hydroxide

- 5.1.1.1.2 Magnesium Hydroxide

- 5.1.1.1.3 Boron Compounds

- 5.1.1.2 Phosphorus-based

- 5.1.1.3 Nitrogen-based

- 5.1.1.4 Others

- 5.1.1.1 Inorganic

- 5.1.2 Halogenated

- 5.1.2.1 Brominated Compounds

- 5.1.2.2 Chlorinated Compounds

- 5.1.1 Non-Halogenated

- 5.2 By End-user Industry

- 5.2.1 Electrical and Electronics

- 5.2.2 Buildings and Construction

- 5.2.3 Transportation

- 5.2.4 Textiles and Furniture

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Adeka Corporation

- 6.4.2 Albemarle Corporation

- 6.4.3 BASF

- 6.4.4 Clariant

- 6.4.5 DIC Corporation

- 6.4.6 Dow

- 6.4.7 Eti Maden

- 6.4.8 ICL

- 6.4.9 Italmatch Chemicals SpA

- 6.4.10 J.M. Huber Corp. (Huber Engineered Materials)

- 6.4.11 LANXESS

- 6.4.12 MPI Chemie BV

- 6.4.13 Nabaltec AG

- 6.4.14 RTP Company

- 6.4.15 THOR Group

- 6.4.16 TOR Minerals

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment